원저자 : dt

원문 번역: Lisa

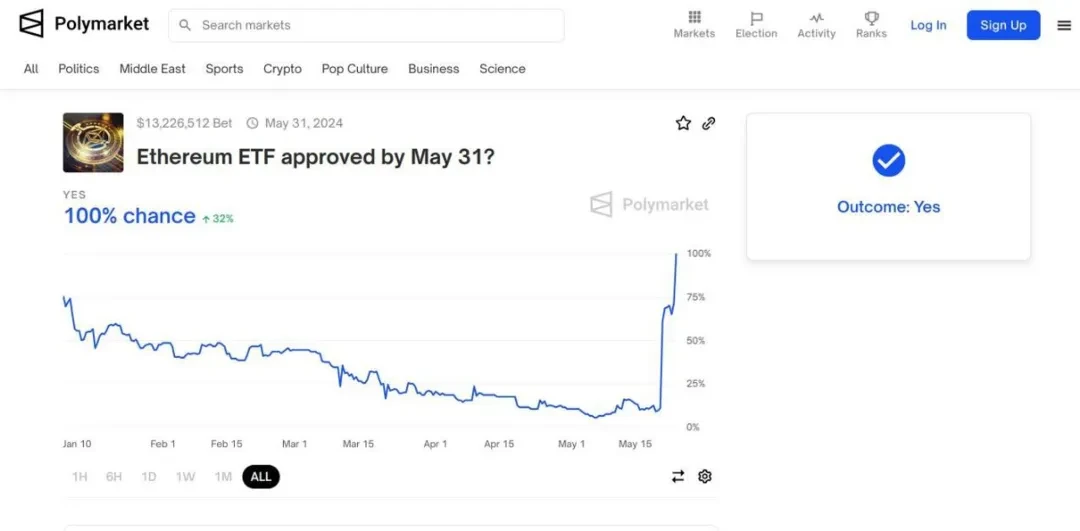

Recently, as the expectations of the $ETH ETF passing have been raised, the market has gradually returned to the EVM ecosystem. As the largest prediction market on the chain, Polymarket has attracted much attention for whether the $ETH ETF can pass smoothly. As the saying goes, a tall tree attracts the wind. Although Polymarket has gained huge liquidity, its settlement method has been questioned by participants. Let us follow Dr.DODO to explore the whole story of this controversial incident.

폴리마켓

First, let me introduce the Polymarket protocol. Polymarket is a prediction market based on the Polygon public chain. Due to its early launch and long operation time, it is currently the largest prediction market on the chain. The platform allows traders to bet with $USDC or $ETH to predict the hottest and most controversial topics in the world today, ranging from national presidential elections to whether the price of $ETH will exceed $4,000 the next day. Polymarket attracts market makers through a liquidity reward program to provide traders with excellent trading depth.

Polymarket has conducted two rounds of public financing. The first was a seed round of financing, which raised $4 million; the second was $45 million led by Founder Fund on May 14, 2024. For a DApp, this scale of financing is already considerable.

Source: polymarket.com

UMA

When talking about Polymarket, we have to mention the service provider UMA behind it. Polymarket uses UMAs OP oracle (Optimistic Oracle, abbreviated as OO) deployed on Polygon to ensure the fairness of the prediction results.

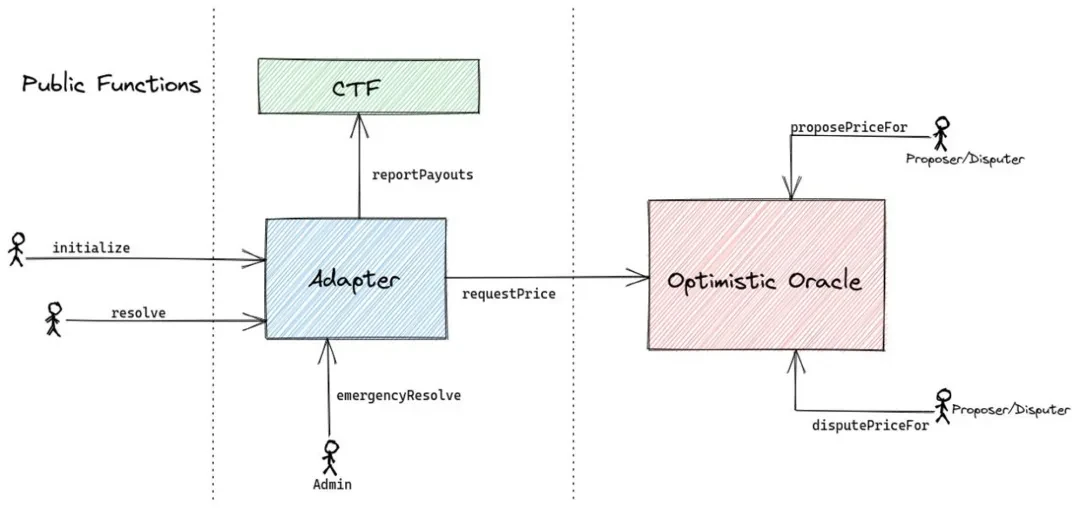

Polymarket’s UMA integration consists of three parts: the market contract, the CTF adapter contract, and the OO. Each market, when created, contains a condition generated by the CTF adapter, which is a question that the OO needs to answer, such as “Will the price of $ETH exceed $10,000 in Q3 2024?”

When the market is initialized, the CTF adapter automatically sends a request to OO. Proposers in the UMA system can respond to this request. If there is no dispute, the response will be considered correct and submitted to the CTF adapter after a two-hour challenge period. If the answer is incorrect, or other participants in the UMA disagree with the answer, other participants can debate the response as disputers.

In the first objection, the CTF adapter will ignore the objection and send the request with the same parameters to OO again. If the second request is challenged again, the request will be sent to UMAs DVM system (OOs arbitrator), which is composed of UMA token holders, who will vote to decide the objection result.

원천 : https://github.com/Polymarket/uma-ctf-adapter?tab=readme-ov-file

The controversy over whether ETFs are approved or not

Objection:

Some traders believe that the $ETH ETF was not actually approved before May 31, and everything is just speculation by UMA decision makers. Because US ETFs need to obtain approval for 19 b-4 applications and S-1 applications before they can be officially traded on the exchange, and the S-1 application has not yet been approved, which means that whether the $ETH ETF can actually be traded is still uncertain.

timeline:

-

After the U.S. Securities and Exchange Commission approved the 19 b-4 applications for multiple Ethereum ETFs, the UMA proposer gave the result of the ETF approval.

-

Perhaps because the challenge period was too short or UMA voting rights were too concentrated, no voter raised any objection during the next two-hour challenge period, so the response was adopted as the final result.

-

Later, some dissenters objected to the result and the request was sent to OO again by the adapter, but the YES result was passed again with an overwhelming vote of 99%.

Polymarket has not made an official response to this incident.

Source: https://polymarket.co m/event/ethereum-etf-approved-by-may-31

The Early Days and Future of Prediction Markets

In an era when major L1 public chains have not yet emerged, the concept of prediction market has already emerged.

예언자

For example, Augur was first deployed in 2018. The early v1 and v2 were too complicated in architecture, and finally optimized to Augur Turbo, which was officially released in 2022. Unlike Polymarket, Augur prediction results are determined by TheRundown data provider of ChainLink oracle. Compared with Polymarkets UMA mechanism, the result determination is more centralized, which may be the reason why it did not continue to operate later, because compared with the centralized prediction market, it does not have much advantage. After all, the centralized prediction market is also very happy to support cryptocurrency recharge.

아주로

Azuro, which has been rumored to be issuing coins recently, has taken another path. Unlike traditional prediction market DApps, Azuro has gone to a lower level. As an emerging prediction market infrastructure provider, it attempts to facilitate other projects to quickly integrate prediction functions through a Uniswap-like architecture, rather than focusing on building a market itself. However, it is inevitable that as long as the prediction is about real events, the final prediction result is still determined by data that is not decentralized enough. Defillama data shows that Azuros current TVL (locked volume) has grown steadily, and its revenue is not low among small and medium-sized DApps. It has also raised a total of 11 million US dollars in large financing. Infrastructure providers will inevitably have the advantages of wide coverage and a large number of users. We look forward to the subsequent development of Azuro.

Source: https://azuro.org /#intro

The new generation of prediction markets represented by Polymarket are mostly built on the first or second layer blockchain with lower GAS fees. Compared with early projects, they have a natural advantage: small traders are no longer excluded due to huge GAS fees. However, prediction markets such as Polymarket are still far from realizing the project vision. In the current situation where the blockchain infrastructure is not yet perfect, projects have to make a trade-off between decentralization and efficiency. Despite this, it can be seen from the financing situation that investment institutions are still optimistic about the prospects or speculative expectations of the prediction market. Technology often requires capital to drive, so we still look forward to the future development of this track.

저자의 의견

We do not comment on whether Polymarket’s decision in this incident is correct, but it can be seen from this incident that in the intersection of decentralization and centralization, decentralized products have not yet fully realized their decentralized vision. When encountering off-chain events, the ruling of centralized oracles is still required, so there is a certain centralization risk. The project party can only try its best to make a relatively fair assessment at present, and perhaps extending the market settlement time is a better way to deal with it. This also indirectly reflects that the actual number of Polymarket users is small, so the official adopted a cold treatment approach to resolve this dispute.

Before solving the problem of the reliability of the source of prediction results, the future of the on-chain prediction market track is still full of uncertainty. We have long been aware of the impossible triangle problem of blockchain, and this problem also exists in the prediction market. For the project to develop further, it is necessary to solve the problem of decentralization of prediction results, which may require major changes or technological innovations in the underlying blockchain and even in society.

This article is sourced from the internet: The decentralization dilemma of prediction markets from the perspective of Polymarket

Related: Tellor (TRB) Market Cap Soars Over 70% – What’s Driving the Growth?

In Brief Tellor’s (TRB) value surged in May and doubling its market capitalization. This growth is attributed to increased crypto whale activity in the TRB network. Market experts foresee a potential for further upward price trends for TRB. In May, Tellor (TRB), a decentralized oracle network, significantly outperformed expectations, doubling its market capitalization early in the month. As of April 30, TRB’s market value was $143.32 million. By the morning of May 7, in Asia market hours, this figure had surged to an impressive $247.81 million. This substantial growth aligns with a noted increase in crypto whale activity. Furthermore, it suggests a wave of profit-taking may influence the market dynamics. Unpacking the Surge in Tellor’s Market Capitalization Data from the blockchain analytics platform Santiment revealed a spike in crypto whales’…