The tariff policy has hit the crypto market hard. What do institutional analysts think about the market outlook?

オリジナル | Odaily Planet Daily ( @OdailyChina )

著者 | アッシャー ( アッシャー )

The butterfly effect of tariff policy has set off a hurricane in the 暗号 市場。 At 4 a.m. this morning, U.S. President Trump officially announced at the White House that a 10% minimum base tariff would be imposed on most imported goods worldwide, and that retaliatory tariffs of a higher proportion would be imposed on dozens of countries and regions, causing the cryptocurrency market to suffer another heavy blow ( for details on tariffs, please refer to: The White House Launches Tariff War 2.0 ).

-

OKX market data shows that around 4:15 this morning, BTC first “lured more” to $88,500 and then continued to fall. At around 8:00 this morning, it once fell below $82,500 (the lowest fell to $82,169) , with a short-term decline of more than 5%. As of around 11:30 (the same below), it was temporarily reported at $83,600.

-

In addition to BTC, ETH fell from around $1960 to below $1800 in a short period of time. It is currently trading at $1824, a 24- hour drop of 3.03%; SOL fell from around $136 to below $117, and is currently trading at $119, a 24-hour drop of 4.04%;

-

In the U.S. stock market, the three major stock index futures plummeted after the market, with the Dow Jones Industrial Average futures plummeting 1,007 points (a drop of 2.3% ), the SP 500 futures falling 3.4%, and the Nasdaq 100 futures plummeting 4.2%;

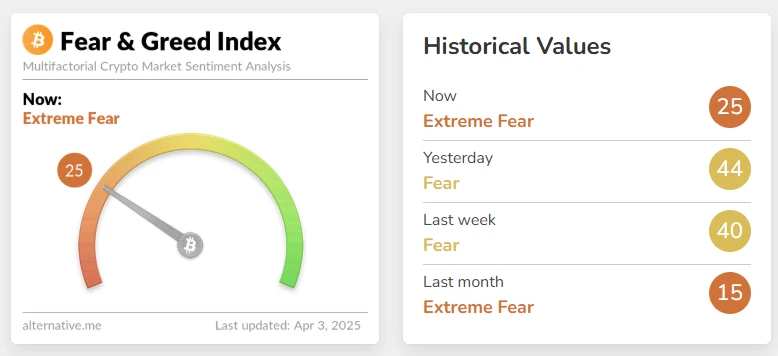

Affected by the overall downward trend, the total market value of cryptocurrencies has also fallen rapidly. According to CoinGecko data, the total market value of cryptocurrencies has fallen below $2.8 trillion, down 4% in 24 hours , temporarily reporting $278 million. 加えて、 代替 data shows that todays Fear and Greed Index has dropped from 44 to 25, once again entering an extreme panic state.

Fear and Greed Index

デリバティブ取引に関しては、 コイングラス data shows that the entire network has liquidated $396 million in the past 12 hours. In terms of currencies, BTC liquidated $151 million and ETH liquidated $75.25 million.

BTC price finally rebounded for two days, will it continue to fall due to the impact of US tariff policy? Will altcoins still have a day to rise? Below, Odaily Planet Daily sorts out the views of industry leaders/institutions on this mornings tariff policy.

What do the various leaders/institutions think?

Arthur Hayes: BTC will be “out of danger” if it can hold $76,500 until Tax Day on April 15

Arthur Hayes, co-founder of BitMEX, wrote that the market’s reaction to “Liberation Day” was not good. “If Bitcoin can hold $76,500 between now and US Tax Day (April 15), we will be out of danger.” He also reminded investors “not to be cut by volatile market conditions.”

Analyst Ali Martinez: BTC is currently in a critical range between $84,800 and $86,900

Crypto analyst Ali Martinez wrote that after the tariff policy was introduced, BTC is currently in a critical range of $84,800 to $86,900. The hourly chart shows that whichever side breaks through/falls below first may determine the next big move.

Chris Burniske: No aggressive action will be taken for now. If the price drops further today, we will focus on specific assets and increase our positions when the time comes.

Placeholder partner Chris Burniske wrote that today is expected to be a positive turning point and no aggressive action will be taken at this time. If the market maintains the current range, it will continue to hold; if the tariff policy causes the crypto industry to fall further today, it will pay attention to specific assets and choose the opportunity to increase positions.

Santiment: Crypto market reacts weakly to tariff policy, safe-haven funds still flow to gold

Analysts at blockchain analysis platform Santiment said that after Trump announced the new tariff policy at the White House, market sentiment quickly heated up, but the performance of the crypto market was relatively sluggish. At present, investors safe-haven funds mainly flow to gold. In the past three months, the price of gold has risen by 20%, breaking through $3,190 per ounce, while Bitcoin still maintains a high degree of linkage with the SP 500 index.

On social media, market opinions diverge: some analysts believe that this situation is similar to the market shock caused by the trade war in 2018, which may be beneficial to the crypto market in the long run; but some voices point out that the US economic structure cannot withstand high tariffs, and the market may usher in greater volatility. In the short term, the crypto market sentiment is cautious, and the real market reaction will be further revealed after the opening of the US stock market.

グレースケールリサーチ : The impact of tariffs on cryptocurrencies may have been priced in and the worst may be over

Zach Pandl, director of Grayscale Research, said, The impact of tariffs on cryptocurrencies may have been priced in and the worst may be over. I think tariffs will weaken the dominance of the US dollar and create space for competitors, including Bitcoin. Prices have fallen in the short term. But the first few months of the Trump administration have further strengthened my long-term confidence in Bitcoin as a global monetary asset.

This article is sourced from the internet: The tariff policy has hit the crypto market hard. What do institutional analysts think about the market outlook?

Related: What to Expect from Bitcoin (BTC) Price in March 2025

After spending most of February trading within a range, Bitcoin (BTC) has broken below the consolidation zone, slipping under $90,000 for the first time since November. The leading coin now trades at $88,956. This downturn signals growing bearish pressure, raising concerns that the decline could extend further into March. Range-Bound or Breakout? Experts Weigh In According to Brian, lead analyst at Santiment, Bitcoin whales continue to reduce their trading activity, increasing the likelihood of a further decline in the coin’s value. “Bitcoin whales seem to have taken a bit of a breather and aren’t accumulating at the moment (mostly staying flat),” Brian told BeInCrypto. The decline in Bitcoin’s large holders’ netflow corroborates Brian’s position. According to IntoTheBlock, the metric has plummeted by over 600% in the past 30 days. Bitcoin…