In the past 24 hours, many new popular currencies and topics have appeared in the market. It is very likely that they will be the next wealth-making opportunities. The sectors with relatively strong wealth-making effects are:

-

DePin (MOBILE, HONEY), ETH ecosystem (ENS, SSV)

-

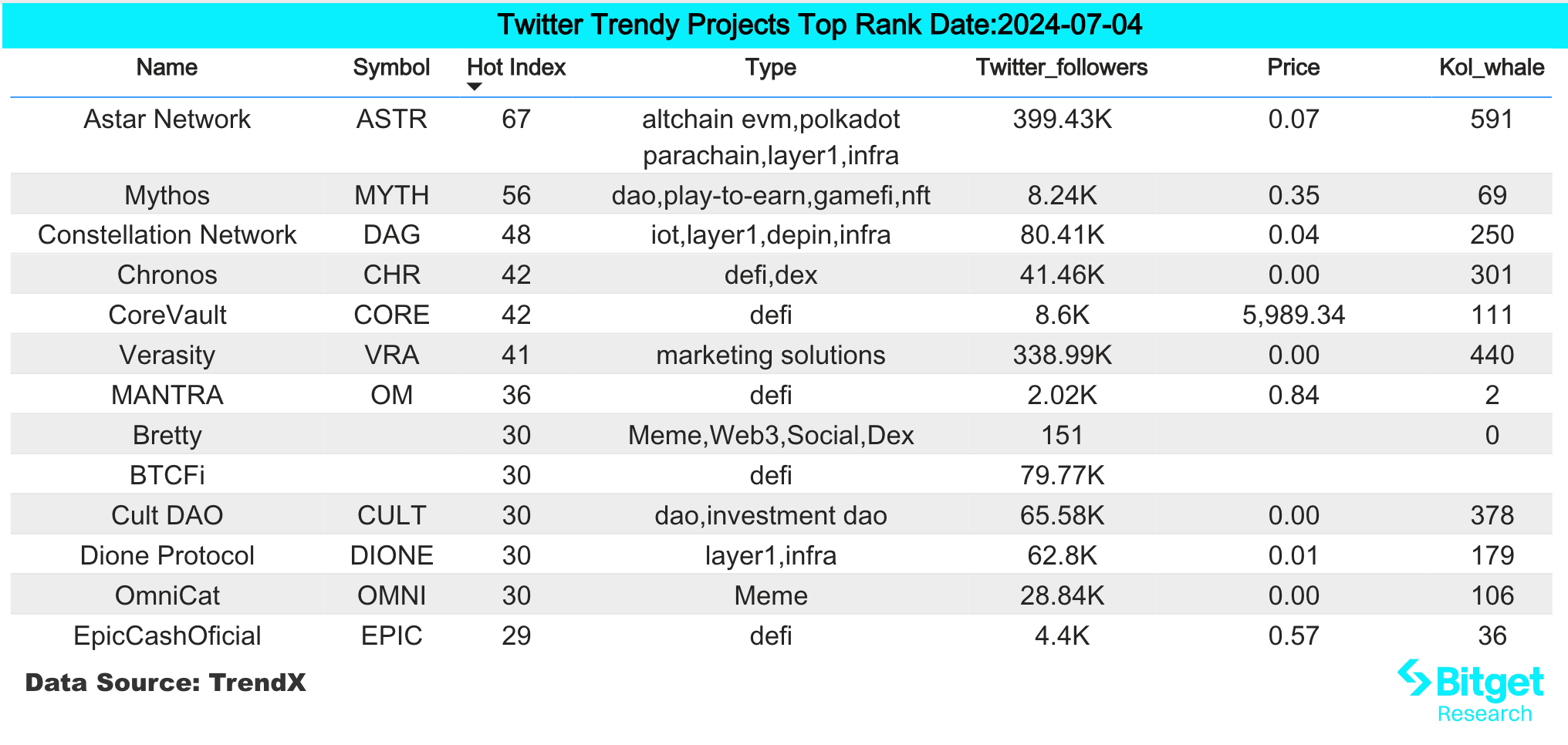

Hot searched tokens and topics: Sentient, Astar Network, TAO

-

Potential airdrop opportunities include: Linea Surge, Solayer

Data statistics time: July 4, 2024 4: 00 (UTC + 0)

1. 시장환경

The overall crypto market fell yesterday, and the price of Bitcoin briefly fell below $58,000, and the overall panic in the crypto market soared. Most mainstream currencies have fallen below the daily bull trend line, and the market may have the possibility of further decline.

Yesterday, the Federal Reserve released the minutes of the meeting, saying that further confidence data is needed to support its interest rate cut, suggesting that inflation has not yet reached its target. In terms of Bitcoin ETF, the ETF had a cumulative outflow of 20.5 million US dollars yesterday. The previous market rumor that the Ethereum ETF was expected to officially start trading on July 4 has now been shattered, and the Ethereum ecological token has plummeted.

Solana LST protocol Sanctum announced the details of the airdrop yesterday. 10% of the token supply will be allocated for the initial airdrop, and half of the airdrop (5%) will be allocated according to the proportion of Wonderland XP. The other half (5%) will be allocated according to Earnestness. Sanctum currently has an overall TVL of 790 million US dollars on Solana, and is currently ranked fifth in TVL on the Solana chain.

2. 부를 창출하는 부문

1) Sector changes: DePin (MOBILE, HONEY)

주된 이유:

Recently, some DePin track projects have frequently announced good news. For example, Helium Mobile will launch a licensing program for its hotspot devices. Through this program, Helium Mobile earns licensing fees from hotspots manufactured elsewhere while developing its cellular network; Hivemapper currently covers 23% of the area in building global maps, etc.

Rising situation: MOBILE rose 70% in the past 7 days, and HONEY rose 48.8% in the past 7 days;

시장 전망에 영향을 미치는 요인:

The future performance of the DePin project will be mainly affected by many factors such as the progress of the project, changes in incentive policies, and the number of global nodes. The core of DePin is to allow more hardware scattered around the world to participate in the incentive network and share the benefits, so more device access will be the primary factor affecting the project. Investors should pay close attention to the projects dynamics and data in this regard to make investment decisions.

2) Sectors that need to be focused on in the future: ETH ecosystem (ENS, SSV)

주된 이유:

-

The Ethereum spot ETF listing and trading plan failed on July 4, causing some tokens in the Ethereum ecosystem to fall. However, there is still a chance that the Ethereum spot ETF will be listed and traded in mid-July, so some tokens in the Ethereum ecosystem may have a certain chance of oversold rebound.

-

Nate Geraci, president of The ETF Store, predicted the launch time of the Ethereum spot ETF. He said that Bloombergs forecast is still mid-July, the revised S-1 is expected to be submitted on July 8, and the final S-1 may be submitted on July 12, which theoretically means it will be launched in the week of July 15.

-

Even in the market news on June 29, the US SEC considered the Lido and Rocket Pool staking projects to be securities, which led to the decline of LDO and RPL, it failed to stop the rise of ETH ecological tokens such as ENS and SSV during the market rebound. ENS broke through the highest level in the past 29 months.

시장 전망에 영향을 미치는 요인:

There are two core factors that affect the price of Ethereum ecosystem project tokens: 1. Whether the Ethereum spot ETF can be listed and traded in the near future, and 2. The regulatory attitude of the US SEC towards some projects. If the Ethereum spot ETF can be approved and listed for trading in mid-July, it will be a big positive for all Ethereum ecosystem projects. Otherwise, it may cause trading expectations to fail and lead to market sell-offs.

3. 사용자 핫 검색

1) 인기 Dapp

Sentient

Sentient is an open source artificial intelligence development platform. Sentient will launch campaigns for contributors, each with specific indicators for evaluating contributions and rewards based on these indicators. The project recently completed a huge round of financing, raising $85 million, with top institutions such as Pantera Capital*, Framework Ventures, Hash VC, and Foresight Ventures participating. The project may become a focus project in the future AI track, and you can continue to understand the project dynamics.

2) 트위터

Astar Network (ASTR) has been listed on mainstream exchanges since the project was launched in 2022. In the past week, under the markets sharp decline, it has achieved an early bottoming rebound, which has attracted the interest of trading users. The token is now listed on Bitget, and you can continue to pay attention to the token trend. If the market stops falling and rebounds, Astar Network may have a good wealth effect.

3) 구글 검색 지역

글로벌 관점에서 보면:

Why is down today:

The crypto market continues to fall, and BTC has a certain support pressure when it drops to 58,000 USD. With the expectation of interest rate cuts in the second half of the year being priced in ahead of time, and with the decline in 10-year Treasury bond yields, the US dollar index is likely to weaken. The interest rate cut will be good for crypto assets, and you can consider planning for the second half of the year in advance.

TAO:

Yesterday, Bittensor was attacked due to the theft of private keys, and 32,000 TAO (worth about 8 million USD) were stolen. As a result, Bittensor (TAO) fell below 240 USDT, temporarily reported at 237 USDT, and fell by more than 10% in 24 hours. The projects token price fell sharply due to the theft, which attracted market attention.

각 지역의 인기 검색어 중:

(1) Asian countries: The terms “why crypto is down today” and “greed and fear index” appeared at the top of the hot searches in many Asian countries, and investors were most concerned about the reasons for the market crash.

(2) European and American countries: There are no obvious hot spots. The tokens and terms on the top search lists of different countries are different. For example, Italian traders are paying attention to TAO, NOT, SOL, etc., German users are paying attention to SOL, LDO, and British users are paying attention to ETH, TAO, etc.

잠재적인 공중 투하 기회

Linea Surge

Following Linea Park, Linea Voyage: The Surge event has officially started. It should be noted that you need to use the referral code to activate it on the Linea website before you can start to receive LXP-L points. Currently, Whales Market has launched Lineas points trading market, and there are potential airdrop opportunities in the future.

The market believes that it will be difficult for Linea to reach a TVL of $3 billion, but currently Lineas TVL has reached $700 million. With the issuance of tokens by top projects such as zkSync and LayerZero, a large amount of funds may flow into Linea, bringing Lineas TVL to $3 billion and ending the event ahead of schedule.

Specific participation methods: (1) First, activate the Linea account through the invitation link; (2) Recharge assets supported by The Surge event such as ETH and DAI to the Linea network; (3) Deposit assets in DEX and lending protocols such as SyncSwap, Mendi Finance, SushiSwap, etc. to obtain LXP-L points (Linea has released more than 20 supported protocols, which can be checked here: https://www.openblocklabs.com/app/linea/dashboard).

솔레이어

Solayer is the native restaking protocol of the Solana ecosystem, and its status is like Eigenlayer to the Ethereum ecosystem. Solayer can protect data security and high-speed transaction verification through decentralized cloud infrastructure.

The project has recently completed financing activities, and the participating institutions and individuals include Anatoly Yakovenko, Sandeep Nailwal, Joseph Delong, Joe Lallouz, Rooter, Richard Wu, Ansem, DCF GOD, etc. Among them, Anatoly Yakovenko is the founder of Solana, Sandeep Nailwal is the co-founder of Polygon, and Solayer is a project with many big names. The future valuation will be relatively high, and the wealth effect of airdrops will be good.

Specific participation methods: (1) Go to the official website and enter the invitation link; (2) Deposit SOL, mSOL, Jitosol, or bSOL on the official website.

원래 링크: https://www.bitget.com/zh-CN/research/articles/12560603812192

【면책조항】시장은 위험하므로 투자 시 주의하시기 바랍니다. 이 기사는 투자 조언을 구성하지 않으며, 사용자는 이 기사의 의견, 견해 또는 결론이 자신의 특정 상황에 적합한지 여부를 고려해야 합니다. 이 정보를 바탕으로 투자하는 데 따르는 위험은 전적으로 귀하의 책임입니다.

This article is sourced from the internet: Bitget Research Institute: Bitcoin fell below $58,000 in the short term, Solana LST protocol Sanctum issued a coin airdrop

관련: 출시 2개월 만에 TVL이 3억 6천만 달러를 돌파, BTC 2계층 Bitlayer 생태계를 점검

원저자: 0xewwierw 서론 Bitcoin Layer 2의 FOMO 감정이 사라지면서 인프라와 사용자 친화성에 성실함을 계속 투자하는 프로젝트가 궁극적인 승자가 될 수 있습니다. BitVM 중국 커뮤니티의 데이터에 따르면, 시장에는 50개 이상의 문서화된 Bitcoin Layer 2 프로젝트가 있으며, 그 중 일부는 2013년부터 건설 중이었고, 일부는 올해 출시되어 사이드체인 및 롤업과 같은 하위 범주를 포함합니다. 이 치열한 시장 경쟁에서 BitVm 기술을 기반으로 하는 네이티브 Bitcoin Layer 2 네트워크인 Bitlayer는 자체 기술 혁신과 지속적인 생태적 구축에 의존하여 Bitcoin 생태계에서 가장 빠르게 성장하는 Layer 2 프로젝트가 되고 있습니다. BitVM을 기반으로 하는 Bitcoin 2차 계층 솔루션인 Bitlayer는 계층화된 가상 머신 기술(Layered Virtual Machine)을 제안했습니다.