The clock has just rung in 2025, and the global economy is entering a critical turning point, which may have a profound impact on the 暗号通貨市場。

After a year of economic ups and downs and interest rate fluctuations, traders are looking for clearer direction from the upcoming economic data. In particular, the market will focus on whether the US Federal Reserve will continue its cautious monetary policy. Any unexpected results in employment and inflation data may trigger market volatility and affect capital flows – including the choice of investing in digital assets.

目次

Economic situation at the beginning of 2025: interpretation of the main trends

Key data release (December 31, 2024 – January 10, 2025)

Strategic Priorities for Crypto Traders

Global Risk and Market Sentiment Analysis

Market expectations for early 2025

Economic situation at the beginning of 2025: interpretation of the main trends

Central bank policy: Tighten first, then watch

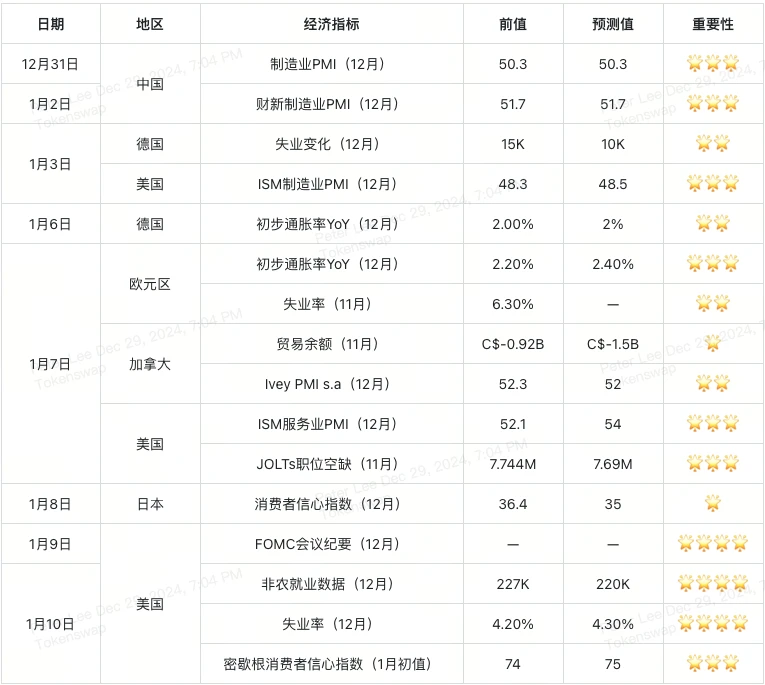

Fed Updates | In 2024, the Fed cut interest rates several times, and the latest rate was adjusted to a range of 4.25%-4.5%. Although inflation has fallen from its peak, it is still above the target level of 2%. According to the latest forecast, the Fed may cut interest rates twice more in 2025, totaling 50 basis points. Impact on cryptocurrencies: High interest rates will increase borrowing costs and may reduce the markets interest in high-risk assets (including cryptocurrencies). However, if future data continues to show a decline in inflation, the market may usher in a more relaxed environment.

Image Credit: Yahoo Finance

ECB Dynamics | 2024 The ECB remains tough and continues its high interest rate policy to deal with stubborn inflation. If future inflation data does not improve significantly, the ECB is likely to continue tightening policy, putting pressure on risky assets including cryptocurrencies.

Inflation: Still in focus

Although global inflation has shown signs of easing, it is still above the target levels of major central banks. US | Core inflation remains stubborn, driven by wage growth and housing costs. Europe | Inflation is falling at a slower-than-expected rate, which has made the market more concerned about the possibility of further interest rate hikes by the European Central Bank. Impact on cryptocurrencies: High inflation may lead more people to view cryptocurrencies as a store of value tool, especially assets like ビットコイン . But on the other hand, tightening policies to combat inflation will reduce market liquidity, which may limit the upside of the crypto market.

Global economic growth: Moderate but solid

United States | The latest data predicts that the US economic growth rate in 2025 will be about 2.1%, slightly higher than the previous 2%. Although this growth rate is solid, it is not enough to drive a full rebound in the market. Europe | Affected by high inflation and geopolitical risks, the economic outlook in Europe remains weak. China | China is taking targeted policies to stimulate the economy, which will help support global demand. However, there is still some uncertainty about the speed of recovery.

Image Credit: Goldman Sachs

Geopolitical risks: a variable that cannot be ignored

Current situation | The friction between the United States and China in the fields of trade and technology remains tense. The war in Ukraine and the conflict in the Middle East also continue to put pressure on energy markets and global supply chains. Impact on the crypto market: Cryptocurrencies such as ビットコイン are sometimes seen as safe-haven assets when tensions rise. However, in the short term, the performance of the cryptocurrency market tends to fluctuate in sync with other risky assets.

Image Credit: Visual Capitalist

Unique drivers of the crypto market

Technological breakthroughs | イーサリアム upgrades, new DeFi trends, and the combination of AI and blockchain could all be catalysts for the market. Institutional participation | As regulations become clearer, traditional financial institutions are increasingly interested in cryptocurrencies, which will provide long-term growth momentum for the market. Central bank digital currencies (CBDCs) | Central banks in many countries are accelerating the launch of digital currencies, which could boost the popularity of cryptocurrencies, but could also pose some competition to existing crypto assets.

Key data release (December 31, 2024 – January 10, 2025)

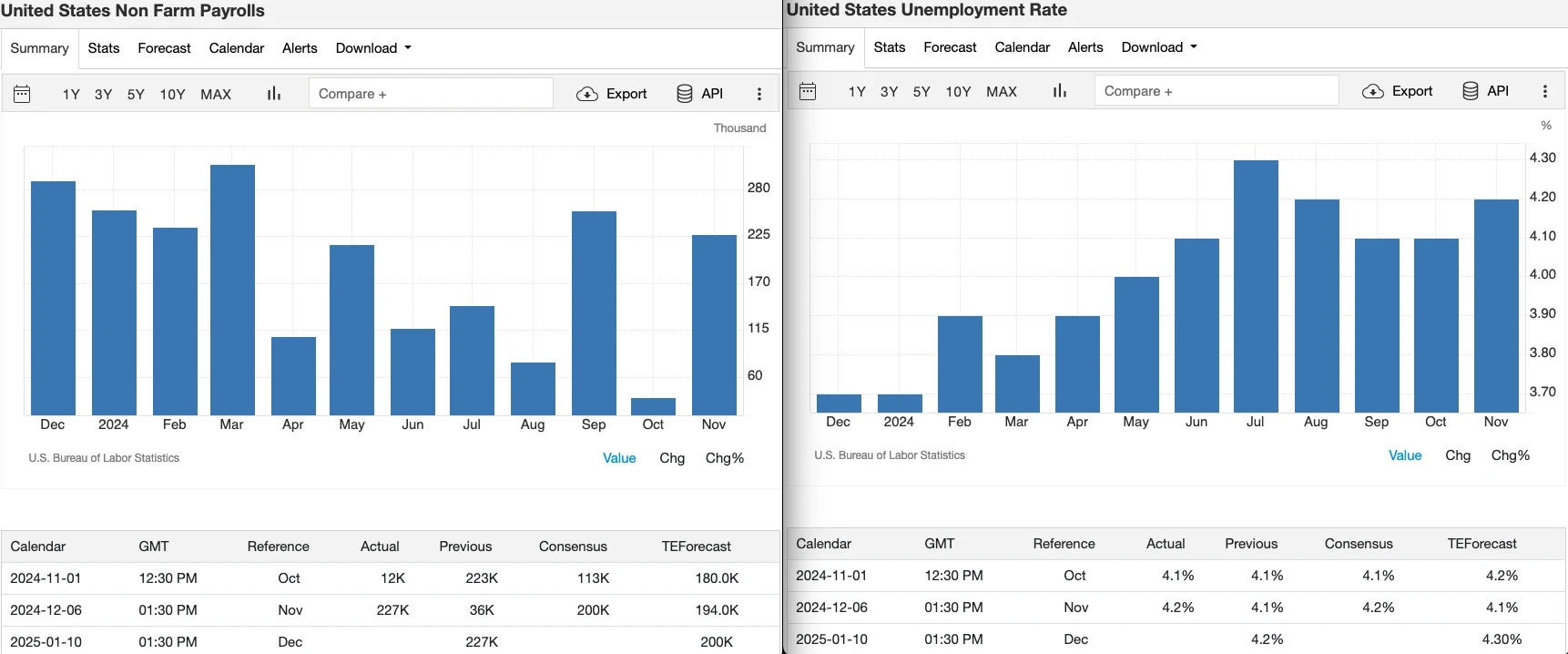

Week 1: December 31, 2024 – January 3, 2025

China Manufacturing PMI

-

Prediction: 51.8

-

Why it matters: The PMI is an important indicator of manufacturing activity, with a reading above 50 indicating expansion and below 50 indicating contraction. The Caixin PMI focuses more on the performance of private enterprises and is one of the bellwethers of the Chinese economy.

-

Potential impact: If the data is strong, it could boost market confidence in the global economy, and this optimism could also be transmitted to the cryptocurrency market.

Unemployment changes in Germany

-

Prediction: +10K

-

Why it matters: Germany is the backbone of the European economy, and the stability of its labor market directly affects economic confidence in the eurozone.

-

Potential impact: If the unemployment figures are lower than expected, it could boost investor confidence in the European market, thereby boosting risk appetite in the crypto market.

US ISM Manufacturing PMI

-

Predicted value: 48.5

-

Why it matters: A reading below 50 indicates a contraction in manufacturing activity, often seen as a sign of economic weakness.

-

Potential impact: If the data is weaker than expected, the market may worry about a slowdown in the U.S. economy, which could weigh on risk assets including cryptocurrencies.

Week 2: January 6, 2025 – January 10, 2025

German Inflation Rate (December)

-

Forecast: 2.0% YoY

-

Why it matters: German inflation data will confirm whether the ECB faces further pressure to raise interest rates. Lower inflation could support a more dovish policy stance, which is bullish for risk assets, including cryptocurrencies.

-

Potential impact: 市場s will be watching to see if inflation shows signs of cooling.

French and Italian inflation (December), Eurozone unemployment (November)

-

Forecast: France 1.6%, Italy 2.3%

-

Eurozone unemployment rate: 6.3%

-

Why it matters: Falling inflation in core economies points to muted price pressures, while stable unemployment suggests economic resilience. Together, these factors shape ECB policy expectations.

-

Potential impact: If inflation falls, it could boost investor confidence; but if data exceeds expectations, it could raise concerns about tightening policy.

US FOMC meeting minutes (December)

-

Why it matters: Traders will carefully interpret the minutes for insights into the Fed’s policy outlook through 2025, particularly the likelihood of interest rate adjustments.

-

Potential impact: Any change in policy tone could trigger short-term volatility.

Image Credit: Trading Economics

Trade balance and labor market data

Trade Statistics

-

Australia: Forecast is A$ 5.953 B

-

Germany: Forecast: €13.4 B

-

Why it matters: A strong trade surplus indicates a healthy economy and can be a positive for cryptocurrency market sentiment.

-

Potential impact: Positive trade data could boost market risk sentiment and drive up crypto asset prices.

Labor market data

-

Canada unemployment rate (December): forecast 6.8%

-

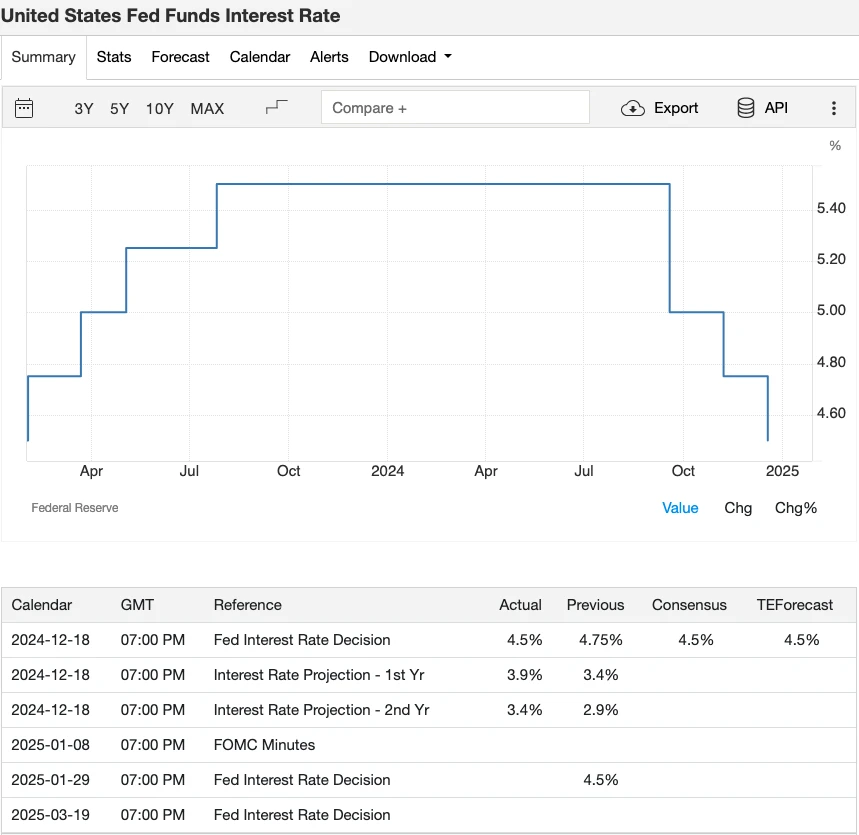

US Non-Farm Payrolls (December): Forecast 220K

-

US unemployment rate (December): forecast 4.3%

-

Why it matters: Employment data directly affects central bank decisions. If the data is weak, it may reinforce market expectations for loose policies and benefit the cryptocurrency market.

-

Potential impact: Non-farm payrolls that beat expectations could briefly boost the dollar, but weak data could reinforce market expectations of easing, thereby boosting cryptocurrency prices.

Image Credit: Trading Economics

Michigan Consumer Sentiment Index (January preliminary value)

-

Prediction: 75

-

Why it matters: Consumer confidence reflects expectations about the economy. Higher confidence may encourage more risk-taking, while weaker confidence may lead to a more cautious market sentiment.

-

Potential impact: The consistency between consumer confidence and employment data will be the focus of investors.

Strategic Priorities for Crypto Traders

Focus on Chinas economic trends

-

If China’s manufacturing PMI data is better than expected, it could boost global market sentiment and bring inflows to the cryptocurrency market.

-

But if the data performs poorly, it could weaken the markets risk appetite and put pressure on crypto assets.

Keep an eye on economic indicators in the Eurozone

-

German employment data and inflation rates in Germany, France and Italy will influence the ECBs policy direction.

-

Dovish policy signals could drive up market risk sentiment, which would be beneficial to risky assets including cryptocurrencies.

Pay attention to the Feds signals

-

The Federal Reserve’s FOMC meeting minutes will be in focus, as well as the ISM PMI and non-farm payrolls data.

-

If the Federal Reserve hints at a rate cut, it could bring upside opportunities to the cryptocurrency market; while hawkish signals could trigger short-term volatility in the market.

Interpreting trade data

-

Positive trade data from Germany and Australia typically reflects strong demand in the global economy.

-

This market environment of rising risk appetite could inject more confidence into the cryptocurrency market.

Consumer and labor market confidence

-

Strong North American labor data and consumer confidence helped boost market sentiment, supporting the performance of crypto assets.

-

If the data is weak, it may trigger a market adjustment in the short term, but it may pave the way for future loose policies and create long-term benefits for the crypto market.

Managing market volatility

-

Frequent data releases may lead to greater market fluctuations.

-

It is recommended to use stop-loss orders to control risks, diversify the portfolio to reduce exposure to a single asset, and pay close attention to changes in market liquidity to ensure stable transactions.

Global Risk and Market Sentiment Analysis

Geopolitical risks

-

Current hot spots: The US-China trade and technology conflict, the war in Ukraine, and tensions in the Middle East remain major uncertainties, particularly affecting energy markets.

-

Impact on the crypto market: Crypto assets such as ビットコイン are sometimes seen as safe havens when geopolitical tensions rise. However, when general risk aversion rises in the market, cryptocurrencies may fall along with other risky assets.

Consumer Behavior

-

Why it matters: Consumer confidence and holiday spending data are important indicators of economic vitality. If consumer confidence is low, it may have a dampening effect on retail investors’ willingness to enter the crypto market.

-

Indicators to watch: Michigan consumer sentiment and whether it moves in line with employment and inflation trends.

Regulation and Central Bank Digital Currencies (CBDCs)

-

Current situation: Major economies are accelerating the development of regulatory frameworks for cryptocurrencies, which may enhance institutional investors trust in crypto assets. At the same time, several countries are testing or launching central bank digital currencies (CBDCs).

-

Impact on the crypto market: Clearer regulatory policies may attract more funds into the market, while vague or overly strict regulations may undermine market confidence.

市場流動性

-

Influencing factors: Central bank policies, as well as special events within the crypto market (such as token unlocking and blockchain protocol upgrades).

-

Why it matters: Insufficient liquidity can increase market volatility, while ample liquidity can provide support to the market and help prices rise.

Energy and Commodities

-

Why it matters: Fluctuations in oil and gas prices directly affect costs for consumers and businesses, which in turn affects inflation and interest rate trends. Higher energy prices can also affect the profitability of Bitcoin mining .

Market expectations for early 2025

The Feds next move

-

Current situation: After multiple rate cuts in 2024, the Fed is expected to cut rates only twice in 2025, totaling 50 basis points. The minutes of the December FOMC meeting will further clarify its policy direction.

-

Impact on the crypto market: If the Fed sends a dovish signal, it may boost market risk appetite and crypto assets are expected to rise. However, if the tone of the minutes is hawkish, it may trigger a short-term sell-off.

Inflation Trends

-

Current situation: Inflation data from Germany and the eurozone will reveal whether price pressures have eased.

-

Impact on the crypto market: If inflation falls more than expected, market expectations for loose monetary policy may increase, which is good for risky assets including cryptocurrencies.

Labor market resilience

-

Current situation: U.S. nonfarm payrolls and unemployment rate will shed light on labor market conditions, while Canadian data will provide additional perspective on the North American economy.

-

Impact on the crypto market: Strong employment data may boost the dollar in the short term and put pressure on cryptocurrencies. But if the data is weak, it may increase market expectations for loose policies and provide long-term benefits for crypto assets.

Chinas economic recovery

-

Current situation: China’s PMI data will reflect whether fiscal policy has effectively stimulated economic growth.

-

Impact on the crypto market: If the Chinese economy performs strongly, it will boost global market confidence and commodity demand, and this optimism may also extend to the crypto market.

Internal driving forces of the crypto market

-

Current situation: Technological advancements, increased institutional adoption, and a clearer regulatory environment are shaping the future of the crypto market.

-

Impact on the crypto market: Even with macroeconomic challenges, イーサリアム upgrades, DeFi revival, and AI-driven project development may still bring growth opportunities to the market independent of traditional economic cycles.

About XT.COM

Founded in 2018, XT.COM currently has more than 7.8 million registered users, more than 1 million monthly active users, and more than 40 million user traffic within the ecosystem. We are a comprehensive trading platform that supports 800+ high-quality currencies and 1,000+ trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading products such as spot trading , leveraged trading 、 そして contract trading . XT.COM also has a safe and reliable NFT trading platform . We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

This article is sourced from the internet: Economic Calendar for Crypto Traders Week 1, 2025

Related: After spending $130 million, what did Musk gain from going all in on Trump?

Original title: How Elon Musks $130 million investment in Trumps victory could reap a huge pay off for Tesla and the rest of his business empire Original article by Jenn Brice, FORTUNE Original translation: zhouzhou, BlockBeats Editors note: Trump returned to the White House, Musk became Ma Baoguo, and people were surprised to find that Musk wrote in his biography published last year: I think it is important to have an inclusive and trustworthy digital public Space is very important. He replied, then paused and added, Otherwise how can we help Trump get elected president in 2024? Fortune magazine wrote in the article that Trumps presidency may lead to loose policies, which will benefit Musks companies. SpaceX and Starlink are expected to reduce regulatory pressure and win more government contracts;…