원저자: Frank, PANews

KOL @0x SunNFT revealed on Twitter that he made 150,000 U in one minute on the MEME token BAYC, which made countless people sigh. After careful research, people found that this might be another project of Huang Licheng (Big Brother Maji), a veteran crypto player.

Arbitrage opportunities caused by price differences

In short, the project that @0x SunNFT is involved in is an ERC-404 protocol that can convert Bored Ape Yacht Club (BAYC) NFTs into tokens. This project is called APE Fi. According to the official introduction of the project, 100 million BAYC tokens can be exchanged for one BAYC NFT. Conversely, holders can also exchange NFTs for 100 million BAYC tokens.

In fact, the current price of BAYC tokens is maintained at around $0.00030, which matches the floor price of BAYC NFT (9.471). In the long run, since the project is tied to the NFT value of BAYC, it lacks the volatility of MEME and cannot be treated as a MEME.

The reason why @0x SunNFT was able to quickly make a profit of 150,000 U is that there was a huge value difference when the BAYC token was first opened. The price once rose to 0.003 US dollars, with a ten-fold price difference. Therefore, @0x SunNFT chose to purchase BAYC NFTs from NFT trading platforms such as BLUR, and then quickly exchanged the NFTs for BAYC tokens and sold them for profit. In essence, it was a successful arbitrage.

Since the project was launched, Huang Licheng has repeatedly posted related content on Twitter to promote it to his fans. When others questioned in the comments whether this was another scam, Huang Licheng responded: You are too stupid to see the innovation.

23 BAYCs were added in advance, but insufficient liquidity made it difficult to cash out after launch

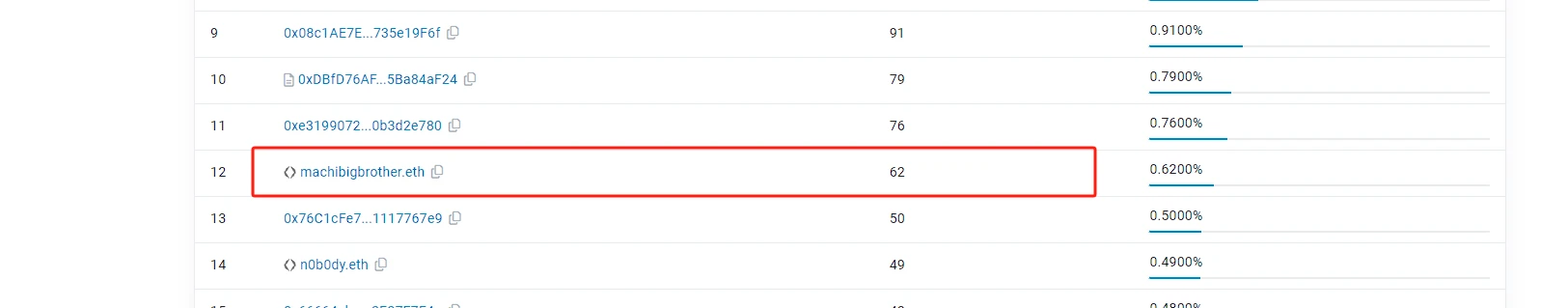

But Brother Machi himself seems to have failed to seize this arbitrage opportunity. As of August 2, Brother Machis Ethereum address still holds 62 BAYC NFTs, and he also increased his holdings of BAYC NFTs in July. As a long-time major holder of BAYC NFTs, Brother Machi began to frantically replenish his BAYC NFTs throughout July. According to statistics, from July 17 to July 31, Brother Machis address purchased 23 BAYC NFTs.

This move may be optimistic about the market trend of BAYC after the launch of the protocol. However, judging from the current results, the floor price of BAYC is not much different from before. On the day the protocol was just launched, the floor price of BAYC NFT was once raised to 10 ETH, and the trading volume rose to 378.9 ETH, but these data soon returned to normal again. At present, the amount of funds in the BAYC token trading pool is about 640,000 US dollars, and the liquidity is about the size of 21 BAYC NFTs. From this point of view, the BAYC NFT in the hands of Brother Maji may have to continue to be held, and it seems difficult to realize it in a short time.

Harvested 38 million fans, harvested 20 million by the market

Previously, on March 28, Big Brother Machi raised more than 200,000 SOLs for his Solana Meme project Bobaoppa, worth about $38 million. After more than a month of waiting, the project was finally launched on May 4, with an opening price of $0.0009055 and a price of $0.0009057 on August 2. The price change in three months is comparable to that of stablecoins. According to the fundraising amount of $38.68 million, the users cost should be $0.00154, and the current price is only 58% of the cost price. The funds in the liquidity pool are only $1.9 million, less than 5% of the fundraising at that time. On March 30, Big Brother Machi deposited the 156,000 SOLs raised into BlazeStake for pledge.

In the few months after the fundraising, Brother Maji transformed himself into an investment expert and participated in investments in well-known projects many times, including spending US$15.35 million to buy 8.048 million FRIENDs, becoming the largest individual holder of FRIEND. The current value is only US$1.177 million, with a loss of US$14.173 million and a loss rate of 92%.

On June 27, Brother Maji once again set his sights on BLAST and spent 1,491 ETH (approximately 4.65 million US dollars) to purchase 198 million BLAST, once again becoming the largest individual holder of BLAST. The entry price was approximately US$0.023. The current price of BLAST is approximately 0,0127, a drop of nearly half.

On July 12, Majida Ge deposited his 1,840 BLUR tokens on Binance and sold them, with an estimated loss of US$3.16 million, a loss rate of approximately 50.2%.

It can be seen that under the recent market downturn, Maji, who was good at investment before, was not spared and lost about 20 million in just a few months. On August 1, Maji sent a tweet: I am an artist. Obviously, investment is an art that is more difficult to master.

This article is sourced from the internet: It is difficult to cash out 23 BAYC NFTs in advance, and Brother Maji lost $20 million in 4 months

관련: Planet Daily | 미국 현물 Ethereum ETF 공식 승인; Gensler 2025년 초 사임할 수도 (07.23)

헤드라인 미국 현물 이더리움 ETF 공식 승인 미국 증권거래위원회(SEC)는 최초의 미국 현물 이더리움 ETF 출시를 신청한 8개 회사 중 최소 2개 회사에 화요일(7월 23일)부터 상품 거래를 시작할 수 있다고 통보했습니다. BlackRock, VanEck 및 다른 6개 회사의 상품은 화요일 아침 시카고 옵션 거래소(CBOE), 나스닥, 뉴욕 증권거래소 등 3개 거래소에서 거래를 시작할 예정이며, 모두 거래를 시작할 준비가 되었다고 확인했습니다. 블룸버그의 ETF 분석가인 에릭 발추나스는 다음과 같이 말했습니다. 현물 이더리움 ETF가 SEC에 등록되었습니다. 양식 424(b)를 제출 중이며, 이는 마지막 단계로, 모든 것이 화요일 오전 9시 30분(오늘 밤 베이징 시간 오후 9시 30분)에 거래를 시작할 준비가 되었다는 것을 의미합니다. 게임 시작…