원저자: IOSG Ventures

체인 추상화

Humans are not usually asset managers, but they are forced to become money managers. In the United States, the average number of bank accounts per person is between 3 and 4, which shows that even in a highly developed banking system, the average American manages only about 4 accounts, although money can flow seamlessly between these accounts.

15 of the top 25 projects by market cap are “consumer-focused L1” projects. Will the average non-crypto consumer dabble in more than 3-4 chains? Do they need to treat their gas tokens as assets, too?

With the crypto market growing so fast, I think the market is ready to pick their favorite three chains (including rollups). Why would they need to do that if the technology is advancing?

Chain abstraction is the end game of liquidity fragmentation in crypto. When there is liquidity fragmentation across different DEXs, DEX aggregators win; when there is liquidity fragmentation across different bridges for inter-chain operations, bridge aggregators emerge (of course, bridge aggregators contribute much more to the ecosystem than that); and finally, when liquidity is fragmented across different chains, the intuitive sense of chain abstraction becomes very obvious. We said it from the beginning: One day, users will not even know which chain they are using.

This is why I am bullish on chain abstraction. It will help to bring a massive increase in cryptocurrency participation without the mental burden of maintaining multiple accounts on multiple chains. This article will dive into how chain abstraction is implemented, the pros and cons, the trade-offs, and the likely winners.

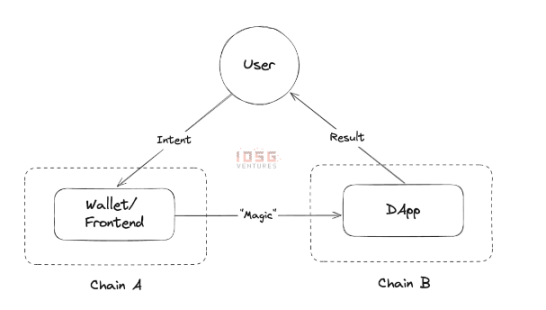

I define chain abstraction as: any user-initiated intent on a chain of choice (where liquidity resides) is executed on the chain where the application resides (where the results reside).

The user submits an intent on chain A, and after some magical operations, the user obtains the desired result on the target chain or back to the same wallet.

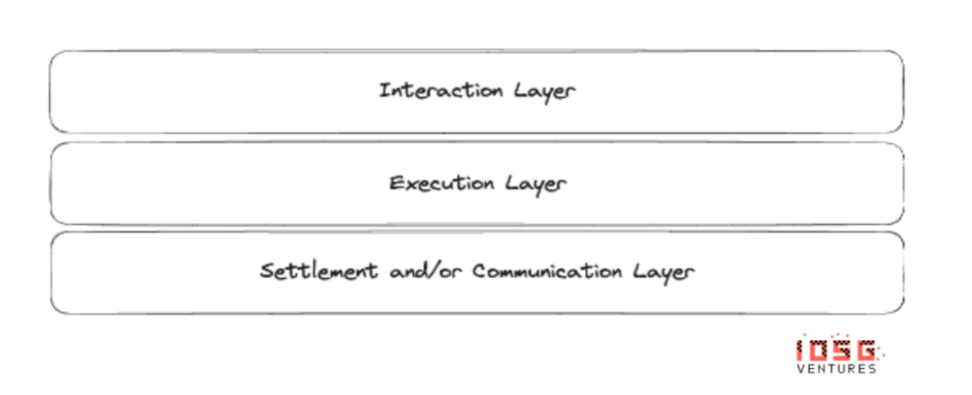

This “magic” can be achieved in a number of different ways, involving different trust assumptions, adoption curves (both user and developer), and goals for the chain abstraction experience that the end application hopes to unlock. Different projects have different views on chain abstraction, but here are the key layers to achieve this goal. Different projects are addressing different layers, and after reading this article, you should have a fair understanding of the key elements required and what the end game might look like.

Interaction Layer

These projects attempt to abstract the chain from the very first interaction of the user.

To users, this may look like a multi-chain version of account abstraction, manifested in the form of a wallet or a unified front-end interface for interacting with multiple chains (such as a cross-chain lending platform).

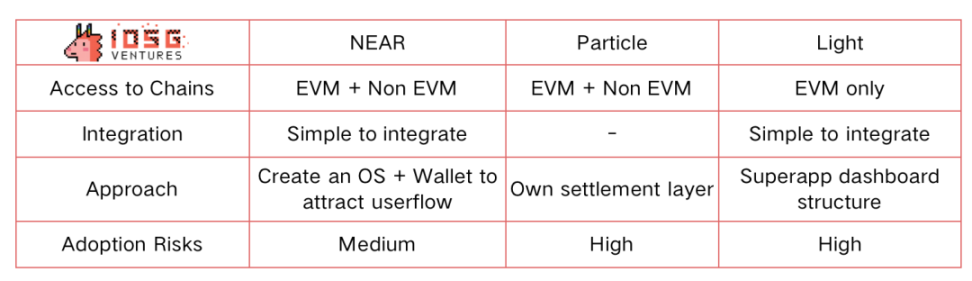

Projects built in this direction include: NEAR, Particle Network, and Light.

NEAR Protocol

NEAR Protocol aims to simplify the abstraction of blockchains for users as much as possible. They have relayers to subsidize gas fees, an authentication service for account recovery via email (very similar to Web2 UX), and most importantly, multiple signature types generated using NEAR accounts.

Applications can remain where they are, with little to no development cost other than integrating the NEAR Wallet.

Multiple signature types help users interact with multiple chains simultaneously. While this sounds simple, solving liquidity and messaging is very important. NEAR must be able to connect to multiple chains through single or multiple messaging protocols and liquidity networks.

Since they are closest to users, NEAR must also market aggressively and capture a high market share.

입자 네트워크

Particle Network holds a similar view on chain abstraction. They originally started as an AA wallet in the EVM ecosystem, but are now moving towards chain abstraction by creating universal accounts on their modular L1. This modular L1 is built using the Cosmos SDK. This enables Particle Network to be compatible with IBC for any inter-chain communication. They are also using Berachains Polaris framework to become EVM-compatible for the Cosmos chain.

Particle Network will not rely on any external protocol to provide liquidity. Since they are their own chain, they will optimistically perform cross-chain atomic transactions and have their own Gas tokens.

We do see a lot of overlap in the approaches of NEAR and Particle. While Particle controls the majority of the tech stack, they will have the additional task of bootstrapping and maintaining their liquidity network in addition to similar problems faced by NEAR.

Light

Light.so is a relatively new project that takes the approach of account abstraction, but is limited to the EVM (Ethereum Virtual Machine) ecosystem. Through the typical gas fee abstraction and the advantages of batch execution, they have changed the wallet user experience to provide a complete dashboard experience. Light is committed to abstracting many common operations and providing users with a dashboard-like experience.

Future development paths may include integrating multiple DeFi operations into the dashboard, such as swaps, borrow/lend, structured yield products, etc. However, in order to facilitate these operations, a bridge/messaging layer is still required on the backend.

Communication Layer

The interaction layer needs to go through the task execution layer, which can be a bridge, proxy, validator, or any infrastructure that can achieve cross-chain interoperability.

Standardized validator network

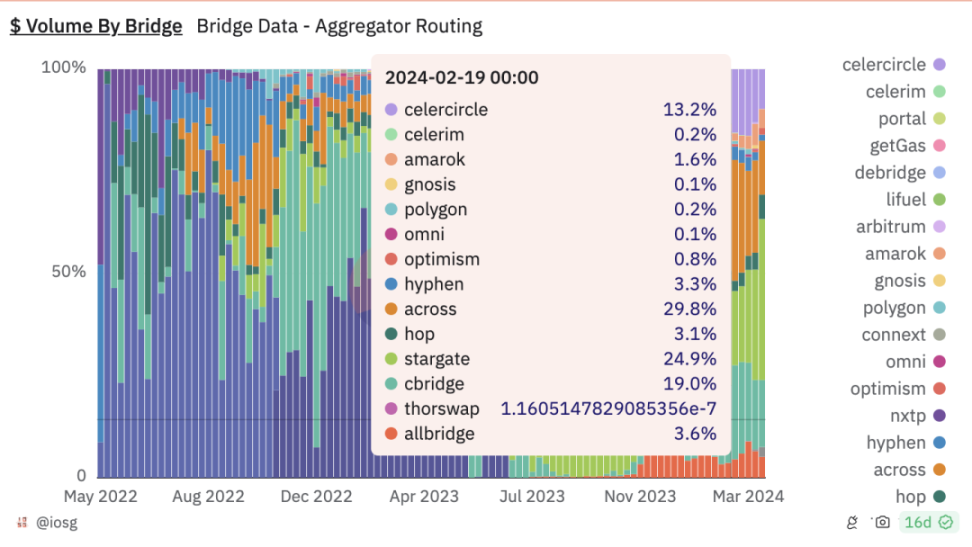

Across has taken the lead in cross-chain aggregators. Existing crypto users who frequently use the Ethereum ecosystem may be familiar with Across. Across’s transition to an intent-driven structure in its V2 version has positioned it as a leader in the bridge aggregator war. This also helped achieve the V3 version, where developers can conveniently combine bridge and protocol operations in a single transaction.

Hypothetical example: OpenSea integrates Across+. If I want to buy Base Chads on Base, I just need to sign a transaction on Arbitrum using the wallet of my choice, and then I can successfully buy a Base Chad from the same address on Base.

This example is the easiest for us to understand because it looks like the solution we have been looking for.

This approach is great for quickly buying a select memecoin or purchasing an NFT listed on a 시장, but may not be suitable for high-frequency activity like a Telegram Bot, or signing every action as a transaction on a rollup hosting a poker game. In the latter case, it may be easier to bridge and use a rollup to achieve lower latency and better execution.

Anoma takes a unique intent-driven off-chain approach, with a validator-based L1 and consensus mechanism. Developers can build directly on Anoma or use Anoma as a middleware (essentially a validator network). In order to standardize communication within the network, Anoma has its own DSL that developers need to learn in order to take advantage of Anomas network.

Validator network standardization is one of the hottest research areas in chain abstraction. Issues such as validator centralization, auction mechanisms, and the impact of open validator networks have been debated for a long time and I will not delve into these issues here. Here is a great article on intent-based bridge architecture by Arjun Chand, including risks and trade-offs.

Projects like Ethereum Swap, UniswapX, and 1inch Fusion have demonstrated best-in-class execution of intent-based architectures. There is no doubt that intent-based architectures will dominate the cross-chain and chain abstraction space, but who will win? We have seen that order flow is king. The validator network that can guarantee best execution will get the best order flow, no matter where the orders come from. Can chain abstraction wallets give them the best order flow?

How good are validators for high-frequency activity? How good are they for latency-critical transactions (e.g. buying low-liquidity memecoin)? These may not be the best use cases for validator networks or chain abstraction in general.

The top-level activity that a mature validator network can enable in the chain abstraction paradigm is large-scale cross-chain (e.g. moving ETH from all L2 to a single Ethereum mainnet account). Anywhere there is a need for research overhead, integration overhead, bridging overhead (including aggregators), gas maintenance, etc. is where validator infrastructure can help. Buying Injective derivatives on Injective should be seamless and one-click, even if I dont have any funds.

Competition in the validator network

To ensure execution, each validator network needs to integrate with some contracts. Across V3 is leading the way with its intent-driven architecture and now just needs to sort out the integration with protocols. Protocols will likely integrate with battle-tested projects like Across, and they will need to keep innovating their architecture to attract more validators (or relayers as they call them) to participate without compromising execution.

However, Across V3 is not a clear winner in terms of order flow. Stargate Bridge is competing head-on with Across in terms of order flow and volume, while Celer Circle and cBridge also seem to be catching up.

Across is the only project with an intent-driven architecture that has consistently delivered superior execution. There has long been a belief that Stargate’s volume is artificially increased through incentives, but there is no way to prove this. However, while Stargate’s volume is comparable to Across’, it has twice the number of transactions. Only after the LayerZero airdrop is complete can we determine which volume is incentivized and which is non-incentivized.

Socket takes a unique approach by introducing a Modular Order Flow Auction Architecture (MOFA), where any of the above modules can submit an order or participate in an auction. I am not familiar with the underlying technology, but with the teams track record of releasing great products, this could be very interesting.

Image Courtesy: Socket

Bridges and Bridge Aggregators

Cross-chain bridges are difficult to use – User feedback

Bridge aggregators used to be my favorite way to transfer assets across chains. They guarantee that assets are bridged to the users chain of choice in the best possible way. While it is currently the best form of cross-chain transfer, it only shields the bridge itself, not the blockchain. Users still need to hold a minimum amount of gas on the target chain to complete the cross-chain transfer. They also cannot help users perform operations on the target chain, which may bring additional complexity to the user experience for users who are new to this space.

At scale, bridges are not as efficient as validator networks. Why? I recommend watching Hart Lambur’s talk at EthDenver 2024 to learn why batching intent can be over 50x cheaper than traditional bridges. (See 9:11 – 13:25).

While I appreciate the teams and founders working to build bridges that allow me to interact in a multi-chain world, I would rather completely eliminate the 3-4 steps in the user flow and the slight anxiety that comes with it.

Full stack framework

Full-stack frameworks help create standards from the wallet layer to the settlement layer and appear to enable complete chain abstraction for users in terms of technical efficiency (security, communication, etc.). Frameworks such as CAKE make protocols easy to adopt and integrate into the entire ecosystem.

It would be very difficult for developers to build projects completely dependent on a new framework or chain. The motivation for developers to choose a specific framework is usually order flow.

I dont know how to convince an entire ecosystem of developers who have chosen their favorite environment to build their projects to use a completely new framework. This will be a battle that relies heavily on marketing and partnerships, as difficult as launching a new L1.

Participants in the full-stack framework include: CAKE, DappOS, and Aarc.

요약하다

A unified framework is essential, and the leader of each module will be determined by the best order flow. The best order flow depends on continuously providing the best execution effect. The entire chain abstract framework may be as follows:

If I had to expose my grandmother to crypto, I would probably wait until NEAR or Particle Network release a product. I don’t want her to go through the cycle of learning about bridges/aggregators, verification, and maintaining multiple private keys when all she needs is an EVM wallet and buying some token on Solana.

To enable all of this functionality, some form of account abstraction, balance abstraction, and possibly even gas abstraction will be required, and many participants are working on each of these issues.

Based on the information currently available, the leaders of each module will determine the ideal framework. NEAR seems most likely to become the entry point for new order flows, Across seems to be the battle-tested project and the easiest to integrate (it will depend on the Chaos Labs team to further optimize the protocol, they know how to win in a crowded ecosystem), and finally the cross-chain messaging layer, which will provide a secure environment for auxiliary infrastructure (such as bridges and oracles) to provide settlement services for assets moving across chains.

This article is sourced from the internet: IOSG Ventures: From bridge liquidity to chain abstraction full-stack framework, what are the innovations?

관련: Web3 콘텐츠 베테랑 Mirror가 인수되어 변환 프로세스와 새로운 소셜 제품 Kiosk에 대해 설명합니다.

원본 | Odaily Planet Daily 저자 | Nanzhi 5월 2일, 웹3 콘텐츠 게시 플랫폼 Mirror가 Paragraph에 인수되었다고 발표했습니다. Mirror 팀은 계속해서 독립적으로 운영될 것이며, Farcaster를 기반으로 하는 웹3 소셜 애플리케이션인 Kiosk 개발에 주력할 것입니다. Mirror의 모회사인 Reflective Technologies Inc.는 Electric Capital에서 $10 million을 모금했으며, a16z crypto, Union Square Ventures, Variant의 추가 지원을 받았다고 밝혔습니다. Mirror는 2021년에 내부 테스트를 시작했으며, 빠르게 웹3 분야에서 중요한 창작 플랫폼 및 도구가 되었습니다. 그러나 포지셔닝, 개발 경로, 제품과 같은 요인으로 인해 시장 점유율이 급격히 감소했습니다. 현재 가장 중요한 공식 콘텐츠 및 크리에이터 플랫폼은 Medium이고, 웹3 분야에서 Mirror의 주요 경쟁자인 Paragraph는…