원저자: DEZ

원문: TechFlow

What is the current state of the venture capital industry? If you ask a venture capitalist what they think about the current market, you will probably hear three consistent statements:

A) The market is too crowded

B) Competition is extremely fierce

C) returns are concentrated at the top.

This is an interesting and consistent comment, especially given the critical role VCs play in the startup ecosystem. So is VC a dying asset class? Of course not. But is it structurally challenged? Undoubtedly.

Let’s look at the reasons from a macro perspective.

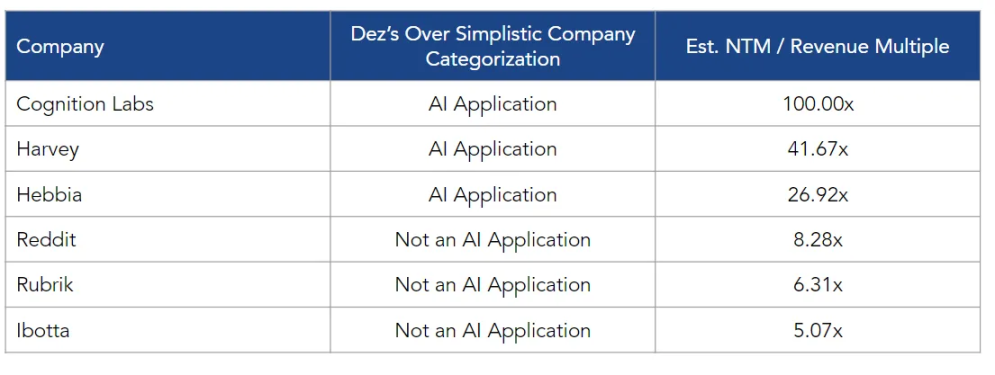

There are currently three high-profile venture-backed companies going public by 2024: Reddit, Rubrik, and Ibotta. As of earlier this week, the three companies had enterprise values of approximately $10 billion, $6 billion, and $2 billion, respectively, and were expected to generate revenues of $1.2 billion, $922 million, and $415 million over the next twelve months.

These companies are large, well-capitalized, and well-known businesses with thousands to millions of loyal customers. These companies have crossed the so-called “chasm” and are on their way to becoming efficient, public companies. These multi-billion dollar success stories are a venture capitalist’s dream and can greatly enhance our careers.

Yet, even though returning capital is the only thing that matters to VCs in the long run, we (as an industry) are still very willing to suspend disbelief when it comes to a core part of our job: pricing.

Over the past few weeks, the early-stage startup landscape has continued to bifurcate into two types: AI-native companies and everything else.

AI native companies focus on the application, inference, and frontier/deep tech model layers. These companies include Hebbia, which recently raised money at a $700M valuation, Cognition Labs, now valued at $2B (just 6 months later, pretty amazing), and Harvey, reportedly about to close a round at a $1.5B valuation.

The reality is that we don’t live in an environment where these rounds are rare. In fact, they are quite common. Other companies like Glean ($2 billion valuation), Skild AI ($1.5 billion valuation), and Applied Intuition ($6 billion valuation) are reinforcing this trend. Three companies in particular that I know of are Hebbia, Cognition, and Harvey, and they have several advantages:

-

They are making money: Hebbia is reportedly profitable with $13 million in revenue, Cognition is probably making between $5 million and $10 million, and Harvey is making more than $20 million.

-

They are building brands and talent density for themselves: if you look at their employee makeup, there are a lot of Ivy League grads and tech veterans.

-

They have well-known brand clients: such as PwC, KKR (Kohlberg Kravis Roberts Co.), T-Mobile, Bridgewater Associates, the U.S. Air Force, Centerview Partners, etc.

-

They represent a new generation of application software: one that focuses more on work outcomes and less on workflow (i.e. don’t do my work for me, do it for me).

Yet, despite their questionable unicorn valuations, they are all firmly in the Chasm. There is no guarantee that they will survive to the day they go public. Competition in this space is fierce. The technology they are building may plateau and fail to provide a sufficiently clear return on investment for their end customers. Moreover, their public peers are 20 times larger in revenue scale, have clearly established themselves as market leaders, and are valued at 5-8 times next 12 month revenues, not 20-100 times future revenues.

This is the structural challenge facing the venture capital industry: there is an excess of capital but few quality assets to invest in, which leads to unsustainable valuation increases that ultimately undermine equity value. Yet, some of these crazy valuations will look relatively cheap in hindsight. There are indeed some real, lasting, multi-generational companies being built today, it’s just that no one can clearly tell which ones will be Webvan and which ones will be Doordash.

(Translators note: It is difficult to predict which companies will ultimately fail and which will achieve great success.

Webvan: An online grocery delivery company founded in 1999, but due to poor management and underestimation of market demand, it eventually went bankrupt in 2001. Webvan is often used as a classic example of entrepreneurial failure.

Doordash: An online food delivery platform that was founded in 2013 and quickly expanded, eventually going public in 2020 and becoming a multi-billion dollar company. Doordash is the poster child for entrepreneurial success.

Companies like Doordash have delivered great returns to their investors, which in turn has fueled a new wave of interest in venture capital as an asset class. This cycle repeats itself, and by 2040 we may be talking about a new investment technology that has seen a similar price dislocation. This is the current state of venture capital. To further illustrate this point, there are a few themes that I think are very clear about the current state of venture capital:

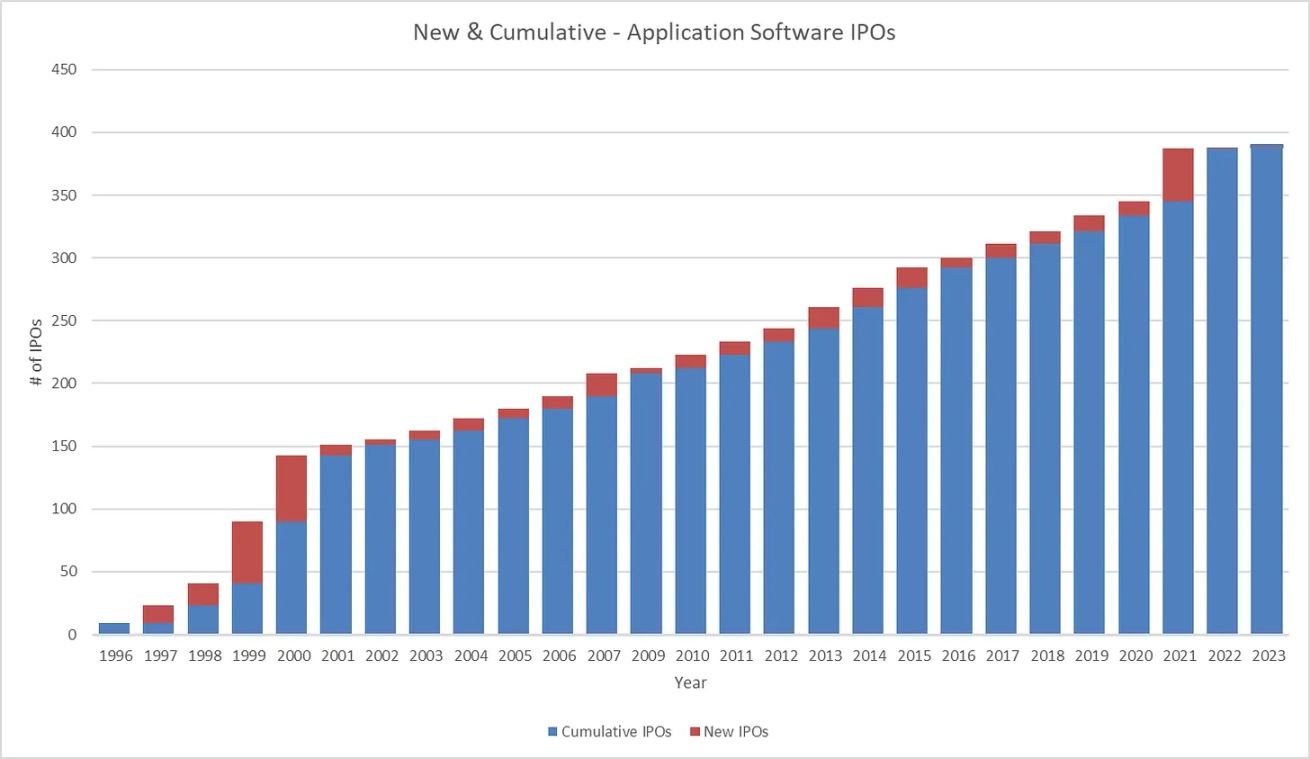

1. We are in a period of low liquidity, near the bottom of the market cycle. 2022 was the year with the fewest IPOs since the global financial crisis, and 2023 has not improved significantly.

2. Application software has been the gift that keeps on giving, accounting for 8% of all IPOs since 1996, but it is maturing as a venture capital sub-sector. Given this, the investable market opportunity is shrinking.

3. Venture capital has never been more competitive. Over the past 20 years, the venture capital asset class has grown more than fourfold. This is a reflection of your profit margin is my opportunity.

4. For assets that are considered unique, price is no longer a consideration. 100x revenue multiples are accepted and becoming more common.

If I had to simplify my core thesis, it’s that when you turn $7 million into $4 billion, it tends to attract competition, and competition is a defining factor in the current state of venture capital. Pricing, deal velocity, the intensity of the deal process, all of these stem from competition, and the competitive dynamics in venture capital today are on full display through the “tale of two cities”; there are AI-native companies and everything else.

Now the real question is, if this is the state of venture investing, then what? I have my own ideas and strategies that I am implementing, but I will keep those to myself for now. In the meantime, I wish you all a great week and good investing.

For the avoidance of doubt, I have not spoken directly with these companies. These figures are estimates I have gathered from public records and private conversations.

To be clear, I’m not saying these are prerequisites for success, but they are strong early indicators of density of talent in a cluster.

This article is sourced from the internet: Current state of venture capital market: fierce competition, returns concentrated in specific areas

Related: Can Bitcoin Be a Productive Asset?

Original article by: Pascal Hügli, Brick Towers Original translation: Lucy, BlockBeats Editors note: With the maturity of the Bitcoin market and the emergence of various income products, people have begun to think about how to promote the financialization of Bitcoin while maintaining its native characteristics. From Bitcoins native consensus, assets to income, this article discusses different categories of Bitcoin income products and emphasizes the importance of localized design in reducing trust dependence and counterparty risk. While analyzing existing solutions, Pascal Hügli shows how to achieve a near-perfect Bitcoin fit by combining native Bitcoin consensus, assets, and returns, using the Brick Towers project as an example. This article highlights the importance of balancing innovation and risk management in the financialization of digital currencies. Despite many challenges and unknowns, Bitcoin, as an…