Original author: Jack

에 따르면 듄 애널리틱스 data, RWA has become the only crypto narrative that has achieved growth in the past three months, except for meme. This performance has attracted our attention in an environment where the market as a whole is stagnant. In fact, since June last year, voices about RWA have been coming one after another, and after BlackRock launched the BUIDL on-chain fund, this narrative was completely ignited.

In the crypto space, RWA is already a story that has been told too much. Although RWA is a new concept, connecting and influencing real industries in a decentralized way seems to always be the intuitive direction of cryptocurrency entrepreneurs: blockchain is like the Internet, and it will definitely completely change traditional business. However, putting everything on the chain is not as simple as everyone imagines. From the on-chain gold of Paxos Gold in the early years to the on-chain energy ledger of Power Ledger during the ICO period, to the on-chain credit Maple Finance and Goldfinch with luxurious backgrounds in the last round of capital, RWA seems to have been failing.

But what’s interesting is that native users in the crypto industry seem to have been underestimating the vitality of this narrative. Through a detailed review of the timeline, we can clearly see the continued changes in the fundamentals of the RWA narrative. Behind this narrative revival is the alignment of RWA product positioning and user needs, as well as the huge incremental opportunities driven by traditional financial institutions.

Everyone has a good sense of smell when it comes to the wind, but not many people can really step on the right spot. In the past six months, countless teams have flocked to transform into RWA, but only a few projects have successfully seized the opportunity and achieved initial results. Whether it is transformation or entry, seeing the opportunity clearly is the key for the team to get a ticket. Among the many competitors, a project called Jiritsu attracted our attention.

RWA always fails

On December 6, 2022, smart contract auditing platform Sherlock updated a blog post on Mirror, informing the community team that it would lose approximately $4 million due to the default of Maple Finance borrowers. Prior to this, Sherlock had about 5 million USDC stored in the Maple lending pool managed by M11 Credit, but now, the overall fund loss of the pools pledgers will exceed 30%. On the same day, DeFi insurance platform Nexus Mutual also expected to lose about $3 million in the Orthogonal Trading default incident.

The day before, crypto hedge fund and credit investment company Orthogonal Trading defaulted on its $36 million loan on Maple Finance, accounting for about 30% of Maple Finances active loans. Just half a year ago, Maple had just suffered a loan default of nearly $10 million from Babel Finance, and it was Orthogonal Tradings 10 million USDC position in the lending pool that was hit hard.

In a year, a series of defaults have made the former RWA lending star miserable. After LUNA and 3AC collapsed, the chain reaction in the crypto market rapidly intensified. The liquidation of mainstream ecosystems and institutions caused the overall credit scale of the market to shrink rapidly, leading to the continuous occurrence of deleveraging events. After FTX collapsed, the total value of active loans in the market plummeted by 80%, from US$1.58 billion to US$270 million at the beginning of 2023. When the market went downhill, Maple did not have an easy time. Even after announcing the tightening of loan standards in October, defaults continued to occur.

관련 자료: From Celsius to Three Arrows: The Dominoes of Crypto Billionaires and the Epic Liquidity Drainage

Many people attribute Maples setbacks to the market, believing that Maple was born at the wrong time. But even with the market recovery, defaults frequently occur in many RWA loan agreements. In April this year, Lend East, a startup credit company, said that it would only be able to repay about $4 million of the approximately $10 million loan it had previously obtained through the RWA loan agreement Goldfinch, and the remaining $6 million would be in default. Since the start of operations, Goldfinch has suffered three large defaults. This project, which was born with a golden key, has also failed to bring magic to RWA.

From June 2021 to January 2022, a16z invested nearly $30 million in Goldfinch twice, but in the following month, Goldfinch had $20 million in bad debts because the borrowers investment did not meet expectations. Last October, the Goldfinch governance platform released another report, pointing out that a lending pool on the platform had bad debts and $7 million was at risk of loss.

Unlike overcollateralized lending in conventional DeFi, private credit agreements (i.e., RWA lending agreements) are designed to allow real-world businesses to obtain unsecured loans based on their credit records, and on-chain funds obtain off-chain returns through the agreement. These third-party institutions evaluate borrowers and lend them to potential borrowers as liquidity by establishing a pool of funds. Compared with concepts such as gold on the chain and real estate on the chain, on-chain credit is already a relatively mature RWA model in the industrial chain, but even so, these agreements still find it difficult to form a flywheel.

One direct reason is the extremely high threshold for guiding users. In most cases, users must go through the KYC procedure before they can participate in the protocols lending pool, which deviates from the image of most DeFi users pursuing no permission and code is law, and to a certain extent turns the protocol into a To B product. In fact, this is also the main problem faced by most RWA projects, that is, the misalignment of product positioning and user portraits. In an industry full of super high ROI, most Degen does not seem to be interested in the profit opportunities that these off-chain assets can bring. Whether it is gold, real estate or art, the increase is difficult to match that of popular tokens.

On the other hand, the stability and security of off-chain revenue sources are also the main problems faced by the RWA lending protocol. From 2021 to 2022, almost all of Maple Finances active credit was transferred to native institutions in the crypto industry, and most of them went bankrupt during the bear market. At the end of 2021, Maple provided $25 million to Alameda Research, the trading company behind FTX, on the grounds that Alameda promised to increase the amount of loans to $1 billion within 12 months. In order to prove that the on-chain credit model works, Maple puts the consideration of yield first when choosing the lending object. The final result is: the so-called off-chain income brought by RWA actually comes from crazy leveraged crypto institutions.

The dilemma Goldfinch encountered reflects a more frustrating fact, that is, enterprises and entities that can obtain financing through conventional channels often do not choose on-chain financing. Goldfinch is indeed seriously looking for lending scenarios outside the crypto industry, mostly focusing on start-up industries and small and micro loans in developing countries and regions. The former are often the low-grade horses left over by top VCs, and the latter have a very high failure rate. On the one hand, it needs to bear higher risks, and on the other hand, the yield is not as good as expected by cryptocurrency speculation. The double debuff of products and users has always made RWA difficult.

This time, the fundamentals have changed

Interestingly, the RWA narrative has been on the rise again since June last year, however this time, its fundamentals have changed in important ways.

When the on-chain whales are eyeing 5% annualized

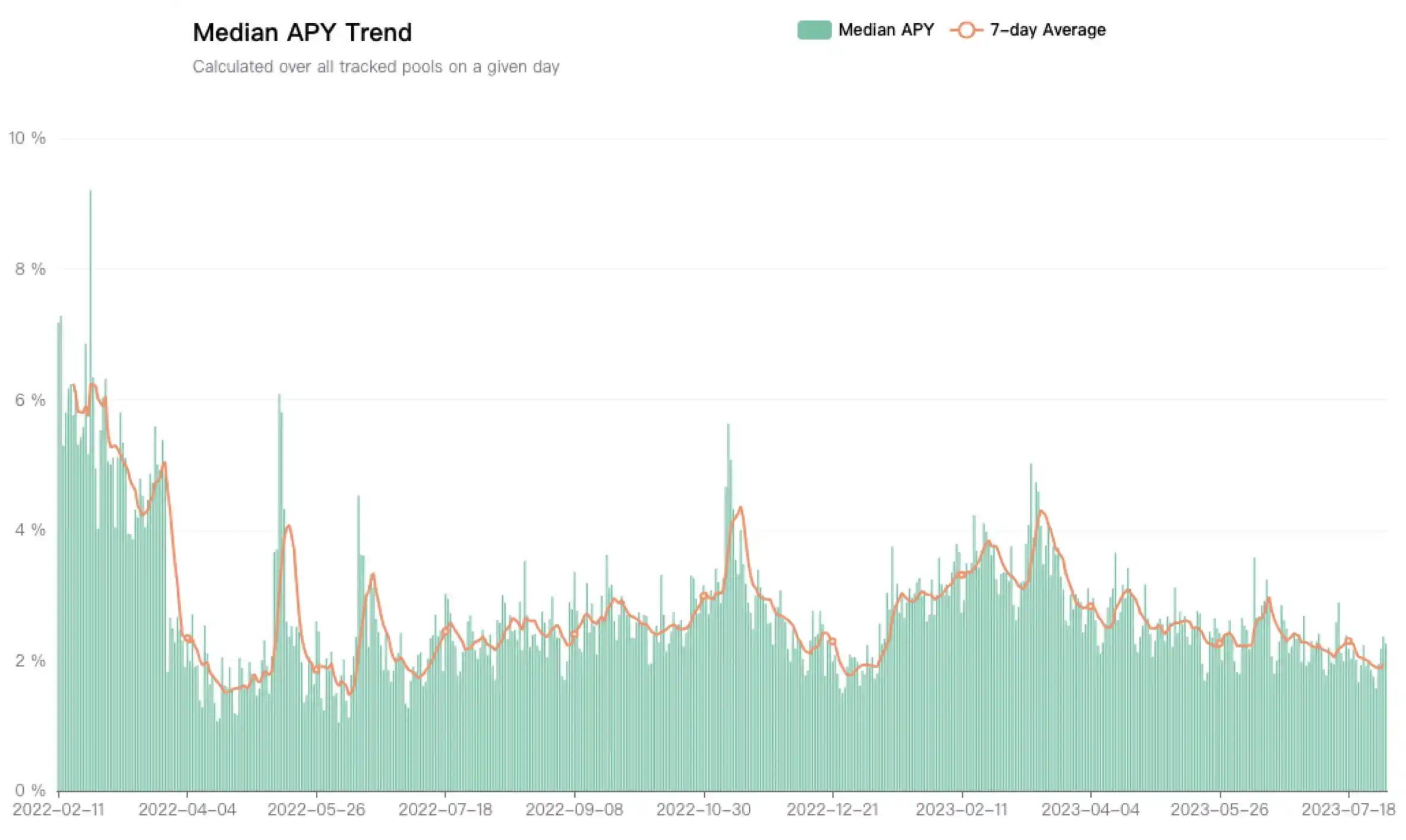

On the eve of the collapse of Three Arrows Capital, the team found that it was almost impossible to find a scenario where the assets it managed could generate expected returns. As the Federal Reserve began to raise interest rates, liquidity tightening has eroded various markets around the world, especially cryptocurrencies, which are defined as risky assets. Corresponding to the steady rise in U.S. Treasury yields since the end of 2021, DeFis yield level has gradually declined, with the median yield falling from 6% at the beginning of 2022 to 2% in July 2023. This is almost unprofitable for large investors, because the risk-free yield has reached 5%.

When the on-chain yield is low enough, the yield in the real world becomes much more attractive, which means that the main bottleneck that plagues the RWA protocol has changed, that is, the crypto industry has begun to be interested in off-chain yields. In order to cope with the continuous outflow of industry funds, the industry began to think about how to bring the risk-free yield of US bonds to the chain, so RWA once again became a savior in peoples eyes.

In August 2023, the page of Spark Protocol, a lending protocol under MakerDAO, showed that the DAI deposit rate (DSR) had been raised to 8%, and the long-dormant DeFi was reignited. Within a week, the DSR income of the protocol climbed to nearly $1 billion, and the circulating supply of DAI surged by $800 million, setting a record high in three months.

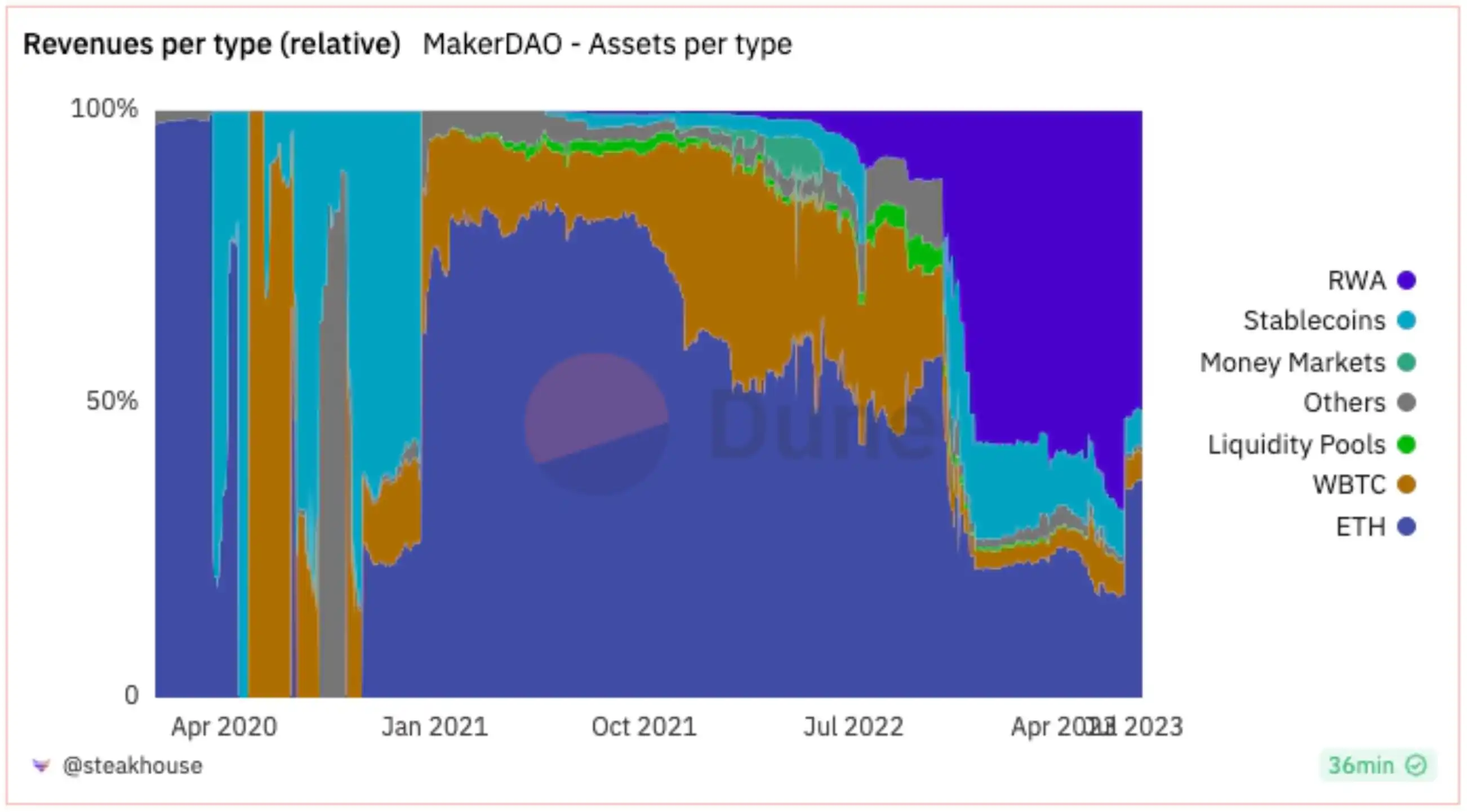

Makers secret recipe for giving huge returns in a deep bear market is RWA. According to statistics from The Defiant, based on total TVL, nearly 80% of MakerDAOs fee income in the past year came from RWA assets. Starting in May 2023, MakerDAO gradually increased its risk exposure to RWA. In addition to deploying funds to Coinbase Prime, it also purchased a large number of U.S. Treasuries in batches through its two entities, Monetalis Clydesdale and BlockTower. In addition, BlockTower Credit has also deployed up to $220 million in loan funds on the RWA lending agreement Centrifuge. According to Dune Analytics data, MakerDAO had an RWA investment portfolio of nearly $2.5 billion as of July 2023, including more than $1 billion in U.S. Treasuries.

The sudden high returns have made RWA the most controversial topic in the Maker community. After the Tornado Cash case, crypto native users are eager to get rid of the shackles of centralized power. The increase in DAIs dependence on US debt has reduced DeFis ability to resist regulation. On the other hand, it also means that once the Fed reverses, the RWA protocol that relies on US debt will fail again.

However, concerns at the vision level cannot hinder the motivation of the crypto industry to make money, and RWA has rekindled peoples interest in DeFi. The ultra-high returns of blue-chip stablecoins have produced a chain reaction in the DeFi ecosystem. The Aave community soon proposed to list sDAI as collateral in order to indirectly obtain leveraged exposure to US bonds. DAI has transformed from a liquidity product to the yield Lego of the DeFi world. Any protocol that wants to gain exposure to RWA can build its own sustainable income based on DAI. MakerDAO governance token holders have also begun to see a large influx of funds. MKR has risen by more than 35% in a single month, becoming one of the best performing tokens on the market.

MakerDAOs successful exploration in the RWA field has set off another RWA craze in the industry. Also in June, the founder of Compound announced his new company Superstate, which is responsible for bringing assets such as bonds to the chain and providing potential customers with returns comparable to the real world. After the news was announced, the price of COMP tokens rose by more than 23% in 24 hours. Since then, protocols such as Ondo Finance and Matrixdoc have also begun their exploration in the field of U.S. debt tokenization.

The gears of the regular army are turning

In June last year, BlackRock, the worlds largest asset management group, submitted a spot Bitcoin ETF application to the US SEC through its subsidiary iShares, and a new round of crypto bull market began. Since its launch in January this year, IBIT has continuously set new records for BlackRock funds. BlackRocks first quarter financial report in April this year showed that IBIT has attracted about US$13.9 billion in net inflows, accounting for 21% of its total net inflows of ETF products. This figure reached 26% in June. BlackRock CEO Larry Fink even called IBIT the fastest growing ETF in history.

After the Hong Kong Web3.0 Summit in April 2023, the gears of institutional on-chain exploration began to turn. In July of the same year, Huang Lexin, head of the Financial Technology Group of the Hong Kong Securities and Futures Commission (SFC), said in an interview that the SFC would change its previous views on STOs, and that securities tokens (RWA) would not be defined as complex products. RWA would be regulated according to the type of underlying endorsed assets and would have the opportunity to be open to retail investors.

Institutional ambitions in the crypto industry go far beyond ETFs. Larry Fink, CEO of Blackrock, said at the end of 2022 that the next generation of markets, the next generation of securities, will be the tokenization of securities. Tyrone Loban, head of JPMorgan Chases Onyx blockchain, has the idea of bringing trillions of dollars of assets into DeFi, making them as large as institutional assets, so that these new mechanisms can be used for trading, borrowing, and lending.

In addition to the internal driving force from the industry, a key reason for the revival of the RWA narrative is the exploration interest from external forces such as governments and large financial institutions. The active participation of traditional institutions means that the situation of RWA protocol chasing the attention of the real world has changed, and putting their own financial products on the chain has become the demand of external institutions for the crypto industry.

In March this year, BlackRock launched its first tokenized fund BUIDL issued on a public blockchain, providing qualified investors with the opportunity to earn US dollar returns. BlackRock stated in the announcement that tokenization remains the focus of its digital asset strategy, and through the tokenization of funds, the issuance and trading of ownership can be realized on the blockchain, in order to expand investors access to on-chain products and provide instant and transparent settlement and cross-platform transfers.

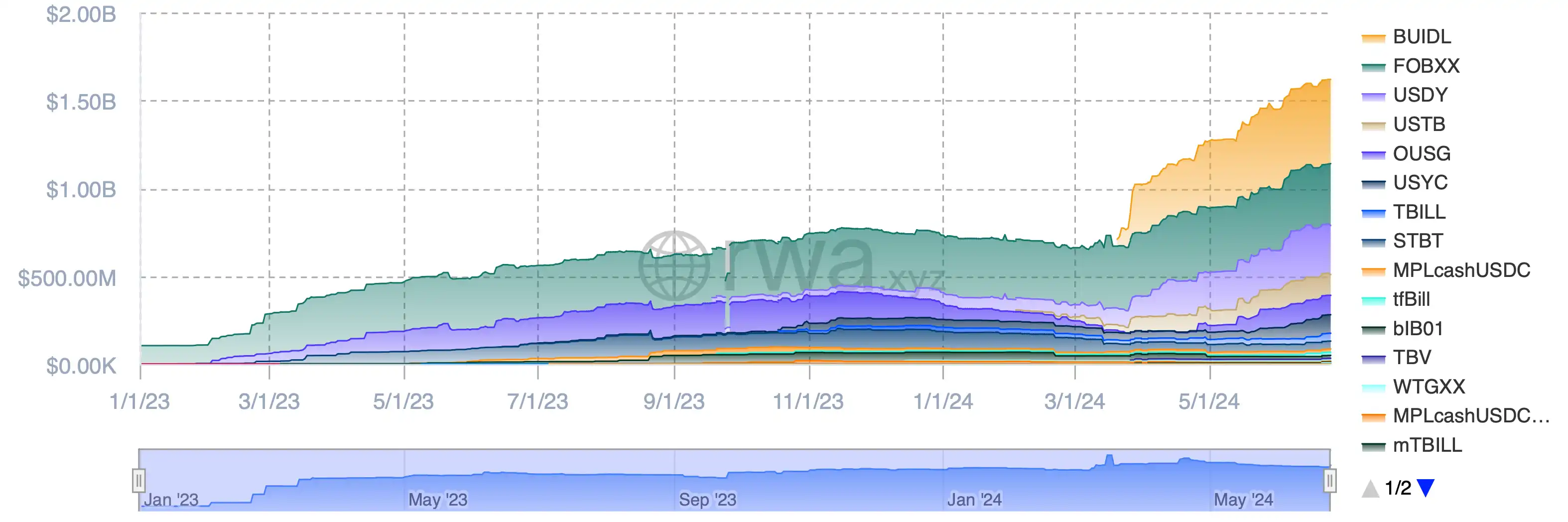

Like the application for Bitcoin spot ETF, the emergence of BUIDL has once again ignited the concept of RWA. Traditional financial giants have begun to test the waters on the chain, and many analysts even call it bringing legitimacy to public smart contract chains such as Ethereum. In less than 10 days after its launch, the size of the BUIDL fund has grown to US$274 million, accompanied by a substantial increase in the market value of tokenized RWA (including treasuries, bonds and cash equivalents), which has increased by nearly 35% since the beginning of April and has now exceeded US$1.5 billion.

The driving effect of BUIDL is very obvious. The entire on-chain U.S. Treasury bond market has shown a clear upward trend after the launch of BUIDL. The previously relatively quiet Franklin Templeton on-chain U.S. government money fund FOBXX has rapidly grown by nearly 27%. In the crypto industry, Ondo Finance, which has also transformed into a U.S. Treasury bond RWA protocol, has also seen its TVL rapidly double to US$500 million driven by the BlackRock concept.

There is almost no doubt that the gears of the huge machine have begun to turn. After Hong Kongs Web3 new policy and BlackRocks pioneering attempts at tokenization exploration, the process of institutions going online to try out new things will become more and more obvious, and their technical needs for blockchain infrastructure will also grow and become more abundant. For crypto-native projects that are struggling to find a better business model, this is a rare and huge To B opportunity.

With the huge To B business, who is taking advantage of the trend?

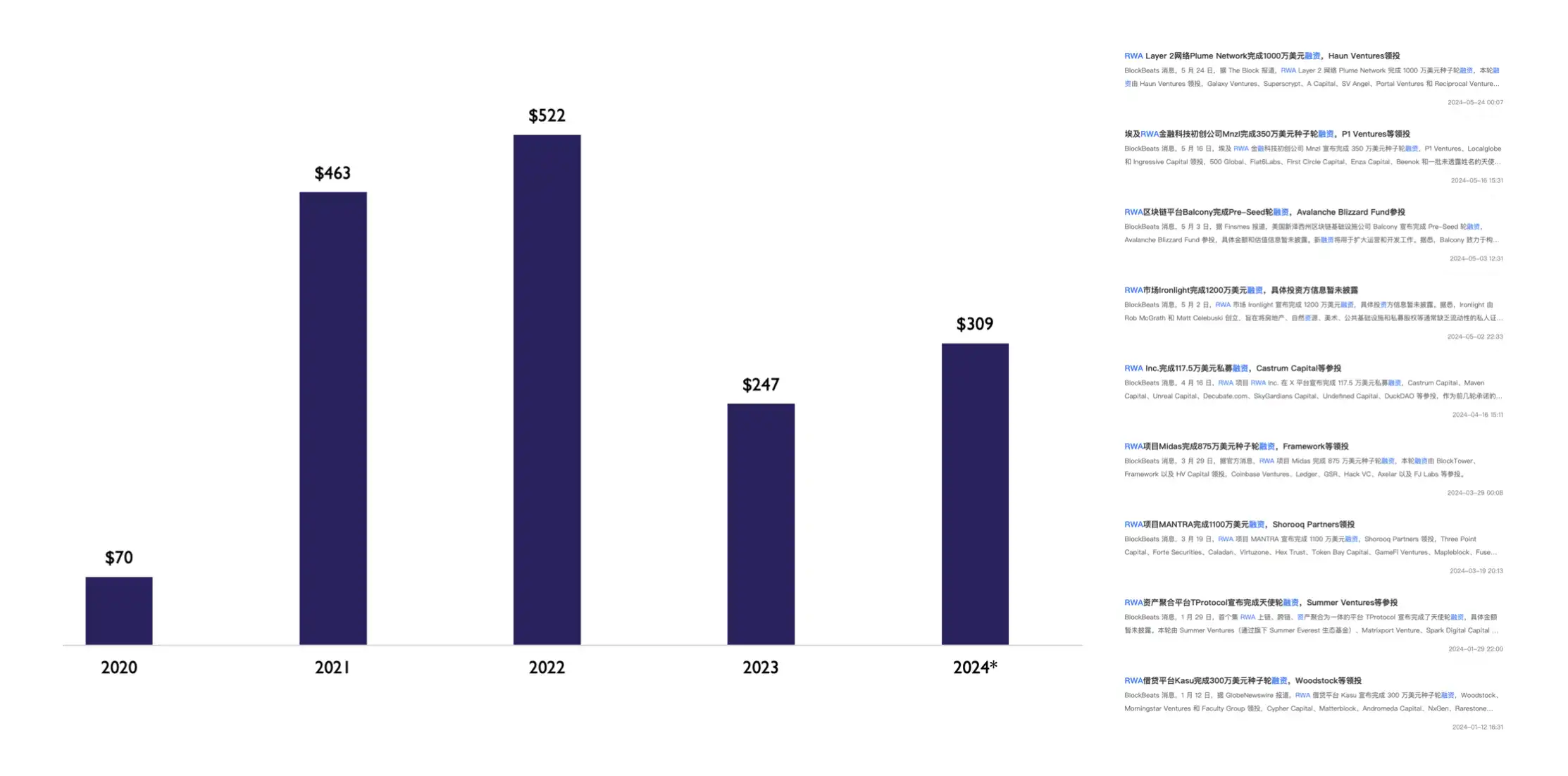

After the trend emerged, the amount of financing in the RWA field surged this year, and many teams wanted to seize this opportunity, but most peoples motivation is still to take advantage of the popularity. Even the former meme coin project TokenFi has stated that it will enter the RWA field. However, not everyone can accurately grasp the opportunities in the market at the forefront.

RWA public chain

In addition to Polygon, which has the second highest TVL of tokenized US bonds, Avalanche can be regarded as the first L1 public chain to fully embrace RWA. As one of the three giants of the new public chain in the last cycle, Avalanche chose a development path opposite to Solana after entering the bear market. Since the end of 2022, Avalanche has begun high-frequency exploration in the direction of enterprise-level applications, and its special subnet structure has also enabled the team to make rapid progress in this field. The Avalanche subnet architecture can authorize institutions to deploy custom blockchains optimized for their specific use cases and seamlessly interoperate with various Avalanche networks, thereby achieving unlimited scalability. From the end of 2022 to the beginning of 2023, entertainment giants from South Korea, Japan, and India have established their own subnets on Avalanche.

The sensitivity to institutions also allowed Avalanche to observe the asset tokenization trend in Hong Kong at the earliest. During the Hong Kong Web3.0 Summit in April 2023, Avalanche launched the Evergreen subnet, which is designed to meet the requirements of specific companies and the entire industry for financial services. Evergreen is a set of institutional blockchain deployment services and tools designed specifically for financial services. Institutions deploy blockchain settlement strategies on private chains with licensed counterparties based on the Evergreen subnet, and maintain interoperability with other subnets through the Avalanche Native Communication Protocol (AWM).

Evergreens solution directly meets the needs of institutions to combine public and private blockchains. After it went online, it immediately attracted the attention of institutions such as WisdomTree and Cumberland, and participated in the development and testing of the network after the launch of Evergreens test network Spruce. In November of the same year, Avalanche reached a cooperation with JPMorgan Chases digital asset platform Onyx, using the full-chain interoperability protocol LayerZero to connect Onyx and Evergreen, and promote the tokenized asset subscription and redemption functions provided by WisdomTree Prime. The cooperation was also included in the Guardian Plan launched by the Monetary Authority of Singapore (MAS) in cooperation with the financial industry.

Since then, Avalanche has successively announced various RWA collaborations with institutions. In November, it helped the financial services company Republic launch its tokenized investment fund Republic Note. In February 2024, it helped Citibank and WisdomTree and other institutions conduct a tokenization concept trial of private equity funds on the Spruce test network. In March, it cooperated with ANZ Bank and Chainlink to use CCIP to connect Avalanche and Ethereum blockchain for tokenized asset settlement. In April, it helped integrate payment giant Stripe.

The foundation within the ecosystem is also working hard in the direction of RWA, launching the Avalanche Vista plan and investing $50 million to purchase tokenized assets issued within the ecosystem, including bonds and real estate. In addition, the ecological fund Blizzard Fund is also actively investing in and attracting RWA projects such as Balcony and Re to enter the ecosystem. In the view of John Wu, CEO of Ava Labs, Avalanches mission is to present the worlds assets on the chain. Unlike traditional financial tracks, blockchain can complete settlements immediately. Now that institutions have seen this kind of instant settlement solution that cannot exist in the real world, the rise of RWA can bring highly regulated entities into the on-chain space and realize more possibilities, and Avalanche will strive to become their best choice for on-chain.

BlackRock Concept

Although RWA covers a wide range of assets, after MakerDAO and BlackRock entered the market, tokenized U.S. Treasuries have undoubtedly become the most popular RWA product, with a market value that has increased nearly 10 times in about a year, from approximately US$100 million at the beginning of 2023 to nearly US$1 billion at the beginning of 2024.

Unlike tokenized assets such as gold and real estate, tokenized U.S. Treasury bonds are not directly backed by the U.S. Treasury, but are often brought to the market in the form of money market funds. Therefore, the issuer of U.S. Treasury RWA is also a licensed fund manager, responsible for creating and managing money market funds and issuing fund units to holders as tokenized treasuries.

However, money market funds are regulated capital market products, and investors investments are also subject to relevant rules and regulations, which means that investors need to go through KYC certification procedures before purchasing. In addition, since the assets of the fund must be kept by the custodian, in addition to buying and selling assets, the fund manager must also work directly with the custodian to carry out new user guidance, net settlement, reconciliation and other operational work, and the custodian will have a complete and updated list of holders and their balance books.

The BUIDL fund issued by BlackRock in March this year is exactly this kind of tokenized money market fund. It invests all its total assets in cash, U.S. bonds, and U.S. dollar cash equivalents such as repurchase agreements. BlackRock pays daily accrued dividends directly to investors wallets as new tokens, allowing investors to earn income while holding tokens on the blockchain. Under the light of BlackRock, Securitize, the issuer and manager of the BUIDL fund, quickly came into peoples view and became a hot commodity in the RWA field.

Securitize, which is cooperating with BlackRock this time, has long focused on the RWA field and has provided services to many large-scale asset securities companies. After obtaining the SEC transfer agent registration qualification in 2019, Securitize received $48 million in financing led by Blockchain Capital and Morgan Stanley in 2021. In September 2022, the team helped KKR, one of the largest investment management companies in the United States, to tokenize some of its private equity funds on Avalanche. The following year, still on Avalanche, Securitize issued equity tokens for Spanish real estate investment trust Mancipi Partners, becoming the first company to issue and trade tokenized securities under the EUs new digital asset pilot system.

After joining BlackRock this year, Securitize received another $47 million in strategic financing led by BlackRock in May. The financing funds will be used to further accelerate its partnerships in the financial services ecosystem. As part of the investment, Joseph Chalom, BlackRocks global strategic ecosystem cooperation director, was appointed as a member of Securitizes board of directors. In the new RWA trend set off by BlackRock, Securitize is undoubtedly the biggest winner.

There is also a type of crypto-native RWA protocol that, after sensing the wind direction, accurately grasped the opportunity for takeoff, among which Ondo Finance is a typical representative.

In August 2021, Ondo Finance announced the completion of a $4 million financing round with participation from Pantera Capital, DCG, and others, and is ready to provide sustainable returns to on-chain investors. In January 2023, Ondo officially launched three tokenized funds, including OUSG (U.S. Government Bond Fund), OSTB (Short-Term Investment Grade Bond Fund), and OHYG (High Yield Corporate Bond Fund), for which Ondo charges an annual management fee of 0.15%. Of course, similar to the situation mentioned above, Ondos tokenized funds have always struggled with PMF.

But when the RWA wind blew up in the industry again, Ondo also responded immediately. In January this year, Ondo Finance announced its own ecosystem directory on social platforms, including RWA business liquidity, custody and asset management companies and other fields of cooperation providers, including the names of financial giants such as BlackRock and Morgan Stanley. Officials said that this directory is intended to help the agreement focus its work on these partners, and the unexpected meaning is: we will work closely with BlackRock.

Later, in the same month when the BUIDL fund was launched, Ondo immediately announced a major adjustment to its U.S. debt product OUSG. In addition to improvements in the purchase and redemption mechanisms, the most eye-catching adjustment was its decision to reallocate most of OUSGs assets (about $95 million) to the BUIDL fund. The team said that this action would help them transfer token-backed assets from less ideal trading funds to blockchain-based tokenized funds. Ondo immediately became the leading hype target of RWA and the BlackRock concept, and the token price rose by more than 110% in a week.

The scale effect is the ultimate winner

Whether it is the public chain of To RWA or the issuers and managers of on-chain assets such as Securitize, their development and launch are mostly determined by the interests of financial institutions such as BlackRock. In other words, the current opportunities for the RWA narrative come entirely from the customized needs of traditional financial institutions. For the industry, relying on the action of financial giants is not the optimal solution to achieve growth. Solving the fragmentation of internal infrastructure and liquidity and achieving economies of scale are the keys to self-reliance.

Liquidity fragmentation

The biggest benefit of tokenizing real-world assets is that it can provide faster and more efficient trading and settlement processes for these assets, which is undoubtedly the main reason why all institutions are interested in RWA. Although this idea is logically sound, it will encounter many technical difficulties when it is actually promoted, and the fragmentation of liquidity after assets are put on the chain is one of them.

When RWA is put on the chain and traded, the fragmented market makes the problem worse. In 보고서 last July, Digital Asset Research emphasized that among the current RWA institutions, more than 60% are trading through their own tokenized asset markets, which means that after the assets are put on the chain after going through hardships, they can only attract a small number of fixed customers.

According to statistics from The Block, the total financing scale of the RWA track has also reversed the downward trend this year and rebounded to US$300 million. The current trend of RWA recovery has allowed many entrepreneurs to see new narrative opportunities, and the RWA concept projects on the market are also increasing at a visible rate. However, most of the projects that have received financing tend to focus on very small vertical fields, such as natural resources, specific commodities, and artworks, and RWA projects in the real estate field are particularly obvious in this regard.

To what extent can this vertical category be subdivided? For example, platforms such as Balcony and Mnzl provide tokenization processes for regional real estate resources. Often, the assets on the chain and the buyers and sellers who trade through on-chain tools are local institutions or government departments, which can basically be regarded as a semi-closed asset market.

The verticalization and regionalization of RWA projects are understandable. After all, many real-world assets are highly regionalized and often require dedicated personnel and targeted solutions. However, due to different regulatory restrictions in different regions, each RWA project is almost building its own on-chain process and trading platform from scratch. At the same time, there are different choices when choosing the underlying public chain and smart contract development tools and other technology stacks, which brings huge challenges to the interoperability between different RWAs.

Many entrepreneurs have seen this liquidity fragmentation, so at the same time, RWA asset aggregation platforms such as Midas and Plume began to appear in the market, or RWA launch platforms. But when you think about it further, you will find that they are still facing a dilemma: if you want to establish a unified market, you must first have a certain degree of compatibility in token and contract standards, which hinders the platform from aggregating RWA assets on a large scale and in multiple categories. If you aggregate different RWA protocols first, you will be limited to the role of a launch platform due to the differences in the technical stacks between the protocols. Although it brings some liquidity to small projects, the assets on the chain still have to face the problem of market fragmentation.

This is true even for the most liquid tokenized U.S. Treasury bond market. Although the scalability problem of a single product category has been solved under the impetus of institutions such as BlackRock and Franklin Templeton, you will still find that in order to provide more choices for potential investors and cooperation projects in the future, these assets are also dispersed on different public chains such as Ethereum, Stellar, and Avalanche.

This also provides a narrative window for cross-chain interoperability protocols that have been slow to gain momentum, such as Axelar, which started to deploy RWA very early. Last year, it launched Centrifuge Everywhere and Ondo Bridge in cooperation with Centrifuge and Ondo, respectively, to optimize the protocol and inter-chain interoperability and liquidity for RWA tokenized products. In the current market environment where fragmentation is obvious, cross-chain interoperability is a compensatory solution.

Self-reliance at the weakest link

In fact, it is not difficult to see that the bottleneck for RWA to break through the scale limitation is the lack of automated processes or technologies such as AMM in the DeFi field. For RWA products, tokenization is often just the beginning. After the product is on the chain, ensuring continuous asset updates and transparency is the key to testing efficiency and cost, which generally includes the following aspects:

1. Financial reporting: Asset managers need to publish financial and performance reports on their assets on a regular basis. For example, real estate managers need to regularly provide payment dates and amounts of rental income, or details of outstanding balances and vacancies, so that investors can have a clearer understanding of the cash flow dynamics of the property.

2. Debt management: Products such as RWA credit need to regularly update details such as loan collateral, repayments, interest rate adjustments, and refinancing activities to let investors understand their health. This is the basis for such products to maintain investor trust.

3. Change of ownership: If there is a change in the basic ownership of the underlying asset or the legal entity that owns the asset, it also needs to be announced in a timely manner.

4. Market regulation: When the market regulatory environment of the underlying assets changes, the manager also needs to report and make corresponding adjustments to ensure product compliance.

Of course, in addition to this, there are also complicated details such as asset insurance and risk management strategies, asset valuation and inspection, and the legal entity of issuance. From tokenization to information update and maintenance, a real-world asset requires asset managers to devote a lot of energy and attention to various details throughout the investment life cycle. In short, in the current market environment of infrastructure redundancy, asset chaining is no longer the most difficult part of RWA development. Off-chain continuous verification and legal supervision are the main reasons for slowing down the growth of asset categories and scale and eroding the value of asset chaining. All of this can only be discussed under the premise of putting aside the centralized audit risks of off-chain entities.

The scale and growth rate of RWA assets depend entirely on the strength of the off-chain issuing and management institutions, which is also the important reason why the U.S. Treasury RWA products have grown rapidly after BlackRock entered the market. In contrast, other assets such as real estate and commodities are difficult to achieve scale effects due to the lack of enhanced automation in the process. Of course, the value of on-chain assets also means huge business opportunities, and for now, this part of the potential income has basically flowed into the hands of asset issuers and managers like Securitize.

Is it possible to build an automated asset oracle system in the RWA field, just like ChainLink does for DeFi? We found some answers in the Jiritsu project.

Jiritsu is an Avalanche L1 specifically for off-chain asset verification, designed to automate and de-trust off-chain asset registration and verification, while improving the economic efficiency and transparency of RWA tokenization and reducing on-chain wear and cost. By integrating ZK proofs and MPC multi-party computing, Jiritsu can ensure secure and private automated verification of asset details, while embedding regulatory compliance and asset integrity into tokenized products. Interestingly, the name Jiritsu comes from the Japanese word じりつ, which means self-reliance. In the current RWA field, where the core links are heavily dependent on centralized manpower, this is exactly what it needs most to enhance its crypto-native properties and achieve economies of scale.

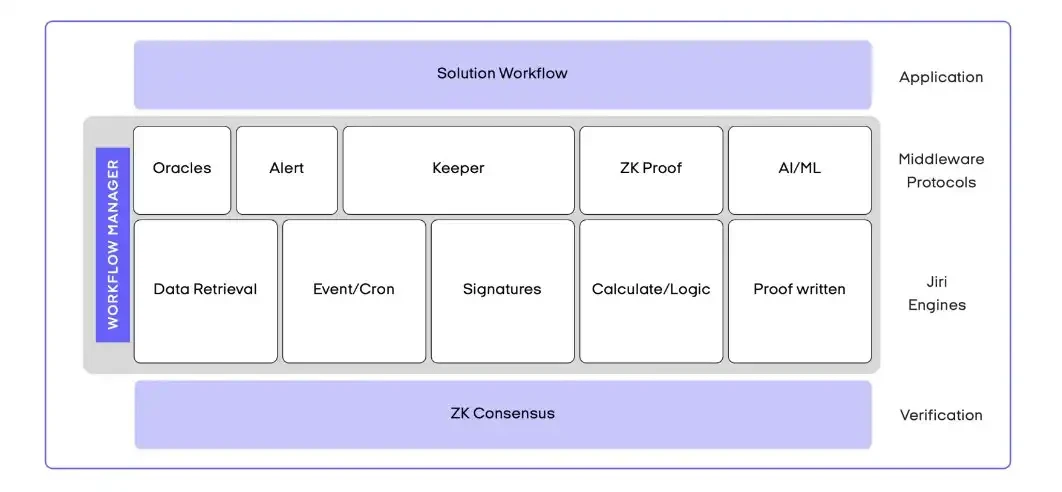

Jiritsu ZK-MPC Oracle aggregates data from multiple sources and verifies related calculations, and adopts a multi-functional data retrieval mechanism to enhance the integration depth of different types of assets. The oracle includes two main mechanisms: Push and Pull. The former is that data providers (such as asset managers) send information directly to the oracle, and the latter allows the oracle to directly obtain data from the integrated information providers systems such as supply chain software, bank information, etc. through APIs.

In terms of consensus mechanism, Jiritsu introduces the concept of Proof of Workflow (PoWF). The nodes in the network run an operating system driven by a computing engine and a workflow manager, and use the generated ZK proof to ensure the consensus mechanism of verifiable computing and smart contract execution, so as to integrate the consensus mechanism directly into its MPC framework. Compared with existing oracles such as ChainLink or Pyth, Jiritsu does not need to use cross-chain bridges for information transmission when aggregating information, and also adds information analysis and verification functions in addition to simple data feedback.

After a user or asset manager registers the assets they wish to tokenize and their details on Jiritsu, the ZK-MPC validator will analyze this information and confirm the value and compliance status of the assets. The analysis process involves two types of validators, one for reviewing business policies and regulatory compliance, and the other for processing financial data, performing tasks such as spot price retrieval and market price assessment. After the information is analyzed and verified, ZK-MPC will generate ZK proofs and store them on the chain. Users can then claim these proofs and embed them into their own smart contracts, and the entire asset tokenization process is complete.

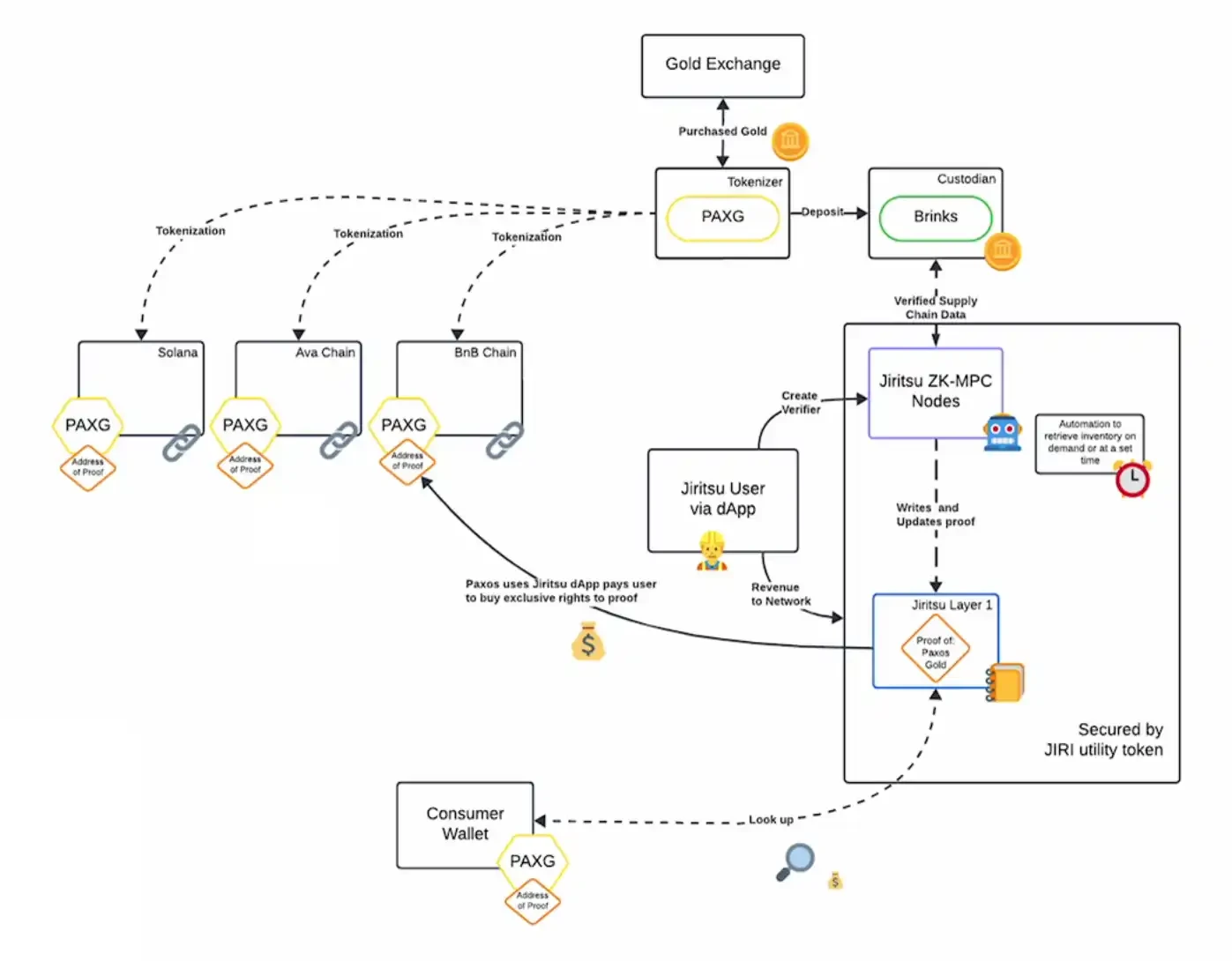

Jiritsu officials used Paxos’ tokenized gold product PAXG as an example to demonstrate the complete process of using its products:

First, Paxos purchases gold through a reliable gold exchange and deposits it in a custodian service. Subsequently, Jiritsu users can use the Jiritsu dApp on a supported public chain to create a validator on the ZK-MPC node of the Jiritsu network. After the ZK-MPC node retrieves the gold custody information about Paxos, the validator generates the relevant ZK proof.

During the verification process, the ZK-MPC node is responsible for off-chain verification calculations, and the generated ZK proofs also have different levels of access and confidentiality permissions, such as auditors can have full access to all information, while asset managers can only see specific information related to their roles. This verification process can update information at preset times or on demand, which is far more efficient and reliable than Paxos current method of manually verifying inventory every quarter.

After the ZK proof is uploaded to the Jiritsu network, Paxos can advance the tokenization process of its custodial gold. In this link, Jiritsu also implements the concept of chain abstraction, allowing asset issuers like Paxos to mint corresponding tokens on ideal target chains such as Solana, Avalanche or BNB Chain.

After the token is generated, Paxos pays fees to nodes and validators through the Jiritsu dApp, a portion of which will be allocated to the Jiritsu network. The PAXG tokens purchased by investors will contain an underlying gold certificate, which can be used to access the gold custody status information on the Jiritsu network, and Paxos can pass the cost of the fee on to investors at this stage.

The dApps on the Jiritsu network are designed to facilitate the writing of specific data, allowing users to create validators for any business logic, data readers, and smart contract integrations. This adaptability ensures Jiritsus ability to provide customized solutions for a wide range of business needs. In addition, Jiritsu Proof under its ZK-MPC cloud service has significantly expanded the asset categories for information verification. In addition to traditional financial verification such as bank information and corporate credit, it can also verify the status information of a series of real-world assets, such as company plant equipment, inventory, and transaction and income information. Jiritsu recently provided inventory proof for an Amazon supply chain company with more than 100,000 SKUs and a total value of approximately US$20 million.

On this basis, Jiritsu also uses two data indicators, Total Asset Verified and Totl Asset Secured, to measure its influence on the on-chain of real-world assets, and uses these data indicators to provide DeFi protocols with more compatible and interoperable underlying asset LEGOs. According to the official Dune dashboard data , Jiritsu has verified more than $18 billion in assets so far, and has more than $60 million in assets waiting to be used by various protocols at any time.

Not long ago, Jiritsu integrated BlackRocks RWA ecosystem to provide automated on-chain proofs for reserve asset valuation and verification, compliance and KYC platform information for its Bitcoin spot ETF and BUIDL funds, so that other protocols can use these assets on the chain more conveniently and quickly. On the other hand, although iBIT and BUIDL bring huge incremental funds to the crypto market and RWA, their asset verification still relies on self-reporting and only provides annual audits, while Jiritsu brings more transparent and cost-effective solutions to these products.

Jiritsu has also integrated with the Republic platform, which is deeply involved in the RWA field, so that any asset manager can directly implement and use similar solutions, improve compliance and operational efficiency while providing a variety of tokenized products, and asset managers can use the mature infrastructure provided by Republic in tokenization, compliance, marketing and customer service. Through automated and trustless verification and auditing, Jiritsu has moved the work previously done by institutions such as Moodys and KPMG to the chain, and the fee income of this part of the traditional market exceeds 150 billion US dollars. Even if calculated at 10%, this is an imaginative business ceiling.

Good money drives out bad money

From DeFi, GameFi to NFT, the past successful cases in the crypto industry have all relied on the innovation of native on-chain assets and interactive forms to attract new users and funds. However, the concept of RWA is to bring the value of the outside world to the chain. Therefore, many native crypto users have always resisted the RWA narrative, believing that bringing real-world assets to the chain is first of all a targeted harvest of crypto users, and secondly, it also squeezes the value growth space of crypto native assets. In addition, crypto users who are accustomed to ultra-high volatility are not interested in the low returns of real-world assets. RWA has been tepid in the past, largely because of the mismatch between this product positioning and user needs.

However, since the second half of last year, the fundamentals of the RWA field have undergone important changes. On the one hand, crypto-native protocols have begun to demand sustained and stable profitability, and on the other hand, traditional financial institutions have begun to actively explore on-chain financial products under the influence of BlackRock. For traditional institutions, the instant settlement of blockchain can not only reduce wear and tear, but also bring a wider investor base to high-threshold financial products, raising the transaction volume and fee income of financial products. Product positioning and user needs are no longer mismatched, and narrative recovery has become inevitable.

As for the crypto industry, although RWA cannot bring ultra-high gains to retail investors like native on-chain assets, it has begun to bring blockchain into the use case era. For traditional financial institutions, RWA assets have the characteristics of openness and transparency in addition to low cost and high transaction volume. In the short term, this does not seem to have much impact on the financial industry, but we might as well imagine that when the scale effect is achieved, this feature of RWA assets will become an extremely important reference indicator for investors when making decisions: on one side is the black box product of traditional institutions, and on the other side is a real-time settlement and open and transparent on-chain product. When the asset targets are the same, how will you choose? There is no doubt that RWA is a game of good money driving out bad money for traditional financial institutions.

This article is sourced from the internet: The revival of RWA narrative: Who is taking advantage of the huge To B business?

Related: A brief analysis of the liquidity war in the re-pledge market

Original author: Larry Sukernik, Myles ONeil Original translation: Frost, BlockBeats At Reverie, we spend a lot of time researching restaking protocols. It’s an exciting investment category for us because everything is fuzzy (opportunities exist in fuzzy markets) and there’s a lot happening (dozens of projects will launch in the restaking space in the next 12 months). In our work studying re-pledge mechanisms, we have gained some insights, so we wanted to predict how the re-pledge market will develop in the next few years. A lot of this is new, so what works today may not work tomorrow. Nonetheless, we wanted to share some initial observations about the business dynamics of the re-pledge market. LRT as a leverage point Today, LRTs like Etherfi and Renzo hold a powerful position in the…