원본 | Odaily Planet Daily ( @오데일리차이나 )

저자|난지( @어쌔신_말보 )

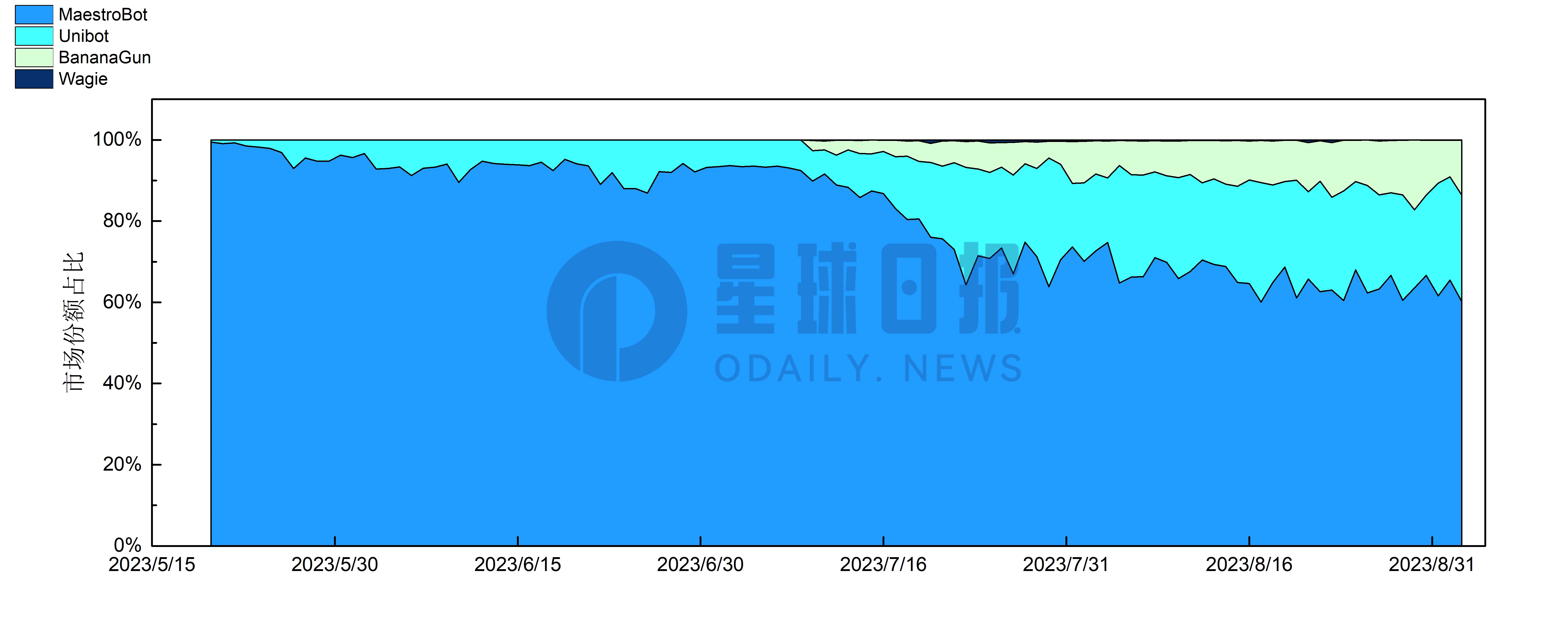

In the third quarter of last year, the Meme market became hot again, breaking the competition pattern dominated by Maestro. A large number of Telegram Bots began to appear on the historical stage, including BananaGun, Unibot and other leading projects at the time, as well as WagieBot, MEVFree and other products that were fleeting in retrospect. Telegram Bot officially became a core track .

A year ago, in Five Charts Predicting the Future Direction of the Trading Bot Track , I believed that due to the Meme stock market and the lack of network effects , Unibot was likely to be disrupted, and the future development direction would focus on one-stop products and significant advantages in a specific function .

One year later, how is the competition in Telegram Bot? What kind of products are the most popular? Odaily Planet Daily will reveal it in this article.

Changes in the competitive landscape

Ethereum: From one superpower to many strong powers to a bipolar pattern

The figure below shows the distribution of Telegram Bot usage fee income in early September 2024. At that time, Maestro accounted for more than 50% of the market share. Unibots market share has not changed much since late July, while BananaGuns share has continued to rise.

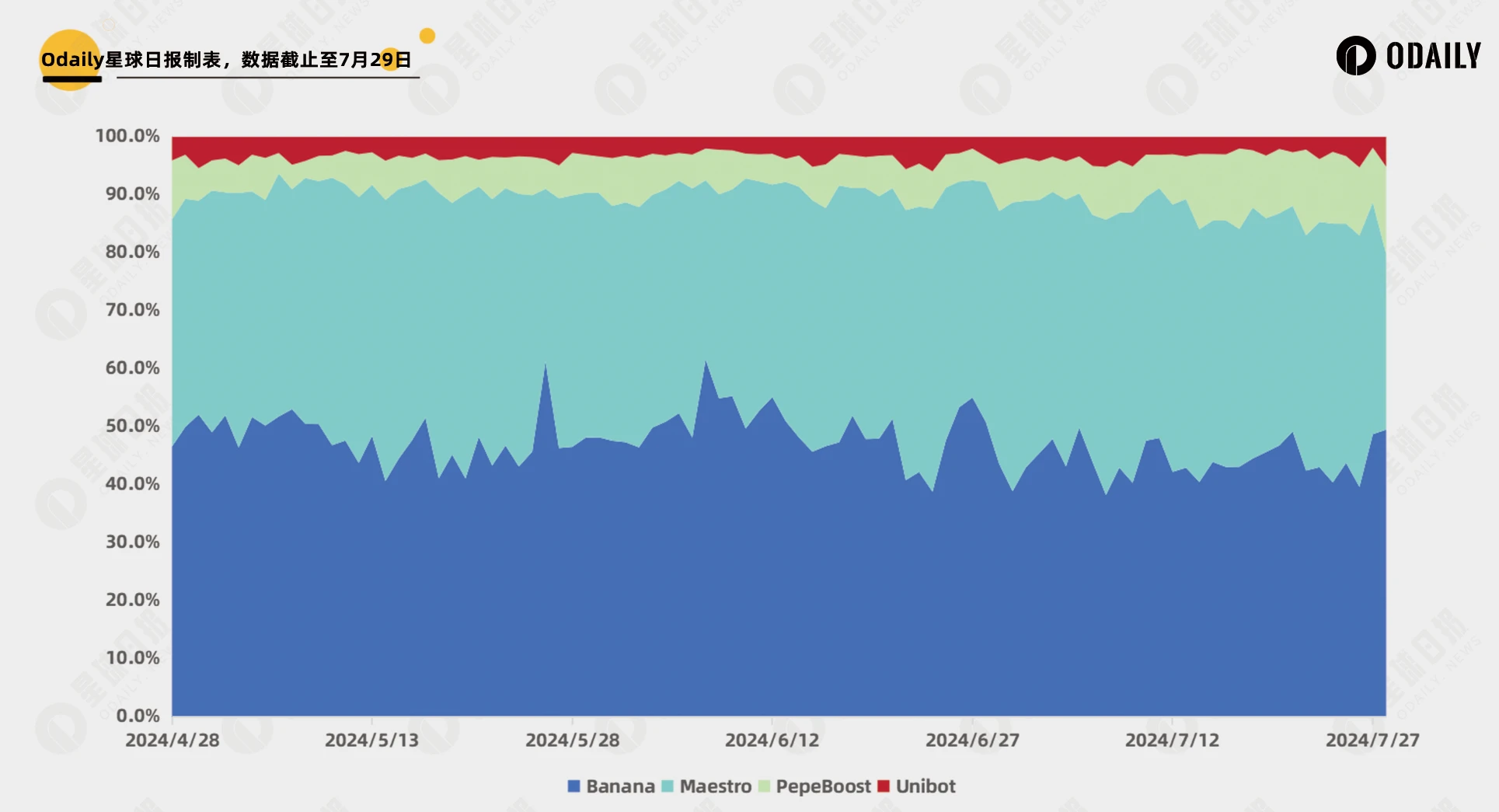

Today, most bots have withdrawn from the competition, but BananaGun has reversed the situation and it and Maestro each have about 45% of the market share. UniBot has retreated completely, and its token has fallen by more than 95% from its peak. The average share of Pepeboost in the past three months is 7%, which has a slight upward trend.

Solana Battle

Solana has more products. The following figure shows the proportion of Bot usage fees in the past three months. Trojan (formerly Unibot on Solana) occupies a dominant position and once became the fifth largest protocol in terms of revenue on the entire network . The market share of other bots is also very solid.

In addition to the products shown in the figure below, several domestic products such as GMGN and CashcashBot are also one of the current mainstream products, but because there is no public query data, they are not included in the statistics.

Product change trends

Telegram Bot has a very high profit margin, and the market competition is very fierce. There is also a serious homogeneity in functionality (mainly sniping and buying and selling). What competitive strategies do various Bots use to stand out?

-

Ultimate product function : BananaGun’s rise last year was due to its 0 block rush purchase function. The bottom buyers of all kinds of new coins all used this protocol. After the tokens rose by hundreds or thousands of times, the market value of the tokens held by the bottom buyers was extremely high, which once again contributed large amounts of income to the Bot and became its core source of income and competitive feature.

-

Community building : One of the key points of PepeBoost is its community building and operation capabilities. The official maintains a high level of user stickiness and conversion rate by setting up relevant Meme channels and personally participating in the operation.

-

Differentiated services : In Meme coin transactions, the movement of smart money is a key factor. CashcashBot guides users to follow orders through its Bot by continuously outputting smart money and the golden dogs it catches to users. Each appearance of the golden dog can effectively achieve user conversion and activation . However, since smart money is public information and easy to copy, there is a problem of a shallow moat.

-

One-stop function : Unibot launched Unibot X a year ago, trying this development direction, but ultimately failed due to overall product reasons. GMGN has successfully achieved certain results through this development strategy, including front-end pump and moonshot new coin tracking; core trading panels and bots; later address data analysis, etc. And iterates very quickly in many details (as expected of a Chinese developer), providing services that other bots cannot achieve alone, achieving differentiated competition .

-

Fee competition : Most Telegram Bots still charge 1% of fees, which is very expensive for Memes that frequently trade. Among the mainstream Bots, only BananaGun charges 0.5% of fees, which is also its core competitive point. Therefore, many Bots offer extremely high rebates for rebates , among which Trojan is the most prominent, setting up a five-level rebate system that can penetrate all the way to the fifth level of the referral.

결론적으로

Currently, Solana Bot’s daily revenue totals about $1 million, and ETH Bot’s daily revenue totals about $150,000, far exceeding all major protocols. Therefore, the current market has not yet started to “roll fees”, but has focused on products, and “one-stop products” and “specific advantageous functions” are still the main development directions. In addition, the community has also become an operational focus, and highly sticky and highly active communities have become the focus of some bots.

충수

The following are the data sources:

Maestro: https://dune.com/whale_hunter/maestro-sniper-bot

BananaGun: https://dune.com/whale_hunter/banana-gun-bot

Trojan: https://dune.com/whale_hunter/trojan-trading-bot

SBT: https://dune.com/whale_hunter/sol-trading-bot

PepeBoost: https://dune.com/whale_hunter/pepe-boost

BonkBot: https://dune.com/whale_hunter/bonkbot

Shuriken: https://dune.com/whale_hunter/shuriken

Unibot: https://dune.com/whale_hunter/unibot-revenue

This article is sourced from the internet: Looking back at the Telegram Bot track that has been popular for a year, these five competitive strategies have helped the representative players stand out

Related: From the hottest to the worst, the rise and fall of Friend.Tech

As the market goes up and down, the prices of some altcoins will never return to their original levels. Products and businesses may also be gone forever. In the daily question of What to play today, will anyone mention the name Friend.Tech? However, you didn鈥檛 say this a year ago: Friend.Tech is the new trend of SocialFi, the darling of Paradigm鈥檚 investment, the hot topic that all research reports are competing to write about, and the god of wealth that liberates the KOL fan economy… How come he has now become an abandoned pawn that even dogs dont play with? Attention is not eternal. The once popular encryption products have already fallen from the altar inadvertently. But the crypto market has memory, so let鈥檚 take a brief look back to…