In the past week, the market has started to rebound strongly. Will this round of rebound become a reversal? Recently, the US economic data has gradually weakened, and the voices of interest rate cuts have gradually increased. Several Fed officials have hinted that interest rate cuts are approaching, but the specific time has not been determined. Ethereum spot ETFs may allow staking, and Bitcoin is in high spirits, testing the 65,000 mark upward. The performance of some altcoins has outperformed the market. We believe that Bitcoin has broken away from the lower limit of valuation, and the next step may be adversely affected by the downward trend of US stocks.

Macro environment

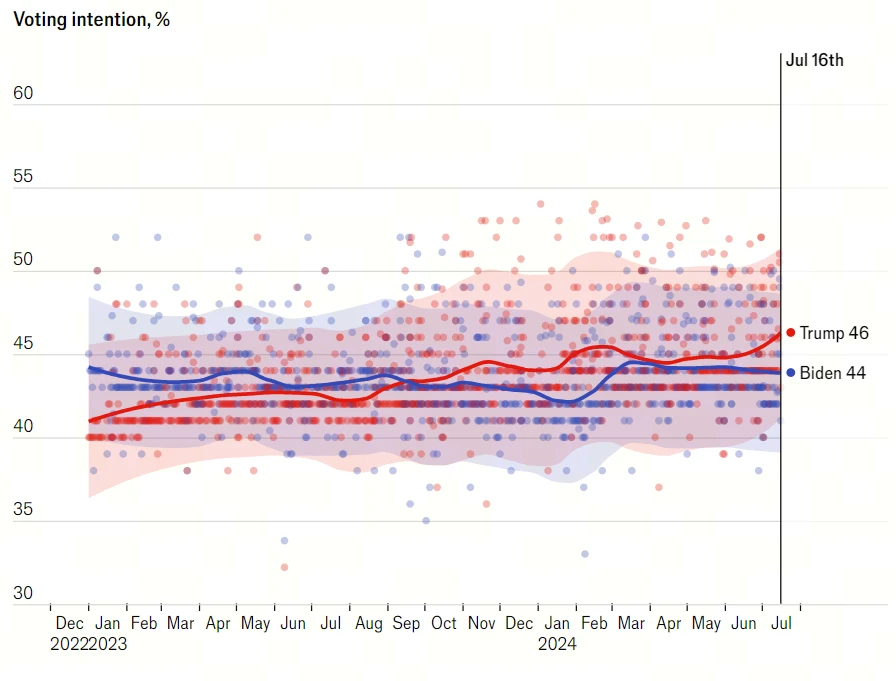

Trumps approval rating rises after assassination

Former US President Donald Trump was shot by a man at a rally to promote the presidential election at the end of the year, bringing him one step closer to the presidency.

Source: The Economist

In recent years, Trump has continuously supported the crypto market and threatened that other countries, especially China, should not be allowed to take over cryptocurrencies. This has led to greater expectations in the market for a more relaxed regulatory environment in the U.S. crypto market. The market is also looking forward to whether China will have further regulatory relaxation policies.

The U.S. economy is waiting to turn around

The US economy is waiting for direction. According to the GDP Now model of the Atlanta Federal Reserve on July 10, the US GDP is expected to grow at an annualized rate of 2.0% in the second quarter. On the one hand, the US economy continues to expand, and the GDP growth rate is still close to the potential growth rate, especially the role of investment in driving economic growth. On the other hand, with the exhaustion of excess savings of US households and the inhibitory effect of high interest rates on consumption, the strong pull of consumption on the economy has obviously weakened. Overall, the US economy is waiting for direction, but the cooling signal is increasing.

Market status and future trends

This week, the market has been strong due to the reduction of selling pressure. The price trend of Bitcoin (BTC) is very strong, and the altcoin market has also strengthened. On July 23, the Ethereum spot ETF may be launched, and the short-term market sentiment has been supported. The Bitcoin Fear and Greed Index has turned to Greed.

Source: Coinglass

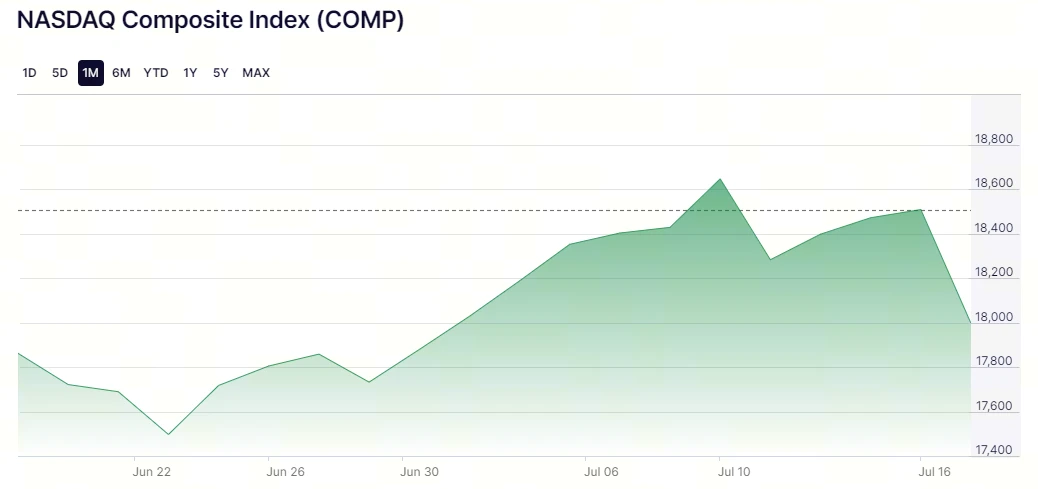

Bitcoins recent trend is similar to that of the Nasdaq index, regaining its relatively strong performance. As our magazine said last week, after the selling pressure eased, there was a rapid rise in the short term. However, before the future interest rate cut, the US stock market may fall and bring the market crash, so we should focus on the trend of the US stock market.

Source: Nasdaq official website

High-quality track

1) AI sector

Hot Spot: WLD postpones unlocking schedule

According to the Worldcoin Foundation, the WLD tokens allocated to Worldcoin contributor Tools for Humanity were originally scheduled to be unlocked daily in a linear manner starting on July 24, 2024. However, TFH extended the unlocking schedule for 80% of the WLD held by team members and investors from 3 years to 5 years.

Reasons for rebound:

The AI sector experienced a round of oversell in the early stage. As BTC and market sentiment warmed up, WLDs rapid rebound promoted the continued recovery of the track, driving mainstream currencies such as TAO and NEAR to continue to strengthen.

2) Meme track

Hot topic: Ethereum spot ETF is about to be approved

The market believes that the ETH spot ETF may be approved by the SEC on July 23, and there may be significant gains by lurking in the Ethereum ecosystem.

특정 통화 목록:

Etherfi: Etherfi’s second season airdrop has been launched. Please check the website. The third season will last from July 1 to September 14, and 25 million ETHFI will be distributed.

PEPE: Currently, it is the most popular Meme coin in the ETH ecosystem. It has a very strong community foundation and can be continuously watched as a big BETA of ETH.

User attention

1) Popular Tokens on Twitter

-

$VANCE

Vance was once a fierce critic of Trump, but later turned to support the Republican leader. He formally accepted the vice presidential nomination at the 2024 Republican National Convention and expressed his loyalty to Trump. He was originally famous for his book Hillbilly Elegy, which was later adapted into a movie. The book describes his experience growing up in a poor mountain area and his insights into American social and economic problems.

Additionally, Vance is considered a politician who supports cryptocurrency. Although his most recent financial disclosure did not disclose the purchase or sale of any cryptocurrency, in 2022 he disclosed holding between $100,000 and $250,000 worth of Bitcoin.

-

$ETHFI

The ether.fi Foundation announced that it has written a description of current and future features to enhance the utility, market dynamics and user engagement of the ETHFI token. In addition, the ether.fi Foundation announced on X that Season 2 ETHFI claims are now live.

Ether.Fi allows participants to stake while retaining control of their private keys. Users’ deposits are re-collateralized locally, using Eigenlayer to support external systems such as Rollups and oracles, thereby increasing returns for ETH stakers.

2) Popular DApps

Meet 48

Meet 48 Metaverse is a unique virtual idol creation platform that combines AI data models, dance choreography, idol song generation, and personalized virtual idol characters. Users can use AI tools to create UGC content and export it to the platform for rewards. In addition, MEET 48 is a social metaverse driven by Web3 and AI technology, containing music, song, and dance elements. Here, users can interact with real idols, meet like-minded friends, create their own Avatar, and train them into high-profile superstars.

요약하다

In the past week, the market rebounded strongly, especially Bitcoin and Ethereum, which showed a significant upward momentum. As US economic data cooled and calls for interest rate cuts gradually rose, the markets expectations for the Feds policy became stronger. The possible passage of the Ethereum spot ETF and the introduction of the staking function further stimulated market enthusiasm, while Bitcoin has broken through key points and some altcoins have also outperformed the market. However, the market still needs to pay attention to the trend of US stocks and its possible impact in the future. In this macro environment, hot events in the AI and Meme tracks deserve close attention from investors.

This article is sourced from the internet: Macroeconomic research: Bitcoins rise is encouraging, and the trend of US stocks may be the key to breaking through 70,000

Related: Bitcoin vs Ethereum: A culture war rooted in fundamental principles

Original author: WILLEM SCHROE , founder of Botanix Original translation: Block unicorn Bitcoin and Ethereum, despite being twin forces in the promotion and adoption of cryptocurrency and blockchain technology, have historically been at odds with each other due to the “L1 war” and its active network supporters. To some, this competition may seem like just a culture war within the crypto community. However, fundamentally, this reflects very different underlying beliefs that have led to the disagreement. Let’s dig deeper into these fundamental beliefs: Bitcoin: A beacon of decentralization (and liquidity) Bitcoin was designed to challenge the traditional financial system and provide an alternative that does not require intermediaries. Proponents resonate with this goal and therefore make decentralization their primary criterion. An example of this commitment is the blocksize war between…