원저자: SecondLane

원문: TechFlow

-

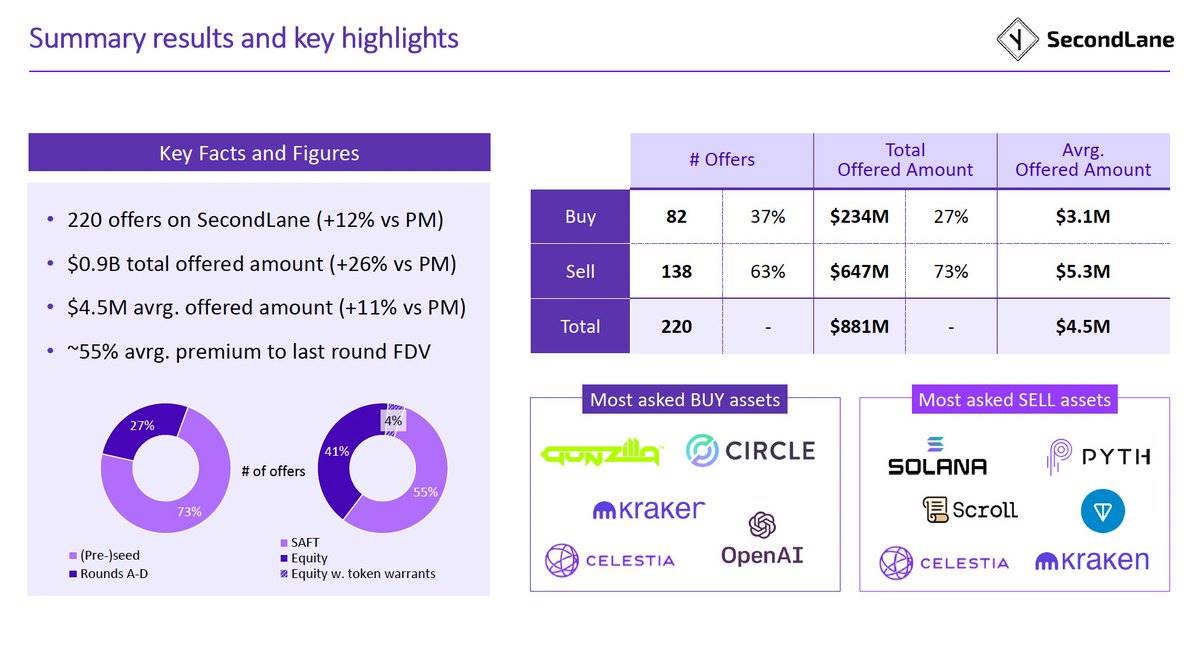

June was the first month this year that clearly showed a buyer’s market, with buy requests outnumbering sell offers by 75%!

-

The valuation gap between bid and ask prices for the same asset fell to 36% from 88% last month

-

The total order book value for June 2024 is $883 million

-

The average asking price was $4.5 million, up sharply from $3.9 million last month.

-

The average premium was 55% of the last fully diluted valuation

-

Major projects: Circle, Solana, Scroll, Kraken, Celestia, TON, Pyth, Gunzilla, OpenAI

-

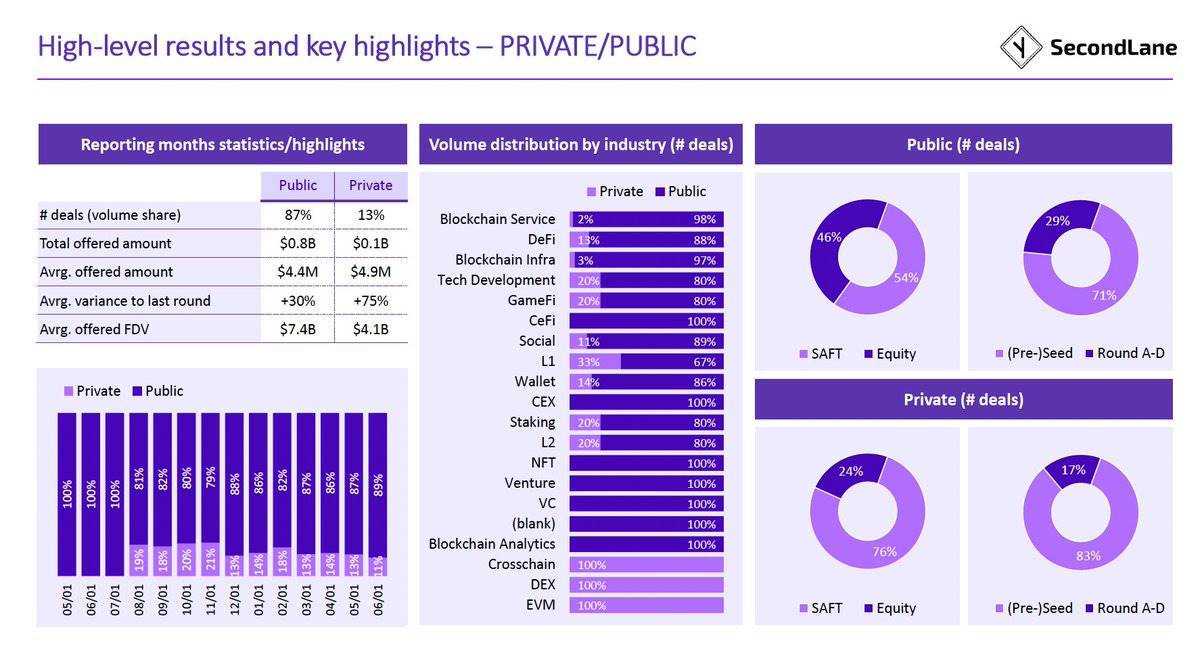

57% of transactions were SAFTs and 44% were equity transactions

-

73% of deals were (early) seed rounds, and 27% were Series A to D rounds

-

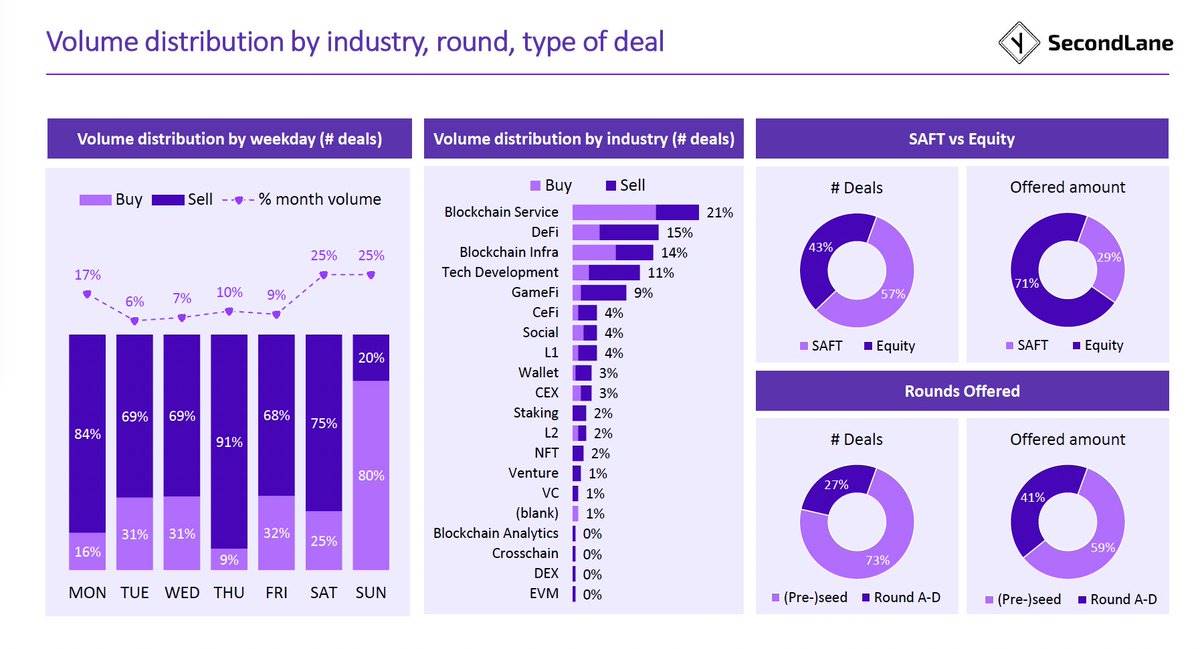

70% of transactions are concentrated in five areas: blockchain services, DeFi, infrastructure, technology development, and GameFi

-

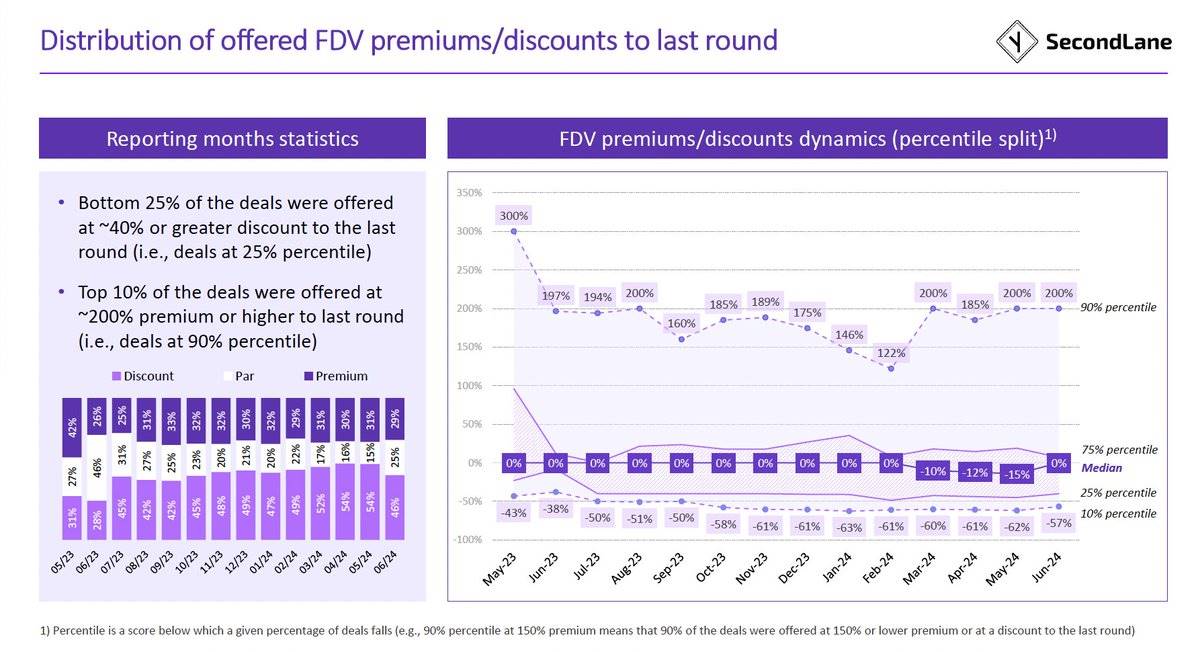

Deals with a previous round premium decreased by 2%

-

The number of transactions was the same as the previous round, an increase of 10%

-

46% of deals in June were at a discount, 25% were flat, and 29% were at a premium to the previous round

-

The median discount across all deals in June was 15% of the previous round

-

The top 10% of deals offer a 200% or higher premium over the previous round

-

The bottom 25% of deals offer discounts of 40% or more from the previous round

-

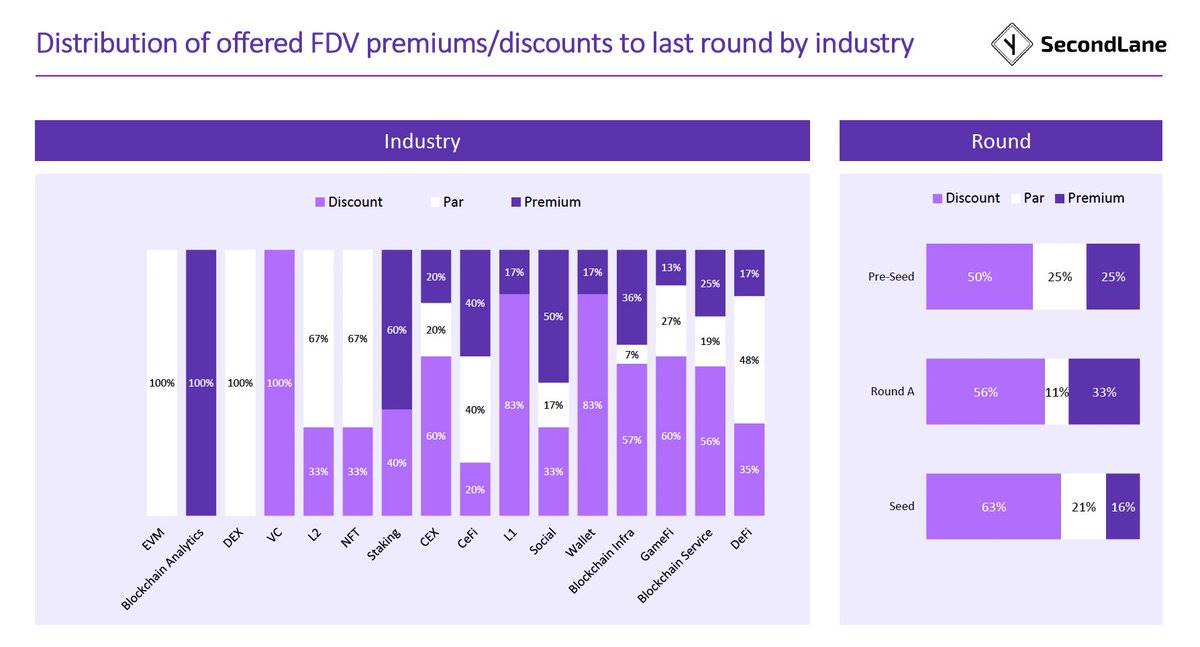

Enjoy the biggest discounts on LP positions in VC funds, CEXs, L1s, wallets, GameFi, blockchain infrastructure and services

(Note from Shenchao: The term “discount” in this article refers to a discount in a transaction, which means that the transaction price of some assets is lower than its previous round of financing or market price. For example, some transactions are conducted at a price lower than the previous round of financing, which is called a “discount”)

-

Blockchain analysis and staking projects enjoy the highest premium

-

Series A projects enjoy the highest premium, and seed round projects enjoy the biggest discount

-

13% of deals floated without public exposure and at lower valuations ($4.1 billion fully diluted valuation for private offers vs. $7.4 billion for public offers)

-

Most private placements were SAFTs (76%), at (early) seed stage (83%), targeting DEXes, EVM, and cross-chain solutions

-

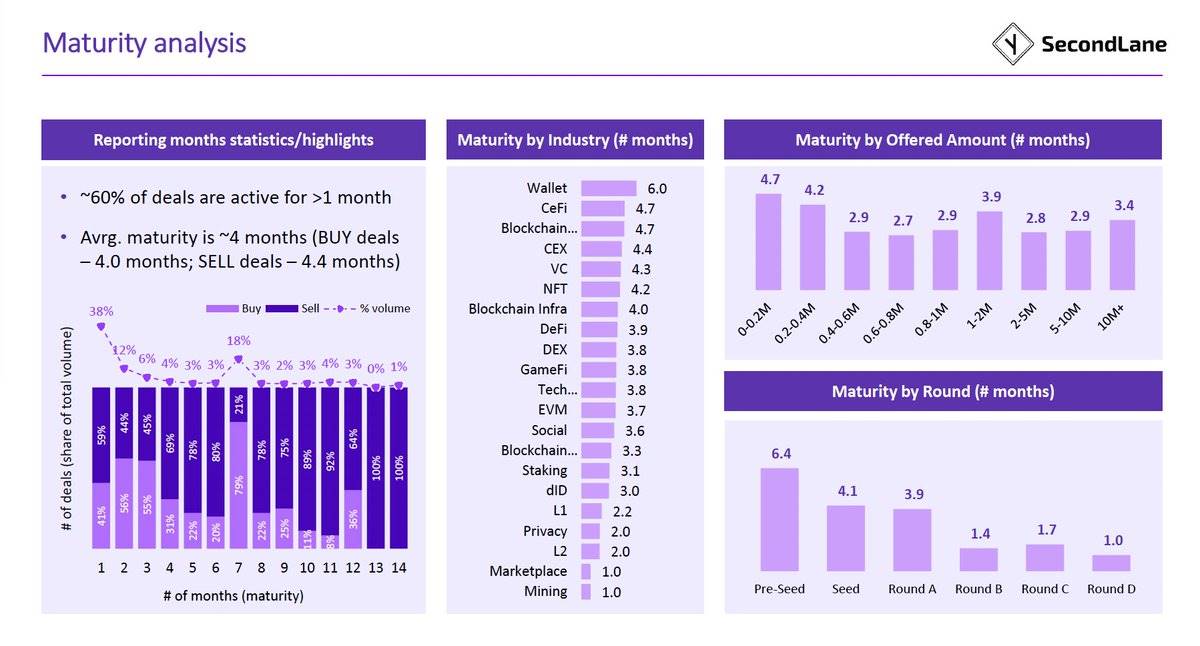

The average time to expiration of trades increased to 4 months for buy requests and 4.4 months for sell offers until expiration or trade completion.

-

60% of transactions are active for more than 1 month

-

The maximum expiration time is:

-

Early vs. late rounds: 6.4 months for early seed rounds; about 4 months for seed and A rounds, and more than 1 month for B, C, and D rounds

-

CeFi, wallets, CEX projects, VC, NFT, blockchain infrastructure

-

The median buy request was $200,000 and the average valuation was $9 billion

-

2/3 of buy requests were made at a discount (average discount was 40% of the previous round or spot price); 6% were flat; 25% required an average premium of more than 80%

-

The median asking price was $2 million, with an average valuation of $6.5 billion

-

40% of deals were done at a discount (average discount was 45%); 32% were flat; 29% required a premium (average was over 270%)

This article is sourced from the internet: June secondary market report: Buyers market signs are obvious, asset purchase demand exceeds offer price by 75%

2024년 6월 10일, UwU Lend가 공격을 받았고 해당 프로젝트는 약 US$19.3 million의 손실을 입었습니다. SharkTeam은 이 사건에 대한 기술적 분석을 수행하고 가능한 한 빨리 보안 예방 조치를 요약했습니다. 후속 프로젝트가 이 사건에서 교훈을 얻어 블록체인 산업을 위한 보안 방어선을 공동으로 구축하기를 바랍니다. 1. 공격 거래 분석 공격자: 0x841dDf093f5188989fA1524e7B893de64B421f47 공격자는 총 3개의 공격 거래를 시작했습니다. 공격 거래 1: 0x242a0fb4fde9de0dc2fd42e8db743cbc197ffa2bf6a036ba0bba303df296408b 공격 거래 2: 0xb3f067618ce54bc26a960b660cfc28f9ea0315e2e9a1a855ede1508eb4017376 공격 거래 3: 0xca1bbf3b320662c89232006f1ec6624b56242850f07e0f1dadbe4f69ba0d6ac3 분석을 위해 공격 거래 1을 예로 들어 보겠습니다. 공격 계약: 0x21c58d8f816578b1193aef4683e8c64405a4312e 대상 계약: UwU Lend Treasury 계약, 포함: uSUSDE: 0xf1293141fc6ab23b2a0143acc196e3429e0b67a6 uDAI: 0xb95bd0793bcc5524af358ffaae3e38c3903c7626 uUSDT: 0x24959f75d7bda1884f1ec9861f644821ce233c7d 공격 프로세스는 다음과 같습니다. 1. WETH, WBTC, sUSDe, USDe, DAI, FRAX, USDC, GHO를 포함한 다양한 플랫폼에서 여러 토큰을 플래시 대출합니다.