원작자: Asher Zhang, Bitpush

6월 11일, ZKsync는 프로토콜 토큰 배포에 대한 정보를 공개했습니다. 레이어 2의 전 상위 프로젝트인 ZKsync가 마침내 도착했습니다. 이는 또한 4개의 전 상위 레이어 2 프로젝트가 같은 단계에서 경쟁을 시작했다는 것을 의미합니다. 이 글에서는 4개의 주요 레이어 2 프로젝트인 Arbitrum, Optimism, Starknet, zkSync의 최신 개발 방향과 기술적 이점을 간략하게 정리합니다.

Arbitrum의 월간 활성 사용자 수가 Ethereum을 추월, L3 게임 전략이 빛을 발하다

Dencun 업그레이드 이후, 이더리움의 2차 블록체인의 거래 비용이 최대 99%까지 감소했으며, Arbitrum은 Dencun 업그레이드의 가장 큰 수혜자가 될 수 있습니다. 업그레이드 전 주에 Arbitrum의 거래 수는 747,000건에 불과했지만, 업그레이드 후 주에 이 숫자는 150만 건으로 뛰어올랐습니다. 6월 3일, 토큰 터미널 데이터에 따르면, Arbitrum의 월간 활성 사용자 수가 처음으로 이더리움을 넘어섰으며, Arbitrum의 월간 활성 사용자는 800만 명을 넘었고, 이더리움의 월간 활성 사용자는 약 700만 명이었습니다. 동시에, 중량급 회사인 Franklin Templeton과 BlackRock의 자산 토큰화를 돕는 회사인 Securitize를 포함하여 여러 회사가 생태계 구축에 참여하게 되었습니다.

Arbitrum은 L3의 장점을 최대한 활용하여 Web3 게임 분야에서 총력을 기울였습니다. Web3 생태계는 이미 형성되었습니다. L3의 이러한 고도로 맞춤화된 전략은 블록체인 성능을 크게 향상시킬 뿐만 아니라 게임 사용자의 요구를 더 잘 충족시킵니다. Arbitrum Foundation도 이를 강력히 지원합니다. 6월 8일, Arbitrum 커뮤니티는 현재 실행을 기다리고 있는 2억 ARB 게임 촉매제 계획에 대한 제안을 통과시키기로 투표했습니다. 이 제안은 Web3 산업의 스튜디오와 게임을 통해 Arbitrum 게임 생태계에 동력을 공급하는 목표로 총 2억 ARB를 제공하는 Arbitrum 생태 게임에 대한 3년 인센티브 계획을 제공하는 것을 목표로 합니다. Arbitrum 생태계에는 이미 많은 Web3 게임이 있습니다. 3월 27일 저녁, Arbitrum Foundation은 인기 NFT 브랜드 Azuki와 Weeb 3 Foundation과 협력하여 애니메이션 팬을 유치하는 Web3 네트워크 AnimeChain을 공동으로 만들 것이라고 발표했습니다. 4월 26일, ApeCoin은 성장을 이끌기 위해 Arbitrum 기술 개발과 Horizen Labs를 채택하기로 투표했습니다. 또한 Arbitrum의 다른 인기 있는 Web3 게임으로는 Xai와 XPET이 있습니다.

Optimism과 Coinbase가 공동으로 Op Stack을 구축, Base가 급등

Optimism은 수평적으로 발전하고 Op Stack은 영역을 확장합니다. Superchain은 Optimism이 제안한 새로운 개념으로, OP Stack 코드 기반을 공개 제품으로 유지하여 원래 고립된 L2를 단일 상호 운용 및 구성 가능한 시스템으로 통합하려고 합니다. 이 과정에서 블록체인 자체의 개념이 추상화될 수 있으며, 이 상호 운용 가능한 블록체인 네트워크는 매장과 같은 단위로 간주될 수 있으며, 각 Op 체인은 상품, 즉 상호 교환 가능한 컴퓨팅 리소스로 간주될 수 있습니다. 각 Op 체인은 OP Stack에서 구축하고 Optimism Collective에서 관리해야 합니다. Optimism Collective는 운영 체제와 같으며 다양한 애플리케이션(Op 체인) 등의 리소스 할당을 조정합니다. Op Stack으로 구축된 Layer 2는 많으며, 그 중 잘 알려진 것은 Base, opBNB, Zora Network, DeBank Chain 등입니다.

Op Stack에서 Base는 빠르게 발전했으며 Optimism과 매우 가까운 관계를 유지하고 있습니다. 2023년 2월, 암호화폐 거래 플랫폼 Coinbase는 OP Stack에 구축된 Ethereum 레이어 2 네트워크인 Base의 출시를 발표했으며 Optimism과 협력을 시작했습니다. Coinbase는 Optimism Collective의 사명에 기여하고 가장 강력한 공개 제품으로서 OP Stack의 선도적 위치를 확대하기 위해 핵심 개발자로 OP Labs에 합류했습니다. Base는 또한 거래 수수료 수입의 일부를 Optimism Collective 재무부에 반환하여 영향력 = 수익성이라는 지속 가능한 미래 비전을 더욱 실현할 것입니다. Base는 2023년 2월에 테스트넷을 출시했으며 생태계가 빠르게 확장되고 있습니다. 지난 90일 동안만 UAW가 20,000에서 270,000으로 증가했으며 BASE 네트워크는 현재 주당 $300만-400만 달러의 수익을 창출합니다. Deflama의 데이터에 따르면 Bases의 월간 자본 유입은 162% 증가했으며, TVL은 7위로 상승하여 많은 유명 퍼블릭 체인을 앞지르고 있습니다. Coinbase의 강력한 지원과 사용자에 의지하여 Base 생태계는 여러 측면에서 꽃을 피웠으며 미래에도 여전히 큰 잠재력을 가지고 있습니다.

스타크넷은 새로운 길을 개척하기 위해 기술을 발전시키고 있습니다.

StarkNet은 STARK 기반 Rollup 경로를 채택합니다. 이 솔루션은 분산화, 신뢰 없음, 검열 방지 측면에서 다른 솔루션보다 명백한 이점이 있지만 개발하기 어렵고 StarkNet은 여전히 성능을 지속적으로 개선하고 있습니다. 최근 StarkNet의 가장 중요한 업데이트는 Starknet 애플리케이션 체인과 무결성 검증기입니다.

2023년, Starknet은 Starknet 애플리케이션 체인(Appchain) 출시를 발표하고 Starknet 계약을 개발하기 위한 매우 빠른 툴킷인 Starknet Foundry 출시를 발표했습니다. Starknet 애플리케이션 체인 출시 후 Cartridge, Influence, Matchbox DAO, Briq, Cafe Cosmos와 같은 여러 체인 게임 프로젝트가 Starknet으로 마이그레이션하기로 결정했습니다. 그러나 체인 게임 생태계에서 Arbitrums 레이아웃과 비교할 때 Starknet의 생태적 개발은 여전히 부족합니다. Starknet 애플리케이션 체인 외에도 StarkWare의 지원을 받아 스토리지 증명 혁신가인 Herodotus가 개발자가 Starknet에서 Stone 증명을 검증할 수 있도록 하는 무결성 검증기를 출시했습니다. 이 새로운 검증기를 통해 개발자는 Ethereum에서 Starknet 실행을 검증하는 것처럼 Starknet의 다른 곳에서 실행되는 Cairo 프로그램을 검증할 수 있습니다. 이는 또한 최근 Starknet의 가장 중요한 기술 업그레이드 중 하나입니다.

최근 StarkNet이 비트코인 확장 계층에 진입한다는 소문이 돌았는데, 이는 다른 Layer 2와는 다른 주요 전략이 되었지만, 현재 소식에 따르면 이는 아직 불확실합니다. 6월 7일, Starknet은 X 플랫폼에서 비트코인 확장 계층에 진입한다는 Starknet의 입장을 명확히 밝혔습니다. Starknet은 계속해서 Ethereum 확장에 집중할 것입니다. Starknet이 출시된 이후로, 우리의 목표는 변함없이 동일했습니다. 즉, 우리가 믿는 블록체인의 확장성과 무결성을 향상시키기 위해 STARK 증명을 개발하는 것입니다. 비트코인에는 새로운 계층(Layer)이나 새로운 독점 토큰이 생성되지 않습니다. 대신 Starknet은 비트코인과 Ethereum의 실행 계층을 동시에 확장하려고 시도할 것입니다. 보안, 거버넌스 및 생태계는 STRK 토큰에 의해 구동됩니다.

StarkNet이 비트코인에서 확장될 수 있는지 여부는 OP_CAT 제안이 통과될 수 있는지에 달려 있습니다. Bitcoin Core 개발자 Peter Todd는 X 플랫폼에 Starknet이 비트코인 확장 계층에 진입한 것은 OP_CAT 활성화에 반대할 만한 충분한 이유라고 게시했습니다. Starknet은 Ethereum과 마찬가지로 비트코인에 파괴적인 MEV 장난을 가져올 수 있으며, 신생 STARKS에 많은 돈을 투자하는 것은 신뢰할 수 없습니다. Elis Zcash는 토큰 인플레이션을 반복적으로(악의적으로) 악용했습니다.

많은 기대에도 불구하고 zkSync는 아직 테스트할 시간이 필요합니다.

현재 zkSync는 전체 네트워크의 초점이 되었고, 오랫동안 기다려온 토큰 에어드랍이 마침내 왔습니다. 공식 뉴스에 따르면, ZK 토큰의 총 공급량은 210억 토큰입니다. 에어드랍 외에도 커뮤니티 할당은 66.7%, 생태계 인센티브는 19.9%(zkSync Foundation에서 배포), 투자자 할당은 17.2%, 팀 할당은 16.1%, 토큰 어셈블리 할당은 29.3%입니다. 투자자와 팀에 할당된 토큰은 첫해에 잠기고, 2025년 6월에서 2028년 6월 사이의 3년 동안 잠금이 해제됩니다.

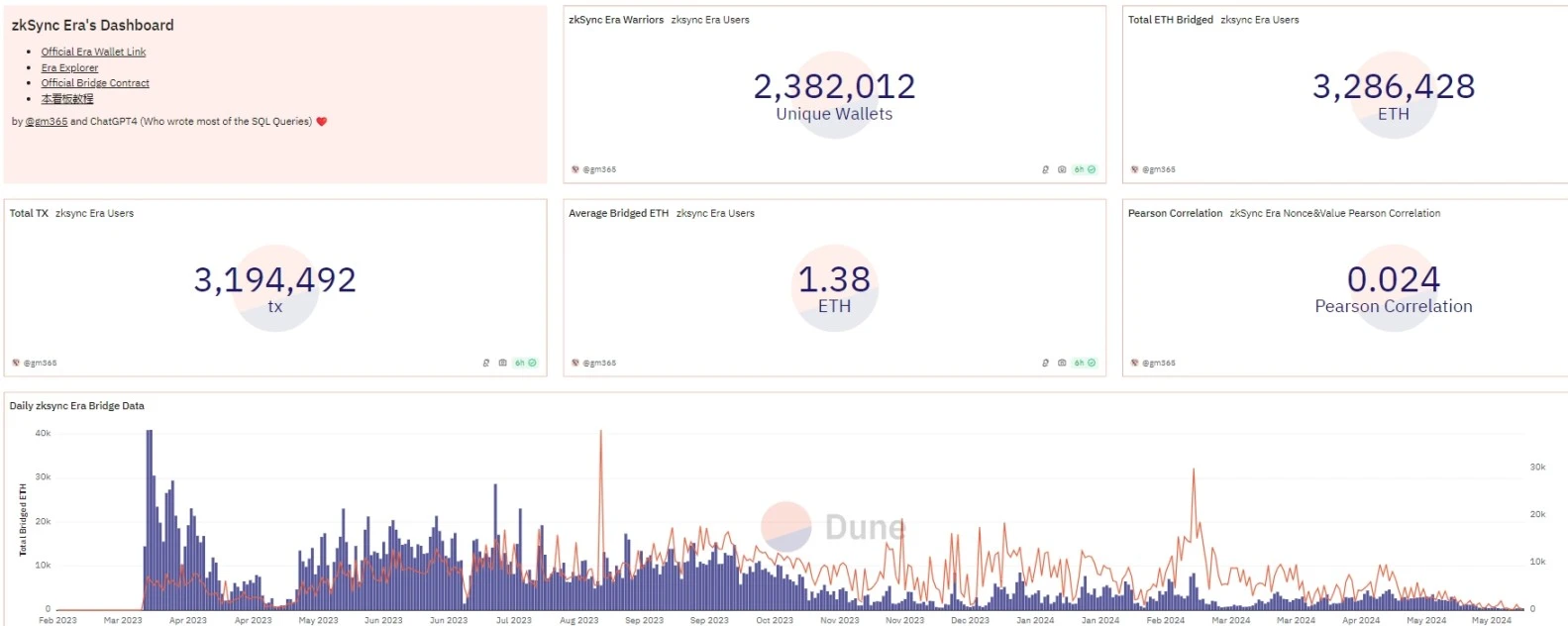

Dune 데이터에 따르면 6월 11일 기준 zkSync 브릿지 스토리지(TVB)의 총 가치는 약 3,286,428 ETH이고 브릿지 사용자 주소의 총 수는 2,926,969개입니다. 다른 L2와 비교했을 때 Optimism 브릿지 스토리지의 총 가치는 770,890 ETH이고 Arbitrum은 3,794,152 ETH이며 Starknet은 904,659 ETH입니다.

하지만 Deflama 데이터에 따르면 6월 11일 기준 zkSync Era의 TVL은 약 1억 3천만 달러로 현재 35위를 차지하고 있습니다. 이는 zkSync의 많은 자금이 여전히 에어드랍에 사용되고 있으며, 생태계를 위해 진정으로 유지되는 자금과 다른 Layer 2 리더 간에 여전히 큰 격차가 있음을 보여줍니다.

에어드랍 외에도 zkSync에게 가장 중요한 것은 Prover 네트워크의 분산화를 촉진하는 것입니다.공식적인 소개에 따르면 Prover 네트워크는 이제 전체 생태계의 참여자에게 개방되었습니다.새로운 참여자의 도입으로 zkSync Era Prover 네트워크는 더 확장 가능하고 강력해지며 거래를 확인하기 위한 증명 계산을 담당하는 핵심 메커니즘을 유지하기 위해 어떤 엔터티에 대한 의존도 없어집니다.Prover 네트워크 마일스톤 정보: 1) 0단계: 테스트 통합(2024년 3분기 초); 2) 1단계: 증명 검증(2024년 3분기 중반~후반); 3) 2단계: 실시간 증명 검증(2024년 3분기 후반); 4) 3단계: 라이브 테스트 검증(2024년 4분기 초); 5) 4단계: 실시간 검증(2024년 4분기).

요약하다

ZKsync에 비해 StarkNet은 토큰을 비교적 일찍 발행했으며 생태계에는 잘 알려진 프로젝트도 있습니다. 최근 비트코인 생태계에 진입할 계획을 세우기 시작했는데, 이 역시 다른 접근 방식이지만 이 길은 우여곡절이 있을 수 있습니다. 데이터에 따르면 Arbitrum은 Decun 업그레이드 후 가장 큰 수혜자가 될 수 있습니다. 동시에 생태계도 빠르게 발전했지만 ARB 토큰의 성과가 저조한 것은 잠금 해제된 토큰 수가 많았기 때문일 수 있습니다. Optimism은 Coinbase와의 협력을 통해 큰 개발 잠재력을 가지고 있으며 Base는 Op Stack을 기반으로 구축되었지만 Optimism 자체 개발은 Arbitrum보다 약간 낮습니다.

4대 Layer 2 프로젝트 중 토큰을 발행한 마지막 프로젝트로서 많은 사람들이 zkSync에 큰 기대를 걸고 있습니다. 하지만 커뮤니티의 반응을 보면 토큰에 가입한 많은 사람들이 만족하지 못하는 듯합니다. 일부 참여자는 "전체 마녀 비율이 매우 높습니다. 결국 수백만 개의 주소 중 70만 개도 안 되는 주소가 남아 있습니다. 개별 주소의 적중률은 약 15%로 모두 저소득 주소입니다. 게다가 ZK의 가격이 너무 낮아서 흥미롭지 않습니다. 게다가 데이터에 따르면 zkSync는 브리지된 자산이 많지만 TVL은 여전히 비교적 작습니다. 다른 Layer 2 프로젝트와 비교했을 때 zkSync 생태계의 구축은 분명히 느립니다. 동시에 ZKsync의 분산형 거래 플랫폼인 GemSwap은 토큰을 발행하기 전에 돈을 챙겼고, 이로 인해 ZKsync 생태계에 약간의 구름이 추가되었습니다. 앞으로 Zk 시스템이 어떻게 발전할지는 더 지켜봐야 합니다.

본 기사는 인터넷에서 발췌한 것입니다: Layer2의 4대 강자가 같은 무대에서 경쟁, 최신 개발 방향과 기술적 우위를 한눈에

관련: EMC Labs Bitcoin 주간 관찰: 미국 금리 인하에 대한 낙관적 기대 속에 BTC가 강력하게 반등

*이 보고서에 언급된 시장, 프로젝트, 통화 등에 대한 정보, 의견 및 판단은 참고용일 뿐이며 투자 조언을 구성하지 않습니다. 시장 요약: 지난주 BTC 가격은 지난 10주 중 가장 큰 반등을 기록했으며, 최저 $60,738, 마감 $66,261, 7.82% 상승, 진폭 11.33%를 기록했습니다. 가장 큰 반등은 5월 15일에 있었습니다. 놀랍지 않게도, 그 원동력은 미국에서 예상치 못하게 긍정적인 금리 인하 데이터였습니다. 같은 날 미국 노동부가 발표한 데이터에 따르면 4월 미국 소비자물가지수(CPI)와 식품 및 에너지를 제외한 핵심 소비자물가지수는 모두 월별 기준으로 예상보다 낮았습니다. 이는 미국 인플레이션의 반등이…