In the past 24 hours, the market witnessed a sharp drop in BTC after the opening of the Asian session. The price once fell below $55,000, then rebounded gently, and successfully returned to around $57,500 at the settlement time. The surge in realized volatility put both short gamma positions in an awkward position, and the implied volatility of options was then significantly raised, forming an inverted pattern.

Source: TradingVie; SignalPlus, ATM Vol

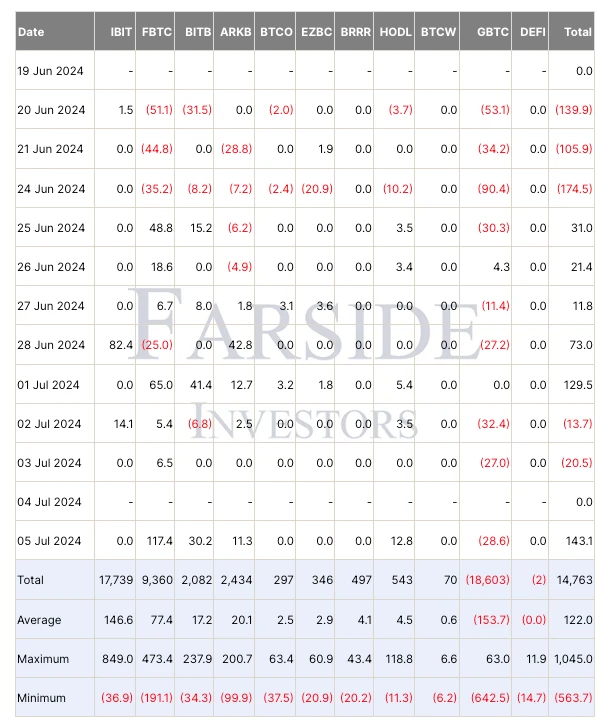

Looking at the current situation, there are two different voices in the community. Negative traders pointed out that the selling pressure from the German government, the US government and Mentougou has not subsided, and the price of the currency may continue to fall. But today, more optimistic traders in the community spoke out. They first denied the excessive impact of the governments selling pressure, pointing out that the amount of BTC sold by the government was only 4% of the previous bull market; on the other hand, even in the downward trend of Spot, ETFs are still bringing positive capital inflows to the market, most of which have gone to FBTC; we can also see that Metaplanet, a consulting company known as Japans MicroStrategy, bought 42,466 Bitcoins at a bottom price yesterday, worth $2.5M. Now the company has a total of 203,734 Bitcoins, with an average price of around 62,000.

출처: 파사이드 투자자

No one can give a confident answer to what will happen next. A group of traders have set their sights on this weeks macro events, including the speech by Fed Chairman Powell and the release of important CPI/PPI data. In a few weeks, there will be a new round of FOMC meetings. When the current situation is still unclear, macro indicators may become an important signpost. Not only that, the market also expects the approval of the Ethereum ETF on November 12 this week, which injects more uncertainty into the market. The second half of the week is expected to be exciting.

출처: SignalPlus, Economic Calendar

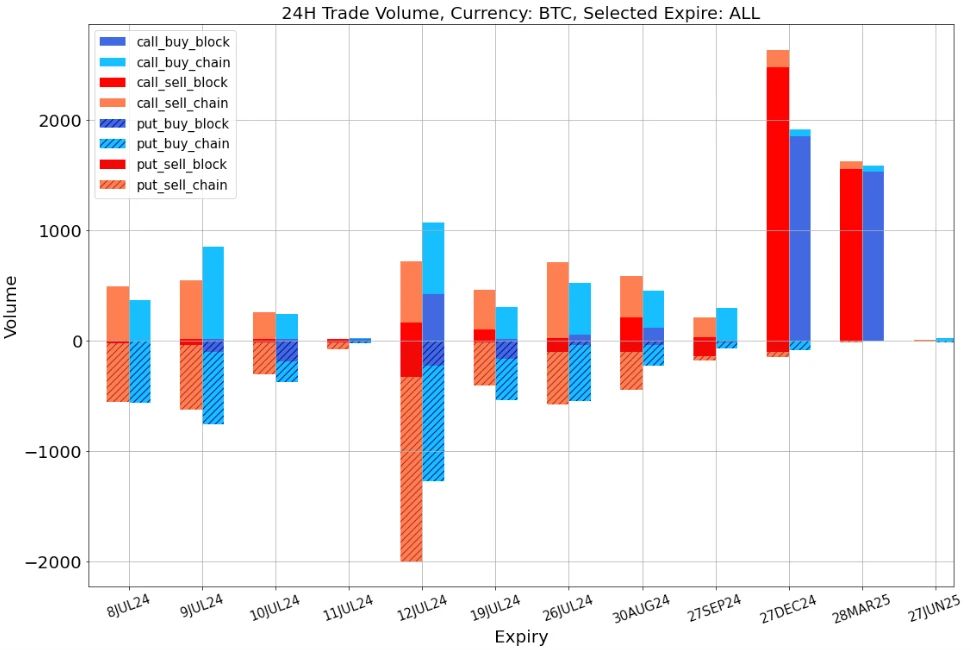

Source: Deribit (as of 8 JU L2 4 16: 00 UTC+ 8)

From the perspective of trading, due to the release of important data on November 11-12 and the possibility of ETF approval, traders bought a large number of ETH 12 JUL put options to protect long positions. BTC is the opposite. The price rebound provides traders with confidence to sell 12 JUL put options. At the same time, the volume of long-term call options has skyrocketed, mainly distributed in the purchase of the wing and the sale of the further tail, forming a long call spread flow.

데이터 출처: Deribit, BTC 거래의 전체 분포

데이터 출처: Deribit, ETH 거래의 전체 분포

출처: Deribit 대량매매

출처: Deribit 대량매매

ChatGPT 4.0 플러그인 스토어에서 SignalPlus를 검색하시면 실시간 암호화 정보를 얻으실 수 있습니다. 업데이트를 즉시 받으려면 트위터 계정 @SignalPlus_Web3을 팔로우하거나 WeChat 그룹(WeChat 보조자 추가: SignalPlus 123), Telegram 그룹 및 Discord 커뮤니티에 가입하여 더 많은 친구들과 소통하고 소통하세요. 시그널플러스 공식 홈페이지: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Volatility Column (20240708): Embrace uncertainty

Related: SEC sues Consensys again? This time it also involves Lido and Rocket Pool?

Original|Odaily Planet Daily Author: jk On Friday, June 28, local time in the United States, the U.S. Securities and Exchange Commission (SEC) sued Consensys in the federal court in Brooklyn, New York on Friday, accusing the company of engaging in securities offerings and sales and acting as an unregistered broker through its digital asset wallet called MetaMask. The scope of the SEC’s crackdown “ConsenSys violated the federal securities laws by failing to register as a broker-dealer and by failing to register the offers and sales of certain securities,” the complaint states. “ConsenSys collected more than $250 million in fees through its conduct as an unregistered broker-dealer.” According to The Block, the SEC stated that Consensys sold thousands of unregistered securities through staking program providers Lido and Rocket Pool, which issued…