Solana staking reward adjustment proposal, what impact will it have on SOL prices?

Original article by: David Grider, Partner at FinalityCap

原文翻訳: zhouzhou、BlockBeats

Editor鈥檚 note: This article discusses the proposal for adjusting Solana鈥檚 staking rewards. There are problems with the arguments in the proposal, especially the impact of high staking rewards on DeFi returns and inflation on selling pressure. David countered that there is a close relationship between staking returns and network security and market demand, and that staking returns should be determined by the market.

以下は元のコンテンツです(読みやすく理解しやすいように、元のコンテンツを再編成しました)。

I have serious concerns about Solanas proposed inflation reduction measure SIMD-0228, especially the current version proposed by TusharJain and Kankanivishal from multicoincap and MaxResnick 1, especially without addressing some key risks and issues.

After listening to the latest Solana validator call, I think the arguments for implementing this change are deeply flawed.

Here is my summary of the arguments presented, which I will refute in the following tweets:

1: High staking reward rates are unfavorable to DeFi returns

2: Inflation increases selling pressure and should be compared to network fees

3: High staking rewards reduce the need for ETFs

4: Staking returns are not US tax-optimized like capital gains

5: Higher staking returns do not lead to higher prices

6: The staking formula will optimize the staking ratio, thus solving the security problem (which is the most important security risk and the wrong approach in my opinion)

Argument 1: High staking ratio is not good for DeFi returns.

Rebuttal 1: SOL staking is Solana鈥檚 risk-free rate. Just as higher risk-free rates on Treasury bonds lead to higher interest rates on the credit curve, higher staking returns drive higher DeFi rates and profits.

Argument 2: Inflation increases selling pressure, which should be contrasted with fees.

Rebuttal 2: This is not true, just like unlocking does not necessarily lead to selling pressure, whether to sell depends on the holders choice. Validators can choose to re-stake. Inflation has a smaller impact on liquidity than other supply factors. Rather than comparing selling pressure to fees, it is better to compare it to fund flows. You can look at Solana ETP fund flows as a measurable indicator, but demand from funds and individuals is larger and more important.

Argument 3: High staking rewards reduce the demand for ETFs.

Counterargument 3: Just because someone uses this argument to explain weak demand for ETH ETFs, doesn鈥檛 mean it applies to Solana as well. Looking at many of the European SOL ETPs, which take the entire staking yield and charge no fees, these products have attracted considerable inflows (see above). Moreover, US ETFs are also close to allowing staking, so this argument doesn鈥檛 hold up in the long run.

Argument 4: Staking returns are not tax-optimized like capital gains.

Counterargument 4: Solana is a global decentralized network, and we should not optimize only for US tax policy, which can change at any time, just like equity investors will ignore the impact of tax changes on stock valuations.

Argument 5: Higher staking returns do not lead to higher prices.

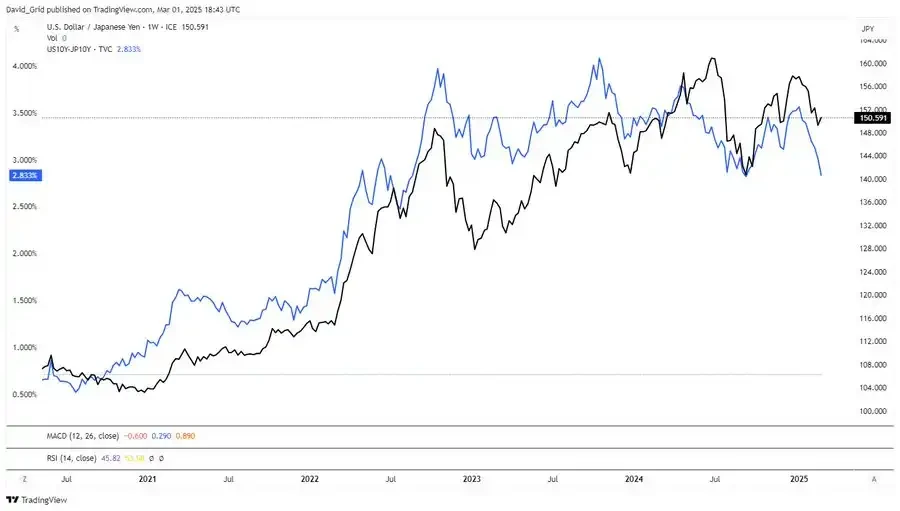

Rebuttal 5: The real world proves this not to be true. Just look at the way conventional currencies are priced. The appreciation of one FX currency relative to another is usually based on interest rate differentials. Relatively higher interest rates lead to stronger currencies. Here is a chart of the USD/JPY spread between the US 10-year Treasury bond and the Japanese 10-year Treasury bond as an example.

Argument 6: The staking formula will optimize the staking ratio, thereby solving the security problem.

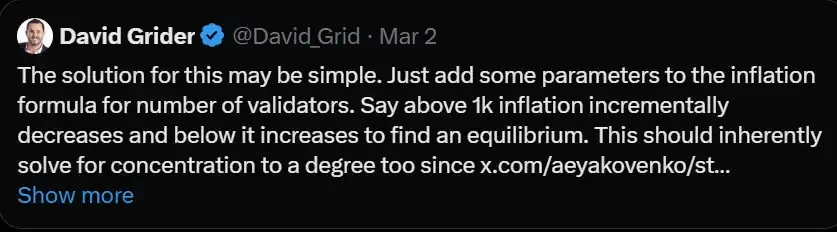

Rebuttal 6: It also requires optimizing the number of validators and stake distribution. Running a Solana validator is expensive, and the number of validators is already declining.

Rebuttal 6 (continued): The analysis that must be done to safely pass this proposal, but which I have not yet seen, is:

Simulate how many of the currently active small validators would become unprofitable and exit under the new proposal. This analysis needs to be done under different network activity and SOL price assumptions, especially in a bear market scenario, considering an 80% drop in MEV, base fees, and price. Then look at the current Solana validator list to see how many current validators would become unprofitable and exit under these scenarios.

We can debate how many validators Solana needs. It may not be artificially inflated to 100,000 like ETH, but we also don鈥檛 want Solana to become a Cosmos chain with only 100 validators.

Also, because proponents have brought up the US tax argument to push this proposal, and we don鈥檛 know what the SEC鈥檚 decentralization test is, we may want to keep the number of validators above 1,000 so that SOL maintains its commodity nature.

In summary, this proposal should not pass unless someone at least completes this analysis.

The proposal does ask the right question: how much inflation is needed? But there are other questions we need to answer before making changes. I do agree that the number could be lower and should be more dynamic. Just like companies don鈥檛 need to pay fixed amounts to suppliers or provide fixed returns to financiers, the market should determine the number, so I support this direction. We just need to slow down and do more work to understand the impact.

This might actually be a high-level solution to this risk.

My sincere suggestion is that we should not assume and generalize the impact. We should do a data analysis and show all the assumptions and data.

This article is sourced from the internet: Solana staking reward adjustment proposal, what impact will it have on SOL prices?

Original author: KarenZ, Foresight News For a long time, the Ethereum Foundation has been mired in criticism for being opaque, ignoring community voices, and burning money like water, and its leadership structure and staffing have been controversial. Coupled with the frequent small-amount selling of ETH and inaction in the face of community needs, a series of FUDs have continuously eroded the markets confidence in it. Recently, many Ethereum community users and developers have turned to Solana, and the Ethereum ecosystem is facing an unprecedented dilemma. It seems that there is not much time left for Ethereum. However, under the reverse urging and criticism of the community, the Ethereum Foundation and Vitalik Buterin seem to have finally realized the urgency of change. In recent days, they announced two major decisions: one…