After three consecutive inflation data exceeded expectations, the CPI data released on Wednesday was roughly in line with expectations. This result is enough to stimulate another round of large-scale rebound in risk markets.

-

SPX hits new high

-

US 1-year 1-year forward rates saw their biggest one-day drop since early January

-

2025 Fed Funds futures pricing in a 25 bps drop from April highs (equivalent to one rate cut)

-

The US dollar index DXY recorded its biggest one-day drop so far this year

-

Cross-asset volatility (FX, equities, rates) retreats to medium-term and/or historic lows

Will the Fed cut interest rates soon? Federal Funds Futures for June show only a 5% chance of a rate cut, and only a 30% chance for July. Even for September, the chance of a rate cut is only about 64%. So what are you all excited about?

Will the Fed cut interest rates soon? Federal Funds Futures for June show only a 5% chance of a rate cut, and only a 30% chance for July. Even for September, the chance of a rate cut is only about 64%. So what are you all excited about?

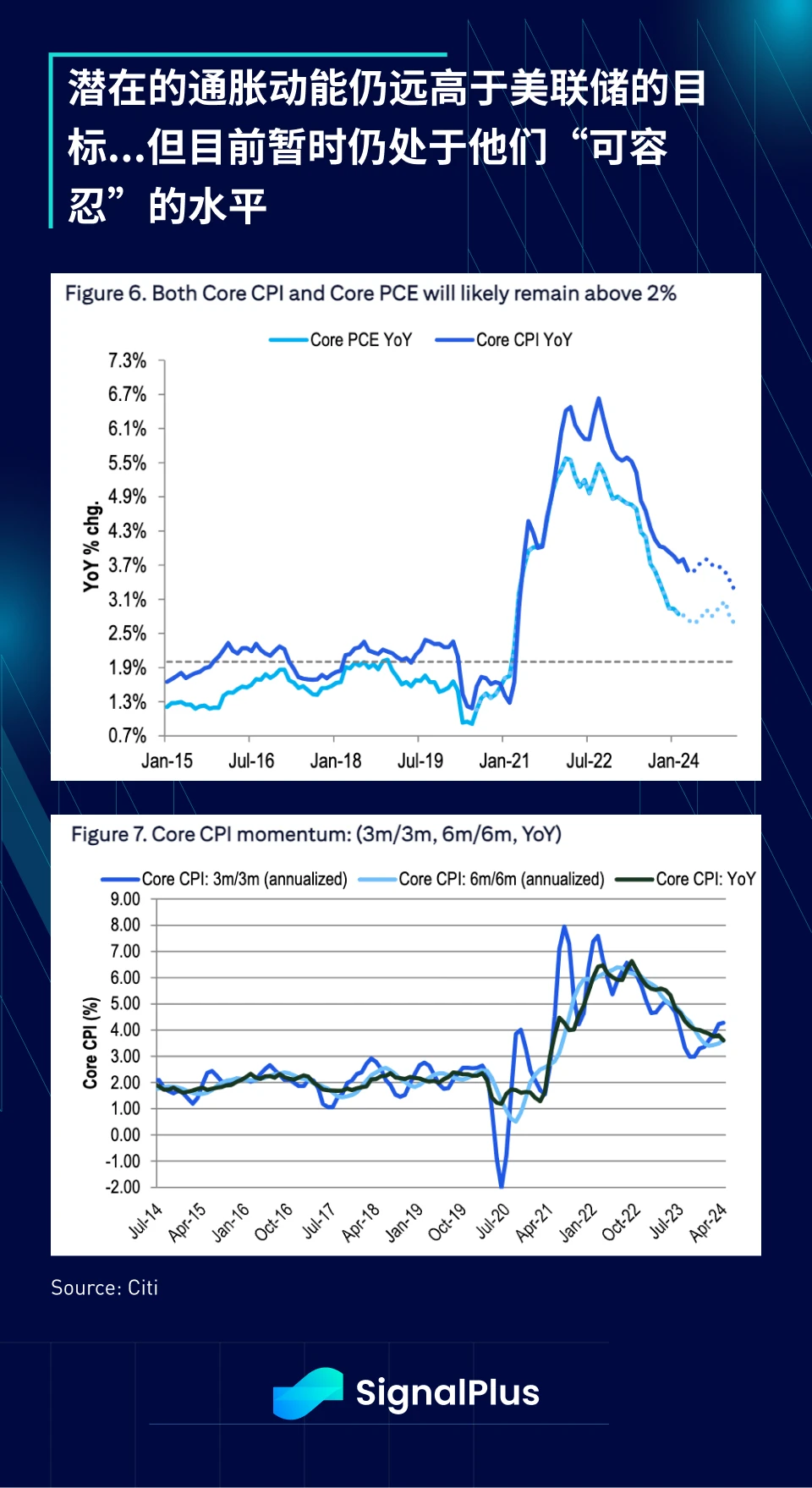

As we have mentioned before, the Fed has moved to a completely unbalanced position, whereby persistent inflationary pressures are tolerated as long as inflation does not re-accelerate, and any signs of weakness in the job market are seen as a driver for policy easing. Therefore, while headline and core inflation remain above the Fed’s 3.6% and 3.4% targets, respectively, the market is concerned about re-acceleration of prices, which did not occur last month, which fits with the Fed’s theme of returning to “watching the timing of easing” as both “slowing job market” and “high but tolerable inflation” are being confirmed one by one.

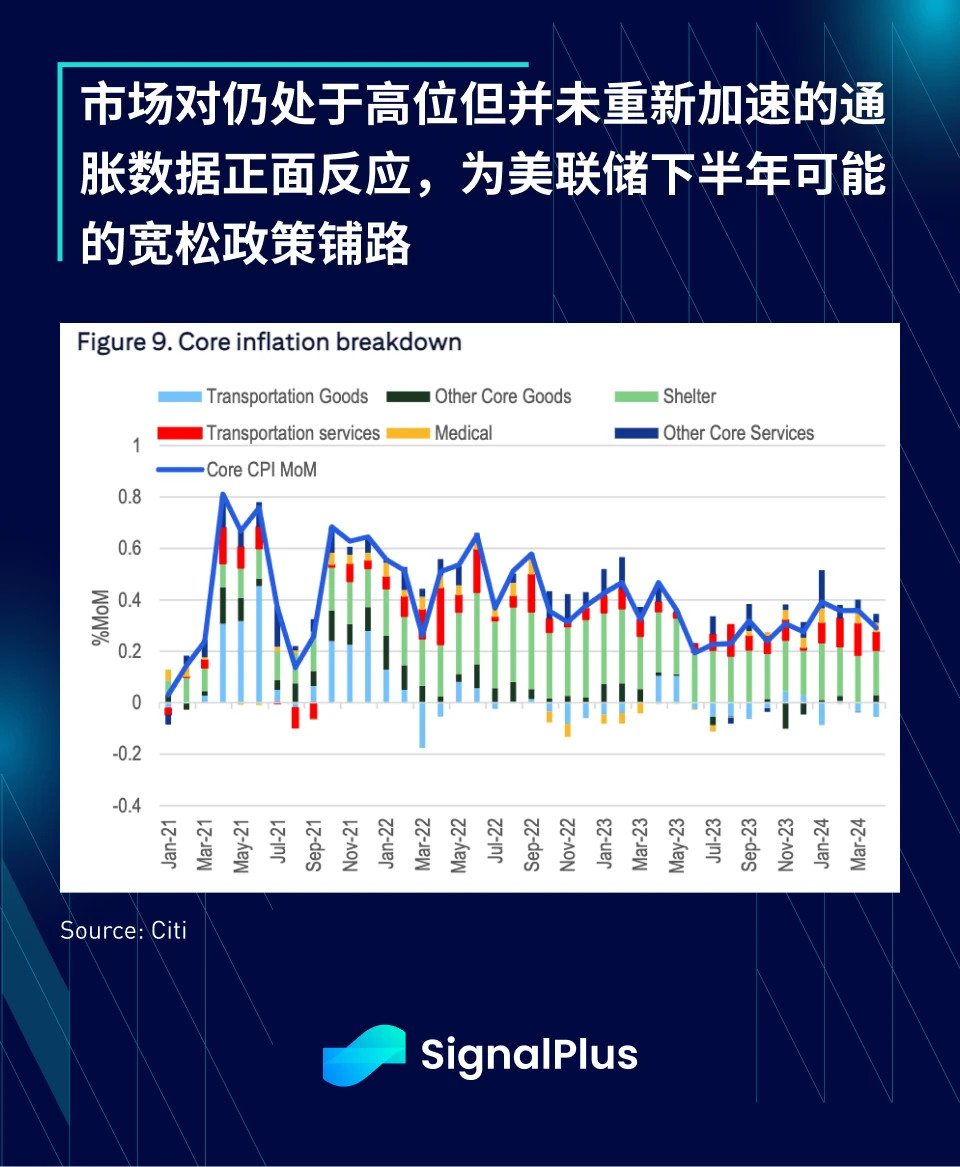

Back to the CPI data itself, the core CPI rose 0.29% month-on-month in April. After exceeding expectations for three consecutive months, the data results this time were only slightly lower than market expectations. The weakness mainly came from the decline in commodity prices and the controlled growth of housing prices and owners equivalent rents. Core service inflation excluding housing rose 0.42% month-on-month, roughly in line with expectations.

After the release of CPI/PPI, Wall Street expects core PCE to grow by around 0.24% month-on-month in April, moving towards an annualized level of 2% and the Feds comfort zone. Traders remain confident that inflation will continue to fall in the second half of the year.

On the other hand, retail sales data in April weakened significantly, with a general softening in different spending categories. Retail sales were flat month-on-month, lower than the consensus expectation of a month-on-month increase of 0.4%-0.5%, and control group spending fell 0.3% month-on-month, and the previous value was also revised down. General merchandise and even non-store sales saw the largest decline since the first quarter of 2023.

The weaker-than-expected retail sales data continued a recent string of weak consumer data, including rising credit card and auto loan delinquencies, the depletion of accumulated excess savings, and a deteriorating job market. While it is too early to call a significant economic slowdown, we appear to be approaching a turning point in economic growth. Are high interest rates finally starting to erode the U.S. economy?

As always, the market is happy to ignore any risk of a slowdown and focus only on the Feds easing policy for the time being. As a reminder, while the market is very forward-looking and good at incorporating all available information into pricing, please be aware that the market is not that forward-looking. Enjoy the current party for a short while!

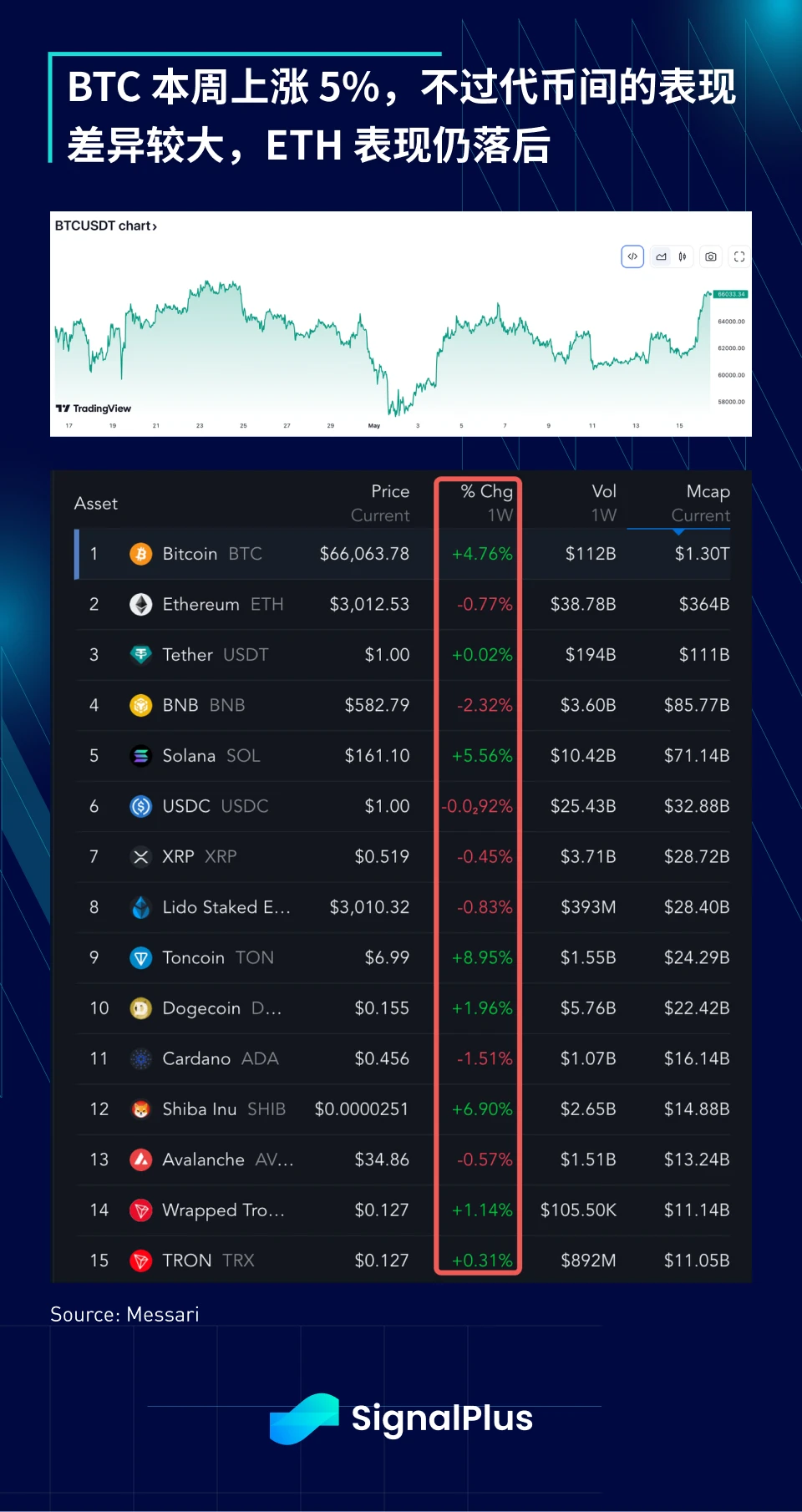

On the crypto side, BTC prices continue to be influenced by overall stock sentiment, with prices breaking through this month’s highs and returning to the April peak of around $67,000. ETF inflows have also been very healthy, with an additional $300 million in inflows following yesterday’s CPI announcement, and even GBTC seeing net inflows. However, the performance of individual tokens remains highly variable, with ETH and some of the top 20 tokens still struggling to recover losses, and market gains increasingly concentrated in a small number of tokens (BTC, SOL, TON, DOGE) rather than overall market gains.

Expect this to continue, with the focus remaining on BTC, the main beneficiary of TradFi inflows (13 F filings show some large hedge funds have increasing exposure to BTC ETFs), and relatively less FOMO on native or degen tokens in this cycle. Good luck everyone!

ChatGPT 4.0 플러그인 스토어에서 SignalPlus를 검색하시면 실시간 암호화 정보를 얻으실 수 있습니다. 업데이트를 즉시 받으려면 트위터 계정 @SignalPlus_Web3을 팔로우하거나 WeChat 그룹(WeChat 보조자 추가: SignalPlus 123), Telegram 그룹 및 Discord 커뮤니티에 가입하여 더 많은 친구들과 소통하고 소통하세요. 시그널플러스 공식 홈페이지: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: Asymmetric

관련: Ethena(ENA)가 $1 저항을 주시: 통합의 끝이 보인다

간략히 말해서 Ethena(ENA)는 $1로의 잠재적인 움직임으로 트레이더와 분석가의 관심을 불러일으킵니다. 소셜 미디어 언급이 급증했으며, 최근 주요 의견 리더들이 강조했습니다. 상승 추세에도 불구하고 장기적인 감정 안정성은 지속적인 참여에 달려 있습니다. Ethena(ENA)는 주목할 만한 주목을 받고 있으며, $1 마크를 뒤집는 것을 목표로 하는 잠재적인 가격 궤적에 대해 트레이더와 분석가 사이에서 논의를 불러일으키고 있습니다. 이 암호화폐는 현재 주요 트렌드 분야인 AI 또는 밈 토큰을 둘러싼 과대 광고 없이도 관련성을 유지합니다. 최근의 감정과 시장 동향을 바탕으로 ENA는 강세 돌파의 조짐을 보이고 있습니다. 소셜 플랫폼에서 Ethena 언급 증가 지난달 동안 암호화폐 커뮤니티 내의 주요 영향력 있는 계정에서 꾸준히 ENA를 언급하여 관심이 증가하고 있음을 나타냈습니다. 분석 결과 32명의 중요한 X 사용자가 ENA에 대해 논의했습니다...