Stock prices once again challenged record highs in the early trading session before retreating, while U.S. Treasuries also experienced a bearish trend, with short-term yields rising slightly due to a sharp increase in import prices (0.7% month-on-month vs. 0.1% expected).

With little important data until next Wednesday, when Nvidias earnings report is released, options imply a +/-8% stock price volatility, slightly lower than its two-year average of +/-8.4% and +10.9% in February. Given the chip giants outsized weighting in the SPX, an 8% implied volatility means an impact of about 0.4% on the SPX, not to mention the spillover effect on sentiment for other related stocks in the index.

In addition to higher-than-expected import prices, an expected rebound in oil prices during the busy summer driving season could keep CPI pressures in place until August, though inflation traders remain confident that CPI will fall back below 2.5% by the end of the year.

Unwavering confidence in inflation and a lack of economic risk have allowed markets to focus purely on interest rate trends, resulting in a perfect negative correlation between U.S. Treasury yields and stock prices since mid-December. In other words, stock and bond prices have risen in tandem in a perfectly ideal boom, (again) ignoring tail risks that could come from a further economic slowdown, stubborn inflation, or a valuation correction.

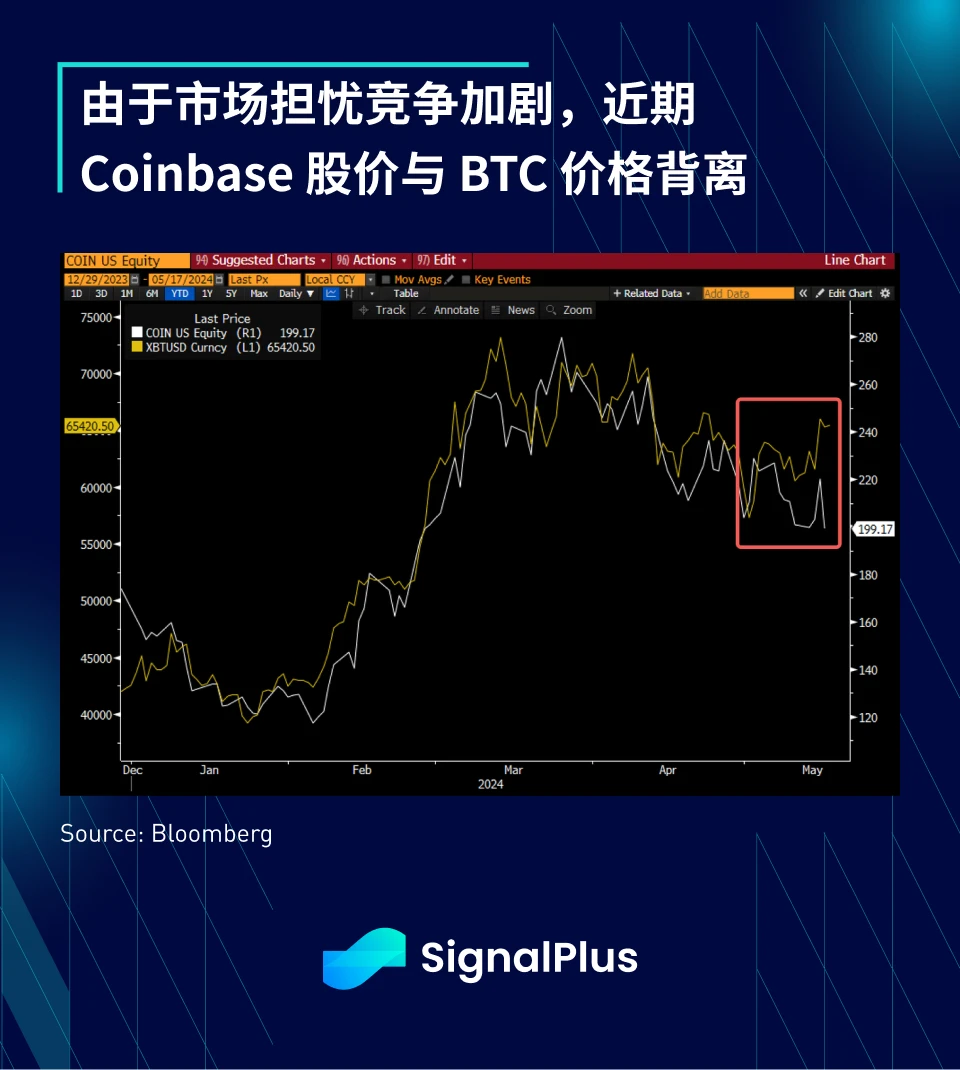

There is not much news worth noting in the cryptocurrency sector, with BTC holding steady at recent highs and trading activity flat. However, Coinbases stock price fell 9% yesterday, a significant divergence from the BTC price, as investors began to worry that the entry of institutions such as CME into the spot trading business will lead to increased competition in the compliance field. The entry of TradFi will undoubtedly bring the inflow of funds needed by the industry, but it will also certainly trigger new competition. What will the cryptocurrency market look like in a year or two? We will wait and see.

ChatGPT 4.0 플러그인 스토어에서 SignalPlus를 검색하시면 실시간 암호화 정보를 얻으실 수 있습니다. 업데이트를 즉시 받으려면 트위터 계정 @SignalPlus_Web3을 팔로우하거나 WeChat 그룹(WeChat 보조자 추가: SignalPlus 123), Telegram 그룹 및 Discord 커뮤니티에 가입하여 더 많은 친구들과 소통하고 소통하세요. 시그널플러스 공식 홈페이지: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis (20240517): Perfect ideal prosperity returns

관련: Merlin Chain 창립자 Jeff: 용량 확장, 이자 생성 및 자산 스왑, Merlins의 기본 혁신은 어떻게 이루어집니까?

5월 BitcoinAsia 컨퍼런스에서 Merlin Chain 설립자 Jeff는 Bitcoin L1에서 Merlin Chains Native Innovation까지라는 제목의 연설을 했는데, 이 연설에서 Merlin Chains의 네이티브 혁신이 비트코인 생태계에 어떻게 힘을 실어 줄 수 있는지 심도 있게 탐구했습니다. 그는 비트코인 생태계의 진화를 검토하고 Merlin Chains의 네이티브 혁신이 비트코인 생태계의 발전을 어떻게 촉진할 것인지 심도 있게 탐구했습니다. 다음은 현장 녹음을 기반으로 편집한 연설 전문입니다. 2023년 이전에 비트코인은 항상 가치 저장을 위한 디지털 골드로 여겨졌으며, 비트코인을 중심으로 새로운 개념과 애플리케이션을 만드는 사람은 없었습니다. 하지만 2023년 중반에 Ordinals 열풍이 불면서 점점 더 많은 사람들이 비트코인 네트워크에서 NFT 관련 콘텐츠를 만들기 시작했고, BRC-20, BRC-420, ORC-20과 같은 자산을 발행한 다음 Atomicals…