오리지널 | 오데일리 플래닛데일리

작성자 | 난즈어

Before Pump.fun became popular, Solana Meme investors were mostly 10u War Gods for security reasons to prevent Rug operations such as DEV removing liquidity. In March, influenced by BOME and SLERF, super-large pools of Meme tokens began to become popular on Solana, but it also reached a freezing point again due to factors such as the overall market downturn and the increasing number of runaway incidents.

Since then, Pump has taken over – convenient opening methods and secure token endorsement have made Meme tokens popular again on Solana. Influenced by the attack, Pump.fun launched a 7-day zero-fee event . The number of new tokens on Solana has continued to set new historical highs, with more than 20,000 new tokens added daily.

However, the emergence of Pump has changed the characteristics and gameplay of Meme again, and the means of harvesting malicious DEV have also continued to evolve. Odaily Planet Daily will analyze the market characteristics and some methods in this article.

Token Market Characteristics

The tokens born in Pump have some notable features, which we summarize as follows.

Riding on the heat

Pump.funs extremely convenient token issuance method has led to a rapid increase in the number of DEVs that specialize in hot projects. Just as anything Musk posted on Twitter would be disassembled into countless Ethereum idiots, Pump is mostly aimed at some Solana ecosystem big V startups, including Ansem, Yelo, etc. Paying attention to such big Vs is expected to get early chips at the first time . However, it is often the case that five or six tokens appear within one or two minutes for the same keyword. In this case, the first token is not the main advantage, and the choice should be based more on the distribution of chips and the speed of purchase .

Internal disk is dead

Pump.fun is divided into internal and external markets. The internal market needs to purchase 85 SOLs to end. After the end, LP will be added and destroyed. However, due to the large difference in chip costs between early participants and late participants in the internal market, which is usually at least five or six times, many DEVs often directly take profits when the internal market is 80%-90%. How to deal with it? The simplest way is to stare at the chip list on the pump interface and exit as soon as the DEV leaves the market. In addition, users can try PlonkBot , which has the function of running away with DEV, but the success rate is limited.

There is a clear upper limit to the market value

The huge number of tokens disperses funds and also makes the creation of Meme consensus fragmented. Even if they succeed in surviving the internal market, only a very small number of tokens can break through the market value of 300,000. According to some users who have participated in the Pump project, there are obvious step-by-step limits to the achievable market value . When one limit is broken, it is easy to rise to the next limit. Users can summarize it by themselves.

Gaming

Website and Community

Generally speaking, having a well-made website can greatly promote the early rise of Pump tokens, and whether there is a community at this time is not critical. However, community and cultural consensus are the key to breaking through the conventional upper limit. For example, the recent DJCAT, NAMI and other tokens, the former rose due to community takeover, and the latter gathered consensus through the continuous creation of theme pictures by the project party.

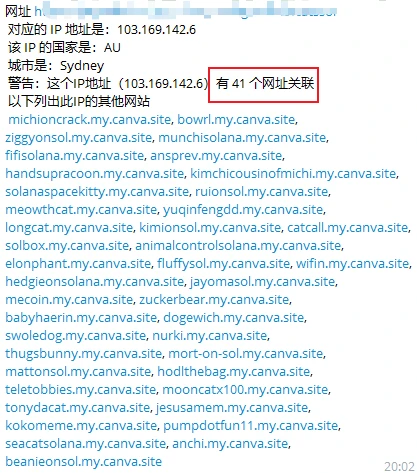

However, it should be noted that some DEVs promote their products by buying high-fan X accounts or creating websites in an assembly line, and then dumping them at high points in the domestic market. As a reference, you can use the TG tool Tugou Website Check to detect the website. This tool can check how many websites are deployed on the same IP , but if the website developer uses some third-party services (such as CDN), the same IP may create hundreds of websites, and users need to identify them by themselves.

GMGN indicator

There are many tools for Pump on the market, and GMGN is one of the websites with more comprehensive data. The website provides multi-dimensional data such as progress, creation time, capital inflow speed, transaction amount and number of comments, which can comprehensively evaluate investment.

But at the same time, DEV is also evolving. Currently, there are a large number of DEVs that have developed their own robots to brush transaction volume indicators. There are also DEVs that purchase from multiple wallets and brush the number of comments on the Pump interface , creating a false prosperity, and then selling at the high point of the internal market.

Be careful with orders

Copy Trading is a common operation for discovering early projects, but it is not suitable at the moment when Pump is popular, because the LP pool of basically all tokens is very small. Buying after purchasing with a smart wallet can even increase the price several times again. Chinese and foreign big Vs have been exposed to using the copy trading mechanism to harvest copy traders. To address this problem, it is far more appropriate to choose an address with a low win rate and a high profit and loss ratio to copy, rather than an account with a high win rate and a low profit and loss ratio.

(Note from Odaily Planet Daily: Because the latter may use the copycats to raise the price and then quickly exit to create address data with a high winning rate.)

결론적으로

Malicious harvesters are constantly innovating their methods. This article can be used as a reference for some ways to fight against them, but when everyone uses the same or similar strategies, the strategies will become ineffective. Only by constantly evolving can you survive in the market.

This article is sourced from the internet: Pump PVP Manual: Scythe and Leek Promote Mutual Evolution

관련: 솔라나(SOL) 가격이 $130으로 떨어질 수 있는 이유는 다음과 같습니다.

간단히 말해서 솔라나(SOL)는 조정 단계에 직면해 있으며 $130으로 하락할 가능성이 있습니다. 단기 강세 지표는 약세 장기 전망과 충돌합니다. MACD 신호와 피보나치 지지는 잠재적인 하락세를 시사합니다. 솔라나(SOL)는 현재 조정 단계를 거치고 있으며, 가격이 잠재적으로 추가 하락할 수 있다는 징후가 있습니다. 이번 수정의 일환으로 SOL이 $130 정도에 도달할 가능성이 있으며 BeInCrypto는 가격 차트를 분석합니다. 솔라나의 가격이 50일 EMA에서 반등했습니다 어제 전날 솔라나는 대략 $160인 0.382 Fib 수준에서 50일 EMA 지지선에 도달한 후 강하게 반등했습니다. 현재 SOL 가격은 $180 및 $195 주변에서 상당한 Fib 저항에 직면해 있습니다. 더욱이 이동 평균 수렴 발산(MACD) 히스토그램은 지난 3일 동안 강세 모멘텀을 보여주었습니다. 그러나 MACD 선은 약세 교차하고 있으며…