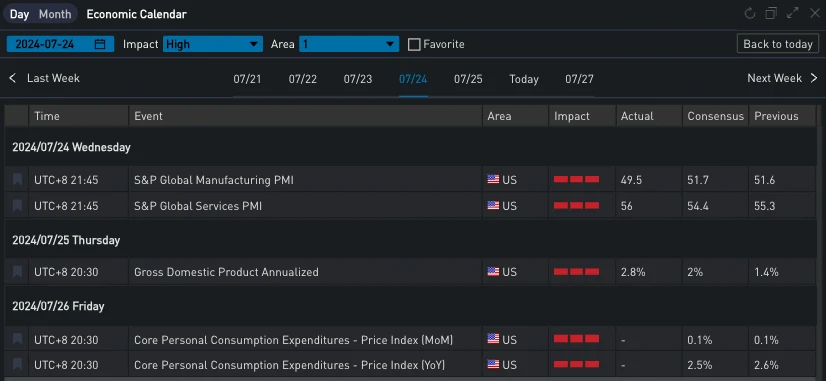

Over the past two days, traditional market concerns about the impact of the AI investment bubble on technology stocks have caused a collective decline in U.S. stock indexes and put pressure on digital currency prices. In addition, strong U.S. GDP data (2.8%, expected 2%) and allegations of market manipulation against Bitfinex and Tether have also cast a shadow on bullish sentiment.

Source: SignalPlus Economic Calendar

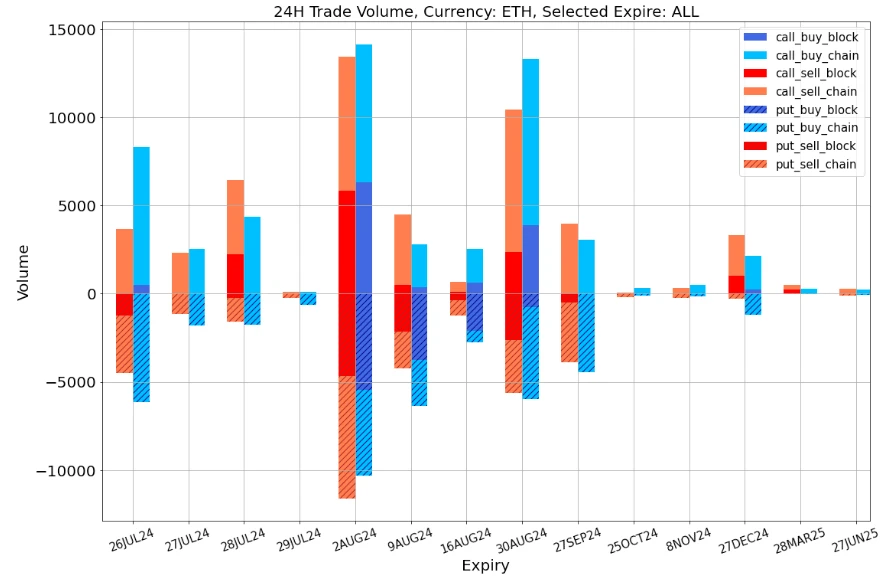

The past two days have been even more difficult for ETH. Although the inflows from the three giants on the first day of the ETFs listing offset the selling from Grayscale, the selling of ETHE has not slowed down in the past 48 hours, while the inflows from other products have been intercepted, resulting in net outflows of 152 million and 133 million US dollars respectively. ETH once dropped to around 3070, giving up nearly half of the gains after the rebound from the bottom in early July, and rebounded slightly today to around 3250. However, some analysts are optimistic about the eventual addition of the ETH Spot ETFs staking function, believing that this will increase the attractiveness of the ETF and make the market rethink and weigh the possibility of short-term risks and potential long-term gains.

Source: TradingView; Farside Investors

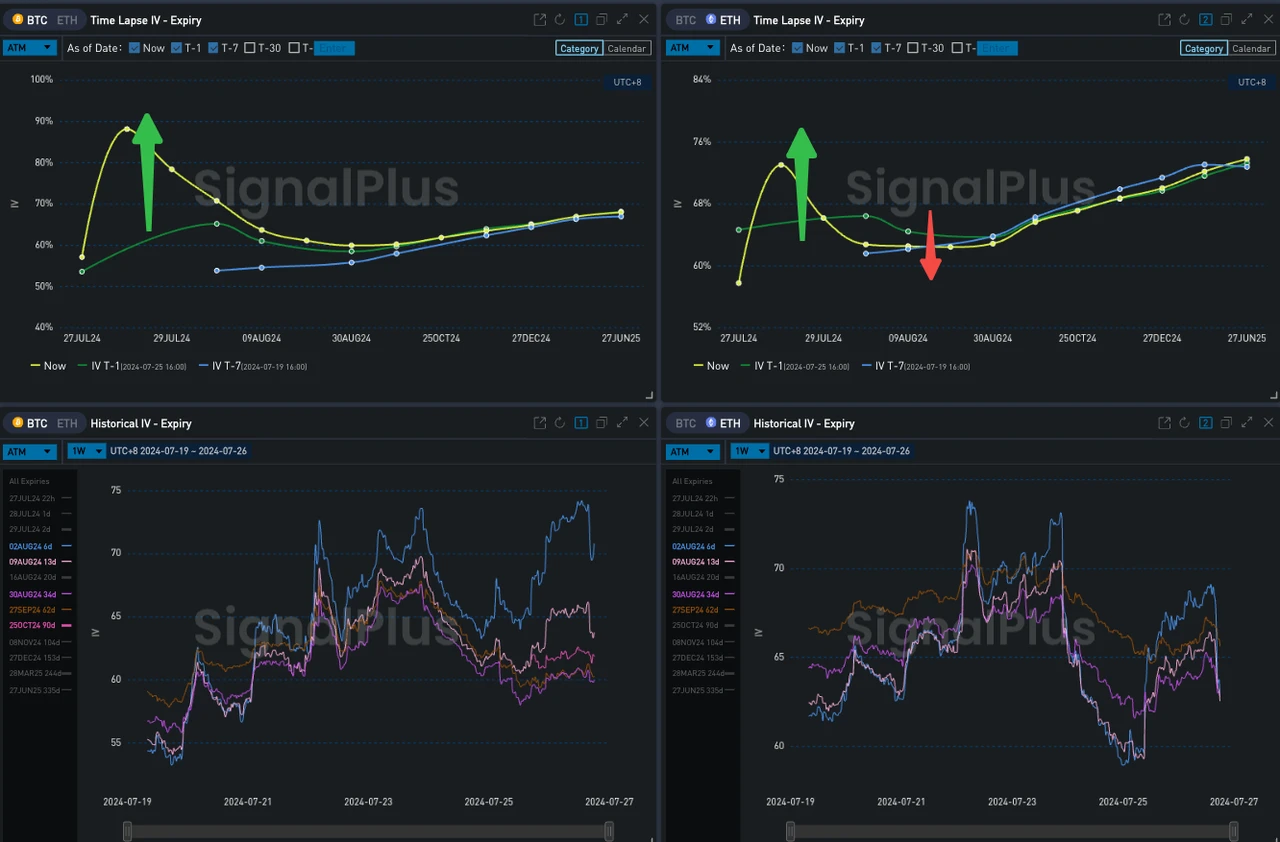

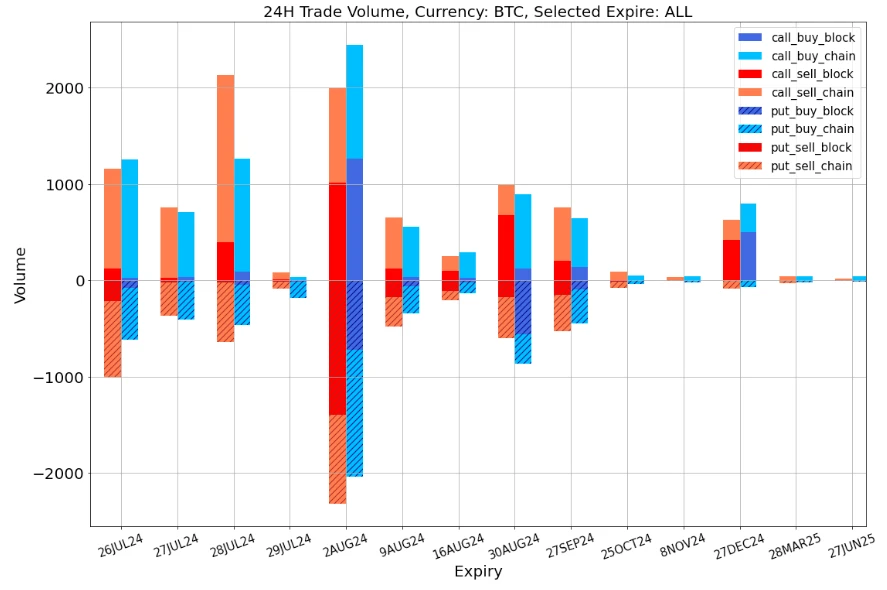

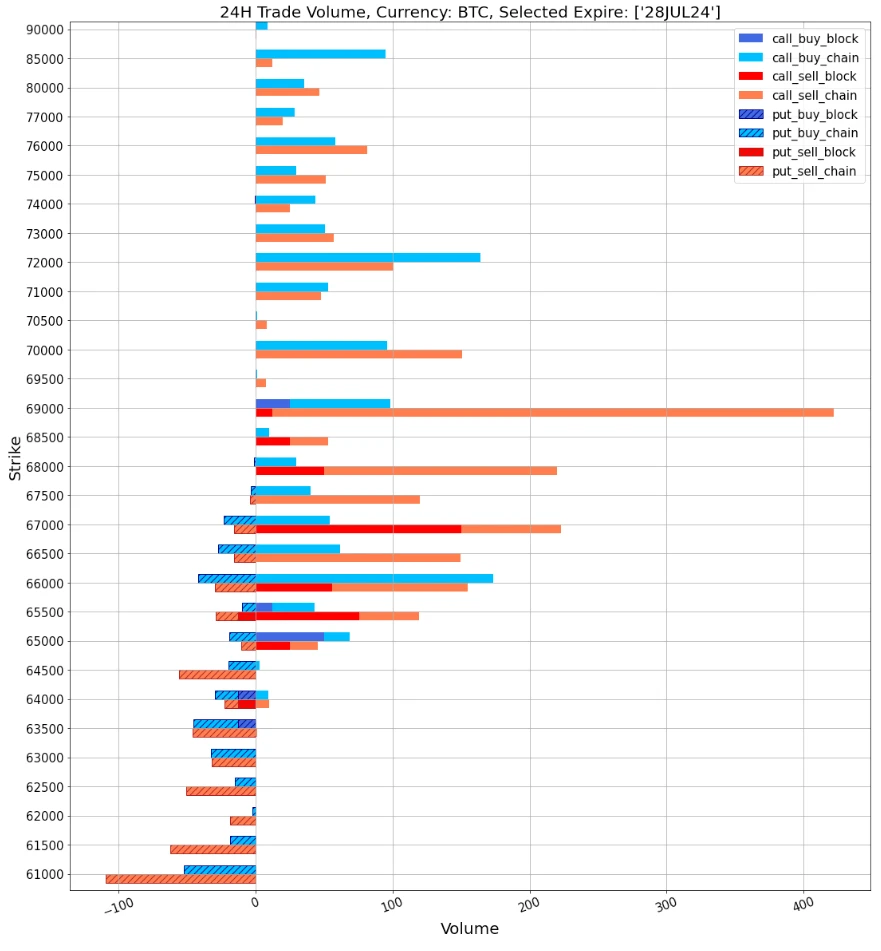

In terms of options, the 28 JU L2 4 options that were delivered on the day of the 2024 Bitcoin Summit were sought after by the market as soon as they were launched. The market priced-in the extremely high price volatility expectations on the Forward IV of the day, and the ATM VOL was priced at a high of 90%. At the same time, the Vol Skew curve rose sharply due to the markets positive expectations, tilting towards call options, but such a high Vol Premium also attracted the attention of traders, and the 67000/68000/69000 Calls all saw fierce selling (see the transaction distribution in the figure below).

출처: Deribit (2016년 5월 2일 00시 UTC+8 기준)

출처: 시그널플러스

출처: 시그널플러스

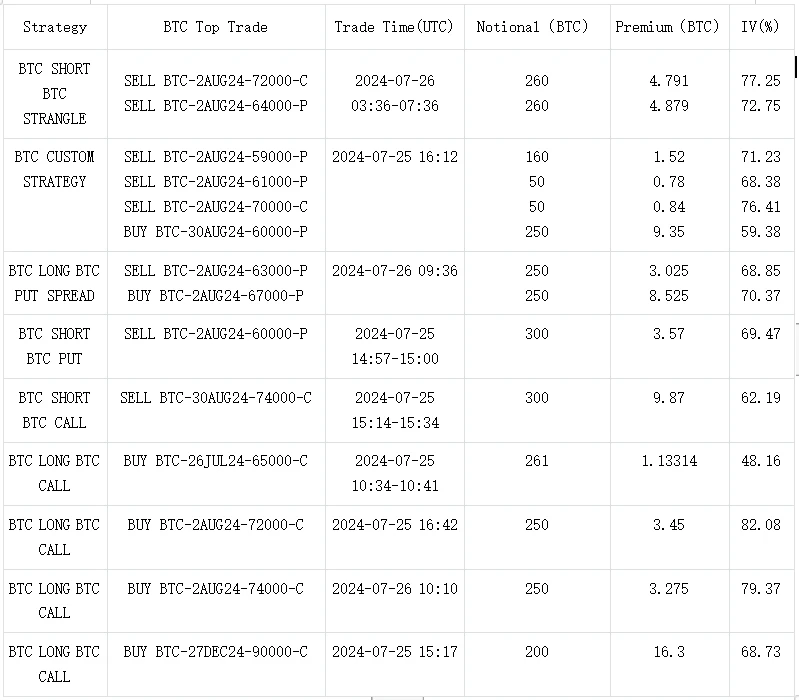

데이터 출처: Deribit, BTC 거래의 전체 분포

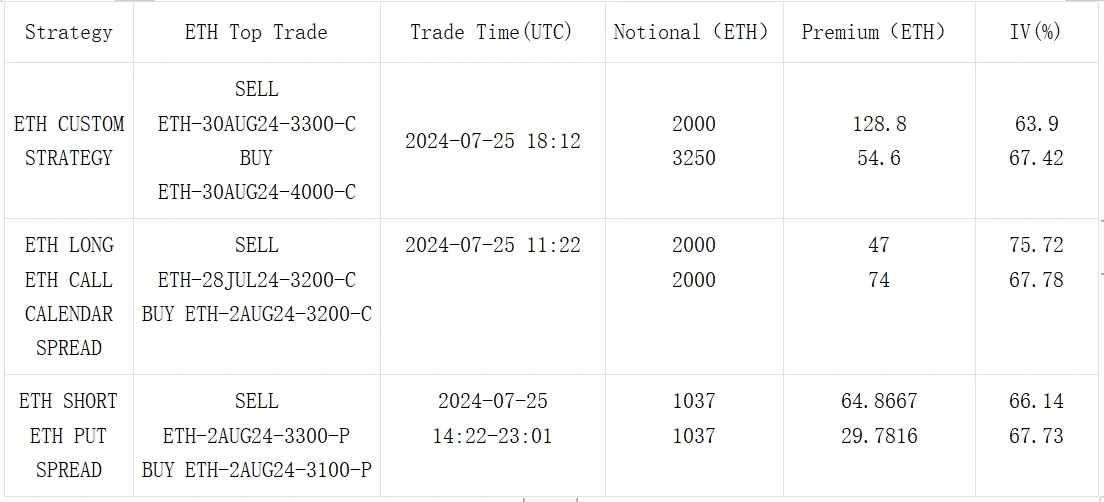

데이터 출처: Deribit, ETH 거래의 전체 분포

출처: Deribit 대량매매

출처: Deribit 대량매매

t.signalplus.com에서 SignalPlus 트레이딩 베인 기능을 사용하면 더 많은 실시간 암호화폐 정보를 얻을 수 있습니다. 업데이트를 즉시 받으려면 Twitter 계정 @SignalPlusCN을 팔로우하거나 WeChat 그룹(WeChat 보조원 추가: SignalPlus 123), Telegram 그룹 및 Discord 커뮤니티에 가입하여 더 많은 친구와 소통하고 상호 작용하세요. SignalPlus 공식 웹사이트: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240726): Beware of the weekend

Related: On-chain liquidity game: the hunt of developers, snipers and traders

Original author: post-goa Original translation: TechFlow Based on my research, here is a brief summary of the roles that play the on-chain liquidity game. Developers and Insiders False utility slowly pulls up or is “exploited”: These were very popular in the early AI craze because no one really understood AI at the time, but everyone wanted early exposure. They never complete more than 1% of their roadmap, usually hyped up by opinion leaders (KOLs). The team often allocates a large amount of supply to themselves when the contract is launched, and then distributes it before anyone else. These tokens are then hidden in multiple wallets and then sold. Slowly pull up after the initial rally or hit a hole after a few weeks of pumping, and quickly run away after…