Original title: 5 bullish arguments that Bitcoin price just bottomed at $53K

Original article by Yashu Gola, CoinTelegraph

원문 번역: 도주, 골든 파이낸스

Despite Bitcoin’s volatility and drop to five-month lows, several key indicators suggest that bulls may still have the upper hand, hinting at a possible recovery in Bitcoin price action.

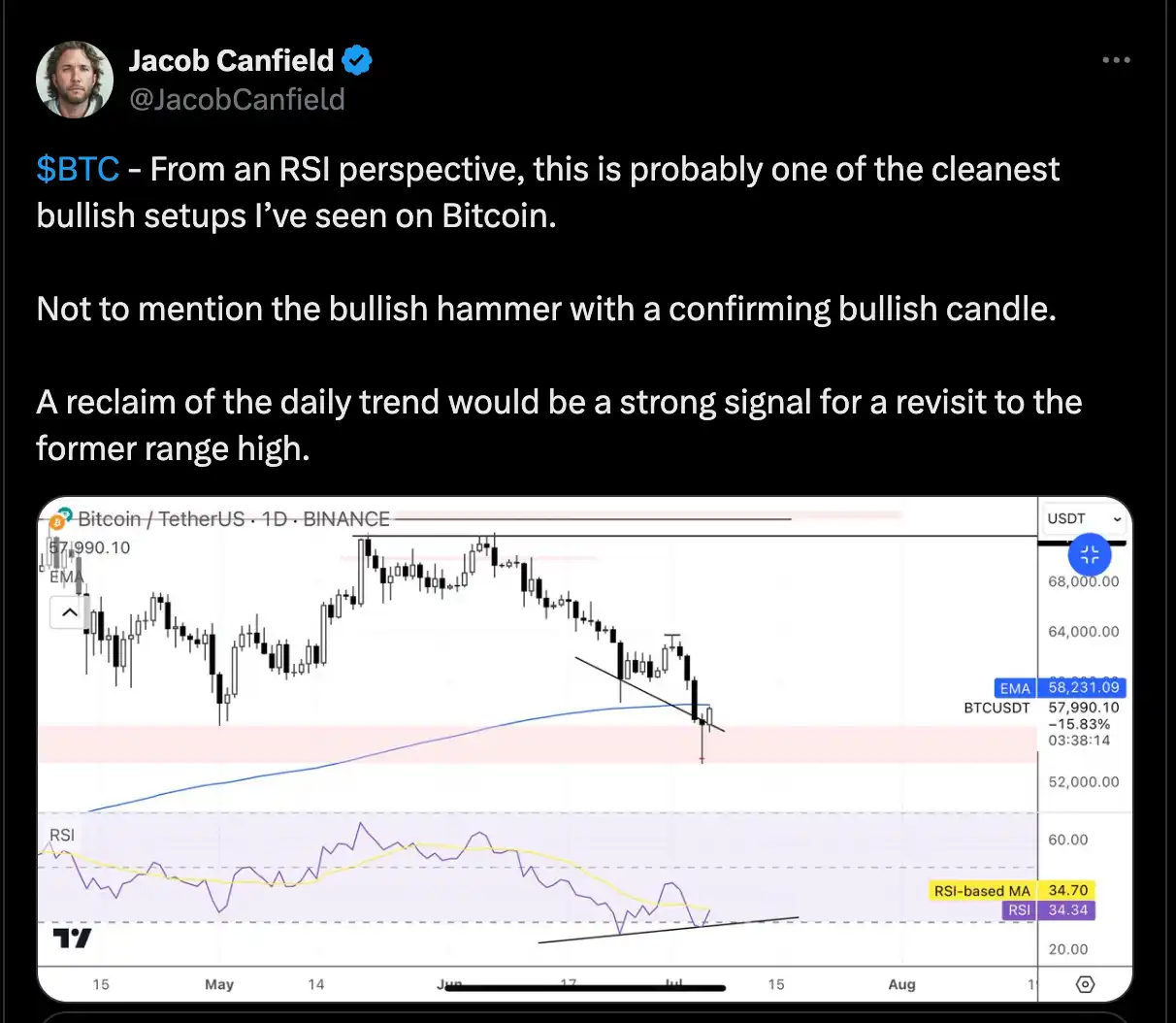

Bullish divergence strengthens BTC rebound prospects

Bitcoin had a turbulent start to the month, plummeting more than 10.50% to hover around $57,000 as of July 7. The lowest point for Bitcoin hit $53,550, and its decline was mainly due to market concerns about Mt. Goxs continued repayment of more than 140,000 Bitcoins to its customers and the German governments liquidation of Bitcoins, which led to a market sell-off.

The latest drop in Bitcoin’s price was accompanied by a growing gap between falling prices and a rising relative strength index (RSI). Such a gap typically indicates that selling pressure is waning even as prices continue to fall.

BTC/USD daily price chart. Source: TradingView

From a technical analysis perspective, this situation typically means that the current downtrend may be reversing or slowing, suggesting that Bitcoin may soon rebound as market sentiment turns back bullish.

Bullish hammer candlestick, oversold RSI

Two other classic technical indicators support the bullish reversal scenario. First, Bitcoin formed a bullish hammer candlestick pattern on July 5, which is characterized by a small upper body, a long lower shadow, and a small upper shadow on the daily candlestick chart. A similar situation also occurred in May.

Second, Bitcoin’s daily RSI reading is hovering around the oversold threshold of 30, which typically signals a period of consolidation or recovery. Analyst Jacob Canfield predicts that the indicator could signal a rebound and BTC could return to “previous highs” above $70,000.

Source: X Wall Street bets on a bigger rate cut in September

As interest rates rise in September, Bitcoin’s ability to resume its bull run in the coming weeks has further increased.

As of July 7, Wall Street traders saw a 72% chance that the Federal Reserve would cut interest rates by 25 basis points, according to data collected by the Chicago Mercantile Exchange. A month ago, the probability was 46.60%.

Probability of target interest rate for the Federal Reserve meeting on September 18, 2024. Source: CME

Expectations for rate cuts have risen as U.S. hiring slowed.

When the job market weakens, the Federal Reserve often considers cutting interest rates to stimulate economic activity. Lower interest rates are generally good for Bitcoin and other riskier assets because they make traditional safe investments such as U.S. Treasuries less attractive.

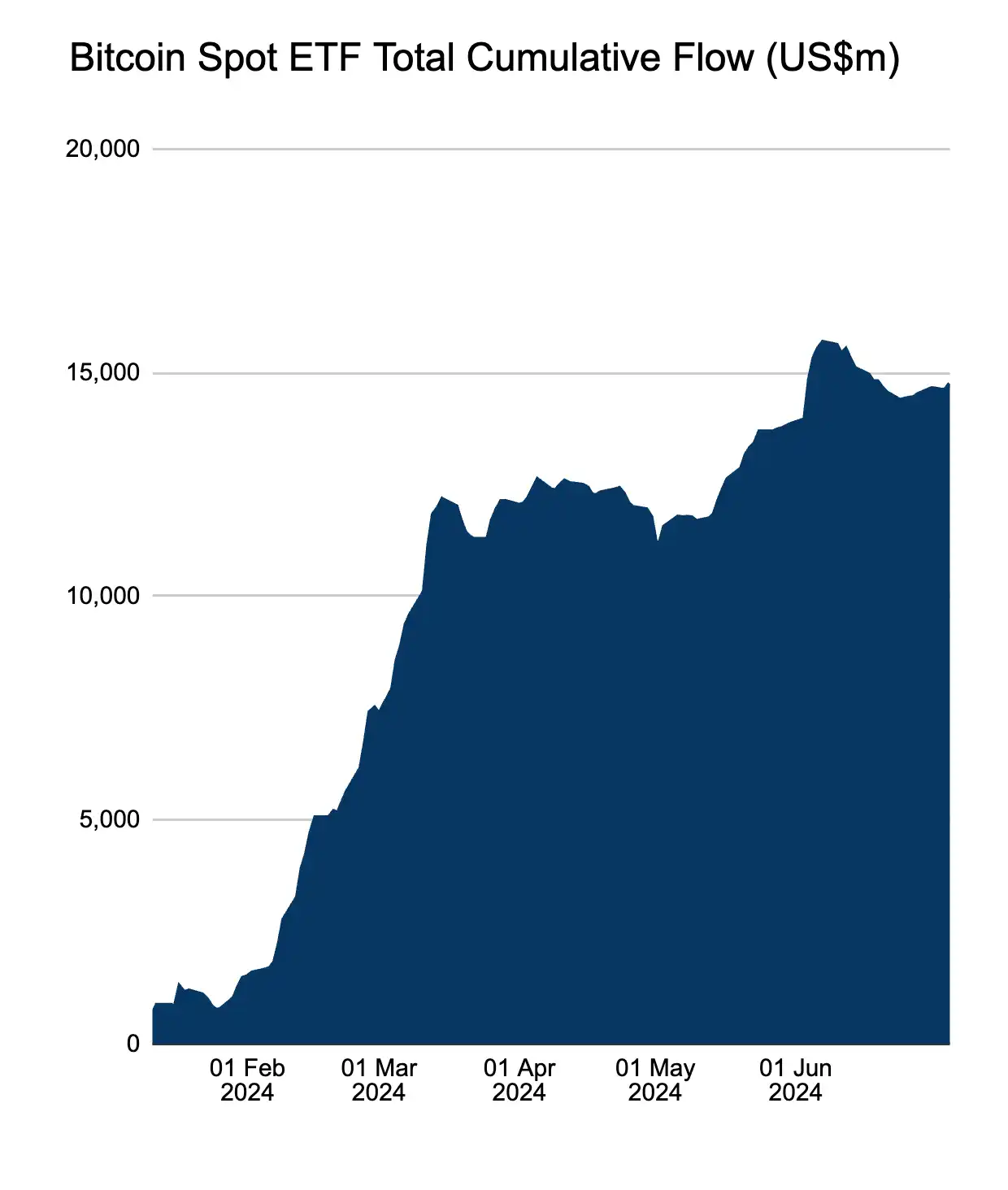

Bitcoin ETF investors return after July drop

Another positive indicator for the BTC market is that U.S. spot Bitcoin exchange-traded funds (ETFs) have resumed inflows after two consecutive days of outflows.

According to Farside Investors, on July 5, when the United States released weak unemployment data, these funds attracted a total of $143.1 million worth of BTC, indicating that risk sentiment among Wall Street investors was rising.

Cumulative inflows of spot Bitcoin ETFs. Source: Farside Investors

Fidelity Think Tanks Origin Bitcoin Fund (FBTC) led the way with $117 million in inflows. Bitwise Bitcoin ETF (BITB) had a net inflow of $30.2 million, while ARK 21Shares Bitcoin ETF (ARKB) and VanEck Bitcoin Trust (HODL) recorded inflows of $11.3 million and $12.8 million, respectively.

In contrast, the Grayscale Bitcoin Trust (GBTC) saw net outflows of $28.6 million.

U.S. money supply expands again

Further upside clues for Bitcoin come from the recent growth in the U.S. M2 supply, a measure of money supply that includes cash, checking deposits, and easily convertible quasi-money such as savings deposits, money market securities, and other time deposits.

As of May 2024, M2 money supply increased by about 0.82% year-on-year, and its total decline has dropped from a peak of 4.74% in October 2023 to around 3.50%.

US M2 supply map. Source: FRED

M2 supply growth is good for Bitcoin because it increases liquidity in the economy. The more money in circulation, the more people will invest in riskier assets like Bitcoin because traditional investments like savings and bonds offer lower returns.

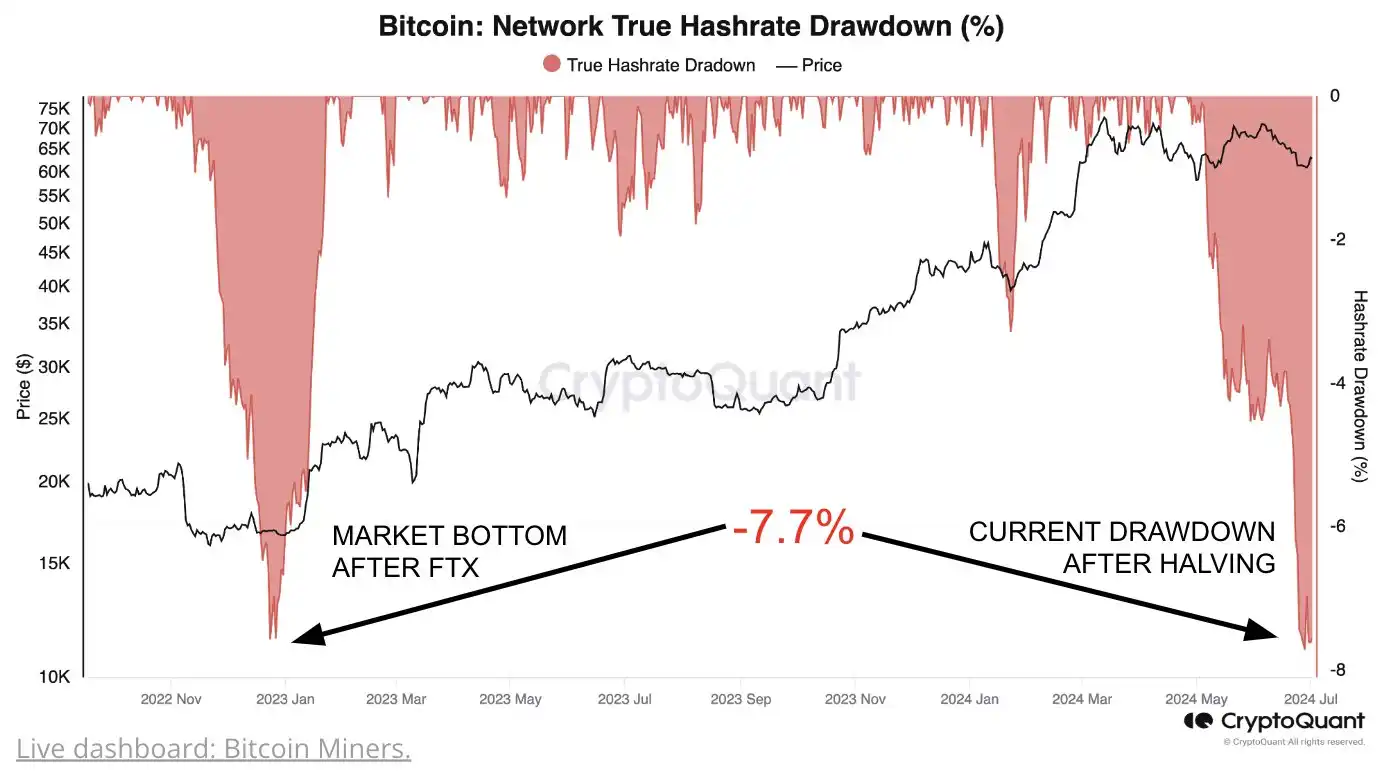

Bitcoin miners capitulation suggests Bitcoin price bottom

The Bitcoin Miner Capitulation Indicator is approaching the level at which the market bottomed after the FTX crash in late 2022, suggesting that BTC may have bottomed. Miner capitulation occurs when miners reduce operations or sell a portion of their mined Bitcoin and reserves to make ends meet, earn a profit, or hedge their Bitcoin risk.

Market analysts have highlighted several signs of capitulation over the past month, during which Bitcoin’s price has fallen from $68,791 to $53,550. One notable sign is a significant drop in the Bitcoin hash rate (the total computing power securing the Bitcoin network).

The hash rate fell 7.7% to a four-month low of 576 EH/s after hitting an all-time high on April 27. The drop suggests some miners are scaling back operations, reflecting the financial pressure on the mining community after the halving.

The real hash rate of the Bitcoin network is declining. Source: CryptoQuant

As weaker miners exit the market or scale back operations, more competitive miners will see greater profits, potentially stabilizing their operations and reducing the need to sell BTC. These indicators suggest that the Bitcoin market may be near a bottom, similar to previous cycles where miners sold off and operations decreased before the market recovered.

This article is sourced from the internet: Key indicators show that bulls still have the upper hand, Bitcoin may usher in a recovery

Original author: James Ho , Co-founder of Modular Capital Original translation: TechFlow Vincent and I founded @Modular_Capital 2 years ago with the belief that the use cases for cryptocurrencies will expand. The last cycle was focused on decentralized finance (defi) and non-fungible tokens (NFTs), which we believe are powerful primitive assets (both speculative and non-speculative), but we believe that the potential of cryptocurrencies goes far beyond that. Here are some instances we’ve found in the B2B space where there is real use case for this that is not speculative, and these are just three examples that I can think of. Stablecoins We have issued over $160 billion in stablecoins (90%+ of which are Tether and USDC) and are doing over $2-3 trillion in monthly trading volume. Instant, global, 24/7 real-time…