원문: TechFlow

Clubhouse, we all remember its golden age. In January 2021, during the pandemic, the Clubhouse app was on everyones lips. It quickly climbed to the top of the app rankings with its audio chat rooms. Initially only available to iPhone users and requiring an invitation to join, it generated a lot of buzz, and invitations were even raffled and sold. But just as Clubhouse rose quickly, it also faded just as quickly.

Fast forward to 2024, and the SocialFi space seems to be having a new Clubhouse moment every other week. New and exciting SocialFi apps are constantly popping up. Two that have stood out recently are Friendtech and FantasyTop. While some people still use these apps, they face challenges with sustainability. Why?

As Eugene Wei writes in Status as a Service , a successful social network relies on three core pillars:

-

Potential to accumulate social capital, i.e. identity

-

A measure of how much entertainment people get on the platform

-

Utility, which we describe as the general practical value that people can extract

Initially, identity on social platforms was primarily earned through “proof of work,” with those who added value becoming the elite of the network. However, platforms like SocialFi, like Friendtech, replaced actual value with financial incentives, leading to problematic dynamics.

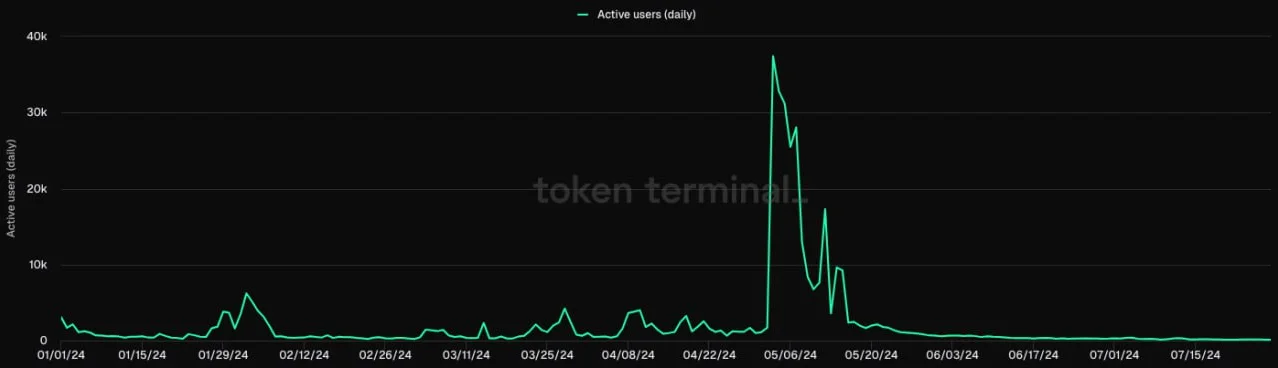

In October 2023, Friendtech had over 70,000 daily active users, but that number has plummeted to only about 400 today. Let’s revisit these three pillars and see what went wrong with Friendtech. Initially, users gained identity by holding keys and joining exclusive but expensive groups. People literally felt a dopamine rush when they saw their investments double overnight. However, the third pillar — actual value — was missing. The primary use case was speculation, with users looking to increase their portfolio value and capture airdrops. Interacting with favorite creators was just a side idea for most.

When the price of keys drops, the dopamine disappears and the actual value is not enough to keep users engaged. Successful creators find it cumbersome to manage another account, and as fees decrease, their engagement drops, leading to the decline of the platform.

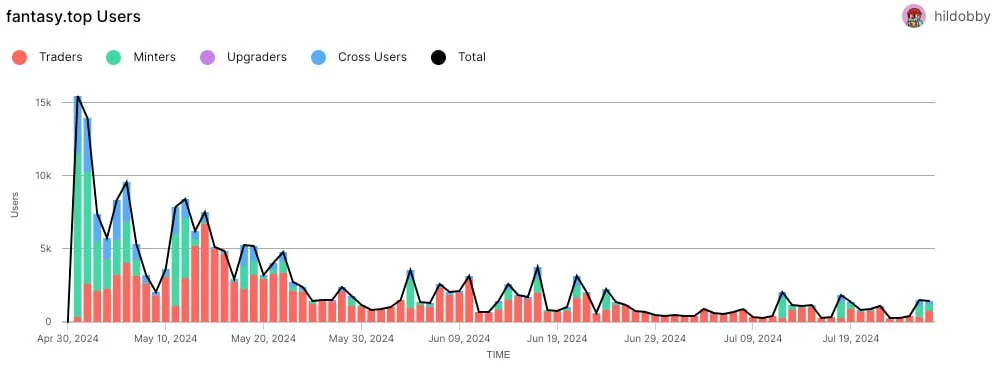

FantasyTop is on a similar path. It started strong with five-digit DAUs in April 2024, but now hovers between 2,000 and 3,000 DAUs.

Unlike Friendtech, FantasyTop is more of a game with social features, similar to fantasy sports, such as fantasy football. Speculation drove initial interest, with card prices rising and creators focusing on getting good scores. But as prices fell and fees disappeared, interest fell. Currently, FantasyTop is transforming into a fantasy sports app with DraftKings features in hopes of regaining users. Most users are currently still stuck on potential airdrops.

The core problem with these apps, as well as SocialFi, is their heavy reliance on financial incentives. As these incentives decrease, user engagement decreases, creating a vicious cycle. We have also seen this pattern in many well-known examples, such as Axie Infinity, Stepn, etc. People tend to prefer to stick with established platforms, as financial incentives should be a feature, not the main driver, and utility should be the main pillar.

Orb and Warpcast, on the other hand, are decentralized applications (dapps) that target the 웹3 ideal of ownership and decentralization. Unlike the mainstream social media giants, these platforms prioritize giving users control over their content. At first glance, they appear to be the future of social networking. But if we look more closely, they face a major challenge: a lack of actual utility. While they could theoretically match Instagram and Twitter in entertainment value with the right network effects, they don’t offer much value.

Think about a typical 15-year-old girl using social media. She doesn’t think about whether she actually owns her photos or texts. Instead, she cares about attention, likes, interactions, and following her idols. Ownership and decentralization are far from her mind.

As Peter Thiel says, from a social experience perspective, current forms of ownership and decentralization do not transform the user experience from 0 to 1, nor do they make it ten times better. Instead, these ideals offer only marginal improvements. While they may appeal to technology enthusiasts, they lack the revolutionary appeal that would convince average users to leave familiar platforms.

The current state of SocialFi apps is challenging. Their initial reliance on speculation to drive capital and user inflows remains an inevitable factor for growth, but is temporary. While decentralization is important, users prioritize the value provided by the product. To achieve long-term sustainability, these networks need to develop enough value to keep users engaged beyond the initial monetary game.

To attract a broad user base, crypto must move from purely financialized products to those that capture the attention economy. If we treat speculation as an interesting supplement rather than a necessity, while stepping out of the Web3 bubble to gain broader attention, SocialFi can become one of the largest verticals. How, you might ask?

Thinking Outside the Crypto Bubble When Integrating Web3

To understand the impact of SocialFi, we first need to examine the dynamics of Web2:

Traditional social media, undoubtedly one of the most used parts of the internet, has achieved success through a clear flywheel effect. Social innovations — new use cases that provide real value — tend to go viral quickly, leading to the emergence of new KOLs. This opportunity for virality attracts a large number of users who are driven by the hope of fame and attention.

The dopamine hits that come from engagement, likes and exposure – probably the most consumed “drug” of the 21st century.

This influx of users attracts existing KOLs who want to reach new audiences but also worry about becoming irrelevant. This in turn strengthens the platform’s credibility and accelerates user onboarding. As this positive feedback loop continues, the network effect continues to strengthen, forming a moat and improving user stickiness.

However, as users’ attention spans shorten and patience dwindles, platform operators are under tremendous pressure to evolve, which ideally will lead to further social innovation and restart the cycle. We all remember the early days of Instagram. It started out as a simple tool for capturing, editing and sharing pictures with followers. Soon, it became a must-have app on everyone’s phone. But like any successful platform, Instagram had to evolve to stay relevant.

In 2016, driven by the surge in popularity of Snapchat Stories, Instagram faced tremendous pressure to adapt. In response to this competitive threat, Instagram launched its own version that not only mimicked the feature but even adopted the same name. This strategic move was aimed directly at retaining user engagement and staying relevant in the dynamic social media environment.

And that was just the beginning. They soon integrated algorithmic push notifications to help users discover content more easily and capture their attention more efficiently. Not long after, Reels was born as a direct response to TikTok’s explosive popularity.

The message of Instagram’s evolution is clear: copy and integrate the innovations of others, rather than being left behind.

So, what does this mean for SocialFi?

Speculation and financialization are certainly interesting features of SocialFi, but should not be the main unique selling point (USP). Instead, the value proposition should focus on social innovation and new use cases to kick-start the flywheel.

The key question is: how can we leverage elements of Web3 to create new and exciting social experiences that challenge Meta, TikTok, and X?

Obviously, we dont have definitive answers to that. If we did, we wouldnt be sitting here telling you this and wed be building this to compete with Zuck and Elon.

While we don’t have all the answers, we do have some ideas that can inspire developers to build novel social use cases.

Attention as a new financial asset

In the Web3 era, we excel at creating new financial assets. Currently, social media is a battleground for attention. Content is growing exponentially while attention spans are shrinking, making attention a scarce asset. Attention is represented through tools such as likes, comments, follows, impressions, and time spent on the platform. However, these tools are highly inflationary and currently available for unlimited use.

그래서 while attention is scarce, it becomes increasingly diluted due to the infinite abundance of attention tools. As each tool receives less attention, its quality decreases.

Imagine that Web3 makes it possible to tokenize these tools, making them scarce or at least inflation-resistant assets, with decentralized social platforms acting as their 시장. Likes, comments, and follows could become some kind of attention tokens, carefully distributed to users and ultimately to creators they like. This would not only encourage users to more selectively curate their feeds, but also incentivize creators to produce high-quality content.

This will enable a shift in entertainment toward more utility, based on the three key pillars outlined by Eugene Wei. The overall percentage of attention per content will increase, potentially attracting large advertisers looking for high-quality engagement.

Or imagine followers themselves as financial assets, with values varying based on their social graph. If you manage a high-profile user, like Vitalik or Ansem, who follows you, you can sell this scarce “credential” of attention to someone willing to pay for his attention.

While these ideas are obviously abstract and require further refinement, they show potential directions.

A more practical use case could involve tokenizing the intellectual property (IP) of content. Coinbase recently highlighted this in their new “Mister Miggles” 운동 , which addresses current issues in the creator economy and calls on everyone to not only create, but also consume on-chain.

Story Network is taking this idea a step further. They are developing a new Layer 1 blockchain that enforces programmable intellectual property rights and licensing at the protocol level, allowing people to legally register their intellectual property as a new financial asset around the world.

Imagine applying this to decentralized social networking.

Take the example of “Finance Girl” , which went viral worldwide. Imagine if this video was published on a platform that ran Web3 technology on the backend, tokenized its intellectual property directly, and distributed part of the proceeds to those who initially helped it go viral, such as their early followers.

With a mechanism like this, you can think of social creators as similar to NFT collectibles or brands, with their early followers acting as their NFT community. This way, each creator will have a loyal, incentivized super-following group that helps spread their content across the internet, accelerating their success while directly engaging with it. We’re not just talking about financial gains, but also the non-monetary value of social capital from your favorite creators — like getting backstage passes when Finance Girl performs with David Guetta.

However, no matter how we look at this, we always come back to one unavoidable characteristic:

Make community great again

Users need to be prioritized once again. This has always been a core feature of Web3 and could become the most powerful feature if applied to social platforms, as network effects are crucial here.

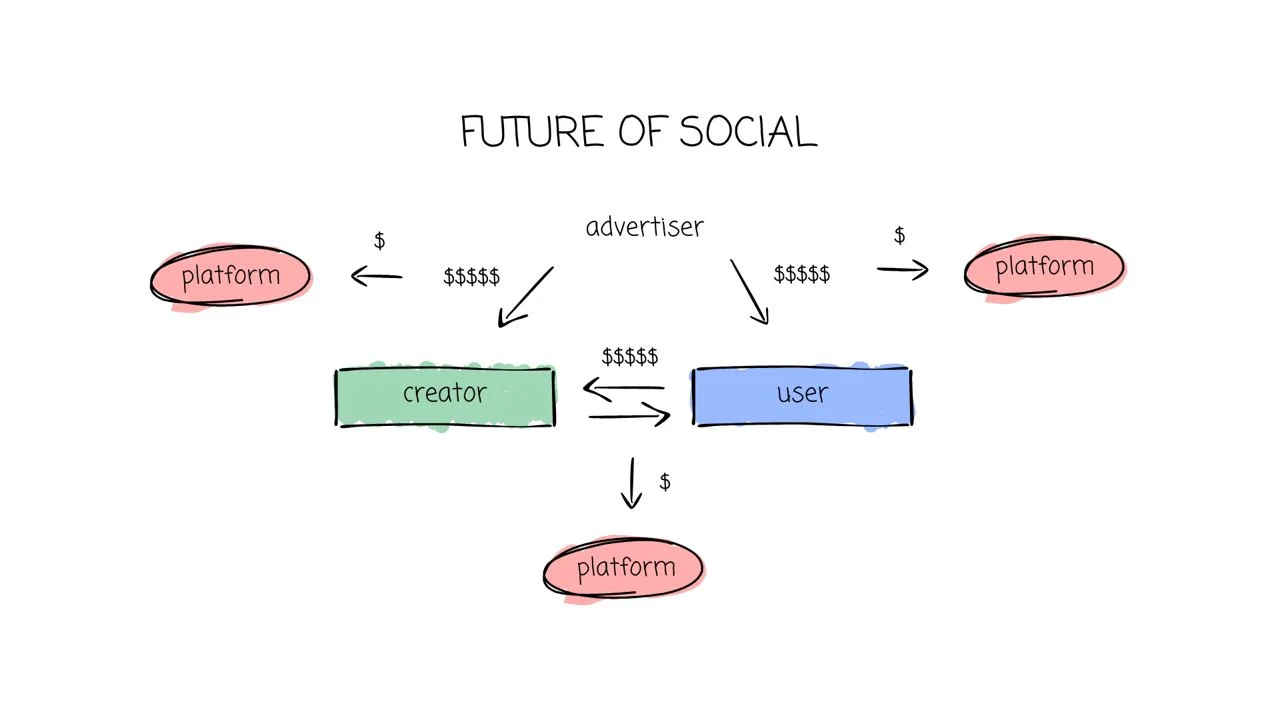

Here’s the current distribution of value, and it doesn’t matter whether we’re talking about Web2 or Web3 social platforms:

As Chris Dickson mentions in his recent book Read, Write, Own, the top 1% of social networks (like Meta and TikTok) control 95% of social network traffic and 86% of social mobile traffic. The value created by advertisers is largely monopolized by these platforms, with minimal returns to creators and nothing to users, despite creating the critical network effects needed. We hope to significantly improve the flow of value by introducing decentralized social platforms so that creators and users can participate more directly in the value they create.

We envision a future with a fairer distribution of value by breaking the monopoly of platform operators as intermediaries between attention suppliers (consumers and creators) and attention seekers (advertisers). Revenue should be distributed proportionally to those who earned it, or to the community of targeted creators.

As a result, building a moat simply by controlling network effects will become more difficult. We believe we will see a major deconstruction, with various vertically integrated niche social platforms attempting to accumulate multiple revenue streams, rather than a single platform horizontally controlling the flow of value.

As long as operators create enough value for both suppliers and seekers, their social platforms will thrive. In this case, they will act as a marketplace between these parties, sharing fairly the value flows they facilitate.

Think of future social platforms as OpenSeas of attention.

In contrast, we go a step further and suggest that creators should redistribute all platform revenue to their most engaged audiences in exchange for social capital.

Status as the new Ponzi scheme

Today, we live in a world where social capital is valued even higher than monetary capital. Done right, status can generate money, even large and sustainable amounts of it. Conversely, money can rarely buy recognition and fame.

Status can open doors that money alone can’t. Imagine getting exclusive VIP seats to the Super Bowl, or getting a last-minute reservation at the city’s trendiest restaurant for your anniversary, or even catching the attention of a powerful and influential figure like a celebrity or politician.

These connections and opportunities, if leveraged correctly, can have far-reaching consequences. For KOLs and creators, nothing is more valuable than their reputation. We believe that building new social platforms that enable them to directly return value to their communities will create a flywheel effect of social capital growth with a similar degree of acceleration and leverage that we typically see in Ponzi schemes.

Take Pudgy Penguins as a perfect example. They became the most popular brand and are now even expanding into the non-Web3 world for one simple reason: they are committed to returning value to their NFT holders, forming a powerful distribution network. Another example is Mr. Beast, who is the biggest YouTuber of all time. While his content is certainly entertaining, the secret to his success has always been giving most of his revenue back to the community, either by reinvesting in the entertainment value of his content or giving back to his community through giveaways .

This is perhaps the most powerful market entry and growth strategy for those looking to grow social capital from scratch. It significantly strengthens the relationship between creators and consumers and can lead to greater engagement and support. As a result, these creators’ social capital and status will continue to increase, enriching their most loyal communities.

Coding such a mechanism at the protocol layer could even serve as a launchpad for creating and owning new influencers.

Before concluding, we would like to present another idea that is destined to be combined with blockchain.

How to become famous with a killer trick

Even if this desire manifests itself more or less in some people, everyone has thought about what it would be like to be a celebrity or have all the attention around them.

Social media gives you a platform to achieve this dream, which is exactly what everyone who posts, tweets, shares on TikTok every day hopes for: a small chance to go viral, to get all the attention and become a celebrity.

Yet the competition for attention and algorithmic favor is not only fierce, but also opaque, extremely complex, and often frustrating.

Blockchain is very suitable in this regard due to its open source nature.

Imagine a social media platform where the rules of algorithmic preference are immutably encoded in the backend, while being transparently and equitably accessible to every user and creator. You could even expand on this to include analytics and metrics about current trends, most popular content, etc.

Now combine this relatively complex set of data with gamification mechanics, and voila, you’ve built an open and fair framework that helps users achieve virality and growth with ease.

There are no more excuses, if people don’t like your content, it’s because the content itself is not attractive enough.

So we want to move slowly but surely to an end.

While we are slightly critical of the current SocialFi market, we have many exciting ideas for new use cases.

The basic flywheel of social growth remains the same, but Web3 elements can accelerate these processes and enhance user retention. While we encourage founders to avoid focusing solely on monetary incentives, tokenization and financialization mechanisms can certainly play a role in driving social innovation.

This potential for dramatically new experiences is what, in our view, differentiates decentralized social from the rest of crypto. Web3 elements appear to enable dramatically new experiences at a whole new scale, which should also interest people outside of our own fallen bubble.

We also strongly advocate starting as a simple tool, built on an existing social network like X or Instagram. This strategy can be effective in kickstarting growth and ensuring a smooth user experience while focusing on delivering a strong value proposition. Fantasy Top is a prime example of this approach. Not only did this lead to explosive growth in their initial stages, but they still have the potential to grow their network if they can further expand their user base and drive engagement.

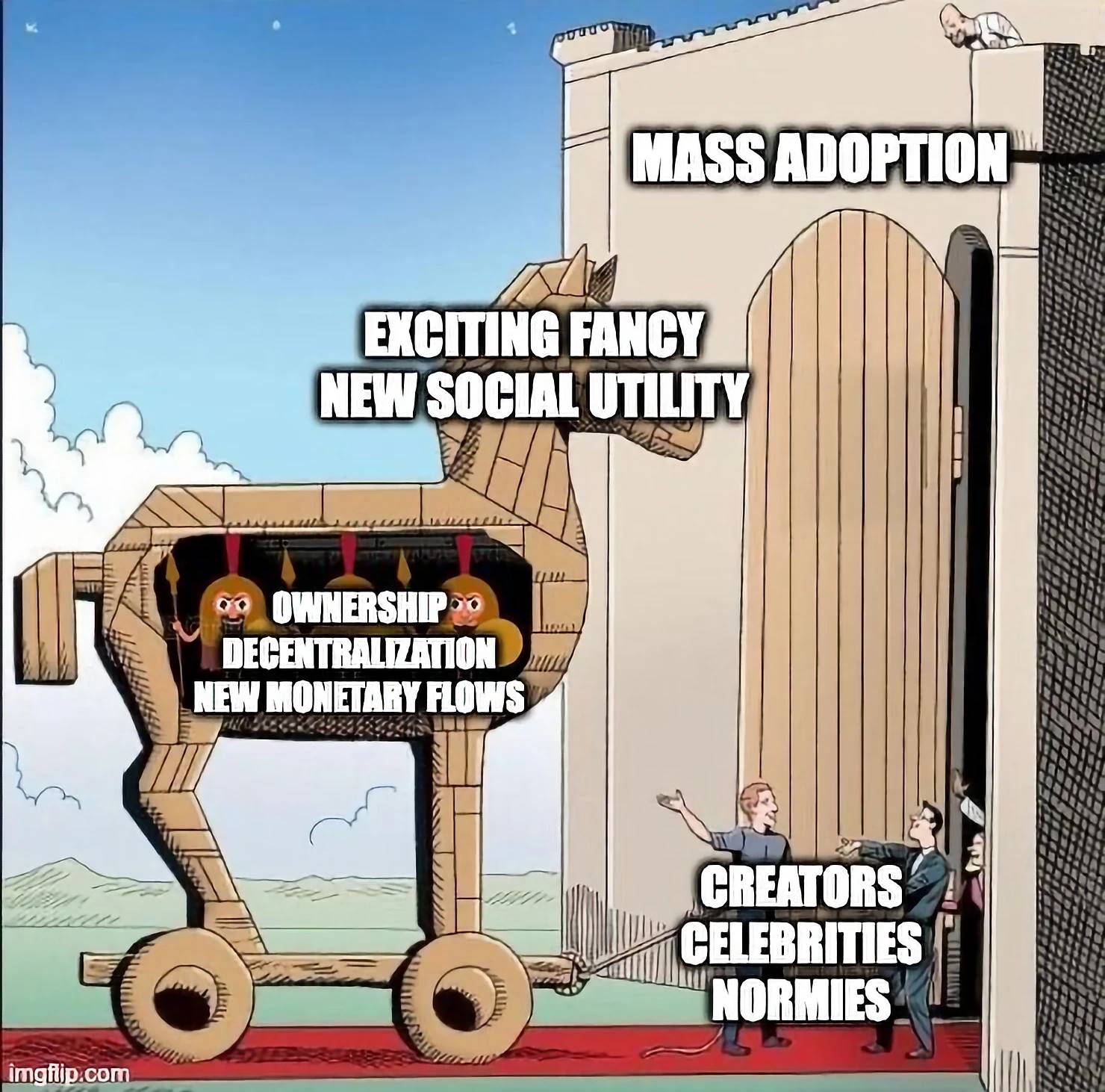

Who knows, if we do it right, we may even be able to leverage these same experiences to eventually impose the true added value of ownership, decentralization, and the flow of new money on the masses as a secret Trojan Horse.

This article is sourced from the internet: SocialFi 2.0: Turning mistakes into successes, attention is a new financial asset

On the afternoon of July 17, Bitget CEO Gracy Chen held a quick question-and-answer AMA with community users. Gracy shared her work experience, team management, and personal life at Bitget, and answered questions about development plans, listing review, BGB destruction, etc. that users were concerned about. The following is a summary of the AMA text: Q1: From joining Bitget in 2022 to being appointed CEO, have you encountered any challenging and impressive problems in the past two years or so? Gracy: I joined the company in April 2022, and the company made an official announcement in June. Soon after, I encountered a series of events such as the collapse of Luna/Terra, the collapse of Celsius and Three Arrows Capital. It can be said that my timing of entering the market…