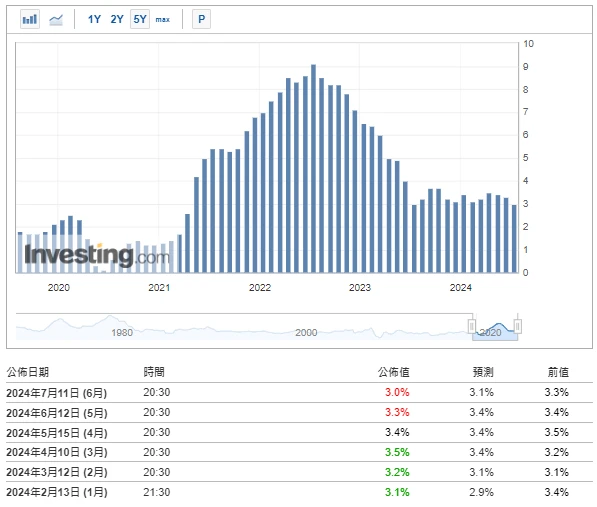

CPI data fell, mainstream currency prices rose and fell

데이터 소스: https://hk.investing.com/economic-calendar/cpi-733

Expectations for interest rate cuts have increased significantly this year, with the probability of the first rate cut in September rising to 80%, and the probability of a rate cut in July reappearing. The prices of Bitcoin and Ethereum continued to rise before the release of CPI data, and then fell back after the data was released. Data released by the U.S. Department of Labor showed that the year-on-year growth rate of the U.S. Consumer Price Index (CPI) slowed from 3.3% in May to 3% in June, the lowest growth rate since June last year; month-on-month, it turned from flat in May to a decline of 0.1% in June, a 0.1 percentage point drop from the previous month, the first negative growth since May 2020, showing signs of continued slowdown in inflation.

There are about 17 days until the next Fed meeting (August 1, 2024)

https://hk.investing.com/economic-calendar/interest-rate-decision-168

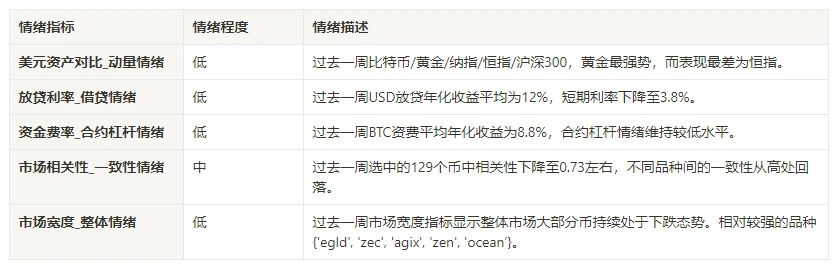

시장 기술 및 정서 환경 분석

감정 분석 구성 요소

기술 지표

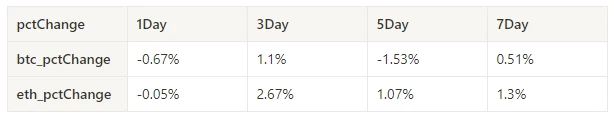

가격 추세

BTC prices rose 0.51% and ETH prices rose 1.3% over the past week.

위 사진은 지난주 BTC 가격 차트입니다.

위 사진은 지난주 ETH 가격 차트입니다.

지난주 가격변동률을 보여주는 표입니다.

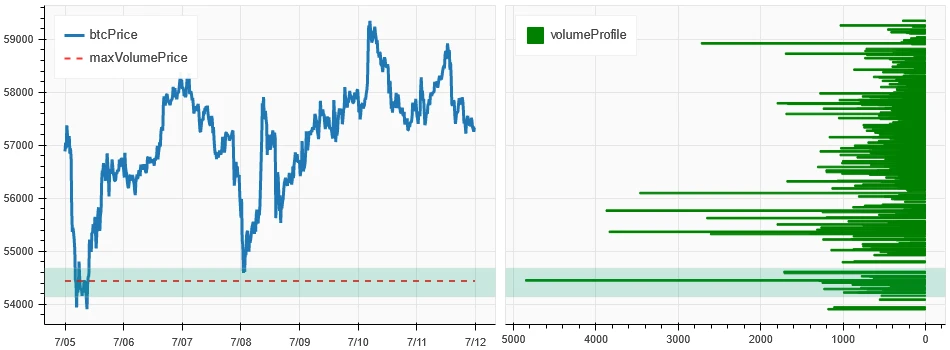

가격 분포 차트(지지 및 저항)

In the past week, BTC and ETH fluctuated upward after forming a new dense trading area with large volumes at low levels.

위 그림은 지난주 BTC의 밀집된 거래 지역 분포를 보여줍니다.

위 그림은 지난주 ETH 밀집 거래 지역의 분포를 보여줍니다.

표는 지난주 BTC와 ETH의 주간 집중 거래 범위를 보여줍니다.

거래량 및 미결제약정

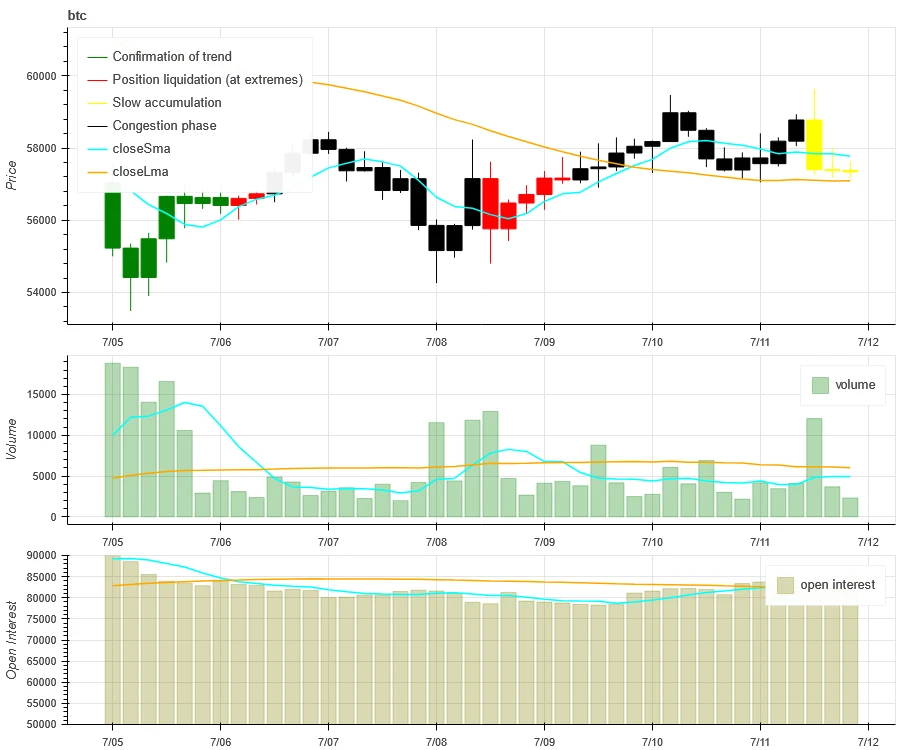

Over the past week, BTC and ETH had the largest trading volume when they fell on July 5; open interest for both BTC and ETH continued to decline.

위 사진의 상단은 BTC의 가격동향, 가운데는 거래량, 하단은 미결제약정, 하늘색은 1일 평균, 주황색은 7일 평균을 나타냅니다. K라인의 색상은 현재 상태를 나타내고, 녹색은 가격 상승이 거래량에 의해 뒷받침됨을 의미하고, 빨간색은 포지션 청산을 의미하며, 노란색은 포지션이 천천히 축적되는 상태, 검은색은 혼잡한 상태를 의미합니다.

위 그림의 상단은 ETH의 가격 추세를 나타내고, 가운데는 거래량, 하단은 미결제약정, 연한 파란색은 1일 평균, 주황색은 7일 평균을 나타냅니다. K라인의 색상은 현재 상태를 나타내고, 녹색은 가격 상승이 거래량에 의해 뒷받침됨을 의미하고, 빨간색은 포지션 청산, 노란색은 포지션이 서서히 축적되고 있음, 검은색은 혼잡함을 의미합니다.

역사적 변동성과 내재된 변동성

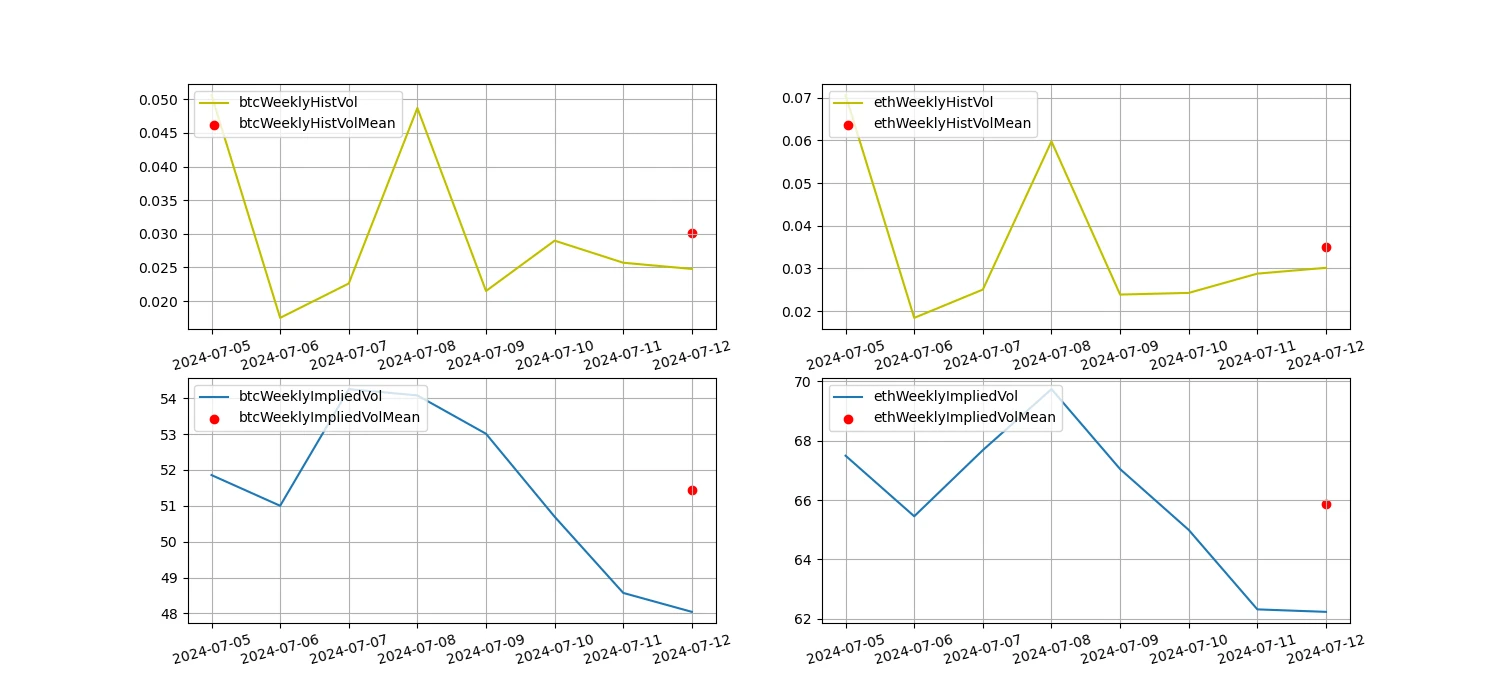

In the past week, the historical volatility of BTC and ETH was highest when it fell to 7.5; the implied volatility of BTC and ETH fell synchronously.

노란색 선은 과거 변동성, 파란색 선은 내재 변동성, 빨간색 점은 7일 평균입니다.

이벤트 중심

Over the past week, the prices of Bitcoin and Ethereum continued to rise before the release of CPI data, and then fell back after the data was released.

감정 지표

모멘텀 감정

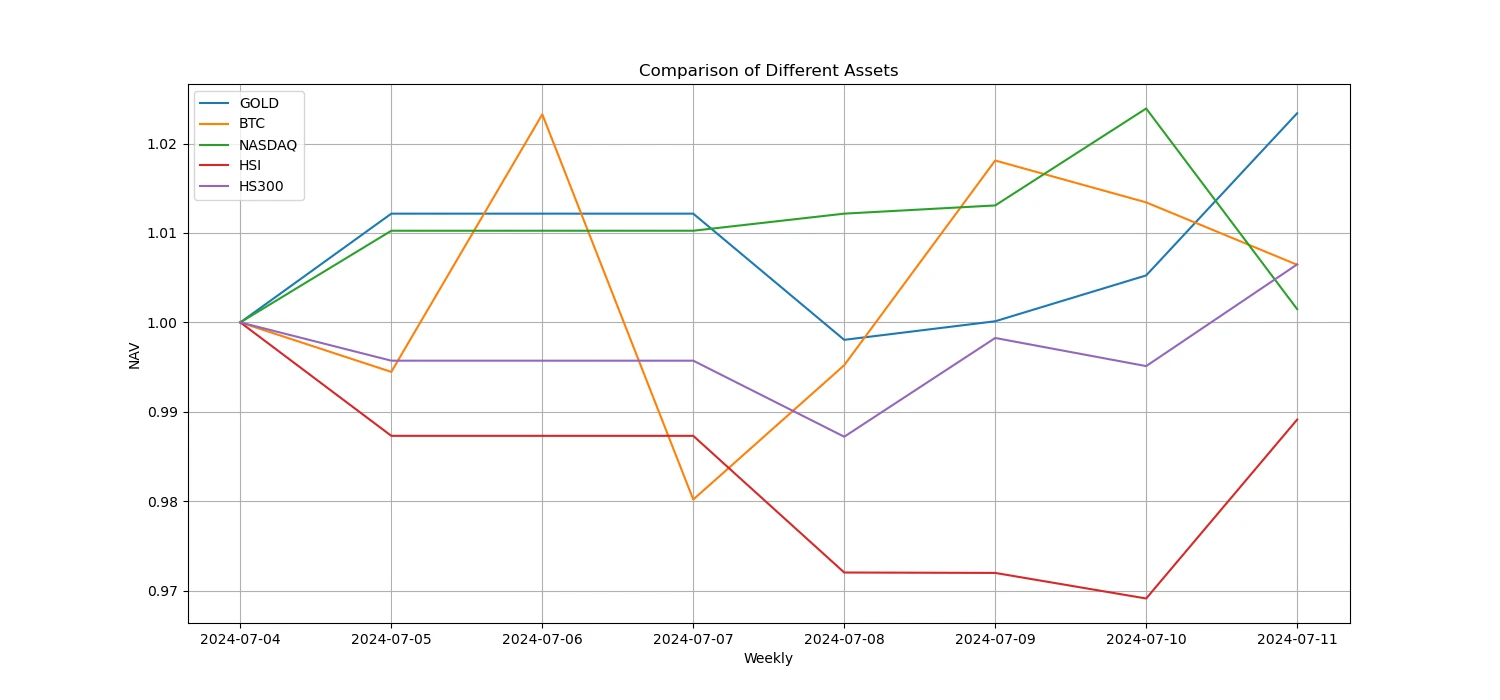

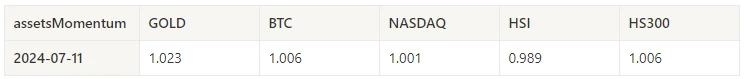

In the past week, among Bitcoin/gold/Nasdaq/Hang Seng Index/CSI 300, gold was the strongest, while Hang Seng Index performed the worst.

위 그림은 지난주 다양한 자산의 추세를 보여줍니다.

대출금리_대출심리

The average annualized return on USD lending over the past week was 12%, and short-term interest rates fell to 3.8%.

노란색 선은 USD 금리 최고가, 파란색 선은 최고가 75%, 빨간색 선은 최고가 75%의 7일 평균입니다.

표는 과거 보유일별 USD 이자율의 평균 수익률을 보여줍니다.

펀딩비율_계약 레버리지 감정

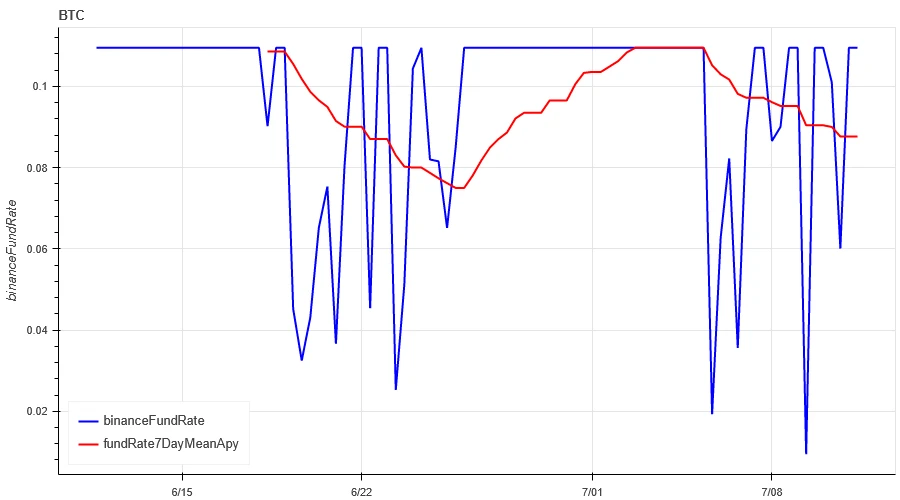

The average annualized return on BTC fees in the past week was 8.8%, and contract leverage sentiment remained at a low level.

파란색 선은 바이낸스의 BTC 펀딩 비율이고, 빨간색 선은 7일 평균입니다.

표는 과거 보유일별 BTC 수수료의 평균 수익률을 보여줍니다.

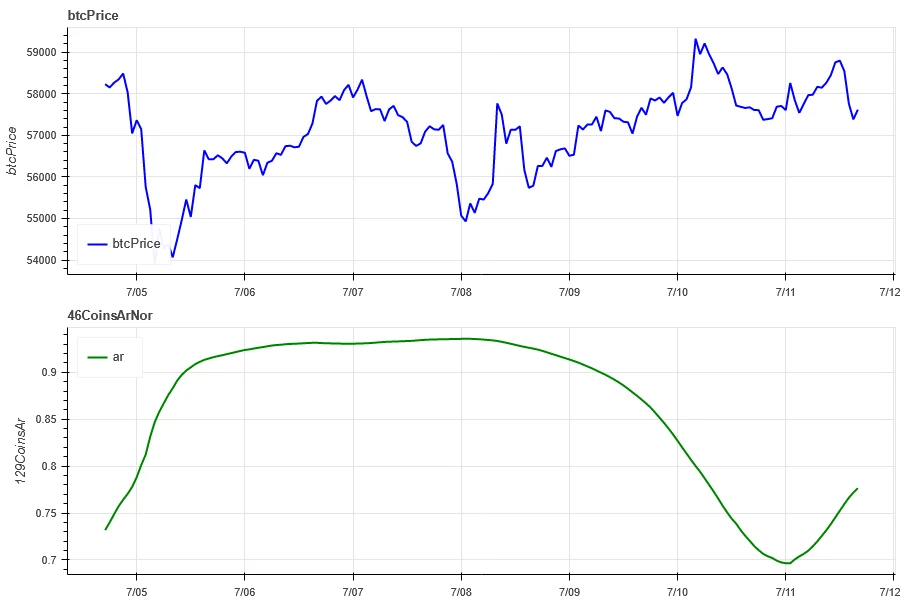

시장 상관관계_합의적 감정

The correlation among the 129 coins selected in the past week remained at around 0.73, and the consistency between different varieties fell from a high level.

In the above picture, the blue line is the price of Bitcoin, and the green line is [1000 floki, 1000 lunc, 1000 pepe, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, algo, ankr, ant, ape, apt, arb, ar, astr, atom, audio, avax, axs, bal, band, bat, bch, bigtime, blur, bnb, btc, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos,etc, eth, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx, imx, inj, iost, iotx, jasmy, kava, klay, ksm, ldo, link, loom, lpt, lqty, lrc, ltc, luna 2, magic, mana, matic, meme, mina, mkr, near, neo, ocean, one, ont, op, pendle, qnt, qtum, rndr, rose, rune, rvn, sand, sei, sfp, skl, snx, sol, ssv, stg, storj, stx, sui, sushi, sxp, theta, tia, trx, t, uma, uni, vet, waves, wld, woo, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx] overall correlation

시장폭_전반적인 심리

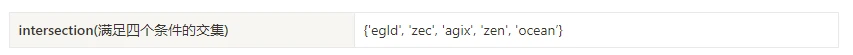

Among the 129 coins selected in the past week, 9.4% of the coins were priced above the 30-day moving average, 33.8% of the coins were priced above the 30-day moving average relative to BTC, 5.5% of the coins were more than 20% away from the lowest price in the past 30 days, and 10% of the coins were less than 10% away from the highest price in the past 30 days. The market breadth indicator in the past week showed that most coins in the overall market continued to fall.

위 그림은 [bnb, btc, sol, eth, 1000 floki, 1000 lunc, 1000 pepe, 1000 sats, 1000 shib, 100 0x ec, 1inch, aave, ada, agix, ai, algo, alt, ankr, ape, apt, arb, ar, astr, atom, avax, axs, bal, band, bat, bch, bigtime, blur, cake, celo, cfx, chz, ckb, comp, crv, cvx, cyber, dash, doge, dot, dydx, egld, enj, ens, eos, etc, fet, fil, flow, ftm, fxs, gala, gmt, gmx, grt, hbar, hot, icp, icx, idu, imx, inj, iost, iotx, jasmy, jto, jup, kava, klay, ksm, ldo, 링크, loom, lpt, lqty, lrc, ltc, luna 2, 매직, mana, manta, 마스크, matic, meme, mina, mkr, Near, neo, nfp, Ocean, one, ont, op, ordi, pendle, pyth, qnt, qtum, rndr, 로빈, rose, rune, rvn, sand, sei, sfp, skl, snx, ssv, stg, storj, stx, sui,ushi, sxp, theta, tia, trx, t, uma, uni, vet,waves, wif, wld, woo,xai, xem, xlm, xmr, xrp, xtz, yfi, zec, zen, zil, zrx ] 30일 비율 각 폭 표시기

요약하다

In the past week, the prices of Bitcoin (BTC) and Ethereum (ETH) fluctuated upward after heavy volume at low levels, while the volatility and trading volume of these two cryptocurrencies reached their highest levels when they fell to the low point on July 5. The open interest of Bitcoin and Ethereum is declining. In addition, the implied volatility of Bitcoin and Ethereum also fell simultaneously. Bitcoins funding rate remains at a low level, which may reflect the continued low leverage sentiment of market participants towards Bitcoin. The market breadth indicator shows that most cryptocurrencies continue to fall, indicating that the entire market has maintained a weak trend in the past week. CPI data fell, and the prices of mainstream currencies rose and fell when the data was released.

트위터 : @ https://x.com/CTA_ChannelCmt

웹사이트: 채널cmt.com

This article is sourced from the internet: Crypto Market Sentiment Research Report (2024.07.05–07.12): CPI declines, mainstream currency prices rise and fall

Original|Odaily Planet Daily Author|LiaoLiao As digital gold, Bitcoins value storage attribute is widely recognized by the market, but its market application scenarios have never been expanded. More projects are still being developed on a large scale on blockchains such as Ethereum and Solana and launched into the market. Although last years inscriptions and the runes that emerged after the halving this year have brought some attention to the issuance of assets on the Bitcoin chain, it is limited to meme culture. The current asset protocol of the Bitcoin ecosystem is difficult to meet the more complex functions and requirements proposed by developers and creators, which is also the core reason why the Bitcoin chain ecosystem has not exploded on a large scale. Giants Protocol came into being and is bringing…