Trump assassination drives Bitcoin surge

The rising probability of Trumps victory has made risky assets such as Bitcoin popular. In particular, the Republican Party mentioned in its latest campaign platform that if Trump takes office, it will end the suppression of cryptocurrencies, which has greatly boosted confidence in the cryptocurrency market.

The “Trump deal” is a hit.

After Trump was attacked over the weekend, a series of Trump-related assets such as U.S. Treasury yields and Bitcoin soared. This is all thanks to the fact that he survived the assassination attempt, and the American peoples support for Trump has soared.

Among them, Bitcoin rose for six consecutive days, with a total increase of 11.59% this week, reaching a high of US$66,000.

There are about 11 days until the next Fed meeting (August 1, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

시장 기술 및 정서 환경 분석

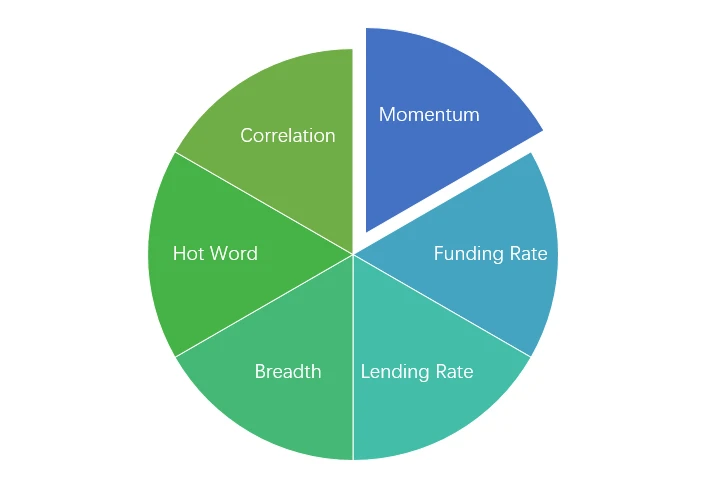

감정 분석 구성 요소

기술 지표

가격 추세

In the past week, BTC prices rose 11.59% and ETH prices rose 10.55%.

위 사진은 지난주 BTC 가격 차트입니다.

위 사진은 지난주 ETH 가격 차트입니다.

지난주 가격변동률을 보여주는 표입니다.

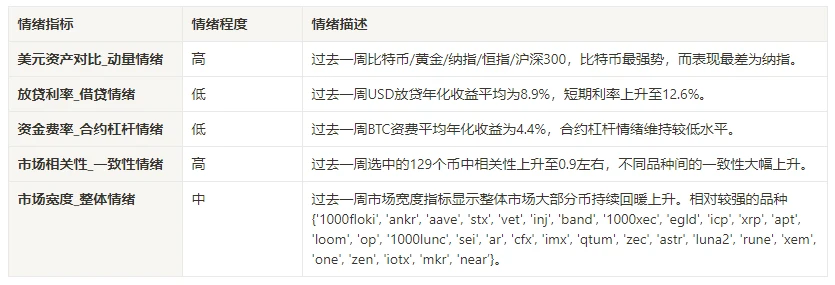

가격 분포 차트(지지 및 저항)

In the past week, BTC and ETH formed a new intensive trading area as they rose to high levels and increased in volume.

위 그림은 지난주 BTC의 밀집된 거래 지역 분포를 보여줍니다.

위 그림은 지난주 ETH 밀집 거래 지역의 분포를 보여줍니다.

표는 지난주 BTC와 ETH의 주간 집중 거래 범위를 보여줍니다.

거래량 및 미결제약정

In the past week, BTC and ETH had the largest trading volume when they rose from July 15 to 16; the open interest of BTC and ETH both fell slightly.

위 사진의 상단은 BTC의 가격동향, 가운데는 거래량, 하단은 미결제약정, 하늘색은 1일 평균, 주황색은 7일 평균을 나타냅니다. K라인의 색상은 현재 상태를 나타내고, 녹색은 가격 상승이 거래량에 의해 뒷받침됨을 의미하고, 빨간색은 포지션 청산을 의미하며, 노란색은 포지션이 천천히 축적되는 상태, 검은색은 혼잡한 상태를 의미합니다.

위 그림의 상단은 ETH의 가격 추세를 나타내고, 가운데는 거래량, 하단은 미결제약정, 연한 파란색은 1일 평균, 주황색은 7일 평균을 나타냅니다. K라인의 색상은 현재 상태를 나타내고, 녹색은 가격 상승이 거래량에 의해 뒷받침됨을 의미하고, 빨간색은 포지션 청산, 노란색은 포지션이 서서히 축적되고 있음, 검은색은 혼잡함을 의미합니다.

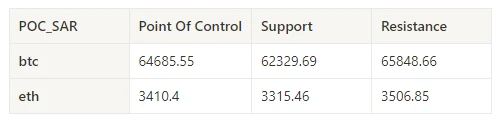

역사적 변동성과 내재된 변동성

In the past week, the historical volatility of BTC and ETH was the highest when it rose to 7.16; the implied volatility of BTC and ETH rose synchronously.

노란색 선은 과거 변동성, 파란색 선은 내재 변동성, 빨간색 점은 7일 평균입니다.

이벤트 중심

There were no major data releases in the past week.

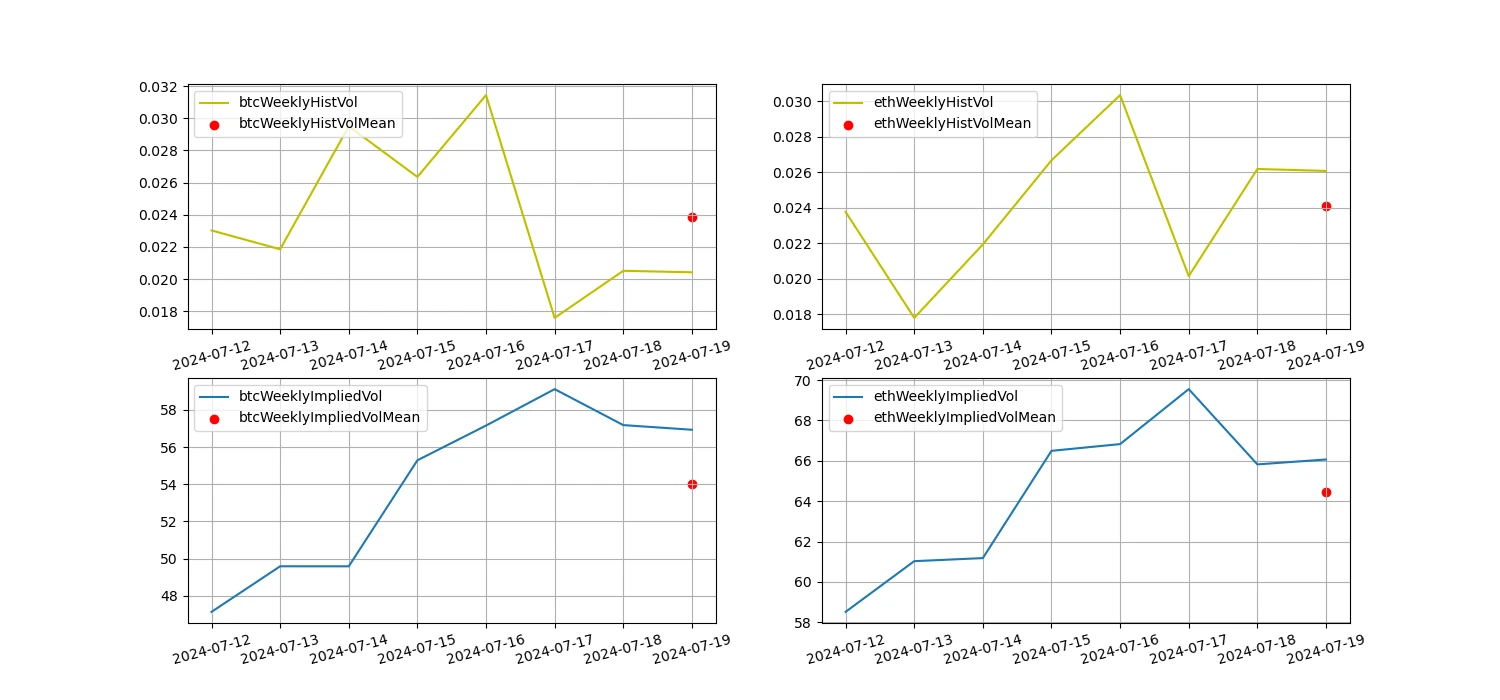

감정 지표

모멘텀 감정

In the past week, among Bitcoin/Gold/Nasdaq/Hang Seng Index/SSE 300, Bitcoin was the strongest, while Nasdaq performed the worst.

위 그림은 지난주 다양한 자산의 추세를 보여줍니다.

대출금리_대출심리

The average annualized return on USD lending over the past week was 8.9%, and short-term interest rates rose to 12.6%.

노란색 선은 USD 금리 최고가, 파란색 선은 최고가 75%, 빨간색 선은 최고가 75%의 7일 평균입니다.

표는 과거 보유일별 USD 이자율의 평균 수익률을 보여줍니다.

펀딩비율_계약 레버리지 감정

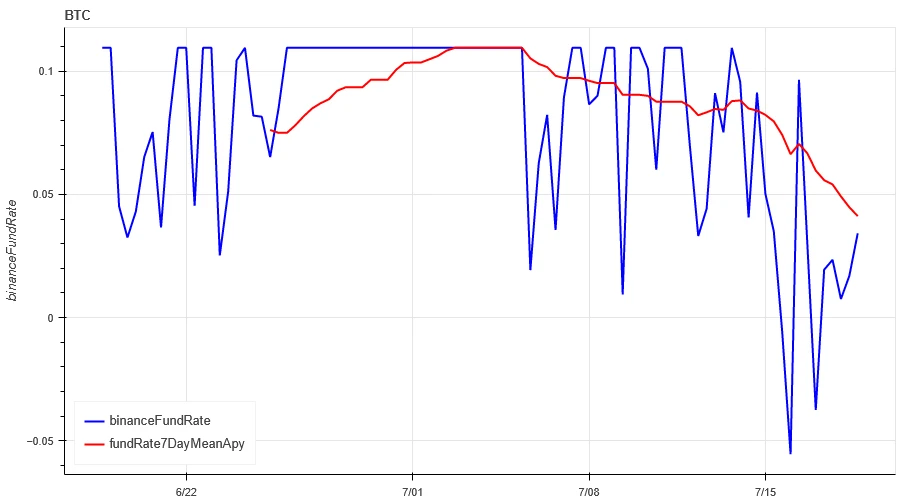

The average annualized return on BTC fees in the past week was 4.4%, and contract leverage sentiment remained at a low level.

파란색 선은 바이낸스의 BTC 펀딩 비율이고, 빨간색 선은 7일 평균입니다.

The table shows the average return of BTC fees for different holding days in the past.

시장 상관관계_합의적 감정

The correlation among the 129 coins selected in the past week remained at around 0.9, and the consistency between different varieties increased significantly.

In the above picture, the blue line is the price of Bitcoin, and the green line is [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx , imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme, mina, mkr, near, neo, ocean, one, ont, op, pendle, qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx , sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] overall correlation

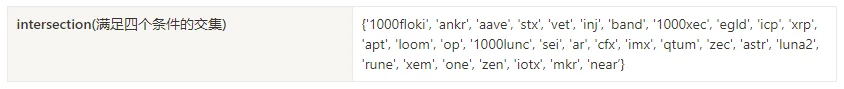

시장폭_전반적인 심리

Among the 129 coins selected in the past week, 78% of the prices were above the 30-day moving average, 37% of the prices were above the 30-day moving average relative to BTC, 33% of the prices were more than 20% away from the lowest price in the past 30 days, and 67.7% of the prices were less than 10% away from the highest price in the past 30 days. The market breadth indicators in the past week showed that most of the coins in the overall market rebounded and rose.

The picture above is [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apt, arb, ar, astr, atom, avax, axs, bal, band, bat, bch, bigtime, blur, cake, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot , icp, icx, idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, manta, mask, matic, meme, mina, mkr, near, neo, nfp, ocean, one, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, robin, rose, rune, rvn, sand, sei, sfp, skl, snx, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] 30-day proportion of each width indicator

요약하다

In the past week, the prices of Bitcoin (BTC) and Ethereum (ETH) rose for 6 consecutive days, while the volatility and trading volume of these two cryptocurrencies reached the highest level when they rose on July 16. The open interest of Bitcoin and Ethereum is declining. In addition, the implied volatility of Bitcoin and Ethereum has also risen in tandem. Bitcoins funding rate remains at a low level, which may reflect the continued low leverage sentiment of market participants towards Bitcoin. Market breadth indicators show that most cryptocurrencies have rebounded and risen, indicating that the overall market has rebounded from lows in the past week.

트위터 : @ https://x.com/CTA_ChannelCmt

웹사이트: 채널cmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.07.12-07.19): Trumps assassination drives Bitcoin up

Related: Decoding Dar Open Network: The infrastructure layer for the next generation of Web3 games

At Dar Open Network, we firmly believe in the transformative power of blockchain games. Games are not only entertainment, but also empower players, revolutionize the digital economy, and push the boundaries of technological innovation. As the crypto industry grows, we believe that blockchain games will become the cornerstone of a new paradigm in driving adoption, creativity, and digital interaction. Our team is committed to building a gaming platform that serves game developers and players. We are not creating a new chain, but building an ecosystem. Guided by this vision, we developed Dar Open Network as the infrastructure layer for future games. The creation of Dar Open Network has been going on for six months. Starting from the mission of providing a one-stop solution, we have made progress in many aspects…