Australian gem company NYBlue Pty Ltd has become a key player influencing the value of the global gem market. The companys strategic plan involves controlling the global supply of blue zircon, a move that is expected to reshape the value proposition of the global gem market.

Earlier this month, the company released its 백서 , which outlines the current token presale and the upcoming public token sale. Prior to this, NYBlue announced that it currently holds more than one million carats of the rare gemstone.

NYBlues primary strategy is to systematically increase its current gemstone holdings by continually acquiring all available Cambodian blue zircon, thereby establishing control over the gemstone supply chain and, in turn, influencing the future value of the gemstone.

Earlier today, company representatives were interviewed on CryptoBanters’ Town Hall podcast to announce the launch of the presale for their RWA token, ZIRC.

A video posted by NYBlue asks: What would be a more appropriate expression of love for your significant other; a piece of ordinary compressed carbon (a diamond), or something much older, much rarer 및 twice as brilliant as a diamond (a zircon)?

“We believe Cambodian blue zircon is one of the most unique, undervalued and overlooked gemstones in the global 시장,” said Mitch Brownlie , majority owner of NYBlue.

The Australian company, NYBlue, is funded by Australian agtech founder and former political consultant Mitch Brownlie , who recently discussed the project on multiple podcasts and often compared the NYBlue project to previous gem crazes, such as the African gem tanzanite that rose from obscurity to rival diamonds.

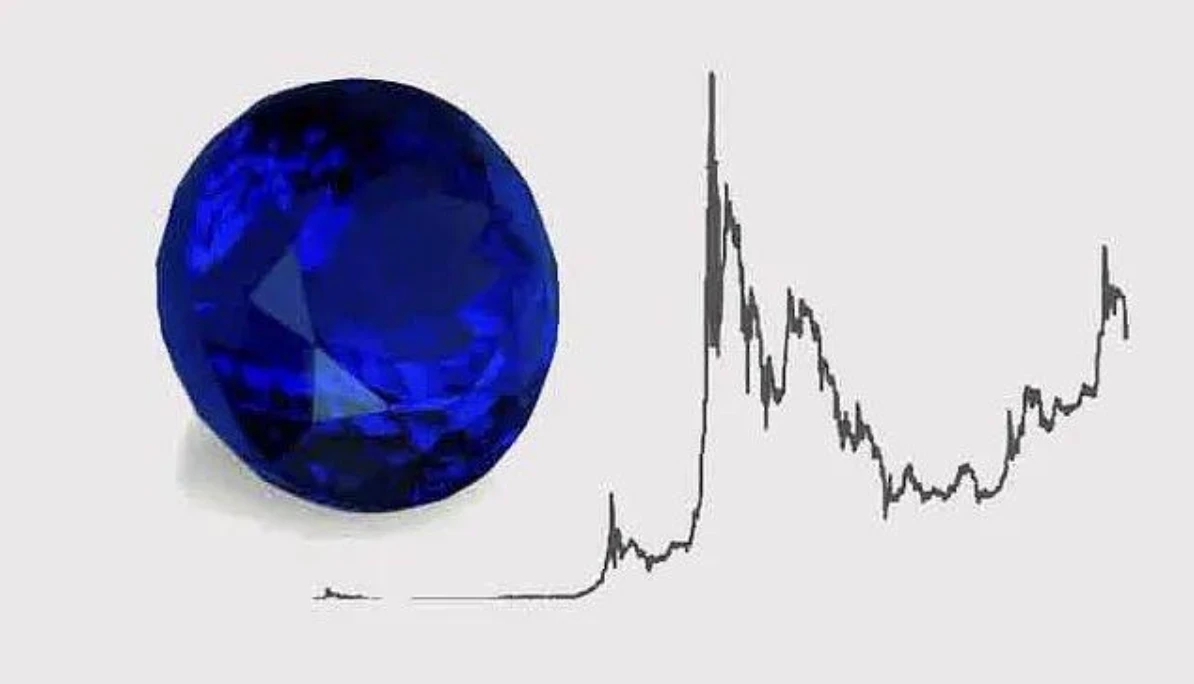

Tanzanite Spot Price: NYBlues Inspiration

Taking inspiration from the historical trajectory of the Tanzanite market, which has seen prices increase tenfold in three years, NYBlue expects a similar growth trend to occur with blue zircon.

NYBlue previously announced plans to launch a gem-backed cryptocurrency, called ZIRC , with each token fully backed and redeemable for one carat of blue zircon . This approach enables consumers to gain access to the potential appreciation of blue zircon without the risk of traditional cryptocurrency volatility. ZIRC token holders can choose to redeem their cryptocurrency for gemstones at any time, ensuring a stable, arbitrage-driven peg between the two assets. This strategic integration of blockchain technology not only enhances transparency and security, but also provides consumers with broader access to this unique sector of the international gemstone trade.

NYBlue aims to acquire the majority of the world’s available gem-quality blue zircon , making it a dominant force in the market. The move is intended to exert influence over the supply chain, which could have a ripple effect on the market value of blue zircon throughout the industry.

NYBlue ’s strategic move is not short-sighted, but an ambitious long-term goal to gain control in the multi-billion dollar gemstone market. With a gemstone collection of approximately $300 million, NYBlue hopes to redefine the gemstone narrative globally. This will make the company a significant player in the gemstone industry with the potential to influence the industry landscape for years to come.

Finally, pre-sales for NYBlue are now live at Zir.co.nz.

About Zirc

The Zirc platform issues a cryptocurrency called ZIRC that is fully backed by blue zircon, with each ZIRC token redeemable for one carat of blue zircon, providing a stable and tangible asset. The platform aims to integrate blockchain technology to enhance transparency and security, enabling everyone to participate in the gemstone market without the risks associated with traditional cryptocurrencies. Zircs approach makes access to blue zircon more accessible and provides a unique investment opportunity based on real assets.

This article is sourced from the internet: NYBlue, which has millions of carats of rare gemstones, announces the launch of RWA tokens

Original author: Day In recent years, the Meme track in the crypto industry has emerged as a new force. Driven intentionally or unintentionally by more and more celebrities such as Musk, Meme has become one of the mainstream tracks and popular narratives in the crypto industry . Many crypto KOLs represented by Vitalik Buterin have gone from initially not supporting it to now moderating their attitude and not denying the value of its existence. Recently, the market value of the popular meme Pepe has reached more than 4 billion US dollars, and the highest has exceeded 7 billion US dollars. It has performed well in this round of meme market. To this day, many people are still confused about Pepe. Today, lets discuss how Pepe has come to where he…