원저자: Lars, head of research at The Block

Original translation: Jordan, PANews

In the past June, most indicators of the cryptocurrency market continued to fall. This article will use 11 charts to interpret the status of the cryptocurrency market in the past month.

1. In June, the adjusted total transaction volume on the Bitcoin and Ethereum chains fell by 13.4% overall to $338 billion, with both Bitcoin and Ethereum鈥檚 adjusted transaction volumes falling by 13.4%.

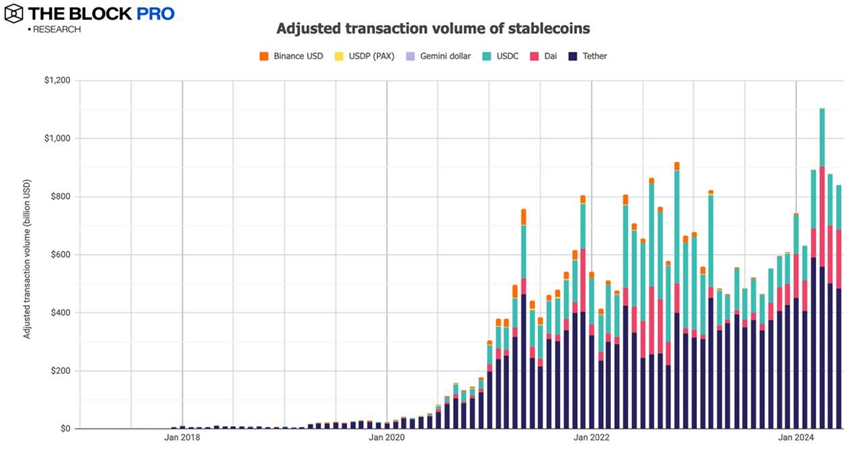

2. The adjusted on-chain transaction volume of stablecoins in June fell by 4.5% to US$839.6 billion; the supply of issued stablecoins increased, but the increase was only 0.4%, rising to US$142.6 billion, of which the market share of the US dollar stablecoin USDT increased to 79.1%, while the market share of USDC fell slightly to 17%.

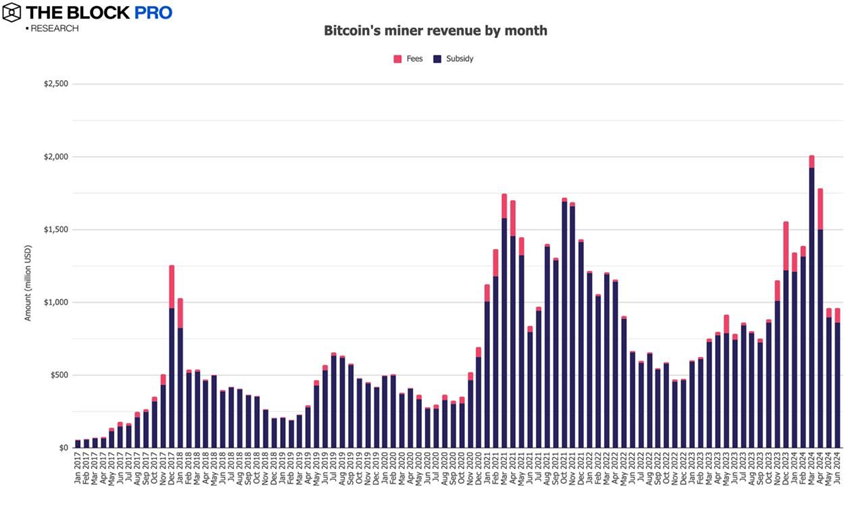

3. Bitcoin miner revenue fell to $961.9 million in June, a smaller drop of 0.1%. In addition, Ethereum staking revenue rose 8.1% to $289.2 million.

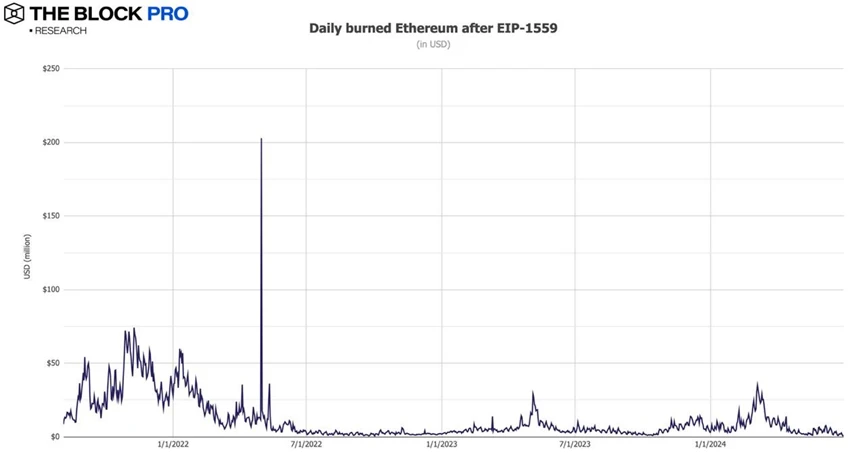

4. In June, the Ethereum network destroyed a total of 26,338 ETH, equivalent to $95.1 million. Data shows that since the implementation of EIP-1559 in early August 2021, Ethereum has destroyed a total of about 4.33 million ETH, worth about $12.2 billion.

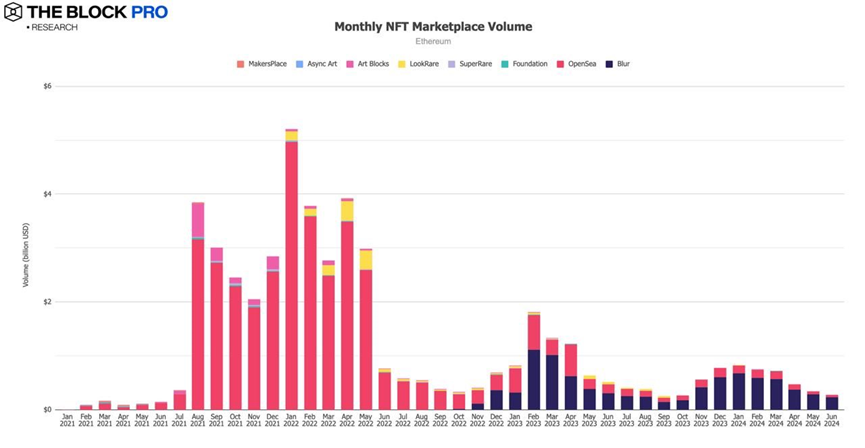

5. In June, the transaction volume of the NFT market on the Ethereum chain continued to decline significantly, falling by 18.4%, further falling to approximately US$280.5 million.

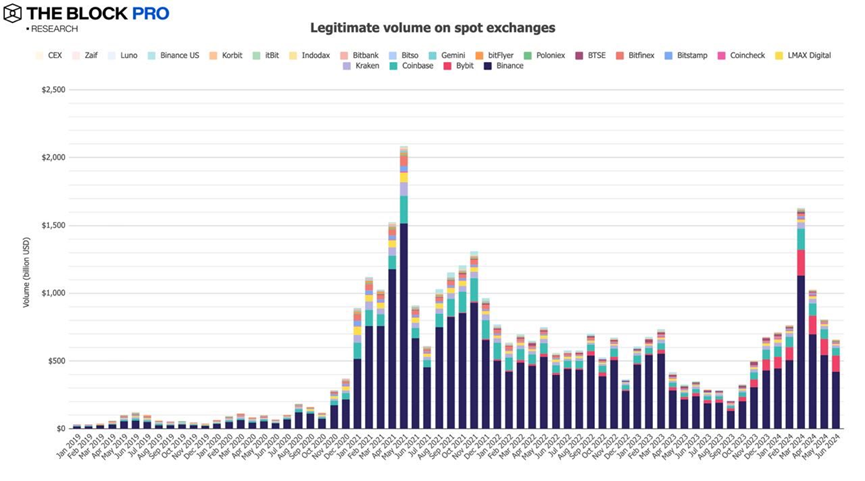

6. The spot trading volume of compliant centralized exchanges (CEX) fell in June, down 18.5% to US$658.8 billion.

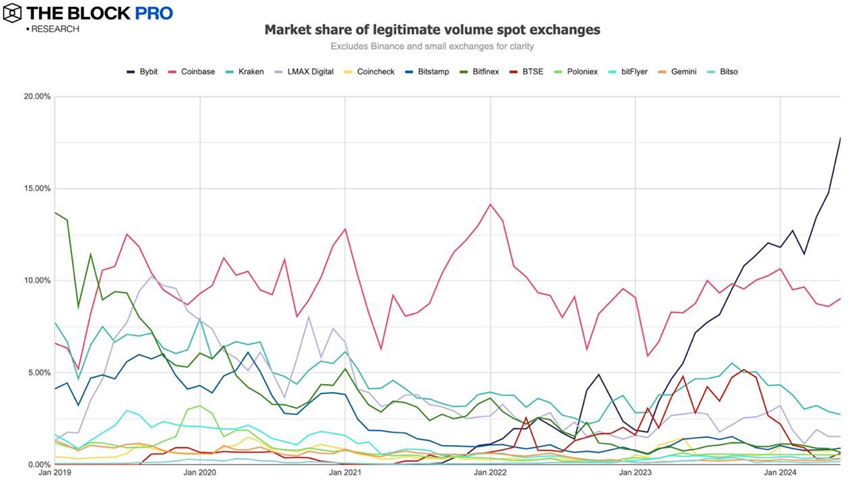

7. The spot market share rankings of major cryptocurrency exchanges in June are as follows: Binance is 64% (a significant decrease from May), Bybit is 17.8%, Coinbase is 9%, and Kraken is 2.7%.

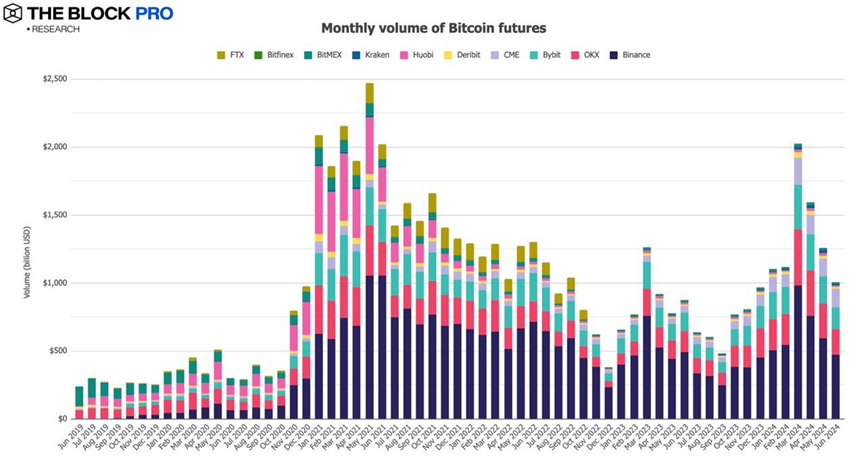

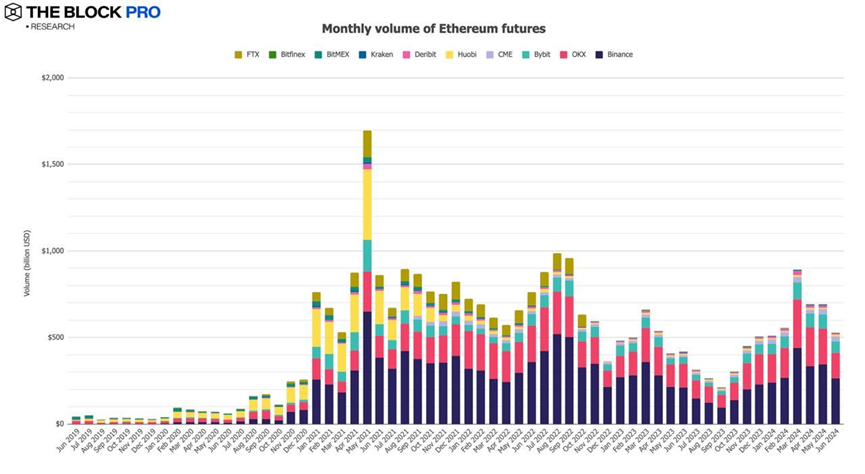

8. In terms of crypto futures, the open interest of Bitcoin futures fell by 6.9% in June; the open interest of Ethereum futures fell by 3.1%; in terms of futures trading volume, Bitcoin futures trading volume fell by 19.9% in June to US$1 trillion, and Ethereum futures trading volume fell by 23.8%.

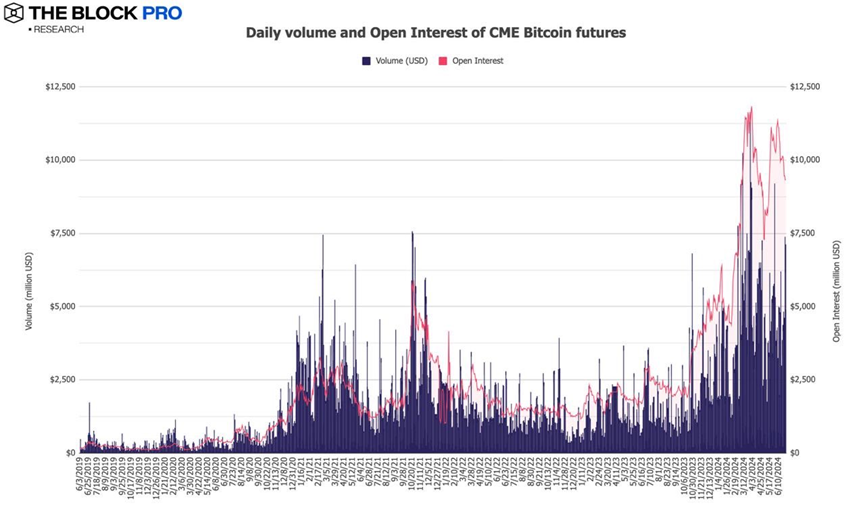

9. In June, CME Bitcoin futures open interest decreased by 9.6% to $9.3 billion, but the daily avg volume increased by 3.4% to about $4.5 billion.

10. In June, the average monthly trading volume of Ethereum futures dropped sharply to US$528.1 billion, a decrease of 23.8%.

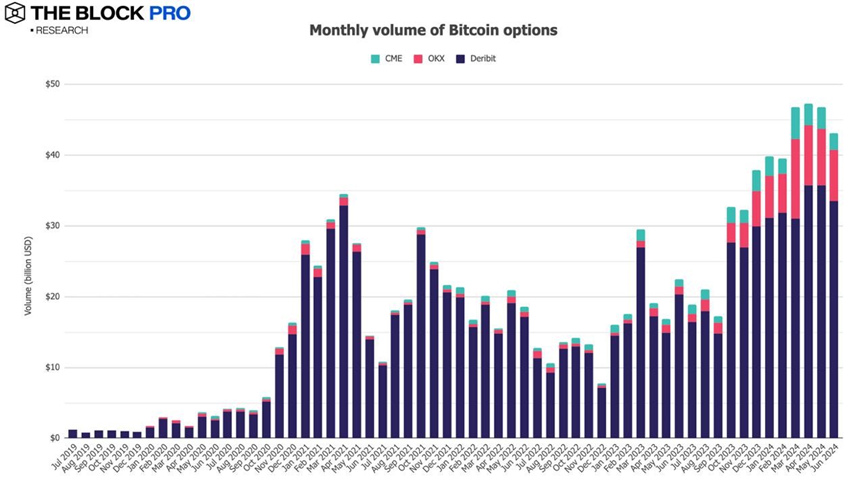

11. In terms of cryptocurrency options, the open interest of Bitcoin options fell by 39.45% in June, and the open interest of Ethereum also fell sharply, by 55.6%. In addition, in terms of Bitcoin and Ethereum options trading volume, Bitcoin options trading volume fell to US$43.1 billion, a decrease of 7.9%; Ethereum options trading volume fell by 46.2%, to US$16.9 billion.

This article is sourced from the internet: 11 charts review the performance of the crypto market in June: most indicators continue to fall

In the past 24 hours, many new popular currencies and topics have appeared in the market, which may be the next opportunity to make money, including: Sectors with strong wealth-creating effects are: New public chain sector and AI sector; The most popular tokens and topics searched by users are: IO.NET, Hifi Finance, Daddy, Aethir; Potential airdrop opportunities include: Symbiotic, Mezo; Data statistics time: June 13, 2024 4: 00 (UTC + 0) 1. Market environment Yesterday, the US released the latest CPI data of 3.3%, lower than the expected 3.4%, and the market rebounded. Then at 2 am Beijing time, the Fed FOMC meeting released the latest dot plot, which showed that most Fed officials lowered their expectations for interest rate cuts to one, or 25 basis points, this year. Then…