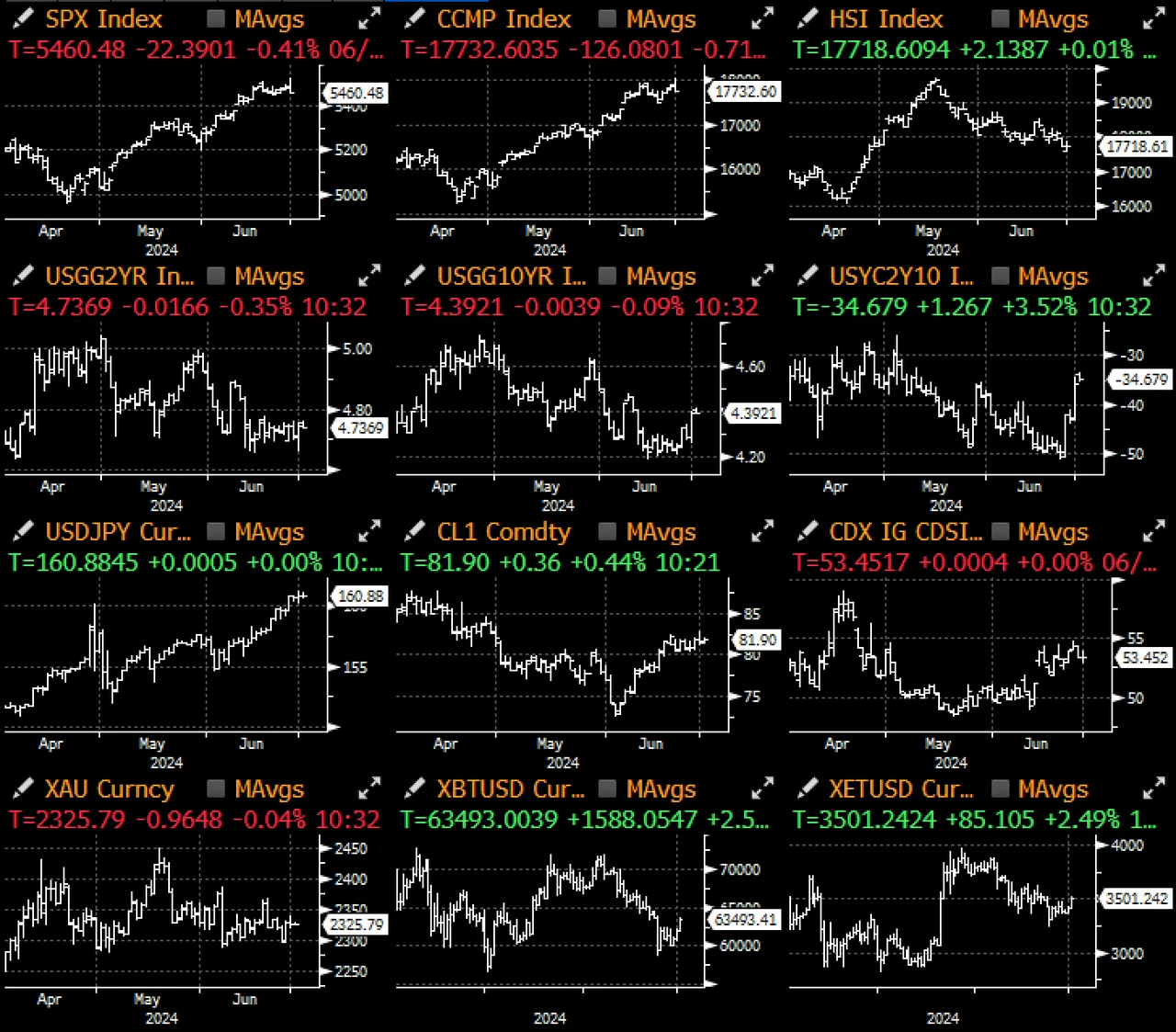

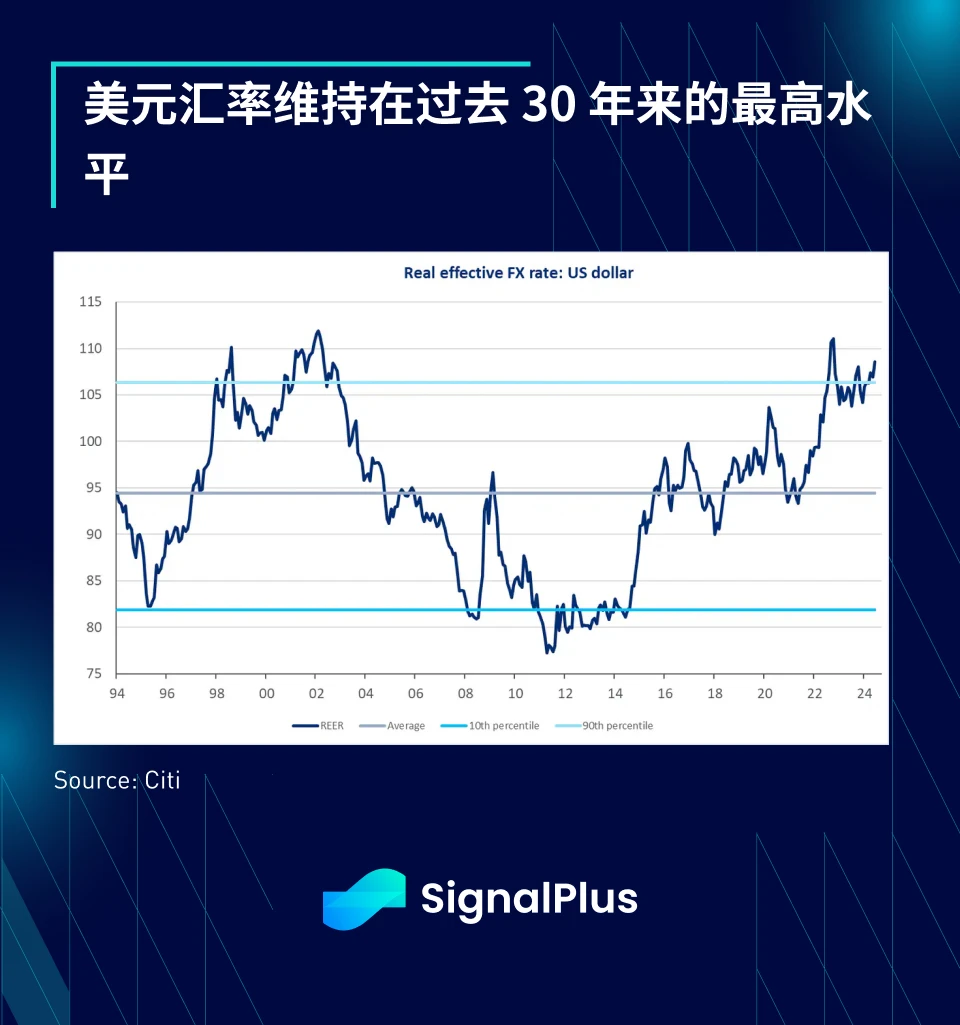

An unusually quiet first half of the year has come to an end, and a quick review of the first half of the year shows that the SPX, Nasdaq, Nikkei and gold prices have outperformed, while on the other hand, the Japanese yen, Japanese government bonds, the euro and most recently French government bonds (OATs) have lagged due to the continued zero interest rate policy of the Bank of Japan and Macrons political adventure of early elections.

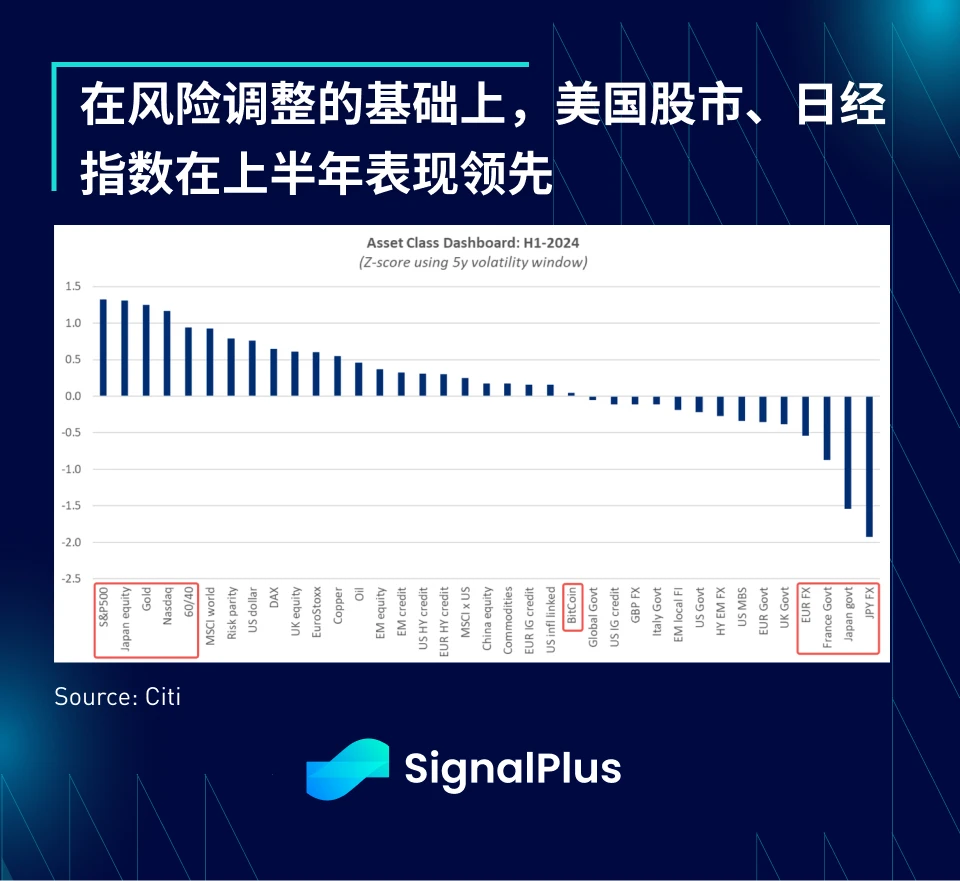

Not to be outdone, the US dollar has also remained near its highest level in the past 30 years as AI continues to drive capital inflows, strong economic conditions and high benchmark interest rates. This year, the outstanding performance of the US capital market continues to exceed the expectations of most skeptics.

As capital continues to flow out of China, India has maintained its lead among emerging markets, with Indian markets up 30% (in US dollar terms) over the past 1.5 years, while Chinese stocks have fallen about 15%, a performance gap of 45%.

In the second half of the year, the US election will be the focus, and the market performance may still exceed expectations, although it may be different from the style of the first half of the year. We have long believed that the main axis of this election is about unsustainable US fiscal policy, which is reflected in the bond market, bringing higher yields and a steeper yield curve. However, in general, US customers believe that tariff policy is more important and that a stronger US dollar is a better choice. Although we basically agree with this view, we are not sure how much upside there is. After all, the US dollar index is only a few percentage points lower than its peak in the past 30 years.

Some clear themes that will emerge in the second half of the year:

-

U.S. economic momentum slows, although overall growth remains healthy

-

US recessions are rarer than unicorns

-

Inflation pressures are easing toward the Fed’s target, but not fast enough to justify a quick rate cut in the near term

-

Although there has been some rotation/correction in the US market, AI continues to drive overall sentiment

-

With the Fed passive and the economy on autopilot, the focus will turn to politics, with the US election, fiscal spending, new tariff policies and Treasury supply dominating the investment narrative

Judging from economic data, the US economy has slowed down from its highs in the past two years, the economic surprise index has fallen to a multi-year low, and high-frequency consumer data showed a sharp drop in savings during the epidemic and a worrying increase in consumer debt.

However, even at a lower level overall, economic activity is still relatively active compared to previous cycles, with non-farm payrolls expected to be around 190,000 this week, unemployment expected to be 4%, and average hourly earnings still having a chance to show a positive growth of 0.4%. At the current rate, the average job growth in 3 months is still 249,000, while the average before the epidemic in 2010-2019 was only 181,000.

On the inflation front, price pressures appear to be finally easing after several disappointments. PCE rose 0.08% in May, below market expectations, and “super core” PCE rose just 0.1%, helping to clarify the Fed’s plans for a possible rate cut in September.

On the political front, President Biden’s performance in the first presidential debate was below expectations, raising concerns about his age and health, while former President Trump’s performance was relatively stable (by his standards), and his post-debate reaction was swift and significant, with the difference in odds between Trump and Biden widening from +10 points before the debate to +22 points. Outside of the head-to-head matchup, Biden’s odds (35%) are now 7 points lower than the Democratic odds (42%), while Trump and the Republican odds are now well over 50%.

A landslide victory for Trump could have far-reaching implications for U.S.-China tariff policy, fiscal spending and extensions of tax breaks, monetary policy and the independence of the Federal Reserve, and potentially even the framework for cryptocurrencies.

Meanwhile, the first round of voting in the French election was won as expected by Le Pens National Rally, with the far-right party winning 34% of the vote, putting it on track for a majority.

This holiday-shortened week, with only 3.5 trading days, will see a slew of data releases on Wednesday, including ADP, jobless claims, the ISM services index and the FOMC, and Friday is expected to be very busy with the release of nonfarm payrolls immediately following Thursday’s holiday.

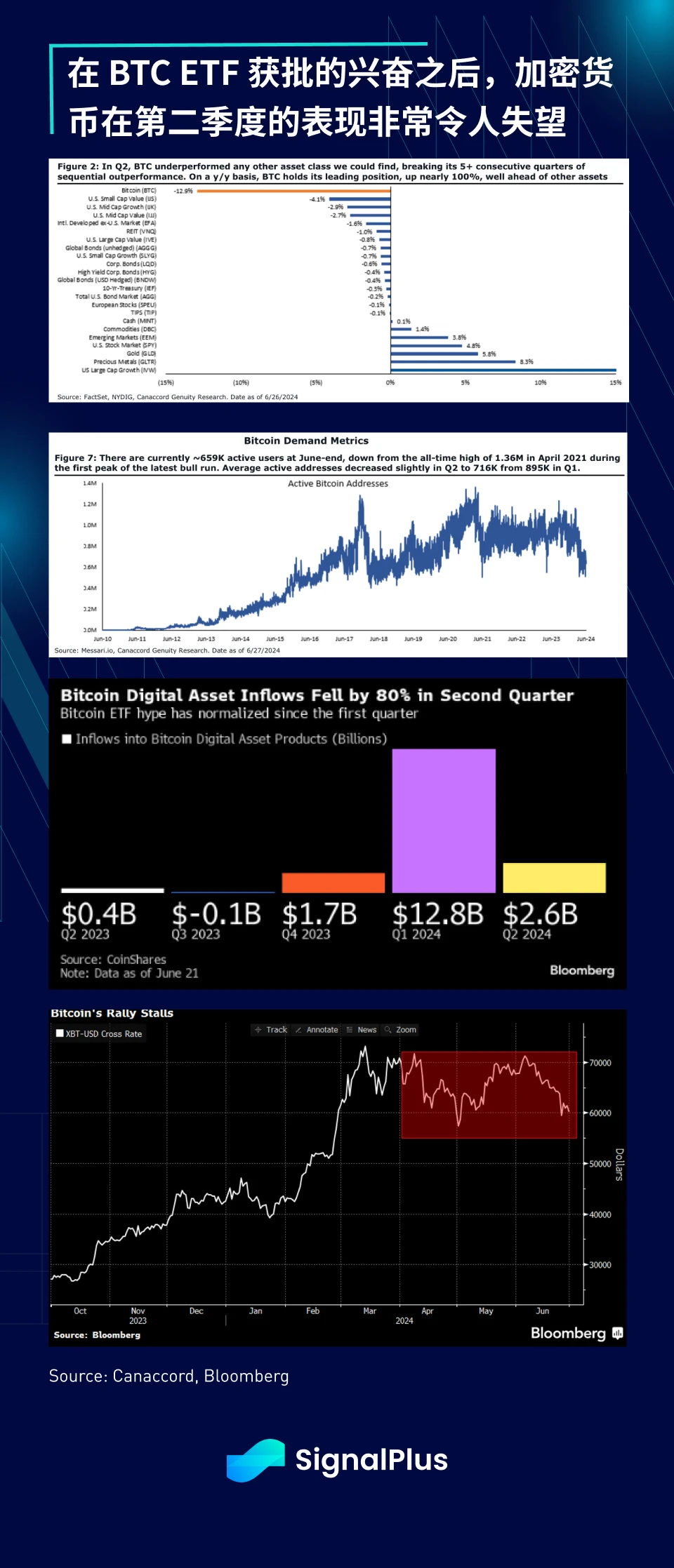

In terms of cryptocurrencies, a very disappointing quarter ended last Friday, with BTC falling 13% in the second quarter. Slowing capital inflows, a lack of substantial mainstream technological innovation, falling demand indicators, and supply-side concerns have all exacerbated the woes of cryptocurrencies, with BTC failing to break out of the 60-70k range.

Ethereum has also been disappointing, with expectations of ETF approval failing to generate excitement about the mainnet, and concerns about L2 offloads and reduced fees/increased supply (L1 fees fell to an all-time low last week), as the community continues to question the Ethereum Foundation over long-term structural issues.

Will the ETFs expected approval in the third quarter and the lawsuit victory against the SEC (regarding staking) change ETHs fortunes? Will Trumps victory solve the problem of mainstream application in the industry? Only time will tell…

ChatGPT 4.0 플러그인 스토어에서 SignalPlus를 검색하시면 실시간 암호화 정보를 얻으실 수 있습니다. 업데이트를 즉시 받으려면 트위터 계정 @SignalPlus_Web3을 팔로우하거나 WeChat 그룹(WeChat 보조자 추가: SignalPlus 123), Telegram 그룹 및 Discord 커뮤니티에 가입하여 더 많은 친구들과 소통하고 소통하세요. 시그널플러스 공식 홈페이지: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: Half Way Through

관련: Outlier Ventures: 분산형 소셜 네트워크의 부상

원문: Lorenzo Sicilia, Outlier Ventures 엔지니어링 책임자 원문: xiaozou, Golden Finance Outlier Ventures는 일부 분산형 소셜 네트워크에서 건강한 성장을 발견했으며, Farcaster와 Lens Protocol이 실제 사용자의 관심을 끌기 시작했습니다. 대중 시장 제품의 경우, 암호화폐는 점점 더 실용적이고 효율적이 되고 있습니다. 지금까지 개인 키 관리와 모바일 우선 경험이 부족하여 사람들의 암호화폐 채택이 방해를 받았습니다. 이 기사에서는 주요 암호화폐 분산형 소셜 미디어 경쟁자, 해당 기능, 아키텍처, Web3 설립자가 새로운 허가 없는 소셜 그래프 프로토콜을 구축하는 데 열의를 보이는 기회에 대해 자세히 살펴보겠습니다. 1. 소셜 네트워크 Instagram, Facebook, Twitter 및 기타 플랫폼을 10년 이상 사용한 사람이라면 누구나 소셜 네트워크가 어떻게 작동하는지 알고 있습니다. 소셜 네트워크는…