지난 금요일, 미국 거시경제 데이터는 부진했습니다. 5월 1년 물가상승률 예상치는 3.2%에서 3.5%로 상승했습니다. 미시간 대학 소비자 신뢰 지수는 약세를 보이며 67.4로 떨어져 최근 고용 데이터가 부진하여 시장 위험 심리에 미치는 긍정적 영향을 상쇄했습니다. 미국 10년 국채 수익률은 한때 4.5% 마크 위로 돌아왔고, 금리 정책에 더 민감한 2년 수익률은 4.853%로 상승했습니다. 위험 자산은 비교적 안정적으로 성과를 보였고, 3대 미국 주가 지수는 오르락내리락했습니다. 그 중에서도 다우와 SP는 각각 0.32%/0.16%로 약간 상승했고, 나스닥은 0.03%로 하락했습니다. 이번 주에 시장의 초점은 수요일에 발표된 CPI 데이터에 맞춰질 것이며, 이는 중기 가격 추세의 주요 원동력이 될 수 있습니다.

출처 : 투자

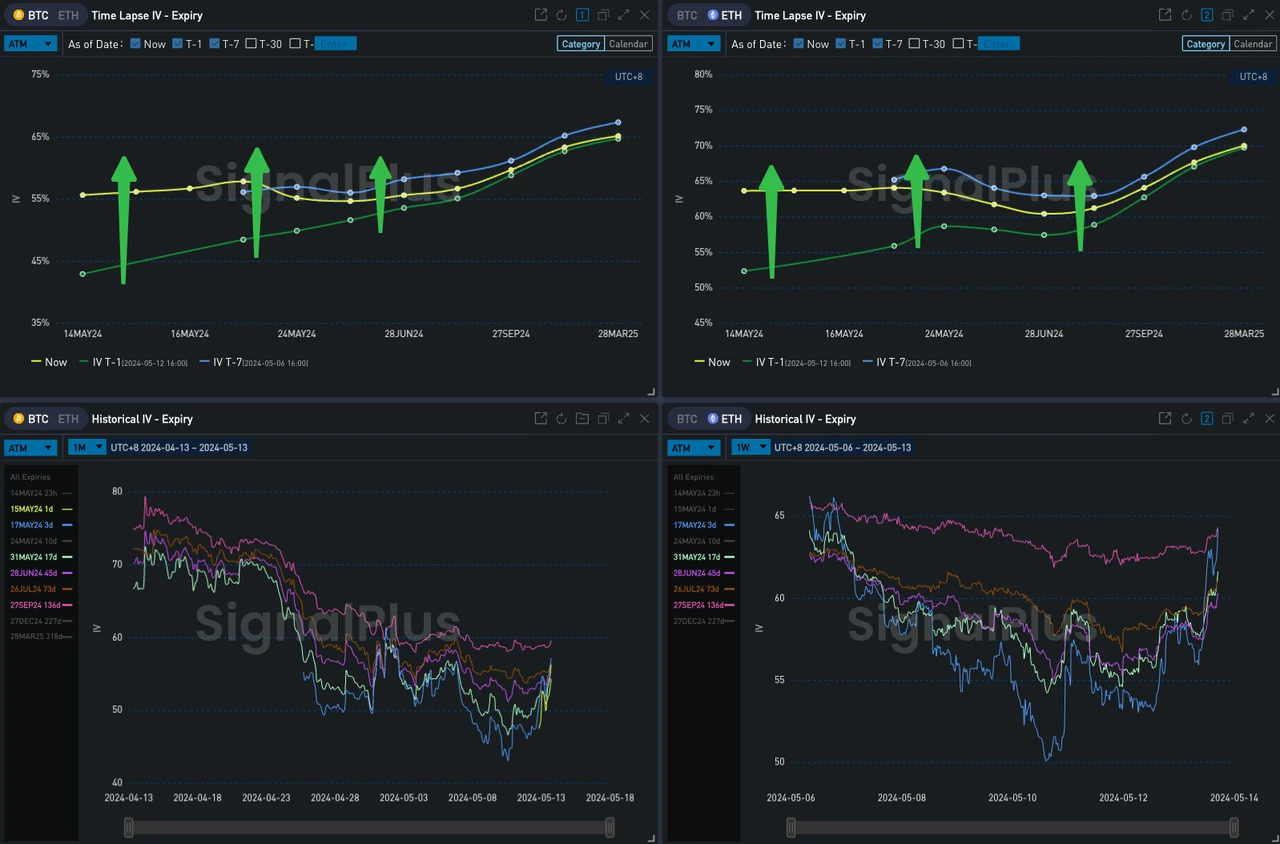

디지털 통화 측면에서, 주초에 BTC는 강세를 보이며 단기적으로 63,000 마크를 돌파했습니다. 프런트엔드 내재 변동성은 평평해지고 급등했습니다. 그 중 5월 17일은 CPI 불확실성의 영향으로 지역 IV 고점을 형성했습니다. 투자자들은 소비자 물가가 냉각될 조짐을 보일지 주의 깊게 지켜보고 있으며, 이는 디지털 통화 및 기타 위험 자산에 베팅하는 시장에 큰 도움이 될 것입니다. 반면에 나쁜 인플레이션 보고서는 또한 거래자들에게 경제적 과부하에 대한 우려를 불러일으킬 것이며 디지털 통화 가격 하락으로 이어질 수 있습니다.

출처: TradingView

주목할 만한 두 가지 사항이 더 있습니다. Cryptonews에 따르면, 일본의 투자 컨설팅 서비스 회사인 Metaplanet은 회사의 비트코인 우선, 비트코인 전용 전략을 성명서에서 명확히 밝혔으며, 장기 엔화 대출 및 정기 주식 발행과 같은 금융 솔루션을 제공하며, 이는 점점 약해지는 엔화를 유지하는 것보다 지속적으로 더 많은 비트코인을 축적하기 위한 것이라고 덧붙였습니다.

또 다른 것은 미국 대선에 관한 것입니다. 최근 바이든 행정부의 디지털 통화 규제 강화 조치가 투자자들 사이에 불만을 불러일으켰습니다. 현재 미국 대통령인 바이든의 지지자인 억만장자 마크 쿠반은 최근 갑자기 돌아섰습니다. 그는 바이든의 리더십 하에서 미국 증권거래위원회 위원장인 게리 겐슬러가 투자자를 보호하지 못하고 합법적인 암호화폐 회사가 운영되는 것을 거의 불가능하게 만들었다고 생각합니다. 그는 비트코인과 암호화폐에 계속 반대한다면 공화당 대선 후보인 도널드 트럼프가 2024년 대선에서 이길 가능성이 높다고 경고했습니다. 사실 트럼프의 비트코인에 대한 태도도 최근 180도 바뀌었습니다. 2019년에 그는 공개적으로 비트코인을 좋아하지 않는다고 말했지만 최근 Mar-a-Lago 행사에서 참석자들에게 암호화폐를 지지한다면 트럼프에게 투표하는 것이 낫다고 관대하게 말했고 이는 커뮤니티에 센세이션을 일으켰습니다. 미국 언론 폴리티코는 이 발언을 바이든에 대한 새로운 무기로 묘사했고, 디지털 화폐 정책 개발도 다음 선거에서 점점 더 중요한 역할을 할 것으로 전망했다.

출처: Deribit (2016년 5월 13일 16:00 UTC+8 기준)

출처: 시그널플러스

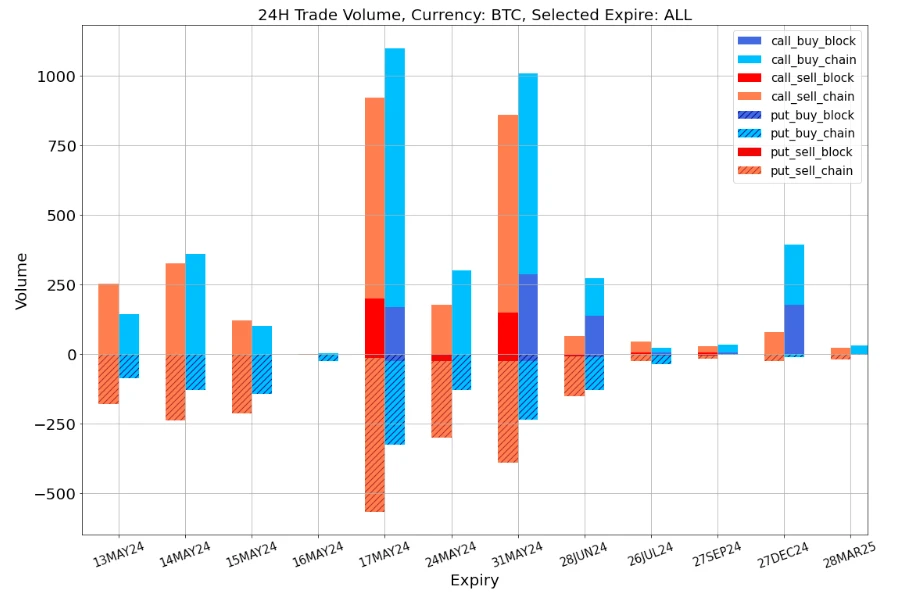

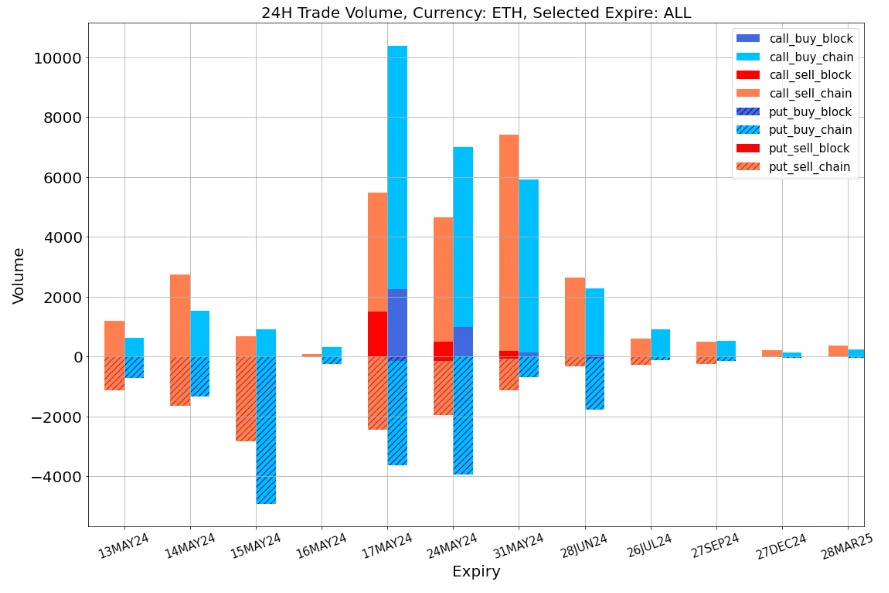

데이터 출처: Deribit, BTC ETH 전체 거래 분포

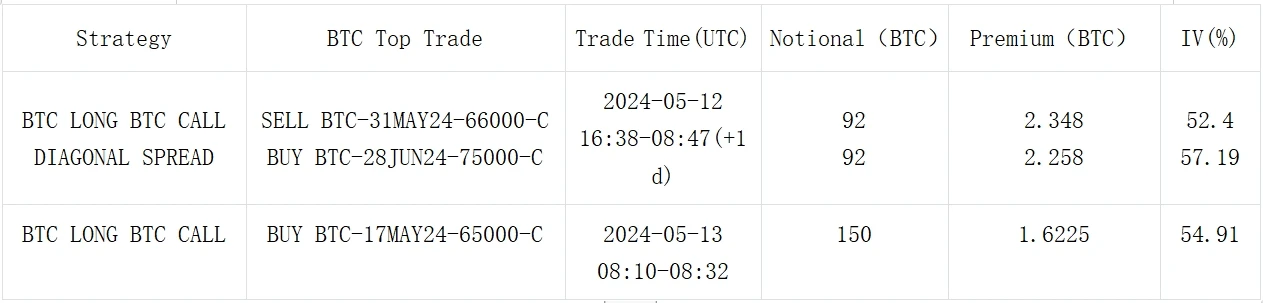

출처: Deribit 대량매매

출처: Deribit 대량매매

ChatGPT 4.0의 플러그인 스토어에서 SignalPlus를 검색하여 실시간 암호화 정보를 얻을 수 있습니다. 업데이트를 즉시 받으려면 Twitter 계정 @SignalPlus_Web3을 팔로우하거나 WeChat 그룹(WeChat 보조자 추가: SignalPlus 123), Telegram 그룹 및 Discord 커뮤니티에 가입하여 더 많은 친구와 소통하고 상호 작용하세요. SignalPlus 공식 웹사이트: https://www.signalplus.com

이 기사는 인터넷에서 발췌한 것입니다: SignalPlus Volatility Column (20240513): Strong Start

관련 항목: Crypto Whale, Meme Coin PEPE로 $1040만개 구매

간략히 암호화폐 고래는 PEPE에 $1,040만 달러를 투자합니다. 해당 거래에는 1조 2380억 PEPE가 포함됩니다. PEPE의 가치는 지난달 29.70% 상승했습니다. 암호화폐 고래가 밈 코인 PEPE에 $1040만 달러를 투자한 것으로 알려지면서 주목할만한 거래가 암호화폐 시장을 뒤흔들었습니다. 시장 활동이 급증하는 가운데 진행된 이러한 대규모 투자는 밈에서 영감을 받은 이 디지털 자산의 미래에 대한 격렬한 논의를 촉발시켰습니다. Crypto Whale은 1조 2400억 개의 PEPE 토큰을 구매합니다. Spot On Chain은 유명한 암호화폐 분석 플랫폼으로 이 거래를 조명했습니다. 0x1a2e64b8a1977bf018850b377020bc33eaaac3c9로 알려진 다중 서명 지갑에 대한 세부 정보가 공개되었습니다. 이는 바이낸스에서 무려 9,158억 5천만 개의 PEPE 토큰 이동을 촉진했습니다. 이 초기 거래의 가치는 약 $775만 달러로, 토큰당 $0.000008466의 비율로 계산됩니다. 다음 28시간 동안 신속하게 연속적으로…