원본 | Odaily Planet Daily ( @오데일리차이나 )

저자|난지( @어쌔신_말보 )

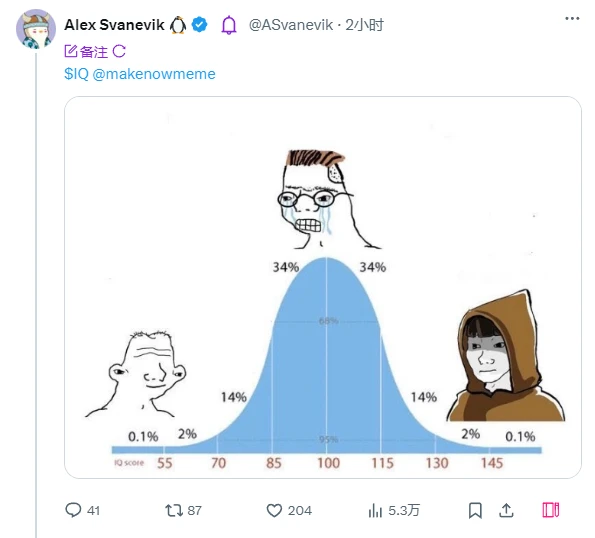

This afternoon, Nansen founder Alex Svanevik published a post on the X platform with the content $IQ @makenowmeme.

MakeNow.Meme mentioned in the post is a token launch platform similar to Pump.fun. Its biggest highlight is that it can issue tokens directly through posting on the X platform. Alex’s move is to release a “test” token through the platform function. Odaily will interpret the platform’s functions and potential directions in this article.

Protocol Features

According to the official definition, MakeNow.Meme is a platform that allows anyone to launch Meme tokens directly through tweets on X. In fact, the platform was launched on July 10, but it did not appear in the public eye until Alex tweeted.

The application of this platform is also very simple. Users first write the $ symbol and the beginning of the token code in the tweet, then add the description of the token, and finally @makenowmeme. In addition to text, users can also attach pictures or videos as supplementary information.

In addition to the release process being different from traditional token launches, MakeNow.Meme has several important features:

-

Devs (deployers) do not need to pay for deploying tokens , which are subsidized by the platform. Other platforms require devs to pay for gas, which is about 0.02 SOL. It costs 2-3 SOL to launch from the internal market to Raydium. Pump.fun pays this part from the 85 SOL raised in the internal market. It is not yet clear whether MakeNow is the same.

-

You can’t have both the power of communication and low-priced chips. When users post on the X platform, they cannot get the bottom chips, but they can spread the token as quickly and as much as possible. In addition to posting on the X platform, MakeNow also supports website deployment like Pump.fun . At this time, the dev can choose to purchase the token first, and the purchase ratio can also be freely determined, but the spread of token information requires a second operation.

-

Bonding Curve may be steeper. The specific algorithm of Bonding Curve has not been announced by any platform, but according to community users, MakeNows curve is steeper than Pump, which means that the profit multiples of early chips will be relatively higher. (Odaily Note: Bonding Curve is often translated as joint curve, which can be more accurately translated as price change function, which means that the price of tokens changes with the progress of the sales process.)

Where does this leave us?

A relatively fair launch method

One of the most widely criticized aspects of Pump.fun’s celebrity token issuance is that some celebrities choose to buy chips first and then publish the Pump.fun link on platform X. Subsequent purchasers can only snap up the remaining chips, which indicates serious insider trading and dumping.

By releasing through MakeNow, users are theoretically on the same starting line as the coin issuers , and can buy with greater confidence without worrying about insider trading. This may become the main way for subsequent celebrities to issue coins.

Feast for scientists

Previously, in the case of Pump.fun’s celebrity token issuance and friend.tech’s early days, multiple Alpha communities developed a technology system for big V monitoring, which far exceeded the speed of obtaining information for regular users. MakeNow also has this problem. Although theoretically users and token issuers are on the same starting line, if the platform successfully occupies a certain market position, the early chips will be acquired by robots, and the possibility of ordinary users taking over is likely to appear again.

결론적으로

Previously, the author analyzed in the article Fairness or Multipliers? Interpreting Pumps Dominance from the Copycat Platform Promoted by the Founder of Whales Market that what Meme users need most is the purest and most profitable casino. MakeNow has eliminated Devs bottom chips, which has improved the money-making effect to a certain extent, and retained the core casino content of Pump.fun, which may have the potential to gain market share in specific aspects.

This article is sourced from the internet: Meme launch platform MakeNow: Posting a message is issuing a coin, and users and coin issuers start at the same time

관련: 암호화폐의 킬러 역량: 확장성, 온체인 평판 및 지불

원저자: 리진 원번역: Vernacular Blockchain 지구상에서 가장 큰 회사들은 모두 네트워크 효과에 기반을 둔 마켓플레이스입니다. Amazon($1.9조), Meta($1.2조), Tencent($4.59조)와 같은 회사들은 모두 시장 공급과 수요를 집계하며, 공급과 수요를 더 많이 통제할수록 네트워크의 가치가 커집니다. 암호화폐 공간에서도 마찬가지입니다. Bitcoin($1.4조 시가총액), Solana($790억 시가총액), Ethereum($4600억 시가총액)과 같은 고가치 네트워크는 모두 개발자, 사용자, 네트워크 운영자로 구성된 다면적 네트워크로, 확장할수록 가치가 커집니다. 하지만 Web2와 Web3 시장의 풍경을 살펴보면 이미 존재하는 시장뿐만 아니라 아직 존재하지 않는 시장도 있습니다. 제가 투자한 수년 동안…