Ethereum is in a midlife crisis, data dimension analysis of development performance

オリジナル|Odaily Planet Daily ( @OdailyChina )

著者: ウェンザー ( @ウェンサー 2010 )

There is no doubt that the Ethereum ecosystem, which has just celebrated its tenth anniversary, is now facing a midlife crisis.

On the one hand, Vitalik Buterin is still pushing for the ongoing reform of the Ethereum Foundation, which has not yet been declared over; on the other hand, ETH has been losing ground in many aspects, such as technical route, ecological development, and price performance. The dumping of many ancient whales, the net outflow of Ethereum spot ETFs, and the increasingly rigid deflation mechanism of ETH are all plaguing the huge ecosystem of the former king of altcoins.

When it is difficult to reconcile the decentralized vision and market price performance, perhaps we need to find the answer to why this has come to this from various data performances of the Ethereum ecosystem.

Ethereum in trouble

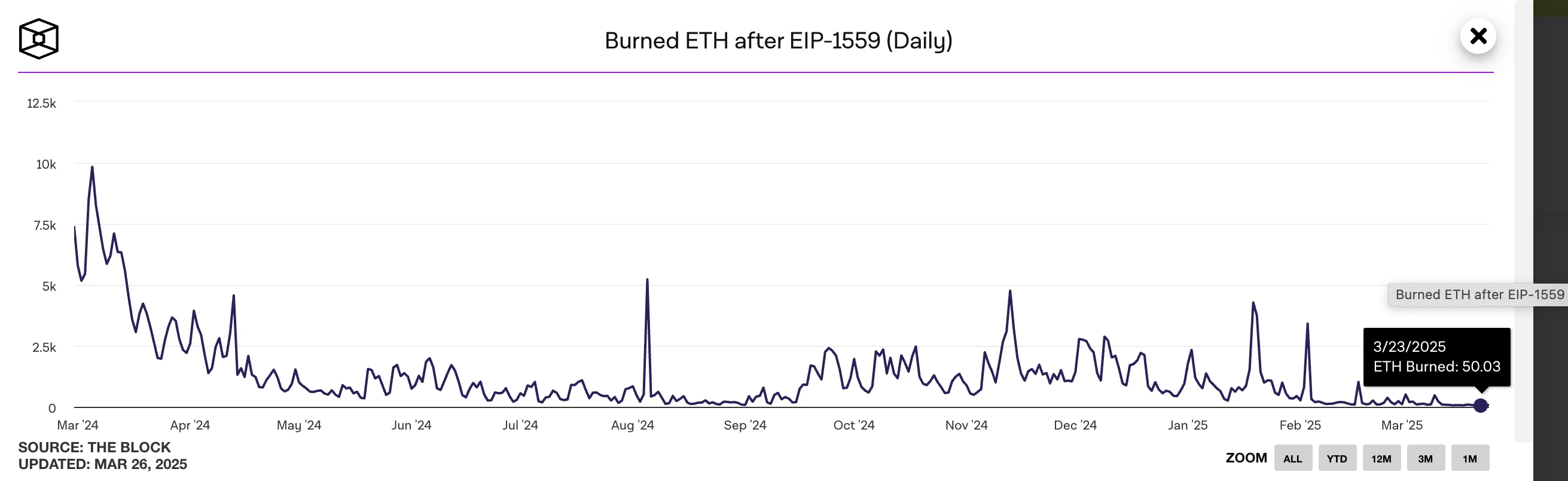

Ethereum daily destruction hits record low

On March 22, the Ethereum network destroyed only 53.07 ETH in a single day , worth about US$106,000; on March 23, the Ethereum network destroyed only 50.03 ETH in a single day , setting a new historical low.

ソース: TheBlock Data

These data indicate a significant reduction in demand for Ethereum block space. Ethereum’s EIP-1559 change streamlines the transaction fee process while requiring the destruction of all ETH used to pay for basic transaction fees. This mechanism is designed to reduce inflationary pressure and could make Ethereum a deflationary asset during periods of peak network activity.

But contrary to expectations, as the activity of the Ethereum ecosystem has further declined, EIP-1559 has not been very effective in alleviating ETHs inflation.

In addition, the number of newly created addresses, transactions, and daily transaction volume in the Ethereum ecosystem have also declined in recent weeks.

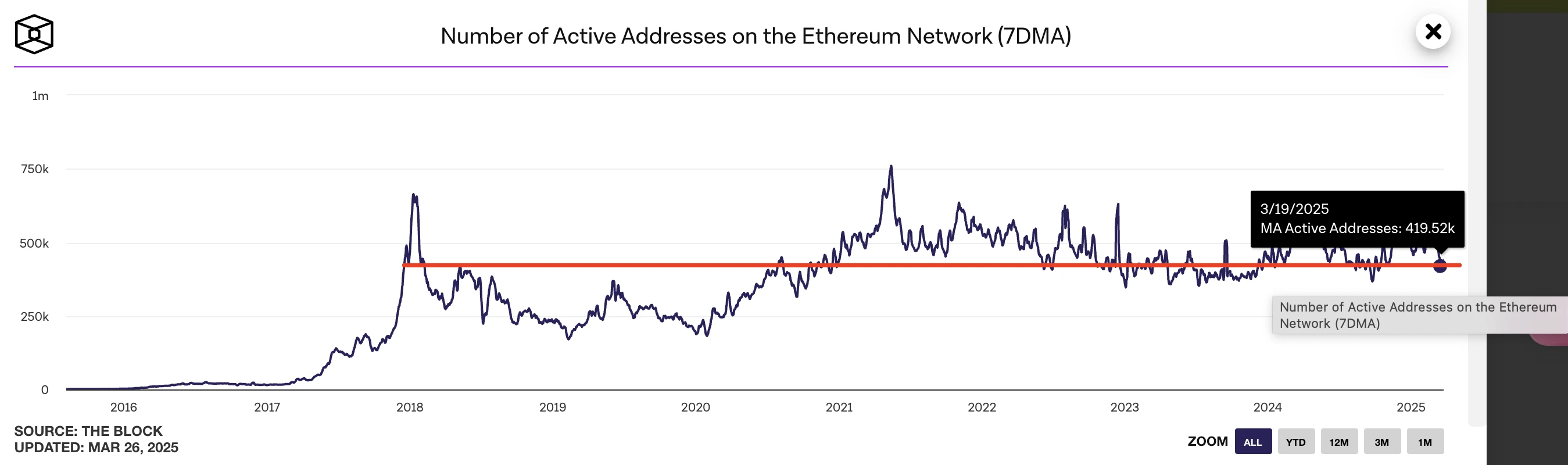

The 7-day average number of active addresses on the Ethereum network has fallen to its lowest point so far this year

ソース: TheBlock Data

According to data from TheBlock, the seven-day average number of active addresses on the Ethereum network fell to 419,000 on March 19, the lowest point since 2025; it was the same as the number of active addresses in October 2024.

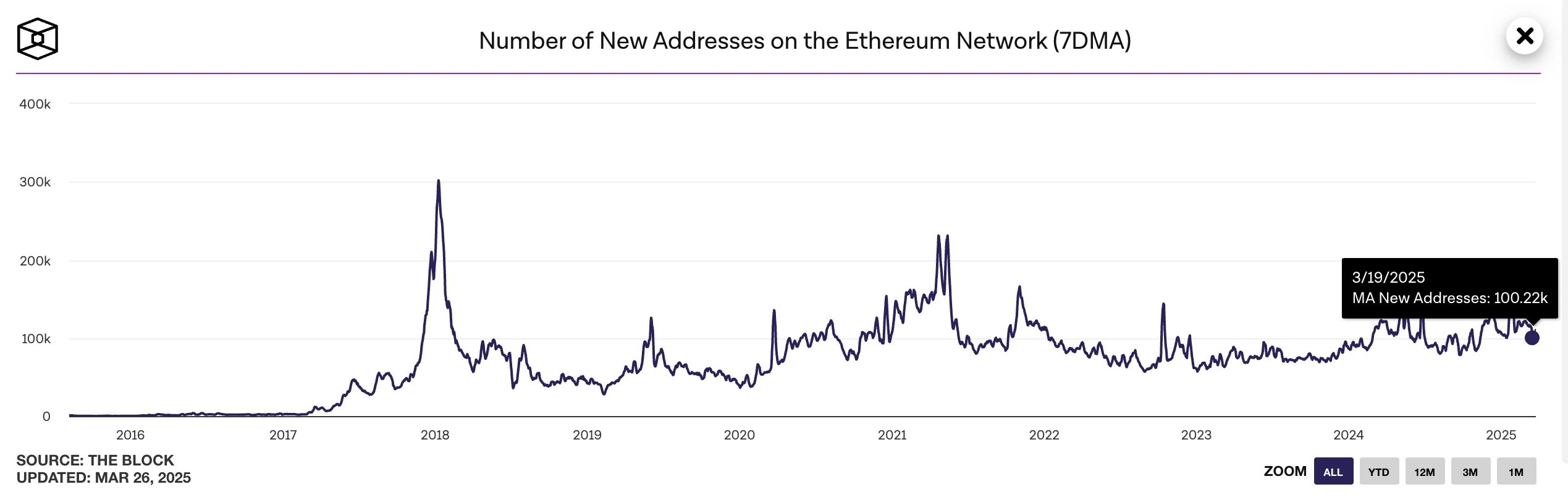

The 7-day average of new addresses on the Ethereum network has dropped to 100,000

によると data from TheBlock , on March 19, the 7-day average number of new addresses on the Ethereum network dropped to 100,220, which was the same as around November 12, 2024; compared with the data of 163,000 on January 25 this year, it has fallen by more than 38%.

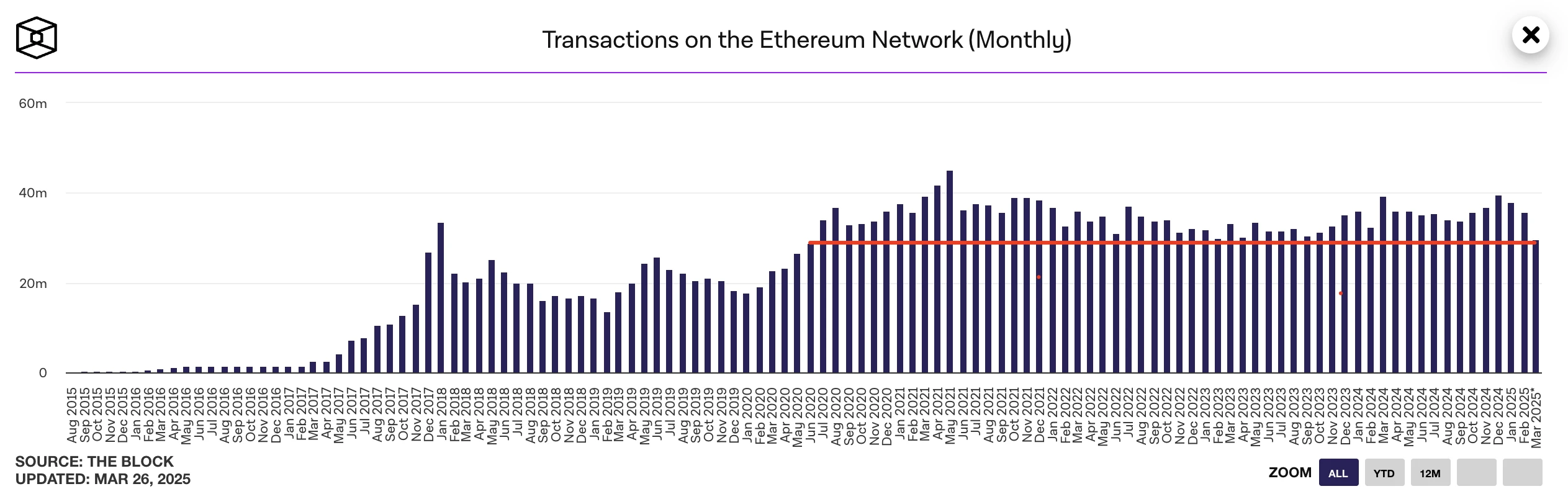

Ethereums monthly transaction volume fell back to around 30 million

によると TheBlock data , as of March 26, the monthly transaction volume of Ethereum was 29.53 million times, close to the same period in September 2023; in June 2020, the number was about 28.8 million times.

Ethereums monthly new addresses drop to pre-October 2024 levels

によると TheBlock data , as of March 26, the monthly number of new addresses in Ethereum was approximately 2.75 million, which is comparable to the level before October 2024; slightly higher than February 2024.

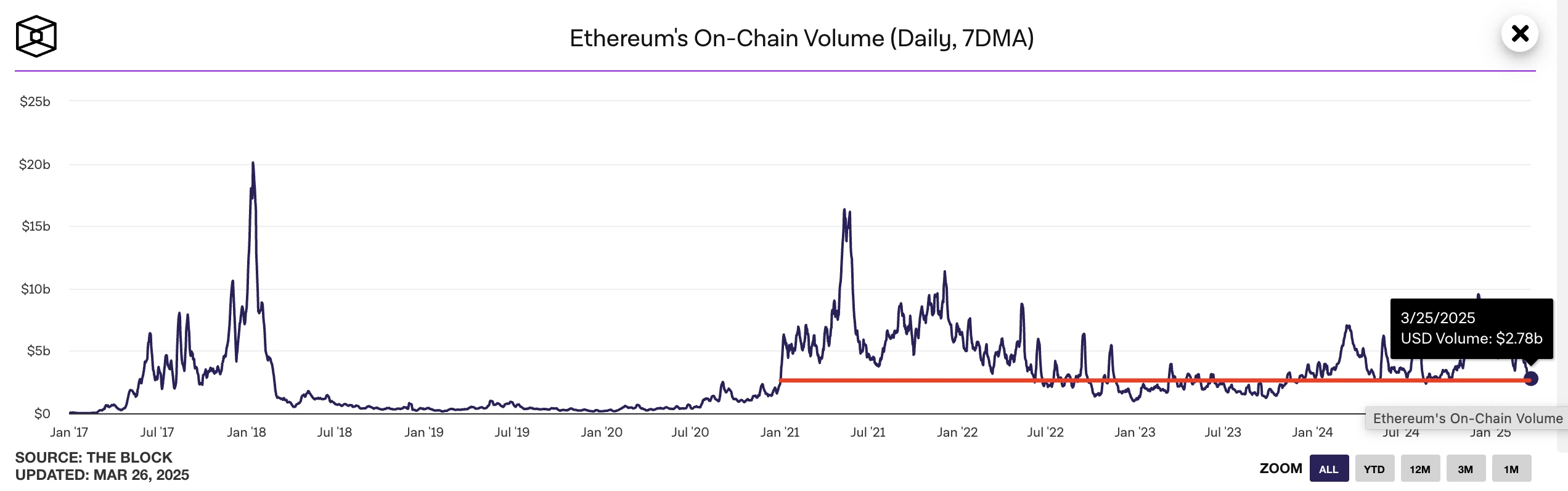

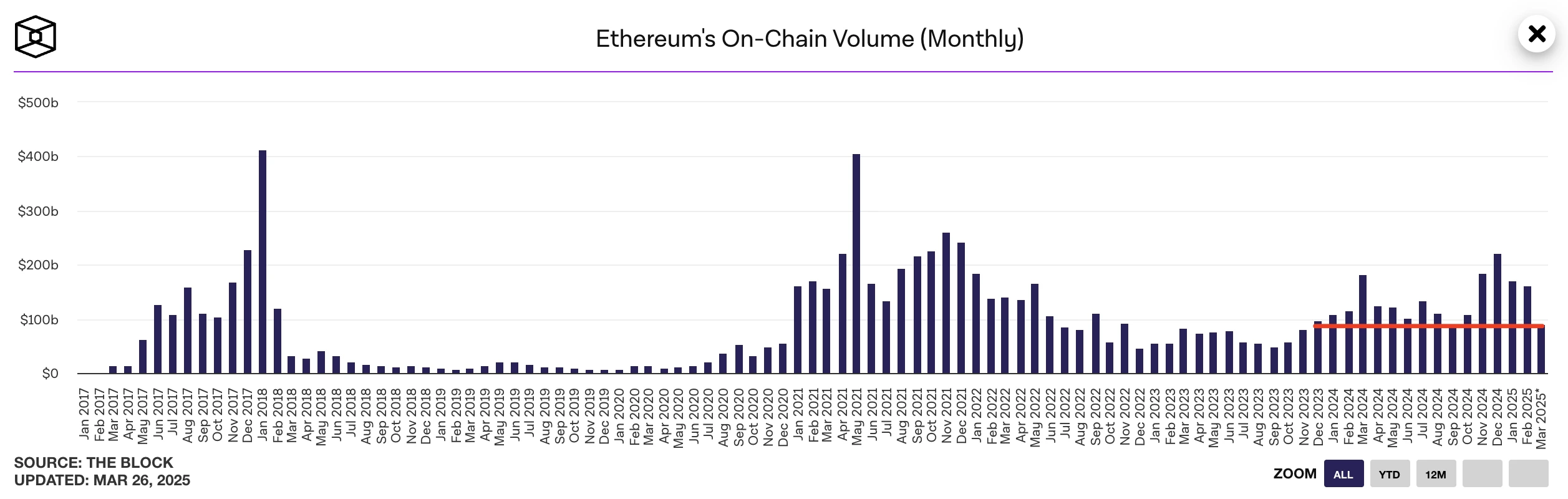

Ethereum network daily transaction volume drops to August 2024 levels

によると TheBlock data , on March 25, the Ethereum chain transaction volume was approximately US$2.78 billion, which is approximately the same level as the same period in August 2024.

Ethereum network monthly transaction volume drops to September 2024 levels

によると TheBlock data , as of March 26, Ethereums monthly on-chain transaction volume was approximately US$90.93 billion, comparable to the same period in September 2024 and slightly higher than US$80.99 billion in November 2023.

Ethereums average transaction fee cost has dropped by more than 99.1% from its historical high

によると TheBlock data , on March 25, the average transaction fee cost of Ethereum was only US$0.43; compared with the average transaction fee cost of US$52.53 on November 2, 2021, it was only 0.81%.

ETHs annual inflation rate is about 0.76%, slightly lower than BTCs 0.82

によると ultrasound.money data, considering the destruction rate in the past 7 days, the supply of ETH is expected to grow by 0.76% per year.

Currently, the total supply of ETH is about 120 million; in the past 7 days, a total of 18,128.15 ETH were issued; 487.76 ETH were destroyed; the estimated annual destruction amount is about 25,000 ETH.

ETHs midlife crisis: swinging between the dilemma of urgently needing to find a new position and resisting the traditional financial system

ETH’s “new positioning dilemma”: Unable to become the second BTC

As Geoff Kendrick, head of digital asset research at Standard Chartered Bank, puts it, Ethereum is in the midst of a “midlife crisis,” still fumbling through a series of technological upgrades designed to make it more attractive to a wider audience.

In my personal opinion, whether it is ZK or L2 route, in the short term or even in the medium term of 3-5 years, it is somewhat powerless to boost the price of ETH and develop the ecosystem.

At the same time, ETH prices have fallen by 40% in the past three months. Meme coins promoted by Trump and Argentine leader Miley both use Solana. Adam McCarthy, a research analyst at data provider Kaiko, believes that Ethereum is not interesting to most people. If compared with Bitcoin, Bitcoin has long established the narrative of digital gold. David Lawant, head of research at FalconX, also said that Ethereum has failed in the native field and ETFs are not very attractive.

In other words, ETHs vision of a world computer has lost the excitement and coolness of participating in building a new world that the blockchain world had in its wild days. It has gradually become a testing ground for closed development by a huge vested interest group and technical bureaucrats.

Despite this, the traditional financial market still has extremely high expectations for the ETH ecosystem and places heavy bets on it.

BlackRock BUIDL Fund deploys RWA track: funds on the Ethereum chain exceed $1 billion

によると トークン Terminal dataon March 23 , BlackRock BUIDL Fund has deployed more than $1 billion in funds on the Ethereum chain, currently reaching about $1.145 billion. The BUIDL Fund focuses on tokenized real-world assets (RWA) and makes diversified investments on chains such as Avalanche, Polygon, Aptos, Arbitrum and Optimism, but Ethereum remains its core configuration.

According to Nansens analysis, the number of addresses holding 1,000-10,000 ETH has increased by 5.65% since March 12, 2024, while the number of addresses holding 10,000-100,000 ETH has increased by 28.73%. In other words, ETH whales are still increasing their holdings, and their belief in Ethereum remains unshakable.

From an outsiders perspective, this is both ETHs luck and misfortune – the luck is that Diamond Hand is an indispensable part of maintaining price stability and ecological development; the misfortune is that vested interest groups are often unable and unwilling to promote disruptive innovation and subversive development because it involves their own vital interests – as the old saying goes, touching the cake is like killing the parents, and the 暗号 circle is no exception.

Conclusion: ETH has regressed to the 2021 stage and needs a new wave of revolution

After experiencing the GameFi, NFT, and Meme coin waves starting in 2021, ETH has gradually regressed to the stage before 2021 since 2024. On the one hand, the problem of further dispersion of liquidity brought about by embracing the L2 technology route has been solved. The ETH mainnet Gas problem has been solved, but the problem of no one using it and no one wanting to use it has arisen; on the other hand, various tracks have been falsified layer by layer. Not only the ETH ecosystem, but all cryptocurrencies including BTC have gradually become U.S. stocks and have become vassals of the U.S. economy.

The next step will either be a self-revolution within the Ethereum community or a price revolution from the BTC or SOL ecosystem.

This article is sourced from the internet: Ethereum is in a midlife crisis, data dimension analysis of development performance

At the beginning of 2025, Hong Kong has released two explosive news. One is that Hua Xia Bank has launched the first retail tokenized fund in the Asia-Pacific region in Hong Kong (see Crypto Salads Asia-Pacifics first retail tokenized fund landed in Hong Kong! Web3 lawyers explain the on-chain innovation of fund tokenization and the future of RWA for more details); the other is that the Hong Kong Finance Minister announced that the second Hong Kong Virtual Asset Development Policy Declaration will be released soon, which will further innovate on how to better combine traditional assets with virtual assets. In the eyes of many people, these two pieces of good news represent the implementation of the compliance of the RWA project. At the same time, combined with the news that…