지난 24시간 동안 시장에는 많은 새로운 인기 통화와 주제가 등장했으며, 이는 돈을 벌 수 있는 다음 기회가 될 수 있습니다. 포함:

-

The sectors with relatively strong wealth-creating effects are: Curve-related tokens (CRV, CVX), Meme sector (NEIRO);

-

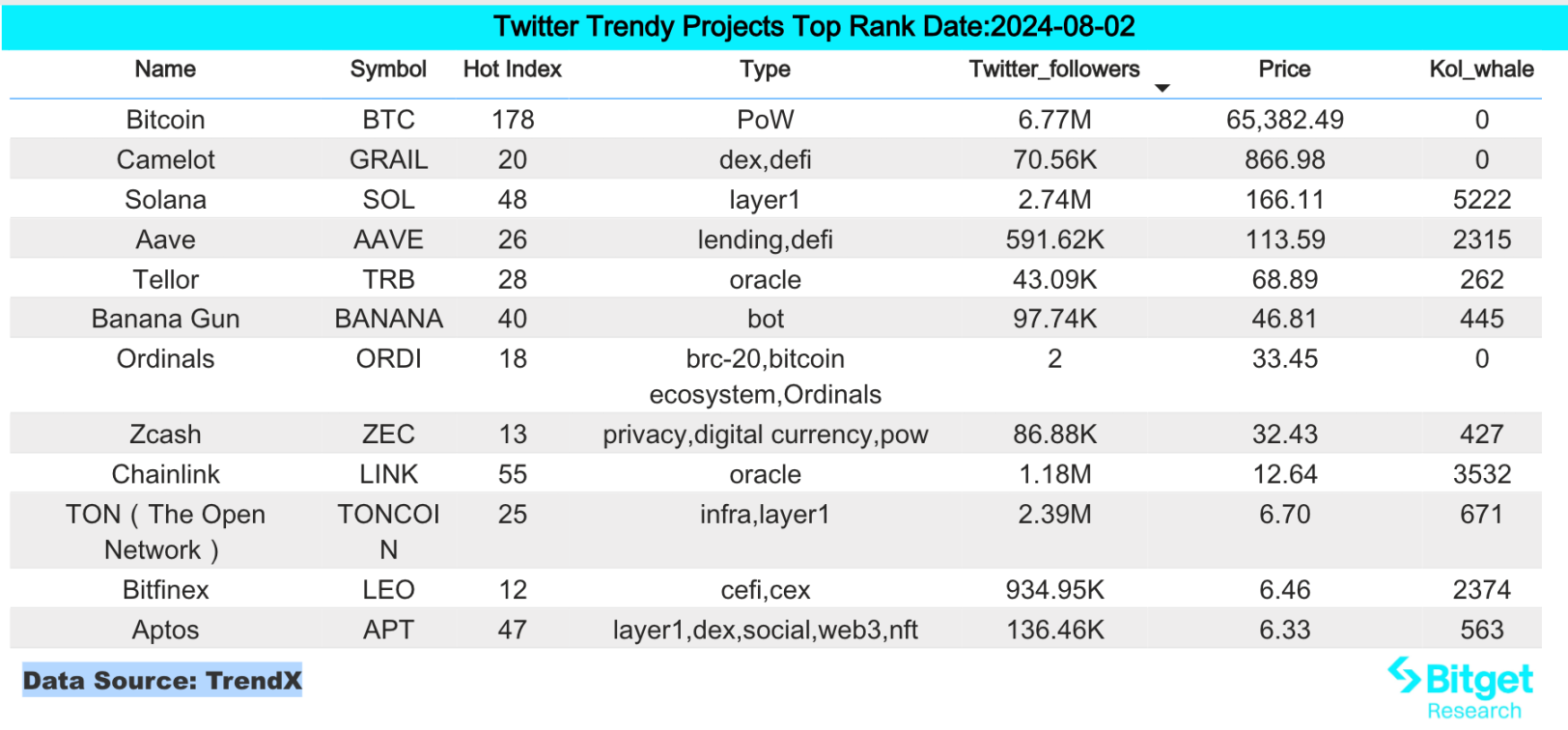

Hot search tokens and topics by users are: Morpho, Aptos;

-

Potential airdrop opportunities include: Symbiotic, Mezo;

Data statistics time: August 2, 2024 4: 00 (UTC + 0)

1. 시장환경

The US ISM manufacturing PMI fell far more than economists expected in July, causing interest rates to fall to multi-month lows across the board. In addition, the number of first-time unemployment claims in the United States jumped to the highest level in about a year. Taken together, these data further confirm that the United States is on the verge of a monetary easing cycle by the Federal Reserve, which is a positive for risk markets in a sense.

Although the U.S. spot Ethereum ETF had a net inflow of $26.2 million and the spot Bitcoin ETF had a net inflow of $50.4 million yesterday, Bitcoin still maintained its downward trend and continued to fall sharply after reaching $70,000 this week. The price fell to a two-week low of $62,700 last night, and the short-term market conditions are poor.

2. 부의 창출 부문

1) Sector changes: Curve-related tokens (CRV, CVX)

주된 이유:

-

The whale has withdrawn a total of 18 million CRV (US$4.68 million) from Binance and OKX in the past 30 hours, with an average price of US$0.26. At the same time, the whale who withdrew CRV from CEX yesterday withdrew another 5.5 million CRV (approximately US$1.51 million) from Binance.

Rising situation: CRV and CVX rose by 7.46% and 5.38% respectively in the past 24 hours;

시장 전망에 영향을 미치는 요인:

-

Curve is still one of the best places for stablecoin bulk transactions, and it still maintains a good real profit. Its biggest problem is that its narrative is too old, and there are no new products or operations that excite the market. At the same time, the previous accidents and this liquidation decline inevitably make the market full of concerns. However, the price of CRV bought by many whales in OTC before was higher than 0.3 US dollars, so the current price of CRV is still attractive.

2) Changes in the sector: Meme sector (NEIRO)

주된 이유:

-

NEIRO has received a lot of support from KOLs, especially those in Japanese. With the help of KOLs with tens to hundreds of thousands of fans, such as @apipiro 22, @mikky_ 8080, @yukimaru_potty, @BrotherMKT, @KookCapitalLLC, and @OfficialTravlad, the price of NEIRO has also risen.

Rising situation: NEIRO rose 15% + against the trend on the day;

시장 전망에 영향을 미치는 요인:

-

On-chain activity: The valuation of DeFi infrastructure depends on whether the chain can have a stable market share, that is, the number of active on-chain users and DEX trading volume, which has a huge impact on DEX, PERP, language machine, and liquidity staking projects of different public chains. Investors should pay close attention to this type of data so that they can judge the markets upward and downward revisions to their valuations;

-

Impact on funding: After the launch of the Ethereum ETF, market funds began to gradually increase the liquidity of ETH. Affected by the increase in liquidity, related meme tokens may rise further in the future due to capital transmission.

3. 사용자 핫 검색

1) 인기 Dapp

-

Morpho

DeFi lending protocol Morpho has completed a $50 million financing round led by Ribbit Capital, with participation from a16z crypto, Coinbase Ventures, Variant, Pantera, Brevan Howard, BlockTower and Kraken Ventures. The specific valuation information has not been disclosed. Morpho is a lending protocol that combines the current liquidity pool model used in Compound or AAVE with the capital efficiency of the P2P matching engine used in the order book. Morpho-Compound improves on Compound by providing the same user experience, the same liquidity, and the same liquidation parameters, but with an increased APY due to peer-to-peer matching.

2) 트위터

-

앱토스

Yesterday, OKX Ventures and Aptos Foundation, a global blockchain leader, announced that they will jointly launch a new $10 million fund to support the growth of the Aptos ecosystem and the widespread adoption of Web3. The fund will be used to develop an accelerator program in partnership with Ankaa to drive the growth of high-quality projects and applications based on Aptos. Aptos is a scalable Layer 1 PoS blockchain that uses the Move programming language to make on-chain transactions more reliable, easy to use, and secure. The accelerator will provide selected Aptos ecosystem projects with risk support, focused guidance, marketing exposure, and a joint network of experts from OKX, Ankaa, and the Aptos Foundation.

3) 구글 검색 지역

글로벌 관점에서 보면:

Why is down today fear and greed index:

Yesterday, the US July ISM Manufacturing PMI fell far more than economists expected, causing interest rates to fall to multi-month lows. The VXX index rose by 13.55%, the markets risk aversion heated up, and crypto assets followed suit.

각 지역의 인기 검색어 중:

(1) CIS 지역의 인기 주제로는 Tapswap이 있습니다. TapSwap은 Telegram 창립자 Pavel Durov가 좋아했던 Tap2Earn Mini 앱입니다. 2023년 말에 출시되었고 처음에는 Solana 네트워크에서 출시되었습니다. 나중에 TON 생태계로 이전되었습니다. 프로젝트의 전반적인 인기는 매우 높습니다.

(2) There are also no obvious hot spots in Asia, but the Philippines has shown interest in US stocks such as Tesla and Nvidia.

(3) Latin America showed a higher interest in SOL and ETH, and AI project tracks appeared on the hot searches in Colombia and Argentina.

잠재적인 공중 투하 기회

-

공생

Symbiotic은 분산형 네트워크가 강력하고 완전한 주권 생태계를 부트스트랩할 수 있도록 하는 범용 재스테이킹 프로젝트입니다. Active Validation Services 또는 AVS라고 하는 분산형 애플리케이션이 서로의 보안을 공동으로 보장할 수 있는 방법을 제공합니다.

Symbiotic은 최근 Paradigm과 Cyber Fund가 투자에 참여하여 10조 580만 달러 규모의 시드 라운드 자금 조달을 완료했습니다.

참여 방법: 프로젝트 공식 웹사이트로 가서 지갑을 연결하고 ETH와 ETH LSD 자산을 입금하세요.

-

메조

Mezo is a BTC Layer 2 project that focuses on the BTC ecosystem, helping BTC holders to transfer and manage money on the chain, and driving the development of the BTC DeFi system. Mezo recently announced the completion of a $21 million financing round, with participating institutions including Pantera Capital, Hack VC, Multicoin Capital and other leading institutions in the industry.

The official has already disclosed its BTC asset pledge plan and introduced a referral mechanism. There are strong expectations for the projects airdrops and it is currently in the initial stages of early operations.

Specific participation methods: 1) Visit the project official website and find the invite code in Discord; 2) Enter the invite code and link the unisat wallet; 3) Deposit BTC.

비트겟 연구소에 대한 자세한 정보: https://www.bitget.fit/zh-CN/research

비트겟 연구소는 온체인 데이터 및 귀중한 자산 채굴에 중점을 두고 있습니다. 온체인 데이터의 실시간 모니터링과 지역별 핫 검색을 통해 최첨단 가치 투자를 발굴하고 암호화폐 애호가에게 기관 수준의 통찰력을 제공합니다. 지금까지 [Arbitrum 생태계], [AI 생태계], [SHIB 생태계] 등 여러 인기 분야에서 Bitgets 글로벌 사용자에게 초기 단계의 귀중한 자산을 제공했습니다. 심층적인 데이터 중심 연구를 통해 Bitgets 글로벌 사용자에게 더 나은 부의 효과를 창출합니다.

면책조항: 시장은 위험하므로 투자할 때 주의하세요. 이 기사는 투자 조언을 구성하지 않으며, 사용자는 이 기사의 의견, 견해 또는 결론이 자신의 특정 상황에 적합한지 여부를 고려해야 합니다. 이 정보를 바탕으로 투자하는 것은 귀하의 책임입니다.

This article is sourced from the internet: Bitget Research Institute: Mt.gox compensation assets continue to be sold, and the short-term market conditions are poor

Related: Viewpoint: Web3 needs Mass Admission, not Mass Adoption

Original author: Cryptoskanda (X: @thecryptoskanda ) Old investors know that every time the market is down, people will blame the market for not attracting Web2 users, so no new funds come in. This is the so-called Mass Adoption narrative, that is, Cryptos Web3 products must cater to Web2s non-profit-oriented users. This logic is like African children will starve to death because you waste food in China, which makes sense but is illogical. Mass Adoption – First understand who Mass is? Who are MASS? Don’t just generalize to traditional Web2 users — Bullshit. “Mass” is a group of different but categorizable individuals. The blind man does not drive a domestic electric car, not because he does not support domestic products, but because he does not have a drivers license (no demand).…