After two months of painful decline, the market saw a comprehensive cooling of the US CPI data yesterday. Bitcoin rebounded smoothly and broke through $59,000. However, the German governments continued selling of coins sold approximately 10,627 bitcoins worth $616 million in just 16 hours yesterday, causing Bitcoin to directly recover all the gains brought by CPI expectations.

핵심 포인트

• The cycle of crypto assets is affected by four important factors: the first is the macro-economy, the second is whether there are innovative breakthroughs in technical infrastructure construction, the third is whether the regulatory system is friendly, and the third is the BTC halving cycle. We are in an important cycle of global interest rate cuts, BTC halving, gradually clear regulations, and cryptocurrencies coming into the public eye.

• Since last year, the strong performance of large AI companies has overshadowed the cryptocurrency market to a certain extent, and investors have transferred a large amount of funds to AI-related stocks. Maybe the market peaked not because cryptocurrencies are bad, but because AI is more attractive.

• The negative factors that still exist in the market include: the economic recession that may follow the US interest rate cut, the selling pressure of Bitcoin from the German and US governments and Mentougou, and the expected delivery after the Ethereum spot ETF is approved. How much selling pressure is there?

• Putting aside the negatives, we should pay more attention to the long-term development trend. The market still has a lot of upside potential: the US election Trump will bring friendly policies to improve crypto regulation, the stable supply of stablecoins will grow steadily, the market liquidity will be good, institutions will continue to buy Bitcoin, venture capital investment will be active, and the user group on the chain will continue to increase. We should look at the long term and focus on these positive factors, rather than being overly obsessed with short-term price fluctuations.

How much more selling pressure will the market endure?

A rough calculation shows that as of July 12, the German government only has 9,094 bitcoins left to sell. They will continue to sell the coins in the next week. According to the current selling speed, all sales will be completed within this week. This may cause a short-term rapid decline in BTC in extreme cases, but the market is sufficient to support such a large scale of selling pressure.

The $1-3 billion of Bitcoin held by Mt.gox and the U.S. government has not yet been moved, and the $2.36 billion sold by the German government has put the crypto market under a total selling pressure of about $4-7 billion, which is also the reason why the market has not been able to rise. But this does not mean that the bull market is over. According to Bitwises second quarter report, some positive factors supporting the long-term rise of cryptocurrencies are mentioned, such as the continued inflow of Bitcoin ETFs, which inflow exceeded $2.4 billion last quarter, setting a new high. The number of active wallets for Bitcoin and Ethereum also increased by 26% and 34% respectively last month, and the number of users holding more than 1 Bitcoin exceeded 1 million for the first time. The average open interest of regulated Bitcoin futures contracts also hit a new high of $9.8 billion (an increase of nearly 400% year-on-year), indicating that institutional investors interest has not diminished, and the asset management scale and trading volume of stablecoins have also been steadily rising. VCs also invested $3.194 billion last quarter, up 28% from the previous quarter. The launch of the Ethereum spot ETF will also boost market confidence, as will the US election in the second half of the year. These data and events prove that the cryptocurrency bull market still has the potential to develop further. There is also an important event that has been forgotten by the market. If FTX is approved to repay $16 billion to creditors, this will be a shot in the arm to boost the cryptocurrency market. Specifically:

Key time points include the customer voting deadline on August 16 and the judges final decision on October 7. If approved, the huge amount will flow back in the fourth quarter of 2024 to the first quarter of 2025. This coincides with other positive factors such as interest rate cuts and the timing of the US election results. And since most FTX customers are crypto enthusiasts, this $16 billion may go directly into the cryptocurrency market and become the biggest driving force for the surge in prices.

US economic data cools, interest rate cuts are coming

As the markets optimistic expectations for falling inflation are consistent, the US June unadjusted CPI annual rate released yesterday was 3.0%, lower than the market expectation of 3.1%, falling to the lowest level since June last year; the core CPI annual rate was 3.3%, lower than the market expectation of 3.4%, falling to the lowest level since April 2021. Both CPI and core CPI are lower than the previous value, and Bitcoin has also rebounded to $59,000. Perhaps traders have bet on the lower-than-expected positive data in advance. Yesterdays rebound was limited and the German government continued to sell BTC. Earlier today, BTC has recovered all of yesterdays gains. Lets take a look at the detailed CPI data:

1. Food inflation has fallen steadily from a high of 11% in 2020 to around 2% now, and is currently at a low level.

2. In terms of energy, gasoline prices fell 3.8% month-on-month. The index fell 3.6% in May. The continued decline in gasoline prices has made an important contribution to the inflation data being lower than expected. The energy index, which includes natural gas, electricity, natural gas and heating oil prices, fell 2% in June.

3. The core CPI data, which excludes volatile energy and food, has dropped to a four-year low.

4. Commodity inflation slowed down, and new and used car data continued to decline.

5. Service inflation data is under control at the best level in several years: Housing prices rose 0.2% month-on-month in June, rents rose 0.3% that month, and the owners equivalent rent index also rose 0.3%, all of which were the smallest increases since August 2021. Entertainment services and educational services also slowed down significantly, showing a lower growth rate.

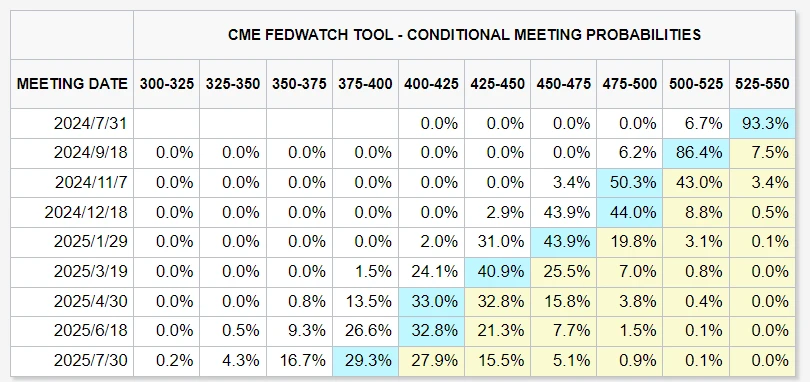

The first rate cut in the United States in September is a foregone conclusion. Powell also said the day before that the Fed does not need inflation to be below 2% before cutting rates. According to the CME observation tool, after the latest inflation data was released, the probability of the Fed keeping interest rates unchanged in August was 93.3%, and the probability of a 25 basis point rate cut in September rose to 86.4%. Traders expect two rate cuts throughout 2024, with a 25% chance of a third 25 basis point rate cut this year.

CME FedWatch Tool

The interest rate cut will increase market liquidity and help risk assets rise, but it is also accompanied by the risk of a US recession, and interest rates are expected to fall this year. For deposit levels, changes in interest rates, adjustments in monetary policy, and changes in the overall economic situation are all crucial to market liquidity.

Ethereum ETF Latest Progress

The ETF launch process is divided into two processes. The first part is that the issuer must submit Form 19 b-4 before May. Many companies have submitted applications for Ethereum ETFs. The SEC has approved 8 spot Ethereum ETF Form 19 b-4 (BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy and Franklin Templeton) through a comprehensive order in May. The second part is the S-1 form, which is not subject to any specific deadline. Several issuers have submitted S-1 registration applications for Ethereum spot ETFs and are waiting for SEC approval. At present, the issuer has processed the revision and resubmitted the S-1 form that was previously returned by the SEC before July 8. It is estimated that at least one round of filing will be required for the ETF to start trading. When the Ethereum spot ETF is listed will depend on the approval efficiency of the SEC. Once approved by the SEC, the Ethereum spot ETF will be officially open for trading.

About the release date:

• Nate Geraci, president of The ETF Store, said on July 8 that the submission of the revised S-1 application was due on the 8th, and it is unclear how quickly the SEC will process it, but he is optimistic that the Ethereum spot ETF can be launched next week or within two weeks.

• Bloomberg analyst Eric Balchunas comments: No one really knows why the SEC is taking so long to process these forms, given there are so few comments, listings should be quick, but it could be that a “problem” issuer slowed things down, or it could just be summer laziness/people on vacation, not sure.

• Bloomberg analyst James Seyffart also previously predicted that the Ethereum spot ETF may be listed later this week or during the week of July 15. There are many examples in history that show that this process takes 3 months, but it is also possible that it will be passed in as short as one day.

The approval progress of these S-1 forms is an important focus for investors to pay attention to the dynamics of Ethereum ETFs. Once these S-1 applications are approved by the SEC, the relevant Ethereum ETF products are expected to be officially listed in a short time, and all signs indicate that the listing will be this month. However, the SEC has always been cautious in approving cryptocurrency ETFs, so there is still some uncertainty about the final results of these applications.

If the Ethereum spot ETF is eventually approved and listed, it will provide investors with a new channel to directly invest in Ethereum, which will have a significant impact on the entire cryptocurrency market in several aspects:

1. Enhance institutional involvement

ETFs are an investment tool preferred by institutional investors and are more conducive to risk management of large funds. ETFs reduce the risk exposure of a single asset by diversifying investments. They are also more convenient to trade and have good liquidity. In addition, the management fees of ETFs are usually lower than those of actively managed funds, which is more cost-effective for institutional investors. Approval of the Ethereum ETF will open a door for institutional investors and attract more funds to flow into Ethereum and the entire crypto market.

2. Improvement of market depth

As a standardized investment tool, ETFs are recognized at the regulatory level and operate relatively standardized, which makes investors feel more at ease. The launch of ETFs will help increase the trading volume and counterparties in the cryptocurrency spot market, thereby improving overall liquidity.

3. Driving the derivatives market

As more institutional investors are attracted to the crypto market, they will usually participate in derivative transactions such as futures and options. At the same time, Ethereum ETF provides investors with a channel to invest directly in Ethereum, which will increase hedging and hedging needs, and directly stimulate exchanges and derivatives providers to accelerate product innovation and launch more derivatives. By then, the gameplay on the market will be more diverse.

4. Promote the prosperity of related ecosystems

As the second largest cryptocurrency, the launch of Ethereum spot ETF will not only drive the demand for related derivatives, but also drive the development of the entire Ethereum ecosystem, including the increased activity of on-chain DeFi, NFT and other applications. Even if Ethereum ecosystem users lose the motivation to continue using these Rollups after some king-level L2 projects are airdropped, I believe that after the demand for derivatives increases, the stagnant ecosystem will usher in new momentum.

The industry is still waiting for the SEC to make a decision on the Ethereum ETF application. Once the S-1 form is approved, the Ethereum ETF will be officially approved for listing and trading on the US stock exchange, and a large amount of passive investment funds will flow into Ethereum. Gemini estimates that there may be up to $5 billion in net inflows in the first 6 months. This influx of passive funds often drives a rapid rise in asset prices. Matthew Sigel, head of digital asset research at VanEck, is also optimistic that more than $6 trillion in assets may flow into cryptocurrencies in the next 20 years.

The current ETH/BTC ratio is close to the lows of the past few years. Ethereum has a large upside potential relative to Bitcoin, which also reserves greater momentum for Ethereums future growth.

If the ETH/BTC ratio can return to the median level of the past three years, the price of Ethereum is expected to rise by nearly 20%; if the ETH/BTC ratio can hit the high point of the past three years near 0.087, the price of Ethereum will rise by about 55%, which is expected to hit a new high. In any case, the current value of Ethereum relative to Bitcoin is significantly underestimated, and the launch of the Ethereum spot ETF will benefit the entire cryptocurrency market, driving more capital inflows to promote the overall market.

A new turn in the US election, will Obama make a comeback?

The 2024 US election is turbulent, and there are certain differences within the Democratic Party on whether Biden should be re-elected. On the one hand, the trump candidate Trump is very competitive. More and more young voters pay less attention to traditional political parties and prefer to express their political positions on online media, which poses a challenge to the traditional politicians canvassing methods. Trump likes to express his opinions on social media and is active in Internet politics. Compared with Bidens worrying physical condition, Trump is more popular, with a high approval rating and a fierce momentum.

On the other hand, the Democratic Party has also failed to cultivate a strong candidate who can fight against Trump. But what is interesting is that the Democratic Party seems to have a backup plan. They have been paying close attention to Bidens physical condition, fearing that he will not survive the election. If something really happens, they already have a backup plan, which is to let former President Obama take over.

Given the US Constitution, Obama must avoid being a candidate, but he can join Bidens team, win the election and become vice president, and then use various means to ensure that Obama can take over as president if Biden is unable to complete his term due to health problems. In fact, Obama has already prepared for this, and Biden has always maintained close contact with Obama. He will regularly report to Obama on the progress of the campaign or exchange family affairs, and Obama will also provide advice to senior White House officials and Bidens campaign team. In addition to behind-the-scenes support, Obama will also appear in campaign activities.

Earlier this year, Biden co-hosted a rare dialogue event with Obama and another former president Clinton in Manhattan. These are all efforts made by the top leaders of the Democratic Party to gather the centripetal force within the party and ensure that Biden can be successfully re-elected.

The presidential election campaign is in full swing. On the other hand, the Republican Party, in its official party platform for the 2024 US election, expressed support for a number of crypto policy measures that would benefit digital asset companies and holders.

According to an official document released by the Republican presidential candidate Trumps campaign team, the Republican Partys Make America Great Again platform vows to end the illegal and un-American crackdown on the US cryptocurrency industry. The platform also promises to defend the right to mine Bitcoin and allow cryptocurrency holders to keep their tokens themselves, in addition to opposing the creation of a central bank digital currency (CBDC). We will defend the right to trade without government surveillance and control, the document reads.

Trump himself has also spoken out many times in support of talking about Bitcoin as a corporate asset. At the upcoming Bitcoin Summit on July 25-27, Trump has also officially confirmed his attendance and will give a speech at the conference. This should be the first time that a former US president has spoken at a crypto conference of this scale. Trumps crypto-friendly stance has also brought him a lot of traffic and votes. According to polls, about 13% of voters who do not plan to vote for the Republican Party have a more positive view of Trump.

Currently, data from the crypto prediction market Polymarket shows that Bidens chance of being elected is 21% and Trumps chance of being elected is 62%. A poll by the New York Times and Siena College, the most watched poll in American politics, shows that Trumps approval rating is 49% and Bidens is 43%. Trump leads Biden by 6 percentage points among potential voters. Bidens current situation is not optimistic. Time magazine reported that his approval rating has been at a low level, far lower than other former presidents seeking re-election. The survey shows that concerns about Bidens age are the main reason for the reversal of the election.

Polymarket forecast results

REFERENCE

1. https://bitwiseinvestments.com/crypto-market-insights/crypto-market-review-q2-2024

2. https://www.techflowpost.com/article/detail_18932.html

3. https://www.odaily.news/post/5196467

4. https://www.odaily.news/newsflash/379211

5. https://www.odaily.news/newsflash/373192

6. https://www.cnfin.com/hs-lb/detail/20240712/4074644_1.html

This article is sourced from the internet: Where did the money go? Interpreting the key events that affect the crypto asset cycle