Volatility is an inherent attribute of the market, which brings opportunities as well as risks to traders.

As the uncertainty of the global economic environment increases, traders demand for structured products is gradually shifting from pure pursuit of returns to risk management and diversified allocation, while the requirements for product transparency and liquidity are also increasing. In particular, they pay more attention to asset allocation and risk management, and avoid blindly following trends and speculative behavior. For example, after the 2008 financial crisis, risk management awareness has increased significantly worldwide. According to the survey, in 2023, more than 70% of traders will consider risk management strategies when making investment decisions, while this proportion was only 40% in 2000.

How to find a balance between risk and return as much as possible has become a common concern for traders and financial platforms. Snowball products have attracted widespread attention in the financial market due to their flexible design, diversified returns and certain risk control mechanisms. Snowball products are structured products linked to market performance, usually with trigger mechanisms and conditional returns. Traders can obtain predetermined returns or protect their principal under certain conditions. In the past five years, the global snowball product market has maintained steady growth.

In addition to the traditional financial sector, Snowball products are also popular in the emerging crypto market. In order to better respond to and meet the diverse needs of users , OKX has launched Snowball after launching it, and now has launched Tunbi Snowball to help users trade their own crypto assets and earn profits in the rising market. In particular, for many users who hold BTC and ETH and are still bullish on them in the future, they can hold their coins for appreciation while also realizing diversified returns.

Coin Snowball

Currently, OKX Coin Snowball supports two trading methods: bullish BTC and bullish ETH.

Users only need to invest the principal, with no additional fees. In addition, you can customize the subscription period, subscription amount, subscription target, etc. Among them, the starting amount for bullish BTC products is as low as 0.0004 BTC, and the starting amount for bullish ETH products is as low as 0.005 ETH. The participation threshold is very low and very user-friendly. In addition, OKX Coin Snowball can achieve three possible profit scenarios: early stop profit, maximum profit and early warning.

Before introducing the three possible profit scenarios, let鈥檚 help novice users quickly understand the Snowball product. In simple terms, a bullish Snowball product generally sets a price range around the target: the lower limit of the range is the warning price, the upper limit of the range is the profit stop price, and then before the expiration date, the target price fluctuates in this range. As a result, three core scenarios are generated.

In general, in scenarios one and two, users can earn profits while ensuring their principal . However, in scenario three, the amount of money returned to users may be lower than the amount of subscription, and the guaranteed annualized income may not be able to make up for the loss. At the same time, in extreme cases, the settlement price may be far lower than the warning price.

In addition to the zero additional fees and low investment threshold mentioned above, OKX Coin Snowball also has several core highlights. First, there is no need for currency conversion, that is, whether you invest in BTC or ETH, the currency of the return remains unchanged. Second, there is a daily early profit-taking opportunity, that is, OKX will observe the profit-taking price every day to keep up with market trends. Third, it provides a protection mechanism for the decline of the currency price, that is, if the currency price does not break through the warning price downward, the user continues to earn income. If it breaks through the warning price, the order will be settled on the same day.

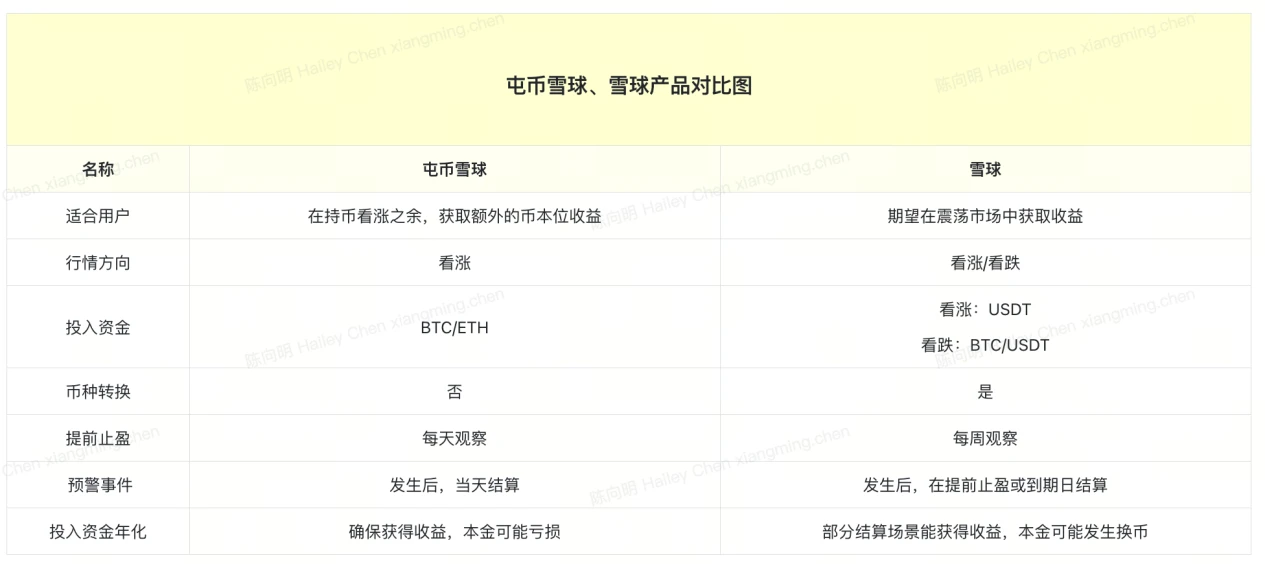

Snowball vs. Tunbi Snowball

Compared with OKXs Snowball, the original Snowball product of OKX provides put options and a higher annualized rate, but the users principal may be converted into stablecoins.

However, considering that many users prefer to hold BTC or ETH rather than stablecoins, and are optimistic about the underlying assets at the same time, and the original Snowball does not support BTC and ETH currency-based bullishness, in order to fully meet the diversified needs of different users, OKX has now launched the Coin Treasure Snowball, which supports users BTC and ETH currency-based bullishness needs.

It is particularly noteworthy that in the loss scenario of OKX Tunbi Snowball, it is better for users to terminate the transaction immediately at the time of knock-in, because the funds are returned to the users on the same day and the users do not have to wait until the end of the product.

In short, OKX Tunbi Snowball and the original Snowball products have their own advantages and disadvantages, and users can choose according to their needs. Each structured product has its own suitable market conditions, and how to choose is crucial.

Tutorial walkthrough

How to use OKX Coin Snowball? The steps are very simple:

1) Open the OKX App, select [Finance] – [Earn Coins] – [Structured Products] – [Treasure Coins Snowball]

2) Take the bullish BTC as an example, select the desired product based on different reference annualization and term, and click [Next] to enter the subscription page. Enter [Subscription Quantity] , click [Subscribe] , and complete [Confirm] to successfully subscribe.

3) Notes on the use of Tunbi Snowball: Tunbi Snowball is not a principal-guaranteed product. As the market fluctuates, the purchase of Tunbi Snowball will face 3 settlement situations (early stop profit, maximum profit and warning) . When in the warning situation, you may suffer partial losses, as shown in the figure below

Innovation never stops

Market fluctuations are unpredictable. Users can use derivatives in structured products to hedge specific market risks, such as interest rate risk and asset price risk. Through sophisticated risk management strategies, traders can obtain certain returns while protecting their principal as much as possible.

Structured products are an innovative financial instrument in the financial market. They combine underlying assets and derivatives to meet users specific risk-return needs, increase market trading volume and liquidity, and promote market activity. In particular, structured products with good liquidity can be used as important trading tools in the market to improve market efficiency. Since its emergence, structured products have occupied an important position in the financial field due to their flexibility and diversity.

As the worlds leading cryptocurrency trading platform and Web3 technology company, OKXs structured products are in a leading position in the market. Currently, it has successively launched Dual Currency Win, Seagull, Shark Fin, Snowball, and Tunbi Snowball. In the ever-changing cryptocurrency market, user needs are constantly evolving, driving the pace of platform optimization and innovation. OKX is committed to continuously optimizing products and services through technological innovation to meet the diversified and dynamically changing needs of users.

In addition, through technological innovation, OKX not only improves the performance and security of the trading platform, but also meets users needs for diversified products and high-quality user experience. In the ever-changing cryptocurrency market, OKX strives to ensure that every transaction of users on the platform is safe, convenient and efficient.

Continuously meeting the needs of a wider range of users will be the key to scaling up trading platforms and even the crypto industry.

부인 성명

The content of this article is for reference only. This article only represents the authors views and does not represent the position of OKX. This article is not intended to provide (i) investment advice or investment recommendations; (ii) an offer or solicitation to buy, sell or hold digital assets; (iii) financial, accounting, legal or tax advice. We do not guarantee the accuracy, completeness or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risks and may fluctuate significantly. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. Please consult your legal/tax/investment professionals for your specific situation. Please be responsible for understanding and complying with local applicable laws and regulations.

This article is sourced from the internet: Hold coins to gain more profits, read OKX coin snowball in one article

Related: ZKSync airdrop sparks controversy, showing the dilemma of cold start of Web3 projects

Original author: @Web3 Mario (https://x.com/웹3_mario) The hottest topic last week was definitely the public airdrop inspection of ZKSync. Originally, the author was studying and writing about some learning experiences of TON DApp development, but seeing this controversial event and the extensive discussion it triggered in the community, I had some feelings, so I wrote an article and hope to share it with you. In general, ZKSyncs airdrop plan adopts a distribution method based on property proof, focusing more on rewards for developers, core contributors and ZKSync native Degen whales, which has created a situation where the native Degen whales are laughing and the LuMao studio is shouting. The focus of community debate: Is interaction the key or is the amount of funds the key? For a long time, the Web3…