지난 24시간 동안 수많은 새로운 핫커런시와 토픽이 시장에 등장했고, 이것이 다음번 수익 창출의 기회가 될 가능성이 매우 높습니다.

-

The sectors with relatively strong wealth-creating effects are: New coin sector (ZRO, ZK, LISTA), ETH ecosystem (ENS, SSV);

-

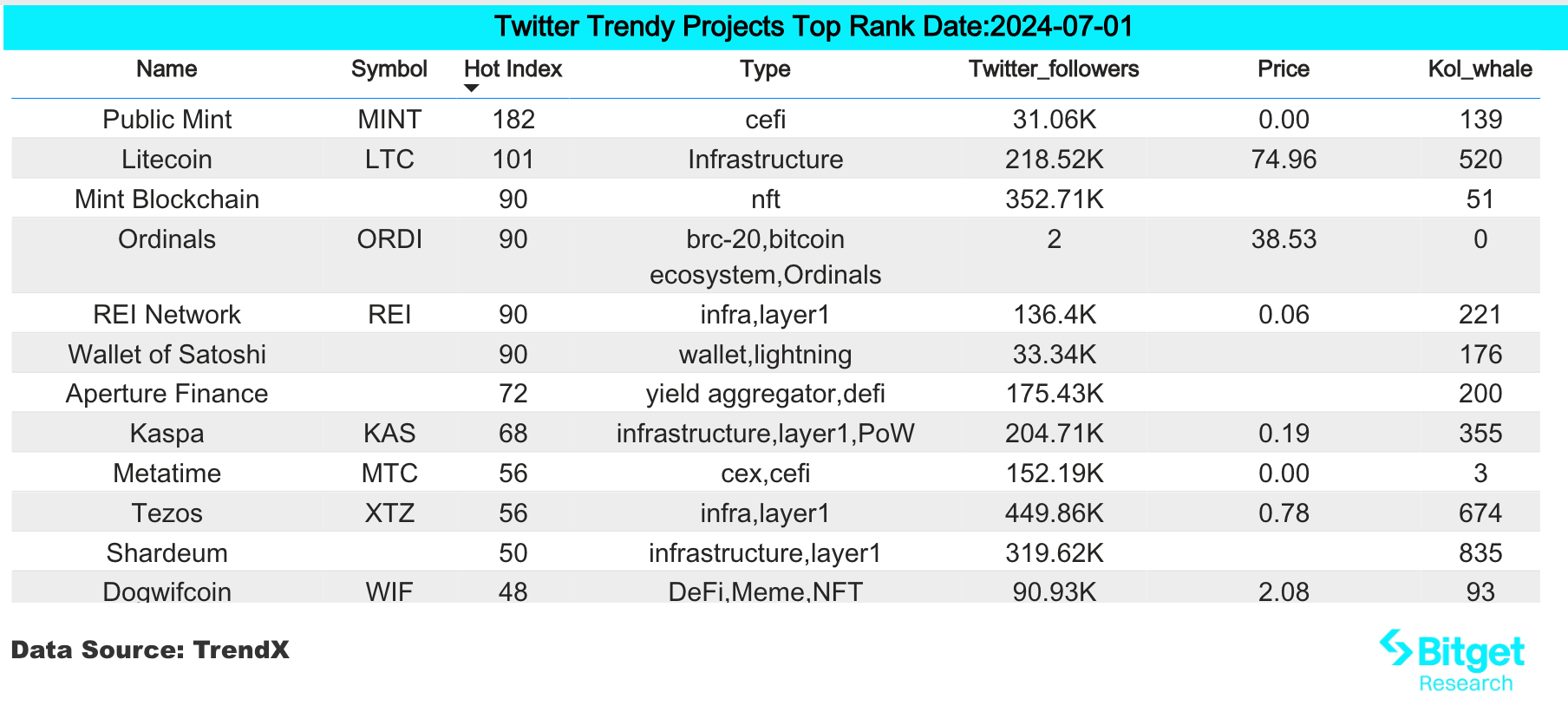

Hot search tokens and topics among users are: Jumper Exchange, Kaspa, Daddy;

-

Potential airdrop opportunities include: Karak, Li.Fi;

Data statistics time: July 1, 2024 4: 00 (UTC + 0)

1. 시장환경

BTC spot ETF stopped its net outflow last week and had a small net inflow for the past four consecutive working days. BTC rebounded after a week of volatile decline, reaching $63,000 and recovering the losses of the past week.

There will be multiple macro data releases this week, with the market focusing on Fridays US unemployment rate and non-farm data. Over the weekend, sources said the SEC had returned the S-1 form to the ETH spot ETF issuer and required it to be revised and resubmitted before July 8.

During the market rebound, new coins such as ZRO, ZK, LISTA and ETH ecosystem tokens such as ENS rose significantly, with ENS breaking through the highest level in the past 29 months.

2. 부를 창출하는 부문

1) Sector changes: New coins (ZRO, ZK, LISTA)

주된 이유:

New coins rebounded from oversold levels. The prices of high-market-cap new coins such as ZRO and ZK were far lower than pre-market expectations amid negative market sentiment. As market sentiment was gradually digested, investment and pricing gradually returned to rationality, and ZRO and ZK quickly rebounded.

시장 전망에 영향을 미치는 요인:

Whether new coin projects such as LayerZero and ZKsync can take further actions to release positive factors to continuously stabilize the coin price, and the extent to which the markets negative sentiment is digested will directly affect the price of the new coin.

2) Sector changes: ETH ecosystem (ENS, SSV)

주된 이유:

-

Sources said the SEC has returned the S-1 form to the ETH spot ETF issuer and required it to be revised and resubmitted before July 8. Even if ETH spot ETH is not directly approved in early July, it is likely to continue to release good news.

-

Even in the market news on June 29, the US SEC considered the Lido and Rocket Pool staking projects to be securities, which led to the decline of LDO and RPL, it failed to stop the rise of ETH ecological tokens such as ENS and SSV during the market rebound. ENS broke through the highest level in the past 29 months.

시장 전망에 영향을 미치는 요인:

The news about ETH spot ETF will directly affect the price of ETH and the trend of well-known projects in the ETH ecosystem. In addition, after the SEC announced that it “believes that Lido and Rocket Pool staking projects are securities”, whether it will further include SSV and other projects in the scope of securities considerations will also have a significant impact on the projects in this track.

3. 사용자 핫 검색

1) 인기 Dapp

Jumper Exchange Li.Fi:

Jumper Exchange is a multi-chain liquidity aggregator that supports cross-chain exchange and gas fee exchange functions of most mainstream blockchains, and is technically supported by LI.FI. Recently, the interaction between Jumper and Li.Fi protocols has increased significantly. The market speculates that the project may have TGE and airdrop plans, which has led users to interact more frequently.

2) 트위터

-

카스파

Recently, Marathon Digital Holdings announced its Kaspa (KAS) mining business. As of June 25, 2024, the company has mined 93 million KAS, worth approximately $15 million. Kaspa is the fifth largest proof-of-work (PoW) digital asset, with decentralized and scalable characteristics. Marathon has successfully diversified its revenue sources by deploying approximately 60 petahash of Kaspa ASICs in Texas, leveraging existing infrastructure and expertise, and plans to be fully operational in the third quarter of 2024.

3) 구글 검색 지역

글로벌 관점에서 보면:

DADDY:

Solana chain token DADDY is a meme coin issued by well-known KOL Andrew Tate. Its main intention is to fight against the MOTHER token on the Solana chain and end the situation of only having a mother but no father on the Solana chain. Andrew Tate has 9.54 million followers on Twitter, and the token rose rapidly after its issuance. However, the celebrity coins on the Solana chain have performed poorly, and investors are advised to invest with caution.

각 지역의 인기 검색어 중:

(1) There is a lack of hot spots in Asia, and no general pattern of hot searches has been found in each region.

(2) The attention of Europe and the United States has returned to the mainstream meme. Maga appeared on the hot search in France; PEPE also appeared on the hot search in many European and American countries.

(3) ONDO has become a hot search topic in South American and European countries. Ondo Finance is a financial protocol focusing on the RWA track. At present, its main business is to tokenize high-quality assets such as US Treasury bonds and money market funds within a compliance framework to facilitate investment and transactions by users on the blockchain. The recent price performance has been relatively strong.

잠재적인 공중 투하 기회

-

Karak

Karak is Ethereum Layer 2, a re-staking layer with multi-chain advantages. Andalusia Labs behind it is a digital asset risk infrastructure provider, raising $51.2 million, and investors include Panetra, Lightspeed Capital, Framework Ventures, etc. Staking in Karak can get staking rewards + re-staking rewards + Eigenlayer points + staked LRT points + Karak XP at the same time.

Specific ways to participate: 1) Add the Karak network (you can add Karak Mainnet on chainlist); 2) Cross-chain the currency to the Karak chain (currently supports rswETH, USDC, wETH), and stake it in Karak Pools.

-

LI.FI

LI.FI is a multi-chain liquidity aggregation protocol that supports the exchange between any two assets by aggregating bridges and DEX aggregators from more than 20 networks including Ethereum, Arbitrum, Optimism, Solana, Polygon, Base, etc.

Cross-chain infrastructure protocol LI.FI completed a US$17.5 million Series A financing round, led by CoinFund and Superscrypt, with participation from Bloccelerate, L1 Digital, Circle, Factor, Perridon, Theta Capital, Three Point Capital, Abra and nearly 20 angel investors.

원래 링크: https://www.bitget.com/zh-CN/research/articles/12560603811974

【면책조항】시장은 위험하므로 투자 시 주의하시기 바랍니다. 이 기사는 투자 조언을 구성하지 않으며, 사용자는 이 기사의 의견, 견해 또는 결론이 자신의 특정 상황에 적합한지 여부를 고려해야 합니다. 이 정보를 바탕으로 투자하는 데 따르는 위험은 전적으로 귀하의 책임입니다.

This article is sourced from the internet: Bitget Research Institute: BTC spot ETF stops net outflow, new coin sectors such as ZRO rebound first

Original | Odaily Planet Daily Author | Nanzhi Early this morning, Racer, co-founder of the friend.tech protocol, posted on the X platform: “A system design bounty: If you can find a way to migrate friend.tech from Base without causing major problems for users, and it works well enough, we decide to use it and will pay you $200,000.” At 0:00 am, the price of FRIEND was about 1.25 USDT. After the news was released, it dropped to 0.948 USDT. Todays lowest point was 0.9 USDT, with a maximum drop of 28%. It has now rebounded to around 1 USDT. In addition, friend.techs current TVL is 11.14 million US dollars , a single-day drop of 8.96%, and a drop of 67.3% in the past month. what happened? Why did Racer want…