원본 | Odaily Planet Daily ( @오데일리차이나 )

저자 : Azuma ( @아즈마_에스 )

The crypto industry has once again reached its darkest hour. From last night to this morning, the cryptocurrency market has accelerated its plunge, with BTC falling below $49,000 at one point, and the daily drop approaching 20%.

Looking deeper into the reasons for the plunge, in addition to macroeconomic influences such as recession expectations and the situation in the Middle East, the potential black swan of Jump may also be seen as a driving factor for the market decline. This morning, Arthur Hayes, co-founder of BitMEX, 메시지를 게시했습니다 saying that a big guy was disposed of and was selling all crypto assets, and the community generally speculated that the big guy he referred to was Jump.

As one of the major service providers and most active investment institutions in the industry, if Jump collapses, it will inevitably have a huge impact on the market, and projects that directly invest and work with the institution may be the first to bear the brunt.

In the following, Odaily Planet Daily will combine public market data to sort out the major tokens that are most deeply bound to Jump.

이더리움(ETH)

ETH has always been Jumps main holding. In this round of plunge, 도약 s crazy selling is also one of the main sources of ETH selling pressure.

Lookonchain monitoring shows that Jump has sold 83,000 wstETH (about US$377 million) since July 24, and there are 37,604 wstETH (US$104 million) left to be sold. These nearly 120,000 wstETH (US$481 million) are the stolen funds that Jump has successfully fought against the Wormhole attacker and recovered.

For specific details about Jumps ETH sell-off, please refer to Jump sold hundreds of millions of dollars of ETH in a week, analyzing the details of the amount and potential selling pressure.

솔라나 (SOL)

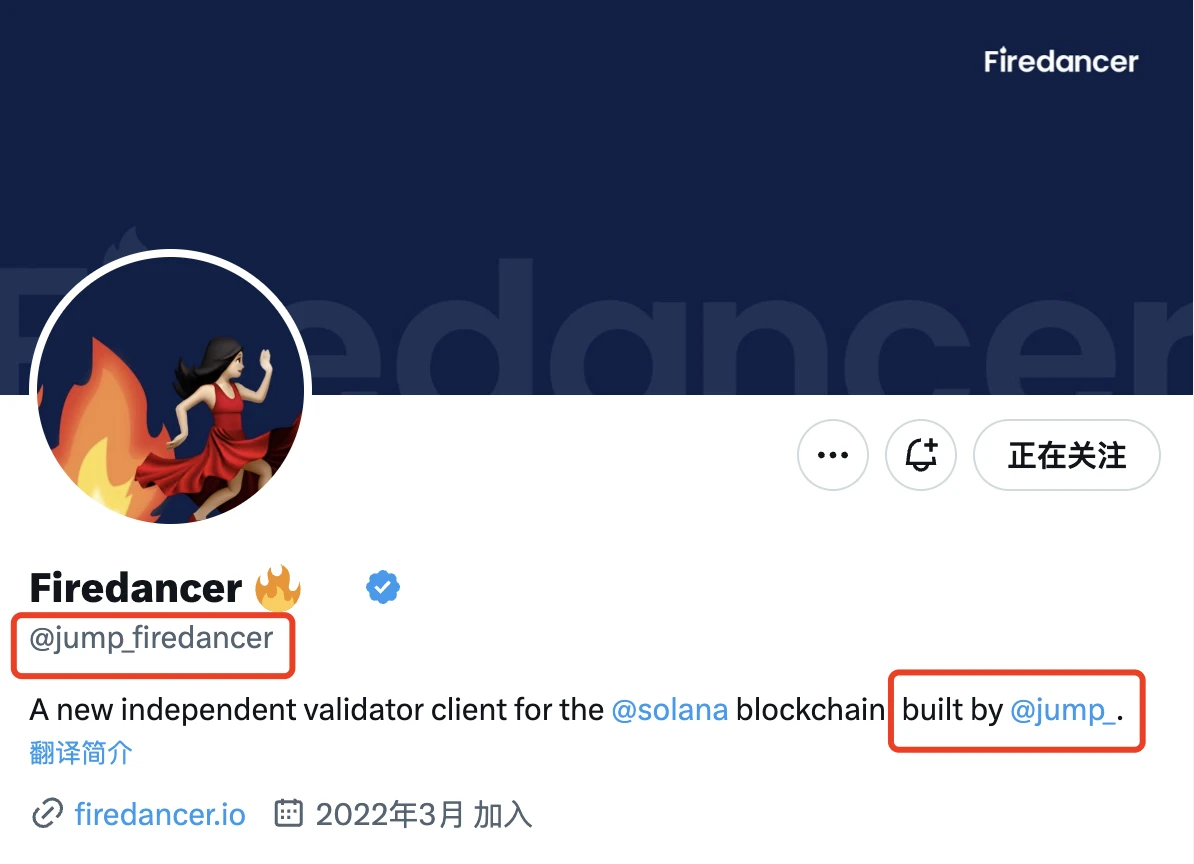

Solana, Ethereum’s biggest competitor, is also a project in which Jump is deeply involved. In addition to direct holdings and market making, Jump has also invested in or incubated multiple projects within the Solana ecosystem (such as Wormhole, Serum, Sanctum), and has even directly participated in the development of the Solana network’s own infrastructure.

It is worth mentioning that the Firedancer client, the most important infrastructure upgrade of the Solana ecosystem in the past two years, was developed by Jump Crypto (Jump’s cryptocurrency department). If Jump collapses, it may affect the final delivery of Firedancer.

웜홀(W)

Wormhole, the most mainstream cross-chain protocol in the Solana ecosystem, was originally created by Jump Crypto, but has now been spun off and operates independently.

In February 2022, Wormhole was hacked and 120,000 ETH was stolen, which was worth about 325 million US dollars at the time. It was one of the largest hacking incidents in the industry. When Wormhole was facing a desperate situation, Jump Crypto first deposited 120,000 ETH into the Wormhole protocol to make up for the loss. This part of the stolen money was subsequently recovered in February 2023 (the 120,000 wstETH mentioned above).

Monad (not yet issued)

The founding team of Monad, a popular project in the parallel EVM track, also came from Jump. Its founder is Keone Hon, the former head of research at Jump.

Previously, when Wormhole airdropped W tokens, it gave a large share to the Monad community free of charge, which was also interpreted by the market as internal binding between Jump projects.

It is worth mentioning that Jump did not participate in Monad’s two rounds of financing, so there is some room for discussion on the exact relationship between the two parties at present.

Lead investment projects: APT, SUI, INJ, ALT…

In addition to the above projects, Jump has also been active in the cryptocurrency investment front line and has participated in key rounds of financing for many projects. The following are some of the mainstream tokens led by Jump:

In 2022, Aptos announced the completion of a $150 million financing round, led by FTX Ventures and Jump Crypto (what a magical combination…);

In 2022, Sui completed a $300 million Series B round led by Jump and a16z;

In 2022, Injective announced the completion of a $40 million financing, led by Jump Crypto;

In 2022, AltLayer completed a $7.2 million seed round led by Polychain Capital, Jump Crypto, and Breyer Capital;

For more details about Jump’s investment and market making, please refer to the following database (data taken from Crypto Fundraising and CoinMarketCap).

-

Jump Capital investment records (70);

-

Jump Crypto investment records (78);

-

Jump Trading investment records (9 transactions);

-

Jump partial position and market making 목록 .

This article is sourced from the internet: Black Swan Countdown? An article on the major tokens most closely tied to Jump

Original author: IOSG Ventures background Currently, the Ethereum Rollup L2 ecosystem is taking shape, with an overall daily TVL of more than $37b, more than three times that of Solana and more than one-third of that of Ethereum. From the users perspective, the recent average daily number of users of mainstream L2 has reached 158k, exceeding Solanas data by about 100k. However, the short-term performance of Rollups is not as expected. In terms of market value, among the mainstream Rollups, Arbitrum has a market value of $7.8b, Optimism has a market value of $7.3b, Starknet has a market value of $6.9b, and zkSync, which has just completed an airdrop, has a FDV of $3.5b, while Solanas FDV reached $74b during the same period. zkSync was recently launched, and its poor…