Bitget Research Institute: CPI 데이터로 인해 미국 주식 시장이 하락하여 암호화폐 시장 전체가 하락세를 보였습니다.

지난 24시간 동안 수많은 새로운 핫커런시와 토픽이 시장에 등장했고, 이것이 다음번 수익 창출의 기회가 될 가능성이 매우 높습니다.

The annual rate of the unadjusted core CPI in June was 3.3%, lower than the market expectation of 3.4%, and fell to the lowest level since April 2021. As a related risk asset, Bitcoin fell due to the negative impact of U.S. stocks.

-

The sectors with relatively strong wealth-creating effects are: Solana Meme, ETH ecology;

-

Hot searched tokens and topics by users are: Nillion Network, Bitcoin;

-

Potential airdrop opportunities include: Espresso, Mezo;

Data statistics time: July 12, 2024 4: 00 (UTC + 0)

1. 시장환경

The annual rate of the unadjusted core CPI in June was 3.3%, lower than the market expectation of 3.4%, and fell to the lowest level since April 2021. US technology stocks fell sharply yesterday, Nvidia closed down 5.57%, Tesla fell 8.44%, Meta fell more than 4%, Apple, Microsoft, Google and Amazon fell more than 2% respectively. Mainly due to the implementation of the expectation of interest rate cuts, the interest rates in the bond market will fall in the future, and prices will rise. Institutions began to withdraw from the overbought stock market and buy bonds instead. As a related risk asset, Bitcoin fell due to the negative impact of US stocks.

In the trading market, according to Arkham monitoring, in the past 24 hours, the German government wallet transferred out 10,627 bitcoins, and then recovered 4169 bitcoins from CEX. It currently still holds 9094 bitcoins (about US$522.29 million). At present, the impact of the remaining selling pressure on the market has weakened.

2. 부를 창출하는 부문

1) Sector changes: Solana Meme (MOTHER, BODEN)

주된 이유:

-

DWFLabs announced its latest strategic partnership with Iggy Azalea, dedicated to supporting innovative projects in the Web3 space.

-

US President Biden said at a press conference that he would not withdraw from the election.

Rising situation: MOTHER and BODEN rose by 10.8% and 21.32% respectively within 24 hours;

시장 전망에 영향을 미치는 요인:

-

SOL 토큰 추세: Solana 생태계에서 SOL 토큰의 추세는 전체 생태계 토큰의 가격에 영향을 미칠 것입니다. DEX의 많은 토큰이 SOL로 가격이 매겨지기 때문입니다. SOL의 가격 추세에 계속 주의를 기울이십시오. SOL이 상승 추세를 유지한다면 SOL 생태계 자산을 계속 보유할 수 있습니다.

-

미결제 약정의 증가 또는 감소: SOL의 미결제 약정은 어제 증가하여 핫머니의 유입을 나타냈습니다. tv.coinglass 웹사이트의 계약 데이터를 사용하여 주요 펀드의 움직임을 파악하세요. 먼저, 계약의 순매수 포지션 증가를 살펴보세요. 그런 다음 계약 데이터가 순매수 포지션 증가, OI 증가, 거래량 증가를 보여주는지 살펴보세요. 그렇다면 주요 세력이 계속해서 매수하고 계속 보유할 수 있다는 것을 의미합니다.

2) Sectors that need to be focused on in the future: ETH ecosystem (ENS, ETHFI)

주된 이유:

-

Etherfis second season airdrop has been launched. Please check the website. The third season will last from July 1 to September 14, and 25 million ETHFI will be distributed.

-

Bloomberg ETF analyst Eric Balchunas predicts that the US SEC may approve the spot Ethereum ETF on July 18.

시장 전망에 영향을 미치는 요인:

-

The news about ETH spot ETF will directly affect the price of ETH and the trend of well-known projects in the ETH ecosystem. In addition, after the SEC announced that it believes that Lido and Rocket Pool staking projects are securities, whether it will further include SSV and other projects in the scope of securities considerations will also have a significant impact on the projects in this track.

3. 사용자 핫 검색

1) 인기 Dapp

-

Nillion Network

Nillion, a decentralized public network based on Nil Message Compute (NMC), announced that it has launched the second phase of Catalyst Convergence. This phase includes: supporting developers to build and deploy Blind applications on the network; using NIL tokens from its Faucet to promote projects; interacting directly with the test network and accessing SDK functions; using Petnet for secure storage and computing; using Blind computing to manage and process sensitive data; and deploying the Nada AI software package.

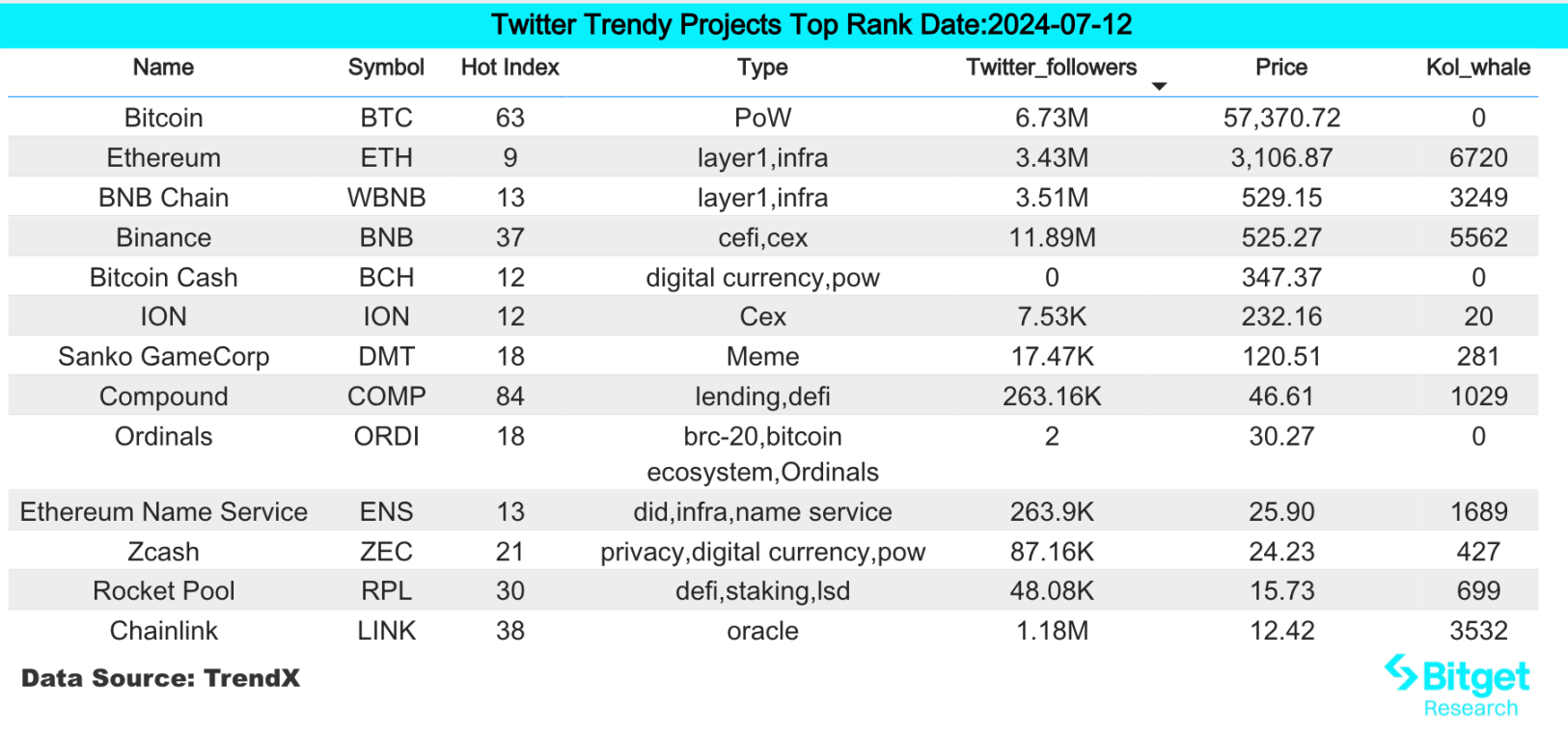

2) 트위터

Bitcoin:

Affected by yesterdays CPI data, BTC has a certain decline in the past 24 hours. Todays Fear and Greed Index is 25, and the level has changed from fear to extreme panic.

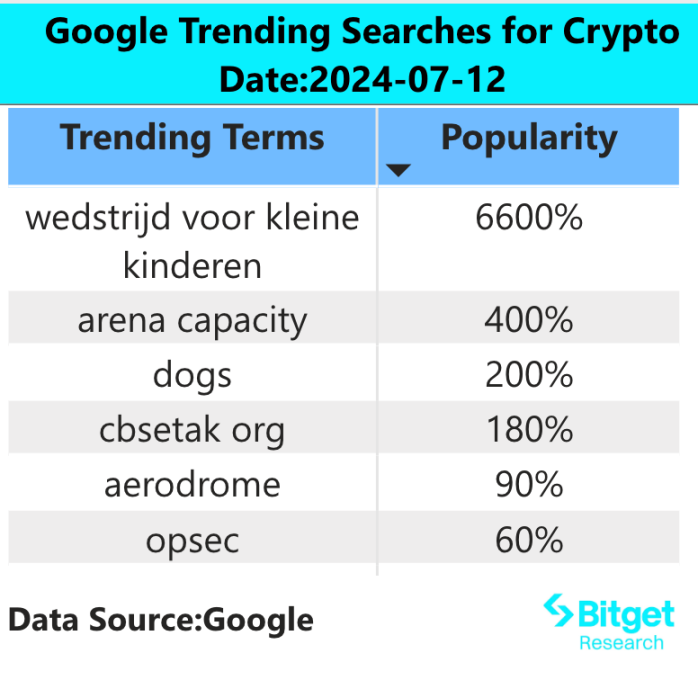

3) 구글 검색 지역

글로벌 관점에서 보면:

Aerodrome:

Since the Base-based DEX Aerodrome announced that Coinbase Ventures acquired AERO tokens in the secondary market, it was found that the Coinbase Ventures address has purchased at least 4.7 million AERO (about $2.7 million). In addition, TradingVaults used by Coinbase Ventures also holds 1.5 million AERO (about $936,000). The last batch of purchases was completed 8 days ago, and all acquired tokens are locked in the Aerodrome ecosystem.

각 지역의 인기 검색어 중:

(1) There are no obvious characteristics in the Google Trends hot searches of Asian countries. BTC has become the focus of market attention. In addition, the Ton ecological game project hamster kombat is on the list, and the market is paying attention to the airdrop opportunities of this project.

(2) There are no obvious characteristics in the hot searches in European and American countries. Coinbase, Crypto AI and other hot topics are on the list. There is no consensus on the tracks and projects that are being paid attention to. Bitget has become the CEX that British users are paying attention to.

잠재적인 공중 투하 기회

에스프레소

Espresso is a shared sorter market project that uses ZK-Rollups. The project mainly solves the consensus and interoperability between various Layer 2s. The core of Espressos strategy is to focus on privacy and decentralization, and the core members of the project are members of the Applied Cryptography Research Group at Stanford University.

The project recently announced the completion of a USD 28 million Series B financing, led by A16Z, with participation from Polychain, Coinbase Ventrues Sequioia, Sequioia, etc., making for a luxurious financing lineup.

Specific participation method: The project is currently in its early stages. Users can participate in the early project by participating in the verification node, and may obtain early airdrop qualities. For specific implementation, please refer to the official document: https://docs.espressosys.com/sequencer/guides/running-a-sequencer-node

메조

Mezo is a BTC Layer 2 project that focuses on the BTC ecosystem, helping BTC holders to transfer and manage money on the chain, and driving the development of the BTC DeFi system. Mezo recently announced the completion of a $21 million financing round, with participating institutions including Pantera Capital, Hack VC, Multicoin Capital and other leading institutions in the industry.

The official has already disclosed its BTC asset pledge plan and introduced a referral mechanism. There are strong expectations for the projects airdrops and it is currently in the initial stages of early operations.

Specific participation methods: 1) Visit the project official website and find the invite code in Discord; 2) Enter the invite code and link the unisat wallet; 3) Deposit BTC.

비트겟 연구소에 대한 자세한 정보: https://www.bitget.fit/zh-CN/research

비트겟 연구소는 온체인 데이터 및 귀중한 자산 채굴에 중점을 두고 있습니다. 온체인 데이터의 실시간 모니터링과 지역별 핫 검색을 통해 최첨단 가치 투자를 발굴하고 암호화폐 애호가에게 기관 수준의 통찰력을 제공합니다. 지금까지 [Arbitrum 생태계], [AI 생태계], [SHIB 생태계] 등 여러 인기 분야에서 Bitgets 글로벌 사용자에게 초기 단계의 귀중한 자산을 제공했습니다. 심층적인 데이터 중심 연구를 통해 Bitgets 글로벌 사용자에게 더 나은 부의 효과를 창출합니다.

면책조항: 시장은 위험하므로 투자할 때 주의하세요. 이 기사는 투자 조언을 구성하지 않으며, 사용자는 이 기사의 의견, 견해 또는 결론이 자신의 특정 상황에 적합한지 여부를 고려해야 합니다. 이 정보를 바탕으로 투자하는 것은 귀하의 책임입니다.

This article is sourced from the internet: Bitget Research Institute: CPI data caused the US stock market to pull back, driving the overall decline in the crypto market

In the cryptocurrency market, data has always been an important tool for people to make trading decisions. How can we clear the fog of data and discover effective data to optimize trading decisions? This is a topic that the market continues to pay attention to. This time, OKX specially planned the Insight Data column, and jointly with mainstream data platforms such as CoinGlass and AICoin, starting from common user needs, hoping to dig out a more systematic data methodology for market reference and learning. The following is the second issue, in which the OKX Strategy Team and CoinGlass Research Institute jointly discussed the data dimensions that need to be referenced in different trading scenarios. It involves topics such as capturing trading opportunities and how to cultivate scientific trading thinking. We…