지난 24시간 동안 시장에는 많은 새로운 인기 통화와 주제가 등장했으며, 이는 돈을 벌 수 있는 다음 기회가 될 수 있습니다. , 포함:

-

The sectors with relatively strong wealth-creating effects are: ETH ecological blue-chip projects, Curve-related tokens;

-

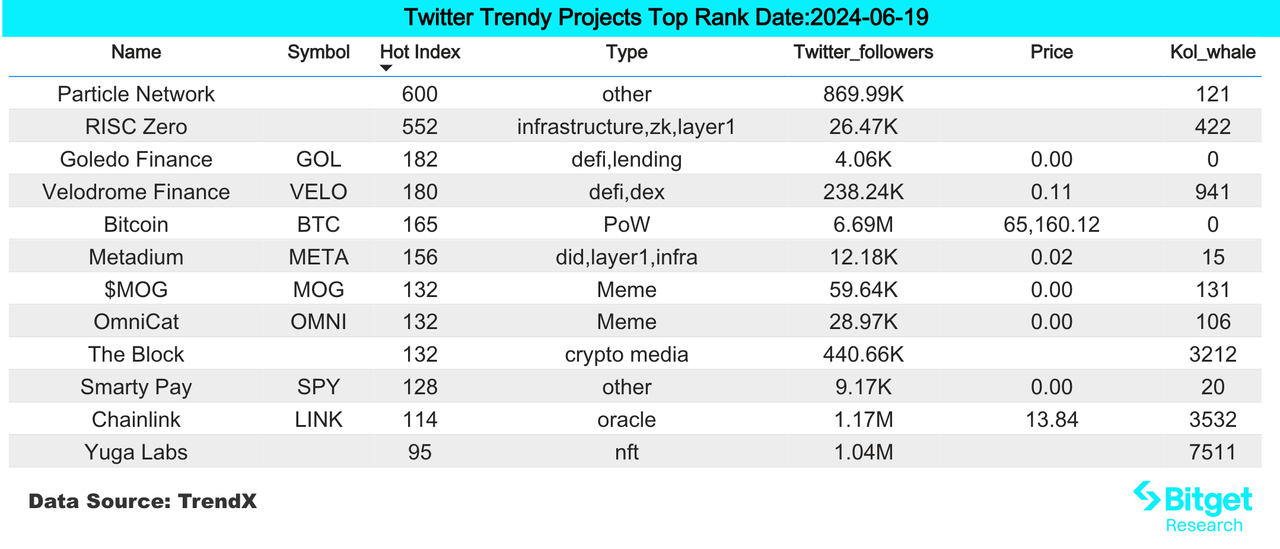

Hot searched tokens and topics: Renzo, Particle Network, DJT

-

Potential airdrop opportunities include: Skate, Sanctum

Data statistics time: June 19, 2024 4: 00 (UTC + 0)

1. 시장환경

On Tuesday, the crypto market fell across the board. Bitcoin fell below the $65,000 support level in the short term. Several mainstream altcoins fell by double-digit percentages. As of now, the trading price of Bitcoin has rebounded to $65,056, a 24-hour drop of 2.36%. According to Coinglass data, about $372 million of crypto leveraged long positions were liquidated in the past 24 hours, and the short positions were liquidated at $61.8 million. The market showed a clear spot premium, indicating that market participants speculative activities have decreased. Earlier, the BTC order book showed that the buying volume was concentrated around $65,000. It has now fallen to around $64,000. Bitcoin is still below the 50-day moving average, which puts pressure on the medium-term trend. Investors still need to remain patient.

In the U.S. stock market, Nvidia surpassed Microsoft to become the worlds most valuable listed company. At the close, the SP and Dow Jones indexes rose by 0.25% and 0.15% respectively, and the Nasdaq index was basically flat. We need to continue to pay attention to the correlation between Nasdaq and BTC. If the correlation begins to turn positive, but Nasdaq begins to fall, it will have a greater impact on the crypto market.

2. 부를 창출하는 부문

1) Sector changes: ETH ecosystem blue chip projects

주된 이유:

Bitwise has submitted an S-1 revision to the U.S. Securities and Exchange Commission (SEC) for an Ethereum spot ETF, which will include changes after the SECs first round of consultation. It is unclear whether more rounds of consultation are needed, and product fees have not yet been disclosed. According to this document, overall, the SECs end of its investigation into ETH 2.0 has led to a substantial rebound in the blue-chip tokens in the ETH ecosystem that had an eye-catching performance in the last bull market cycle. In the future, this sector will be stronger than other sectors, but it also depends on the overall market situation. The market is relatively weak now, and trading still needs to be cautious.

상승하는 상황:

ENS, LDO, and RPL have risen by 16%, 20%, and 17% respectively in the past 24 hours;

시장 전망에 영향을 미치는 요인:

At present, the ETH spot ETF is likely to be approved and start trading in a few weeks to months. Before and after the ETH spot ETF is approved, the ETH/BTC exchange rate may continue to rise, and ETH is expected to break new highs in the next few months. The breakthrough of ETH will drive the market value of the entire altcoin to rise sharply. Traders on ETH will begin to have greater demand for leverage and trading. Blue chip projects, especially blue chip DeFi projects with actual returns, will continue to rise, ushering in the altcoin season.

2) Sector changes: Curve-related tokens (CRV, CVX)

주된 이유:

Influenced by yesterdays news, Bitwise submitted an S-1 revision for Ethereum spot ETF, and the SEC will end its investigation into Ethereum 2.0, which means that ETH is not a security. ETH ecosystem assets CRV and CVX also rose sharply.

상승하는 상황:

CRV and CVX have risen 17% and 36% respectively in the past 24 hours;

시장 전망에 영향을 미치는 요인:

Curve is still one of the best places for stablecoin bulk transactions, and it still maintains a good real profit. Its biggest problem is that its narrative is too old, and there are no new products or operations that excite the market. At the same time, previous accidents and this liquidation decline inevitably make the market full of concerns. However, the price of CRV bought by many whales in OTC before was higher than 0.3 US dollars, so the current price of CRV is still attractive.

3) Sectors that need to be focused on in the future: AI sector

주된 이유:

-

바이낸스는 최근 FET, AGIX, OCEAN을 ASI에 합병하는 것을 지원하겠다고 발표했는데, 이는 유럽과 미국에서 격렬한 논의를 불러일으켰으며 커뮤니티의 높은 관심을 끌었습니다.

-

Arweave AO announced that it has launched AO token minting. Users holding AR can obtain AO. AO issuance is relatively fair and is used for data layer business.

특정 통화 목록:

-

TAO: Bittensor는 블록체인 기반 머신 러닝 네트워크를 구동하는 오픈 소스 프로토콜입니다. 머신 러닝 모델은 협력적으로 훈련되고 집단에 제공하는 정보의 가치에 따라 TAO에서 보상을 받습니다.

-

NEAR: 최근 NEAR 생태계의 많은 AI 프로젝트가 구축/자금 조달 단계에 있습니다. NEAR은 미래의 AI 허브가 될 것으로 기대됩니다.

-

ASI: 합병 후 FET, AGIX, OCEAN 토큰은 변동성이 높아질 수 있으며 투기 기회가 생길 수 있습니다.

-

AR: Arweave’s new token AO is about to be issued, backed by technical fundamentals and has a good track record.

3. 사용자 핫 검색

1) 인기 Dapp

Renzo: Liquidity re-pledge protocol Renzo announced the completion of $17 million in financing, which was divided into two rounds, the first round was led by Galaxy Ventures, and the second round was led by Abu Dhabi-based Nova Fund – BH Digital. Due to the good news, the REZ token rose by 3.74% in a short period of time. Although the token price fell sharply, Renzo still has $3.8 billion in TVL, and user loss is not serious.

2) 트위터

Particle Network: Positioned as a modular L1 that empowers chain abstraction. In the test network Phase 1, Particle Networks Universal Account is based on Particle L1s unique high-performance EVM execution environment, linking various mainstream L1/L2s such as Ethereum, BNB Chain, Polygon, and BTC L2s. Currently, the number of accounts on its chain has exceeded 1 million, and there may be airdrops in the future. It is popular and users are recommended to participate.

3) 구글 검색 지역

글로벌 관점에서 보면:

DJT: Pirate Wires, an American media outlet, published a tweet on the X platform, saying, Rumor has it that Trump is launching an official token on Solana — $DJT. This move has led to a surge in attention to the DJT token, and the on-chain data analysis platform Arkham officially stated that Arkham Intelligence will offer a $150,000 bounty to any user who can clearly prove the identity of the issuer of the Trump-themed Solana on-chain token DJT. But then the price began to fall back, and has fallen by more than 57% in the past 24 hours. The token price fluctuates greatly and is highly uncertain, so users are not recommended to continue paying attention.

각 지역의 인기 검색어 중:

(1) There is a lack of attention on a unified theme in Asia. Each country has its own focus, and there is little attention paid to projects and hot issues.

(2) There is a significant difference between the hot searches in Europe and the United States and those in Asia: English-speaking countries have shown a concentrated focus on meme tokens. For example, meme tokens such as boden, pepe, trump, and floki have a high level of attention in the United States. The United Kingdom pays more attention to public chain projects, and monad, icp, and hedra have always remained on the hot search list.

잠재적인 공중 투하 기회

Skate

Skate aims to break the siloing of DApp applications with the full-chain application layer Skate. That is, Dapps can run on multiple chains with a single state, and new blockchains can also be connected to Skate. Users and developers only need to interact with Skate alone to access various networks instantly and have unified liquidity. The project party will airdrop 8% of the tokens.

Skates predecessor was the on-chain asset management protocol Range Protocol, which completed a $3.75 million seed round of financing in September last year, led by HashKey Capital and Nomad Capital.

Specific operation method: Currently, you can get 600 Ollies points and early bird NFT by completing simple tasks. Link your wallet and complete simple social media tasks such as forwarding tweets. You can mint an early bird NFT without gas fee. You can get more points by inviting.

신성한 장소

Solana Ecosystem LST Protocol Sanctum officially announced the launch of the loyalty program Sanctum Wonderland. According to reports, Sanctum Wonderland aims to make full use of SOL to gain benefits through a gamified experience. Users can collect pets and earn experience points to upgrade by staking SOL, and earn EXP through pets.

Previously, the Solana ecosystem liquidity staking service protocol Sanctum completed its seed round extension round of financing, led by Dragonfly, with participation from Solana Ventures, CMS Holdings, DeFiance Capital, Genblock Capital, Jump Capital, Marin Digital Ventures and others. The total financing has now reached US$6.1 million.

Specific participation method: open the link, connect the wallet, fill in the invitation code, ② exchange Sol for Infinity, deposit at least 0.122 SOL + 0.05. The deposit wallet needs to prepare at least 0.172 SOL, and deposit at least 0.11 SOL. The pet will automatically grow and earn EXP. Once the LST balance is lower than 0.1 SOL, the pet will enter hibernation and stop earning EXP. Those who are capable are recommended to deposit more than 1 SOL. 1 SOL will earn 10 EXP per minute, which can be withdrawn at any time, and the GAS fee is extremely low.

원래 링크: https://www.bitget.com/zh-CN/research/articles/12560603811433

【면책조항】시장은 위험하므로 투자 시 주의하시기 바랍니다. 이 기사는 투자 조언을 구성하지 않으며, 사용자는 이 기사의 의견, 견해 또는 결론이 자신의 특정 상황에 적합한지 여부를 고려해야 합니다. 이 정보를 바탕으로 투자하는 데 따르는 위험은 전적으로 귀하의 책임입니다.

This article is sourced from the internet: Bitget Research Institute: SEC ends investigation into ETH 2.0, ETH ecosystem currencies rebound across the board

Original author: Nina Bambysheva, Forbes reporter Original translation: Luffy, Foresight News When FTX filed for bankruptcy, savvy crypto traders smelled a lucrative opportunity. Sam Bankman-Fried’s (SBF) crypto empire was wiped out of billions of dollars in customer funds, but still held $3.4 billion worth of various cryptocurrencies, an estate that had to be sold to satisfy creditors, likely at well below market prices. Most of the companies responsible for managing bankrupt assets had little experience with cryptocurrencies, and early attempts to integrate funds sometimes resulted in embarrassing losses of tens of thousands of dollars. In September 2023, bankrupt FTX tapped the asset management arm of billionaire Michael Novogratzs Galaxy Digital Holdings to help manage its massive cryptocurrency reserves, including selling, hedging, and staking cryptocurrencies. This process allows token holders to…