원저자: @poopmandefi

원문 번역: Alex Liu, Foresight News

If you are interested in Restaking or AVS (Active Verification Service), this article will briefly compare @아이겐레이어 , @symbioticfi 그리고 @Karak_Network and introduce related concepts, which should be helpful to you.

What is AVS and re-staking?

AVS stands for Active Validation Service, a term that basically describes any network that requires its own validation system (e.g., oracles, DAs, cross-chain bridges, etc.).

In this article, AVS can be understood as a project that uses the re-stake service.

Conceptually, re-staking is a way to re-use already staked ETH for additional validation/services to earn more staking rewards without having to unstake it.

Re-staking usually takes two forms:

-

Native Re-staking

-

LST / ERC 20 / LP re-staking

By restaking, restakers and validators can secure thousands of new services by pooling security.

This helps reduce costs and helps new trust networks gain the security assurance they need to get off the ground.

Among these re-staking protocols, @아이겐레이어 (EL) was the first to be launched.

고유층

Key Architecture

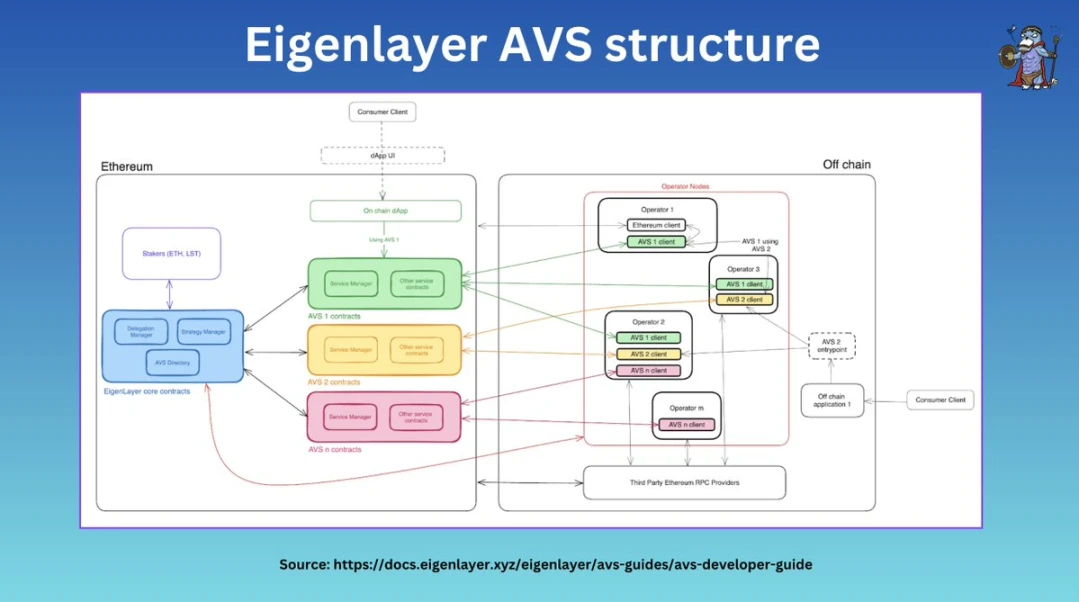

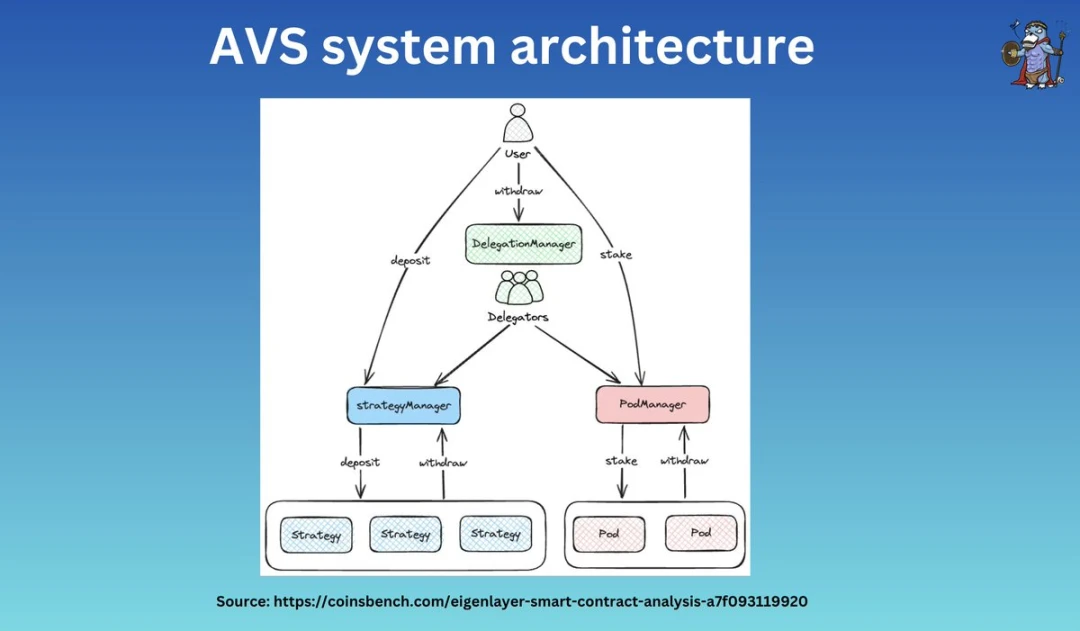

At a high level, @eigenlayer ( EL) consists of 4 main parts:

-

Stakers

-

연산자

-

AVS contracts (e.g. token pools, designated slashers)

-

Core contracts (e.g., delegation managers, slashing managers)

-

These parties work together to allow stakers to delegate assets and validators to register as operators in EigenLayer.

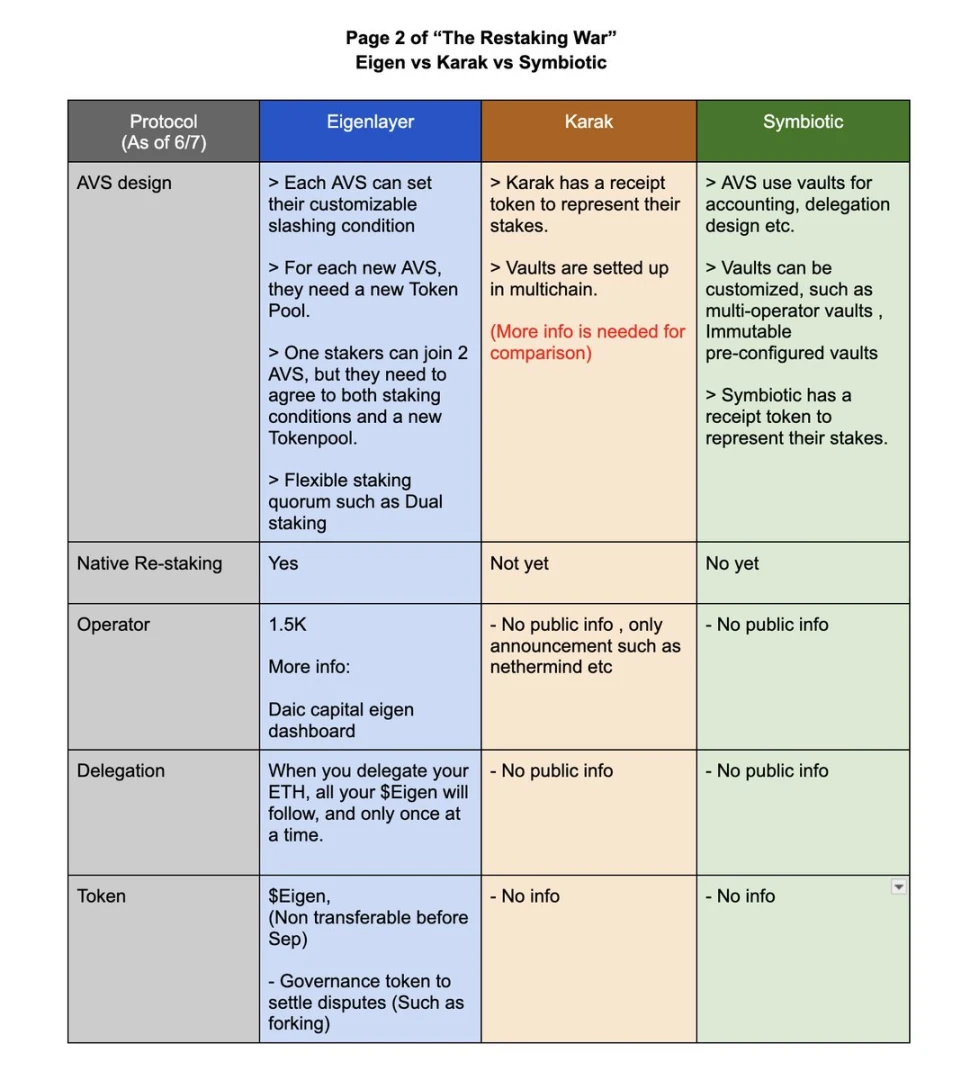

AVS on EL can also customize the quorum and slashing conditions of its own system.

Re-pledge

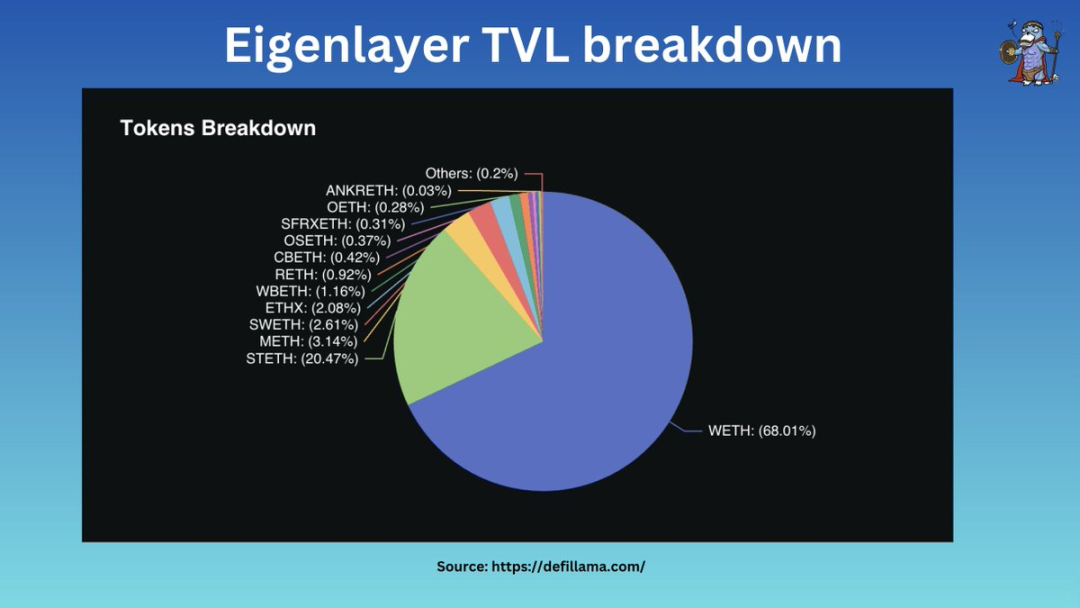

EL supports native re-staking and liquidity re-staking.

Of its approximately $15 billion TVL (total value locked):

-

68% of assets are native ETH

-

32% is LST (Liquid Staking Token).

EL has about 160,000 pledgers but only about 1,500 operators, and 67.6% (about $10.3 billion) of assets are entrusted to operators.

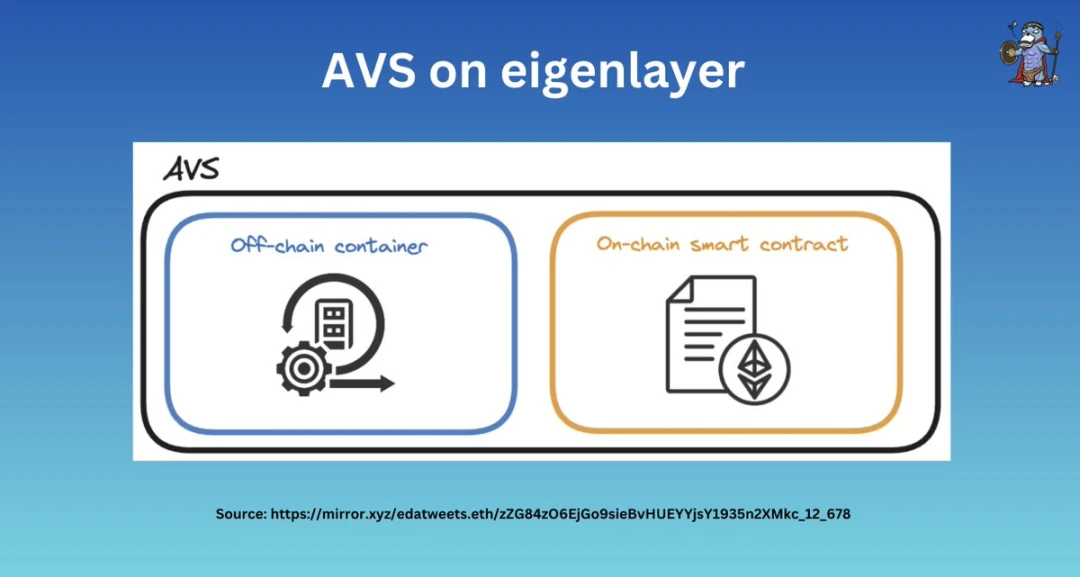

AVS on EigenLayer

EL provides a high degree of flexibility for the self-design of AVS, they can determine:

-

A quorum of stakers (e.g. 70% ETH stakers + 30% AVS token stakers)

-

Forfeiture conditions

-

Fee model (payable in AVS tokens/ETH etc.)

-

Operator requirements

And their own AVS contracts…

What is the role of EigenLayer?

EL controls :

-

Delegated Manager

-

Strategy Manager

-

Confiscator Manager

Validators who wish to become EL operators must register through EL.

The strategy manager is responsible for the balance accounting of the re-staking participants and cooperates with the delegation manager to execute it.

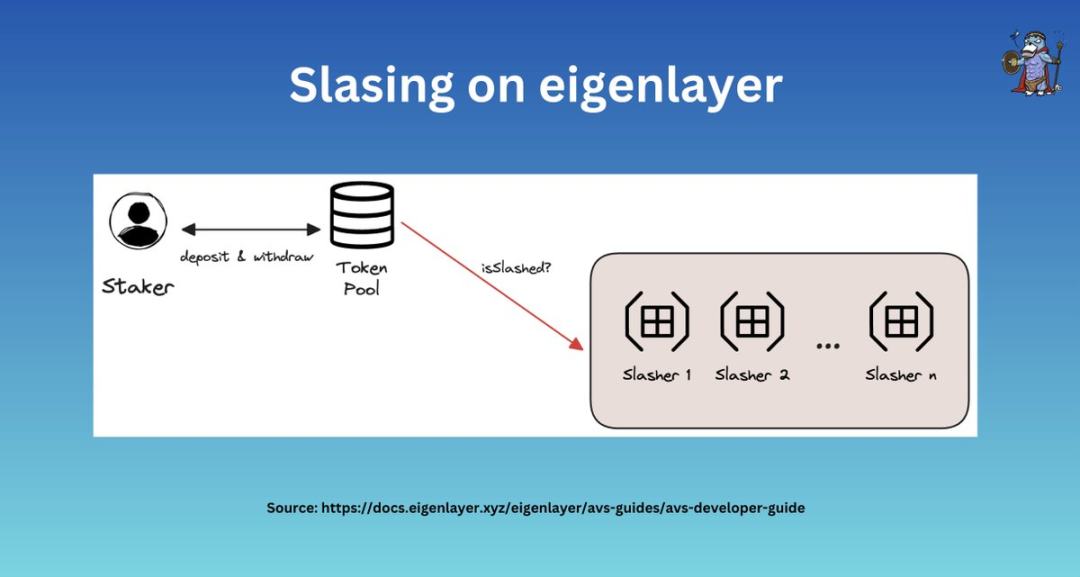

Confiscation

Each AVS has its own slashing conditions.

If the operator behaves maliciously or violates ELs commitment, they will be fined by the slasher, each of which has its own slashing logic.

If operators choose to participate in 2 AVSs, they must agree to the slashing conditions of both AVSs at the same time.

Veto Severance Committee (VSC)

In the case of a wrongful slashing, EL has a VSC that can reverse the slashing result.

The EL does not act as a standards committee itself, but rather allows AVSs and stakeholders to build their own preferred VSCs, thereby creating a market for VSCs tailored for different solutions.

요약하다

In short, EL provides:

-

Native + LST staking

-

Asset delegation (ETH assets + EIGEN)

-

AVS is highly flexible in designing its own terms

-

Veto Severance Committee (VSC)

-

Operators that have gone online (about 1,500 so far)

-

공생

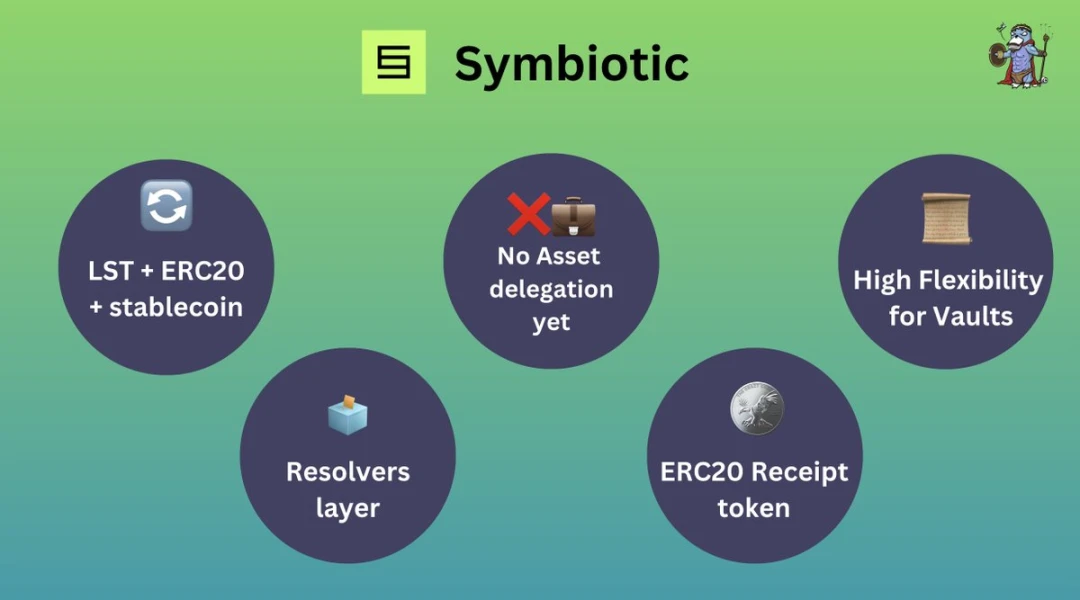

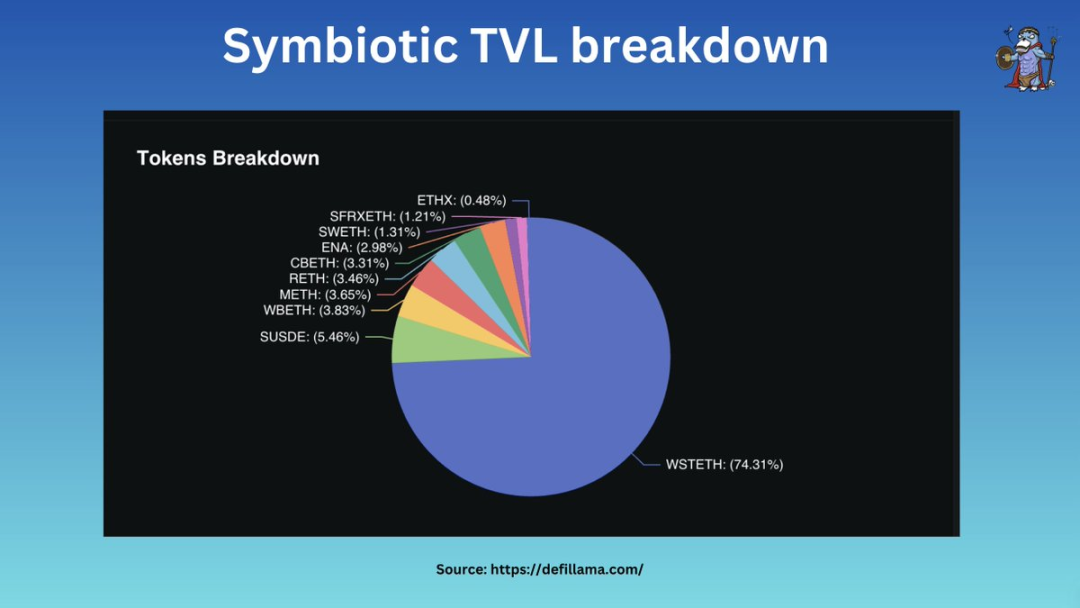

@symbioticfi positions itself as the “DeFi hub” for re-staking by supporting staking of assets like ENA and sUSDe.

Currently, 74.3% of its TVL is wstETH, 5.45% is sUSDe, and the rest is made up of various LSTs.

There is no native re-staking support yet, but it may be supported soon.

Symbiotic ERC 20

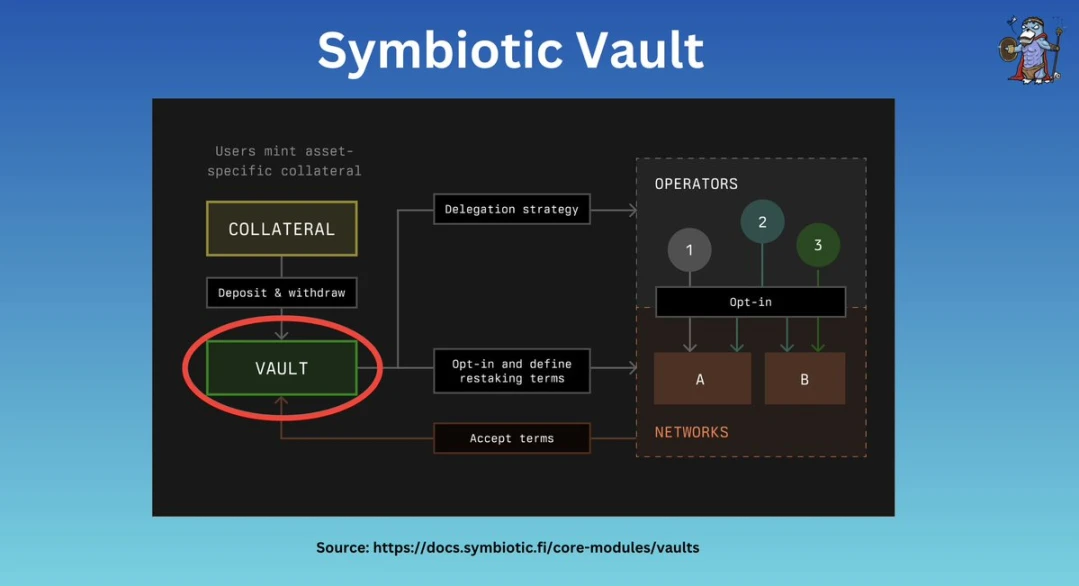

Unlike EL, @symbioticfi mints corresponding ERC 20 tokens to represent deposits.

Once the collateral is deposited, the assets are sent to the “vault” which is then delegated to the corresponding “operator”.

AVS on Symbiotic

In Symbiotic, AVS contracts/token pools are called Vaults.

Vault is a contract established by AVS, which uses Vault for accounting, commissioned design, etc.

AVS can customize the staker and operator reward process by plugging in external contracts.

Vault

Similar to EL, Vault can be customized, for example, there can be Vaults for multiple operators.

A notable difference between Vault and EL is the presence of immutable pre-configured vaults that are deployed with pre-configured rules to “lock in” settings and avoid the risks of upgradeable contracts.

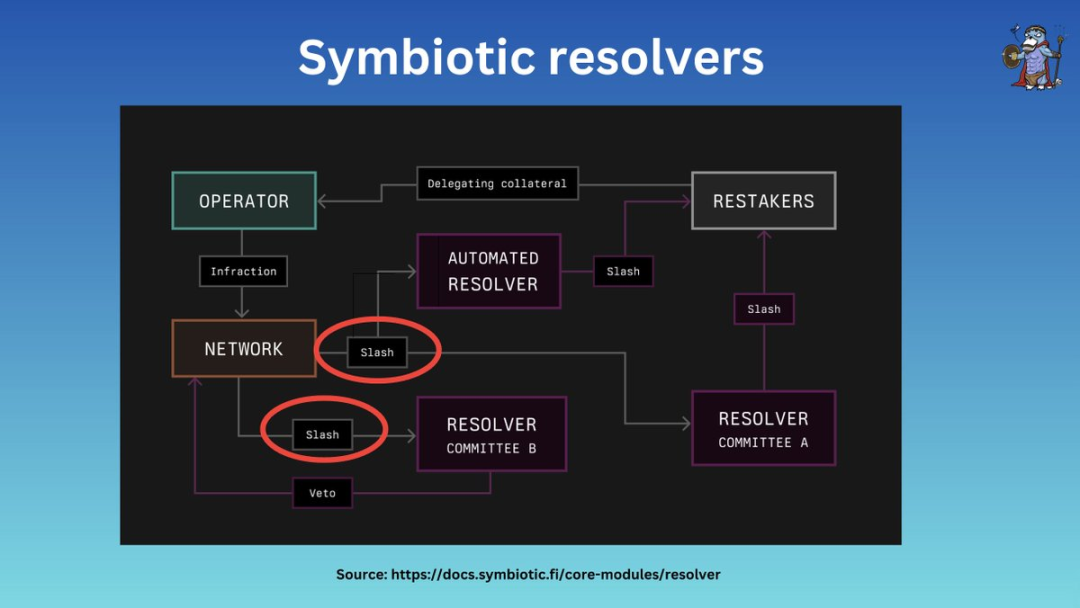

Parser

The parser is roughly equivalent to the ELs veto committee.

When an erroneous slashing occurs, the parser can veto the slashing.

~ 안에 @symbioticfi , vaults can request multiple resolvers to cover staked assets or integrate with dispute resolution (such as @UMAprotocol ).

요약하다

In short, Symbotic offers:

-

Accept LST + ERC 20 + stablecoin collateral

-

ERC 20 Receipt Token Received When Minted

-

There is no native re-staking and no delegation yet

-

Vault with customizable terms

-

Multi-resolver architecture with greater design flexibility

-

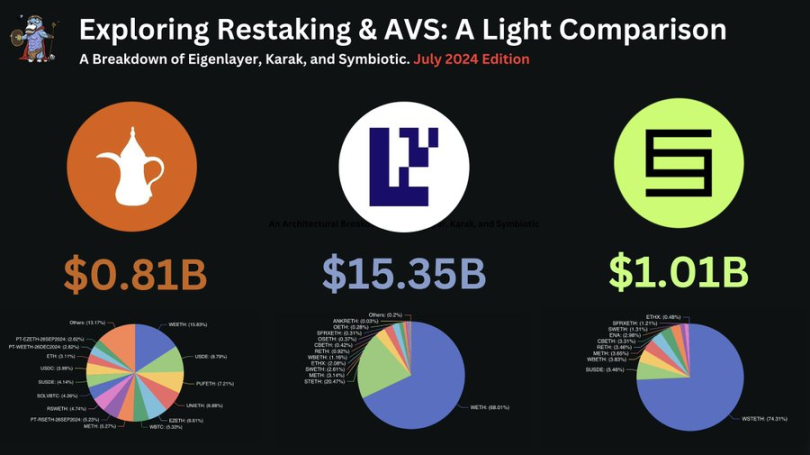

Karak

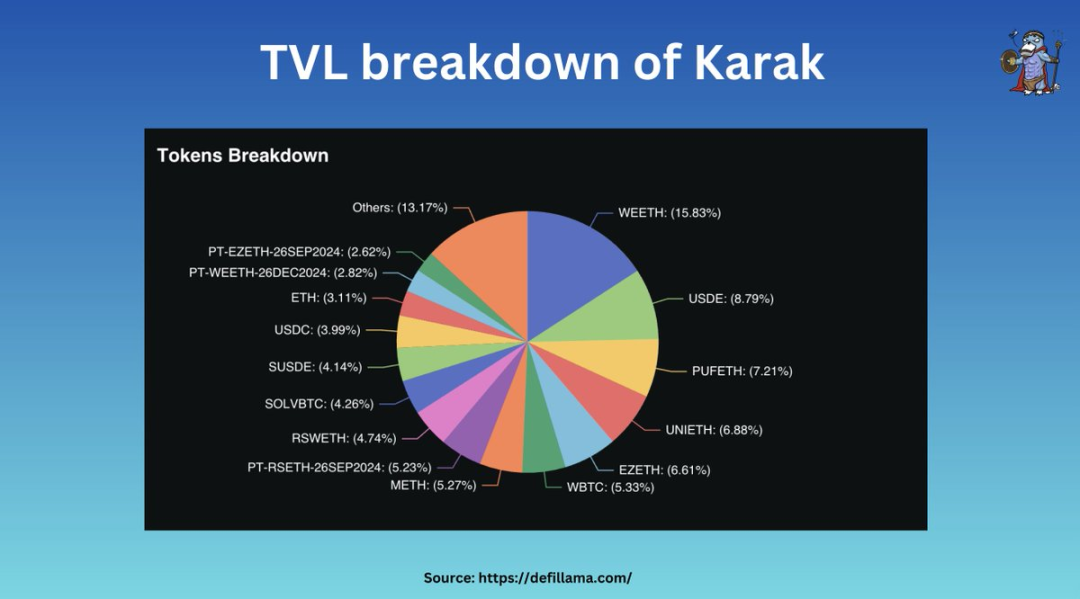

Karak uses a system called DSS, which is similar to AVS.

Among all re-staking protocols, @Karak_Network accepts the most diverse staking assets, including LST, stable, ERC 20 and even LP tokens.

Pledged assets can be deposited through multiple chains such as ARB, Mantle, and BSC.

Pledged assets

Of Karak’s approximately $800 million TVL, most deposits are in LST, and most of them are on the ETH chain.

At the same time, about 7% of assets are deposited through K2, an L2 chain developed by the Karak team and guaranteed by DSS.

DSS on Karak

So far, Karak V1 provides a platform for these participants:

Vault + Supervisor

Asset entrusted supervisor

In terms of architecture, karak provides a Turnkey SDK + K 2 sandbox to make development easier.

More information is needed for further analysis.

비교됨

Intuitively, the pledged assets are the most obvious differentiating factor.

-

고유층

EL offers native ETH re-staking and EigenPods, which has received ETH accounting for 68% of its TVL and has successfully attracted about 1,500 operators.

They will also soon accept LST and ERC 20 tokens.

-

공생

Becoming the “DeFi hub” by partnering with @ethena_labs and being the first to accept sUSDe and ENA.

-

Karak

It stands out for its multi-chain staking deposits, allowing re-staking across different chains and creating an LRT economy on top of it.

Architecturally, they are also very similar.

The flow is usually from stakeholders -> core contracts -> delegates -> operators, etc.

Its just that Symbiotic allows for multiple arbiter resolvers, while Eigenlayer doesnt specify this, but its possible.

rewards system

In EL, operators who opt in receive a 10% commission from AVS services and the rest goes to delegated assets.

On the other hand, Symbiotic and Karak may offer flexible options that allow AVS to design their own payment structures.

Confiscation

AVS/DSS are very flexible, they can customize slashing conditions, operator requirements, staker quorums, etc.

EL + Sym has a parser + veto committee to support and recover erroneous slashing behavior.

Karak has not yet announced the relevant mechanism.

Finally, tokens

So far, only EL has launched tokens, EIGEN, and requires stakers to delegate their tokens to the same operator as they re-stake (but they are non-transferable).

Speculation on SYM and KARAK is the key motivating factor driving their TVL.

결론적으로

Among these protocols, it is clear that @아이겐레이어 provides a more mature solution and the most powerful economic security + ecosystem.

AVS that want to gain security in the early stages will build on EL as it has a $15 billion capital pool and 1,500 operators ready to join + a top-notch team.

반면에, @symbioticfi 그리고 @Karak_Network are still in very early stages and still have a lot of room to grow. Retail investors or investors seeking income opportunities outside of ETH/multi-chain assets may choose Karak and Symbiotic.

결론

Overall, AVS and re-staking technology removes the burden of building an underlying trust network.

Now, the project can focus on developing new features and better decentralization.

Re-staking is not just an innovation, but also a new era for ETH.

This article is sourced from the internet: Exploring re-staking: Overview of Symbiotic, Karak, and EigenLayer

Related: Glassnode: How to determine the market bottom and entry time?

Original title: Breakdown Metrics Applied: Identifying Local Bottoms in a Bull Market Original author: Ukaria OC, CryptoVizArt, Glassnode Original translation: LadyFinger, BlockBeats Editor鈥檚 Note: In the rapid evolution of the digital asset market, accurate data analysis has become the key for traders to grasp the pulse of the market. Glassnodes latest 28 segmented indicators also mark a major leap in the field of on-chain analysis. These indicators not only provide in-depth insights into the behavior of short-term holders, but also provide traders with powerful tools to identify market bottoms and optimize trading strategies. In a significant development in the on-chain analytics space, Glassnode recently launched a suite of 28 new metrics designed to provide a more nuanced perspective on digital asset markets. You can read our original announcement here to…