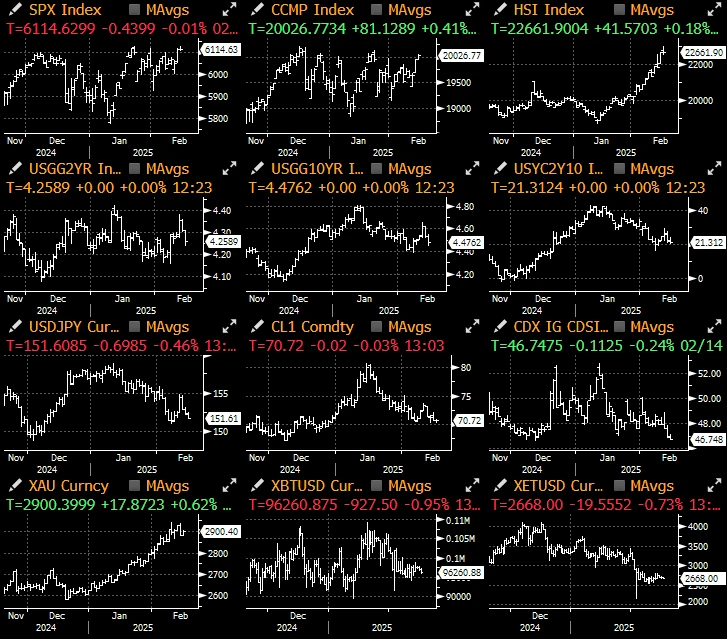

The macro market has entered a low-volatility consolidation phase, with sentiment returning to the familiar Goldilocks mode, with stocks and bonds slowly rising on benign economic data and lower volatility.

The Trump administration once again released new developments regarding tariffs, but the market reaction was relatively cold, indicating that the market has gradually become immune to such news. The latest reciprocal tariffs policy has been postponed to April 1, and will be reviewed against major trading partners such as Canada, Mexico, India and China.

Overall, although the market has many imaginations about Trumps policies in his second term, Trump-related transactions have not performed well this year, lagging significantly behind the broader market index. The US dollar and crude oil prices have fallen sharply, while emerging market stocks and foreign exchange have performed relatively strongly.

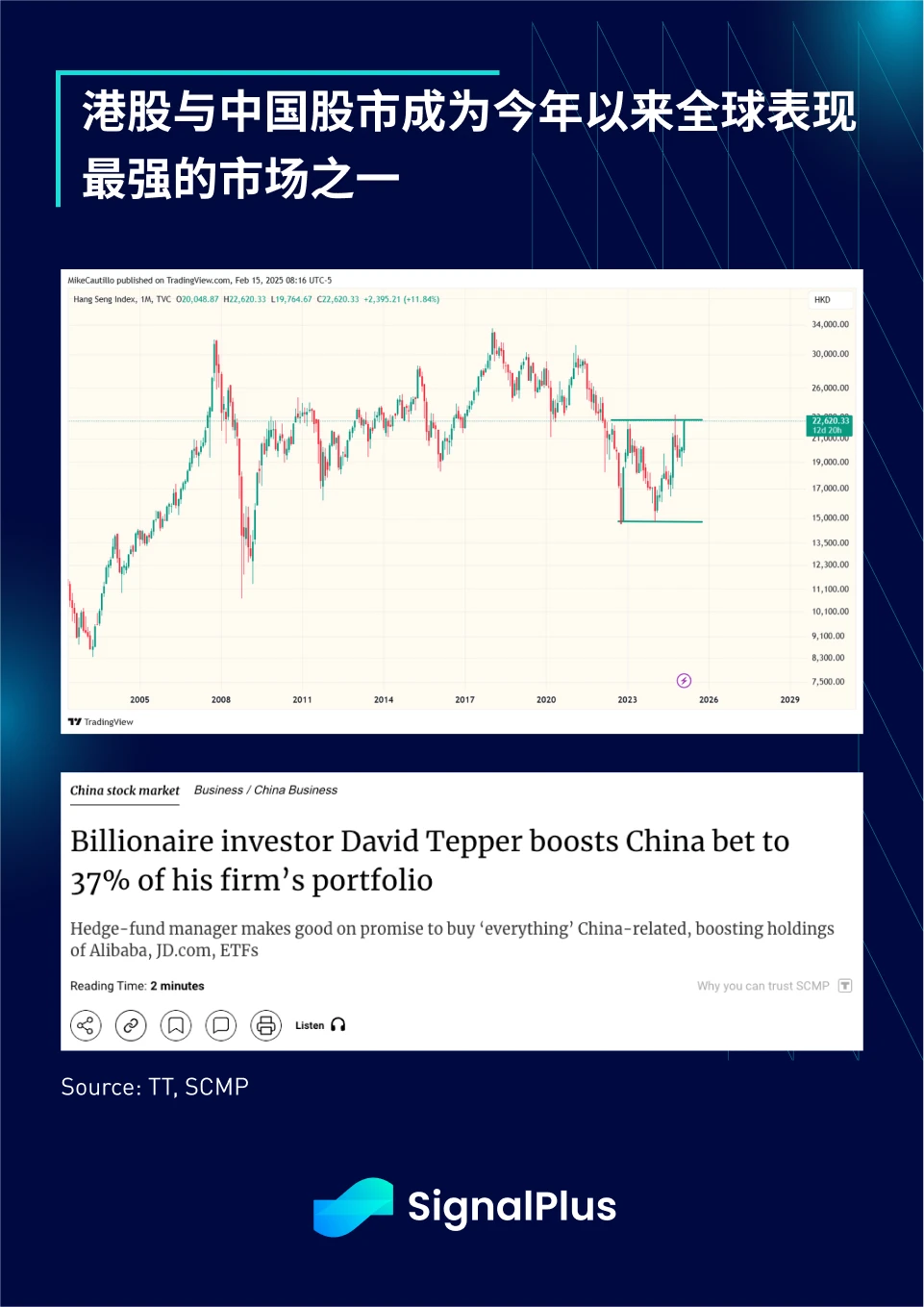

Most notably, Chinese stocks have been performing exceptionally well, initially driven by the DeepSeek AI craze and more recently by warming relations between the government and domestic technology companies. The Hang Seng Index (HSI) appears to be poised to break out of a multi-year downward trend, while major companies such as Alibaba are beginning to attract attention from U.S. fund managers and institutional investors.

US economic data has been lackluster, with last week鈥檚 CPI data coming in above expectations and last Friday鈥檚 retail sales data coming in weak, and market expectations for a June rate cut have returned to around 60%. Chairman Powell did his best to downplay market concerns about inflation at a recent congressional Financial Services Committee hearing:

The CPI data was higher than almost all forecasts, but I want to remind you two things. First, we will not be overly optimistic because of one or two good data, nor will we be overly pessimistic because of one or two bad data. Second, our inflation target focuses on the personal consumption expenditure (PCE) price index because we believe it better reflects inflation conditions. – Powell, February 13, 2024

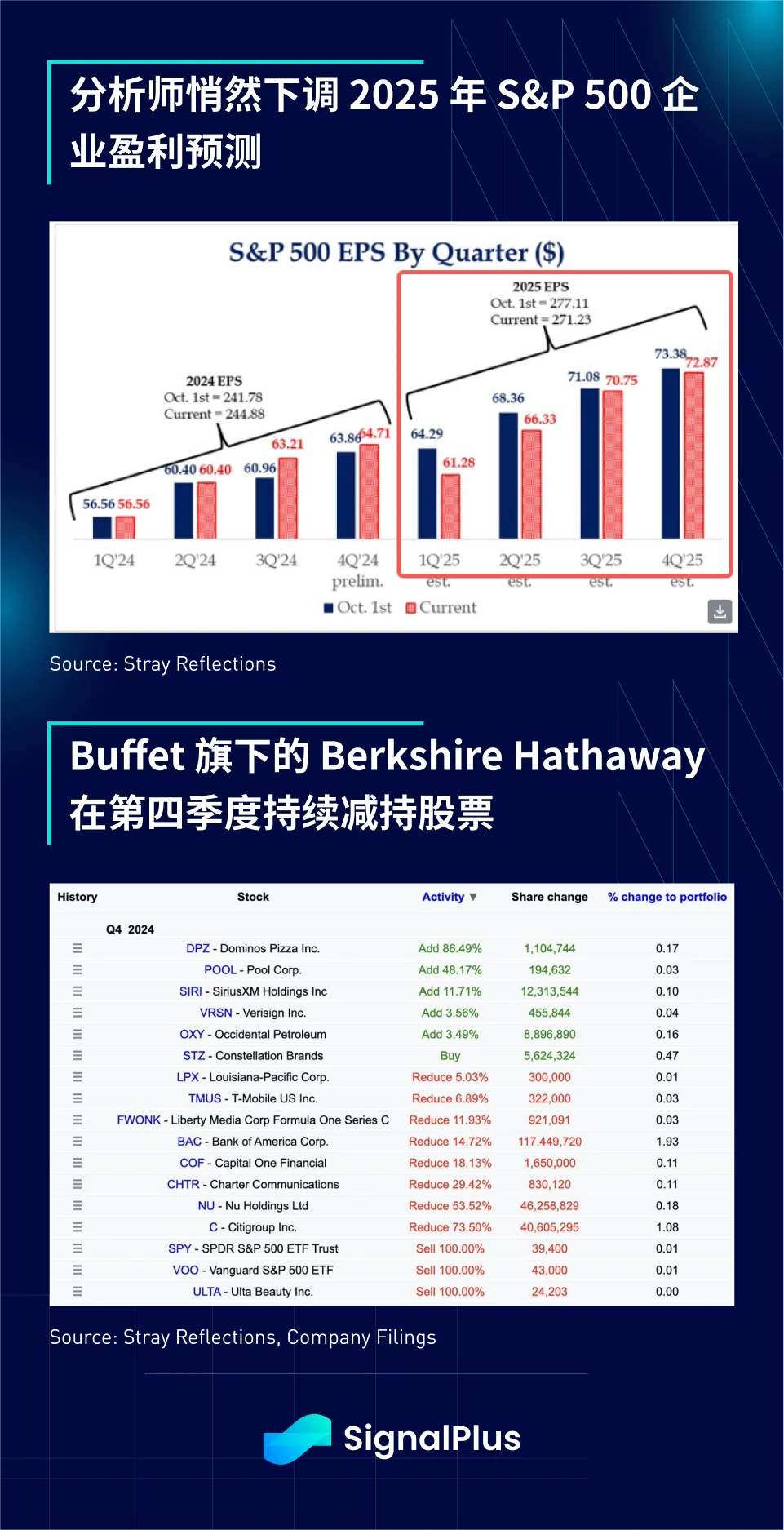

However, in this seemingly stable market environment, EPS forecasts for SP 500 companies in 2025 have been significantly revised down. In addition, Warren Buffet is also gradually reducing his stock exposure, completely selling off his SPX ETF holdings in the fourth quarter of last year, including a significant reduction in bank stocks.

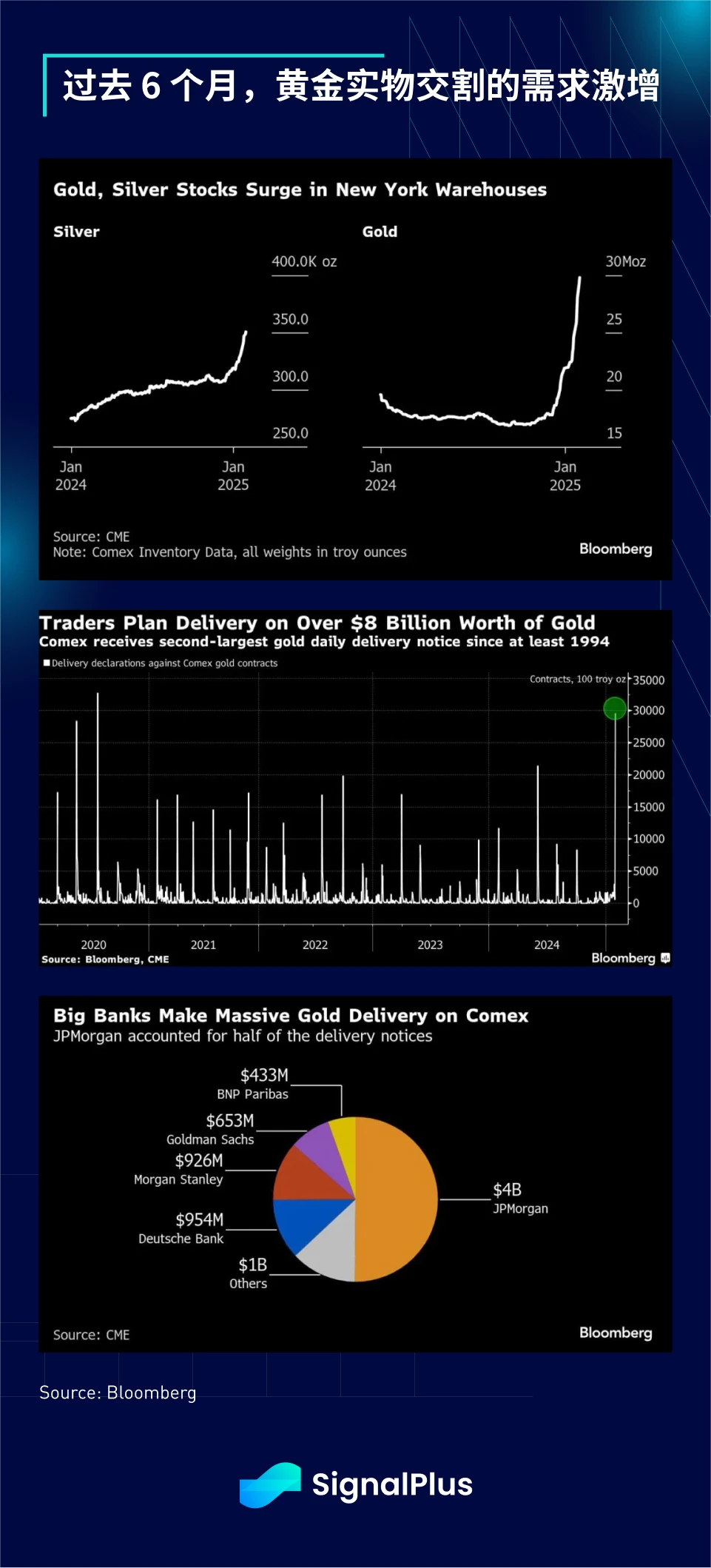

Although the stock market has not risen much since the beginning of the year, the price of gold has soared due to the strong demand for spot gold delivery on major exchanges. According to Bloomberg, the amount of gold transferred by financial institutions to COMEX-approved vaults in the United States has increased by 70%+ compared to usual. In the past 8 months, about 300-400 metric tons of gold have been shipped from London to New York.

市場 concerns that Trumps tariff policy will push up import prices have led traders to hoard gold on a large scale, while the Federal Reserves indifference to inflation has further boosted market demand for gold.

では 暗号currency market, unlike the stable performance of gold, ETH is struggling. Its price has fallen by 20% so far this year, while the actual volatility is about 60-70%, making it the worst performing asset among all major cryptocurrencies and major stock indices.

The only saving grace is that the market sentiment towards ETH trading has been extremely pessimistic, and Trump鈥檚 World Liberty Financial has continued to buy ETH during this downturn. Is ETH about to experience a dead cat bounce?

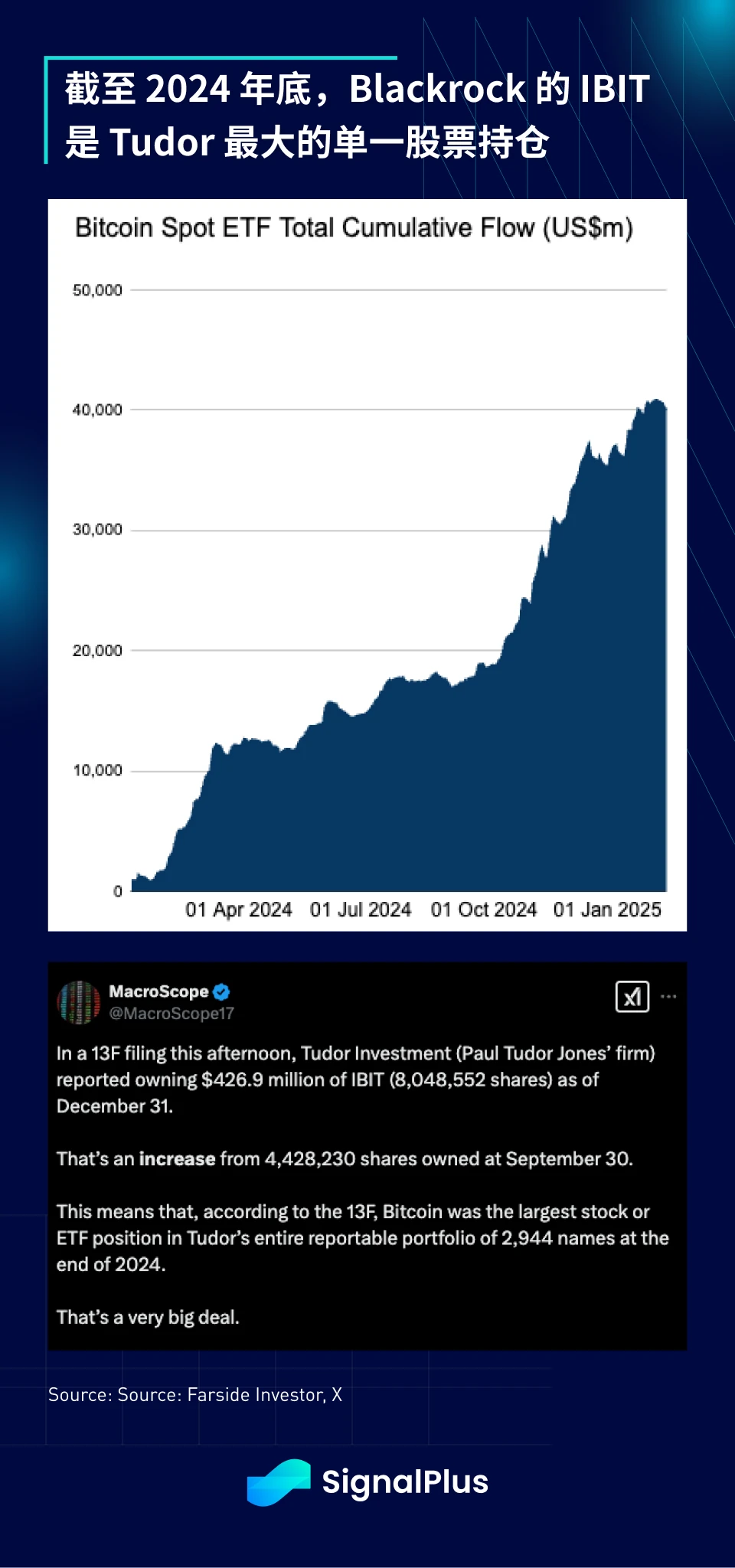

On the other hand, although the BTC price is still fluctuating around $100,000, the cumulative inflow of funds into the BTC ETF remains stable. Tudor Investments 13 F filing shows that as of the end of 2024, the IBIT ETF is the funds largest single stock holding (its AUM is $12 billion).

Finally, FTX will finally start repaying loans this week (starting with small accounts), and it will be worth our attention whether this money will flow back into the cryptocurrency market.

SignalPlusのトレーディングベーン機能は、 t.signalplus.com to get more real-time crypto information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add the assistant WeChat, please delete the space between English and numbers: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends. SignalPlus Official Website: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: Slow Grind

Related: Gate.io Launches AI Tools for Contract Trading

In the wave of the digital age, the integration of artificial intelligence (AI) and Web3 technology is becoming an important force driving change in the financial field. The rapid development of AI technology has not only changed the operating mode of traditional industries, but also brought unprecedented opportunities for Web3 contract transactions. This article will explore in depth how AI technology reshapes Web3 contract transactions and how this integration will promote the future development of the decentralized financial ecosystem. The AI wave is sweeping the world: the technological breakthroughs and industry inspirations behind DeepSeek The AI track is growing explosively, and global market demand is strong In recent years, artificial intelligence (AI) technology has shown explosive growth worldwide, becoming a key force driving changes in various industries. According to a…