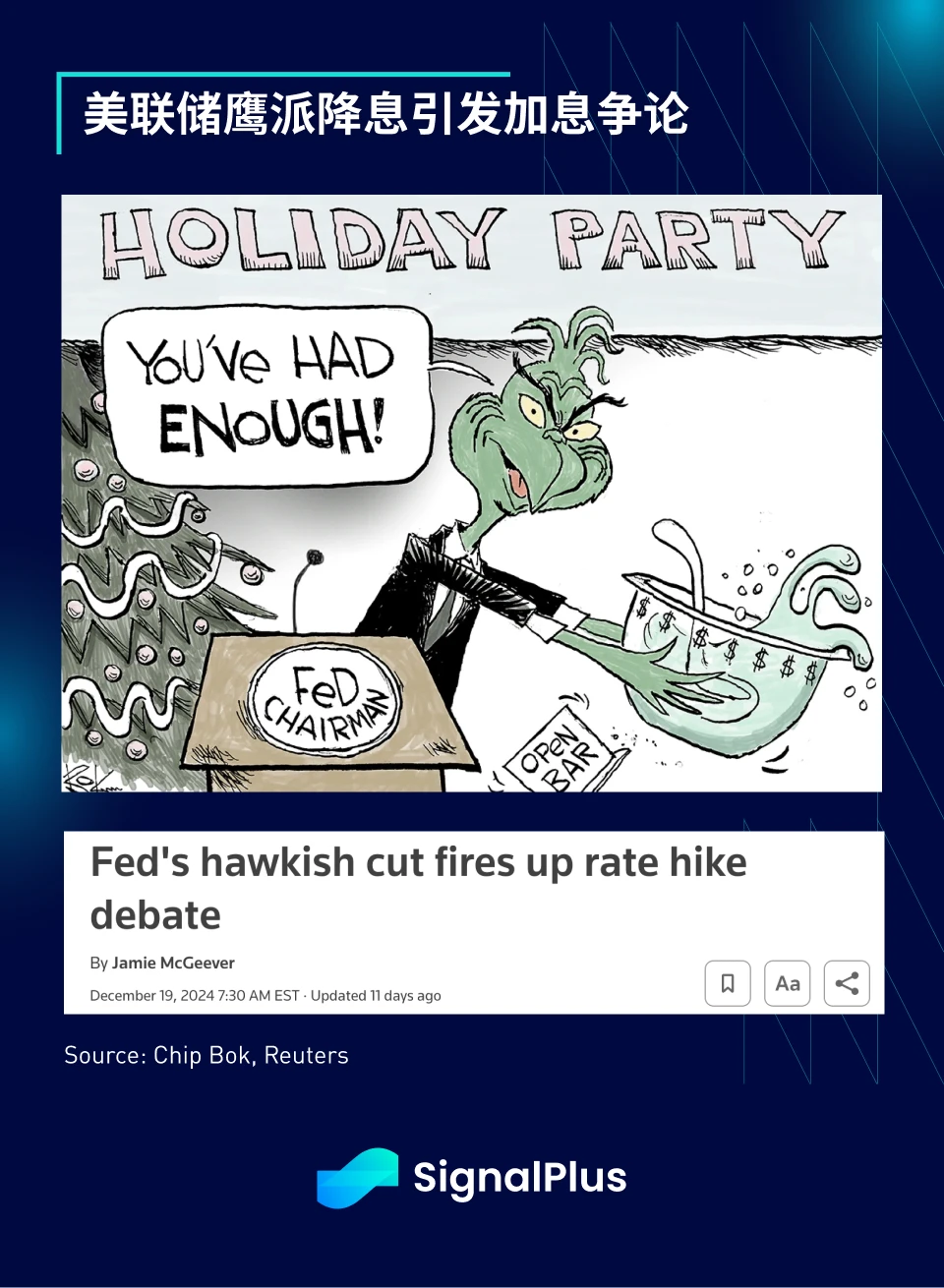

2024 is almost over, and the last few trading days of the year are more important than expected. Although the Bank of England and the Bank of Japan kept interest rates unchanged and leaned towards a dovish stance as expected by the market, the Feds hawkish rate cut and technical adjustment of the overnight reverse repurchase rate surprised the market, indicating that liquidity conditions will tighten at the end of the year.

In terms of interest rates, although Powell announced a 25 basis point rate cut as expected, his statement was clearly hawkish, with special mention of the extent and timing of future rate cuts, reminiscent of the wording used during the 2006-07 suspension of rate cuts. Clevent Fed Chairman Hammack also expressed opposition to rate cuts and hoped to keep interest rates unchanged. The Summary of Economic Projections (SEP) dot plot also showed a hawkish stance, with only five members believing that there will be more than three rate cuts in 2025. The median of the dot plot predicts only two rate cuts in 2025. With the economic conditions still strong, long-term interest rate expectations have also risen to 3.0%.

More importantly, the median core PCE inflation in 2025 also rose to 2.5% (+0.3%), and the inflation risk distribution rose to 15 (only 3 in September), highlighting the stickiness of inflation in the past quarter. In addition, in the QA session of the last FOMC meeting of this year, Powell made it clear that he was very optimistic about the economic situation and believed that after the Fed cut interest rates by 100 basis points, it had now entered a new stage where it should act cautiously, which was indeed hawkish.

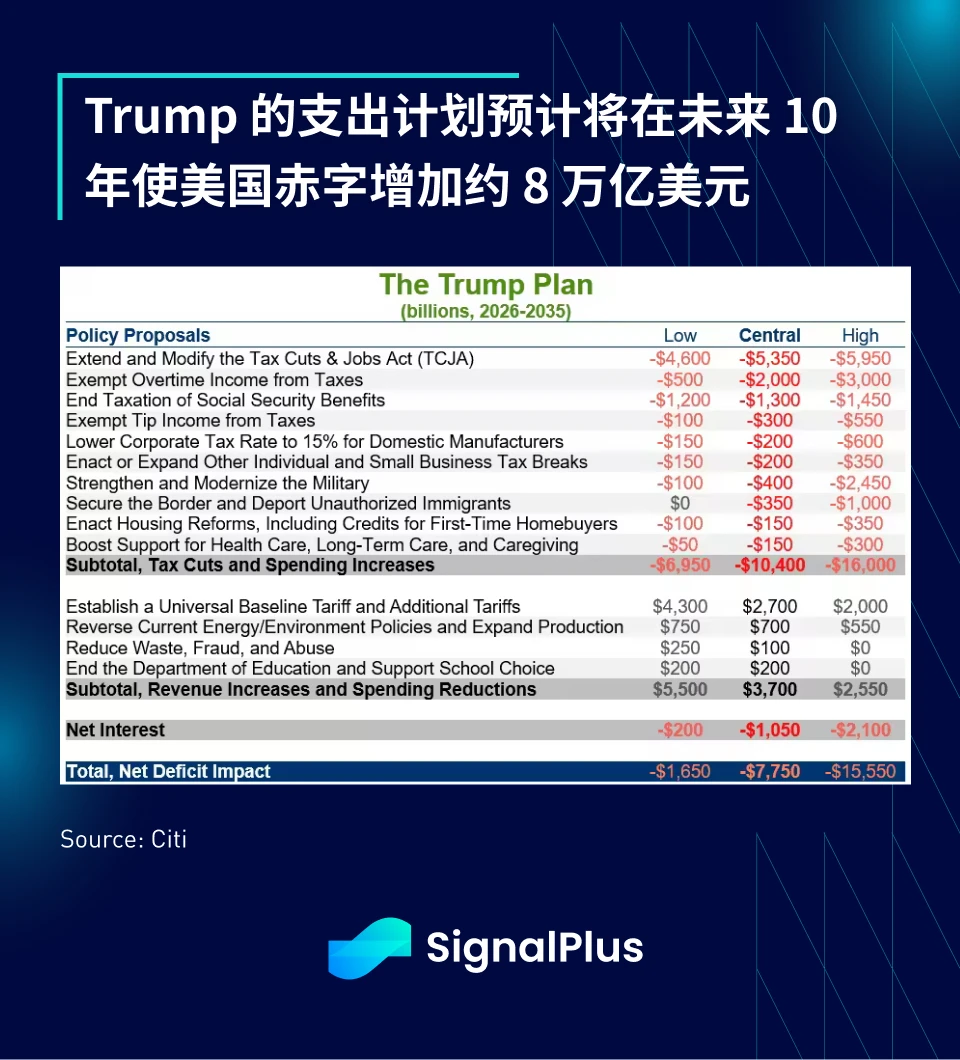

On the fiscal side, Trump’s campaign platform is expected to increase the US デフィcit by $7.7 trillion over the next 10 years (CRFB estimates range from $1.7 to $15.5 trillion), which would bring the US debt-to-GDP ratio to around 145% by 2035. The extent of the ultimate inflationary pressure will depend on how much he is able to implement in his second term, and Trump’s recent U-turn on the TikTok ban could indicate that the actual implementation of his policies may not be as strong as expected?

Regarding government spending, the current debt ceiling suspension is set to expire on January 1, prompting Secretary Yellen to take a series of “extraordinary measures” to create more room for borrowing. According to Wall Street estimates, the Treasury should have enough emergency funds available through August, so the debt ceiling debate may not be in the news until after the spring at the earliest.

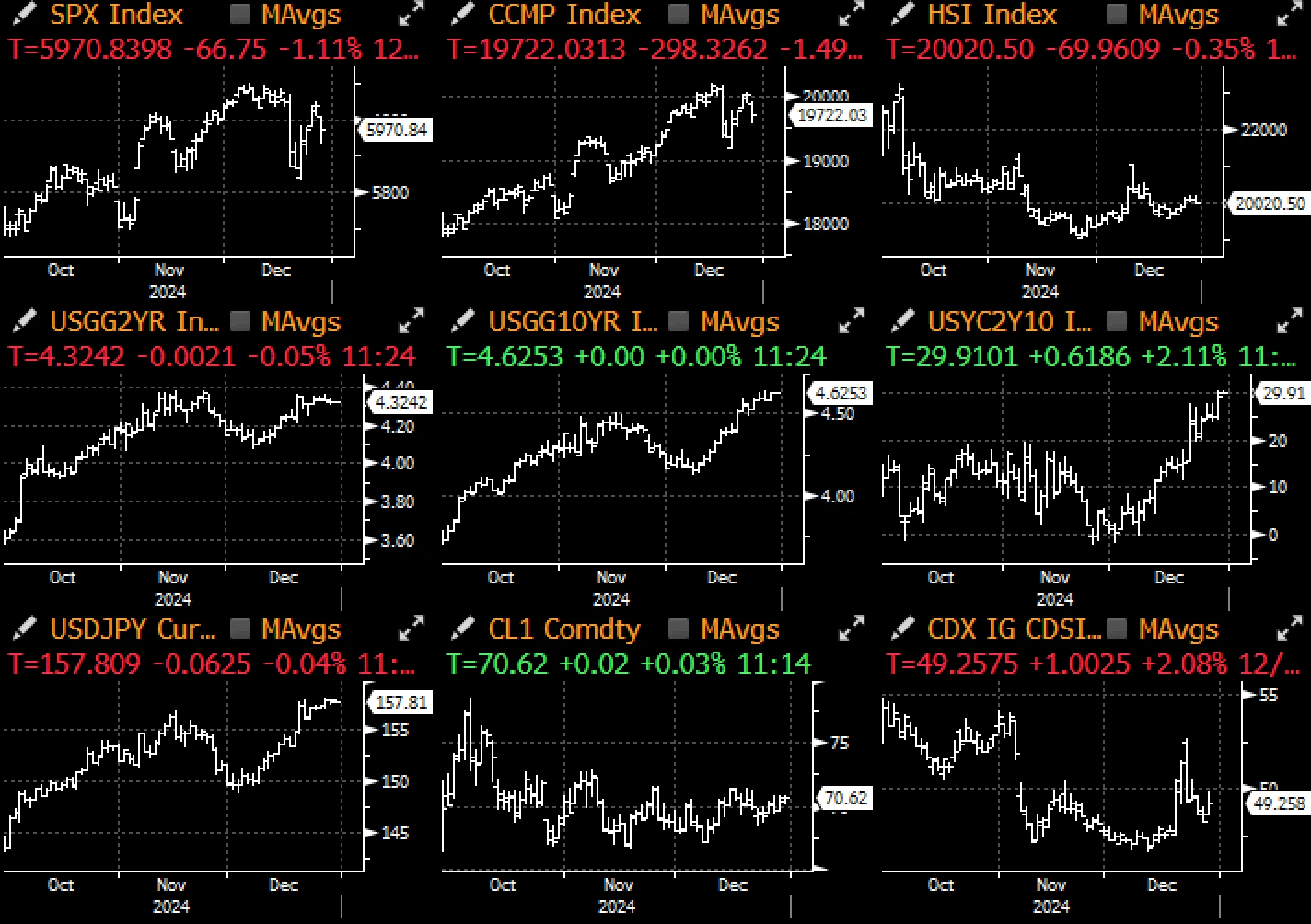

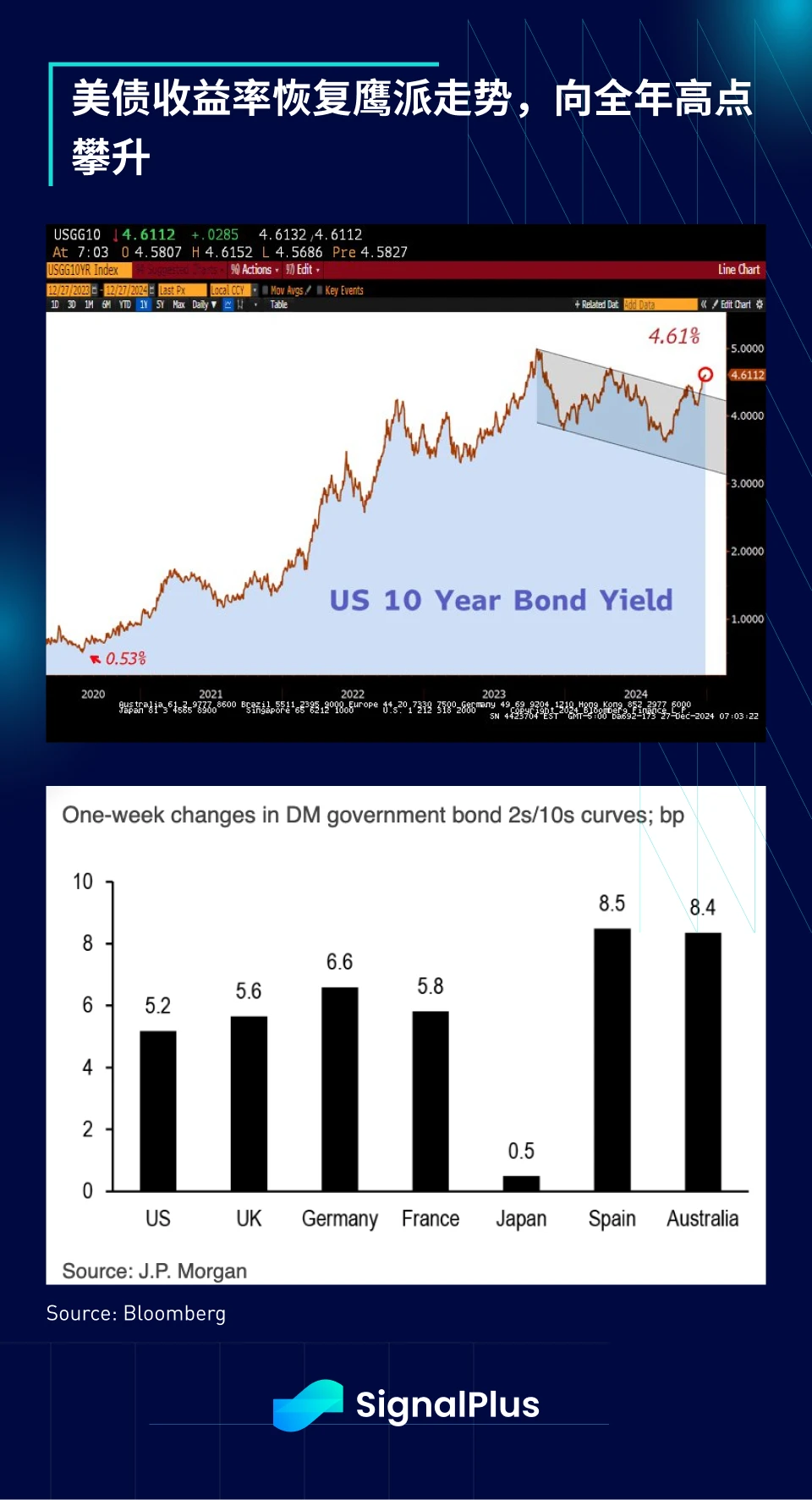

A series of hawkish news brought significant negative risk effects. The SPX index fell 200 points, and the U.S. Treasury yield curve showed a steep bear trend. The 10-year yield broke through the downward channel and is moving towards the high point of the year. It rose by 15 basis points in the past week alone.

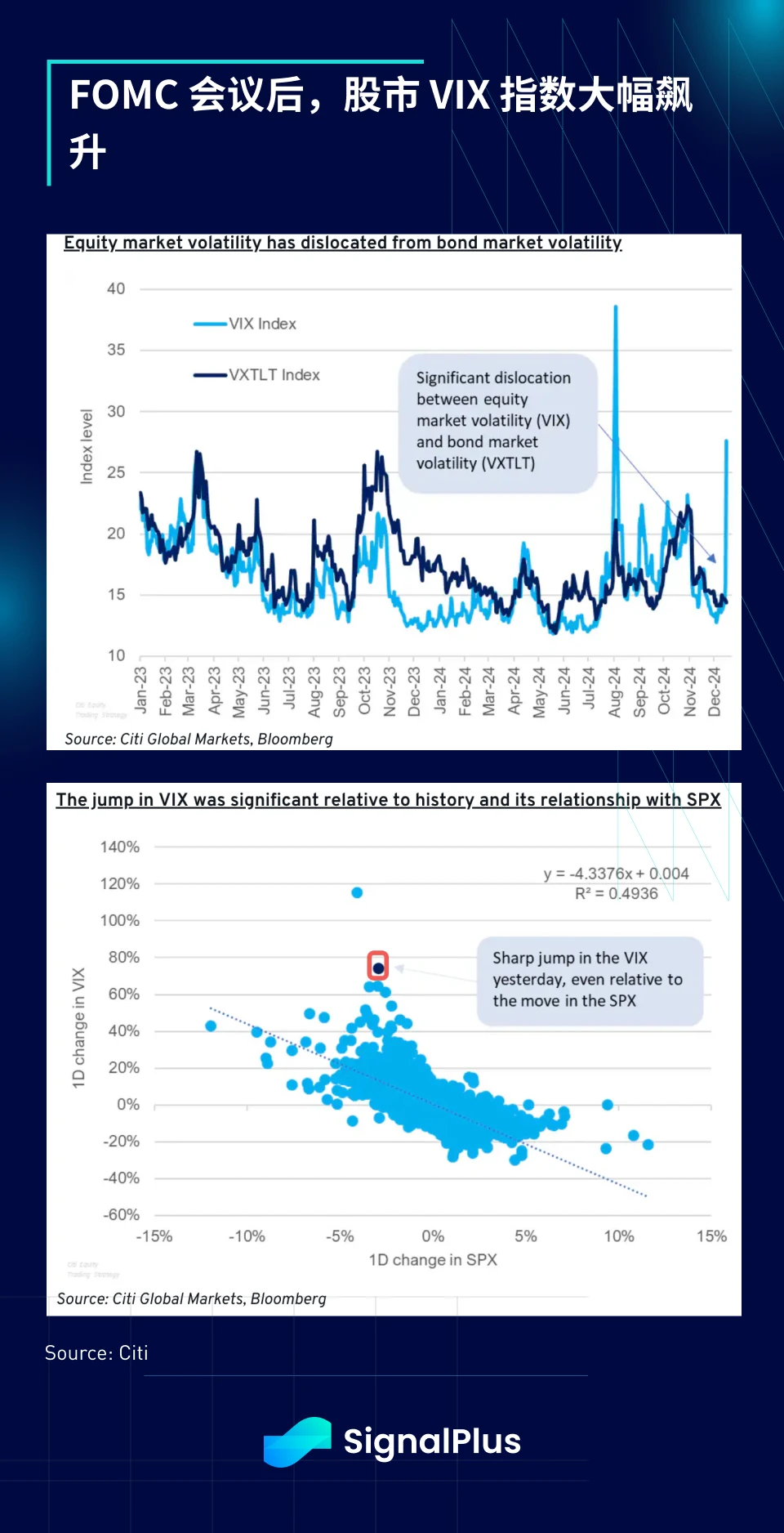

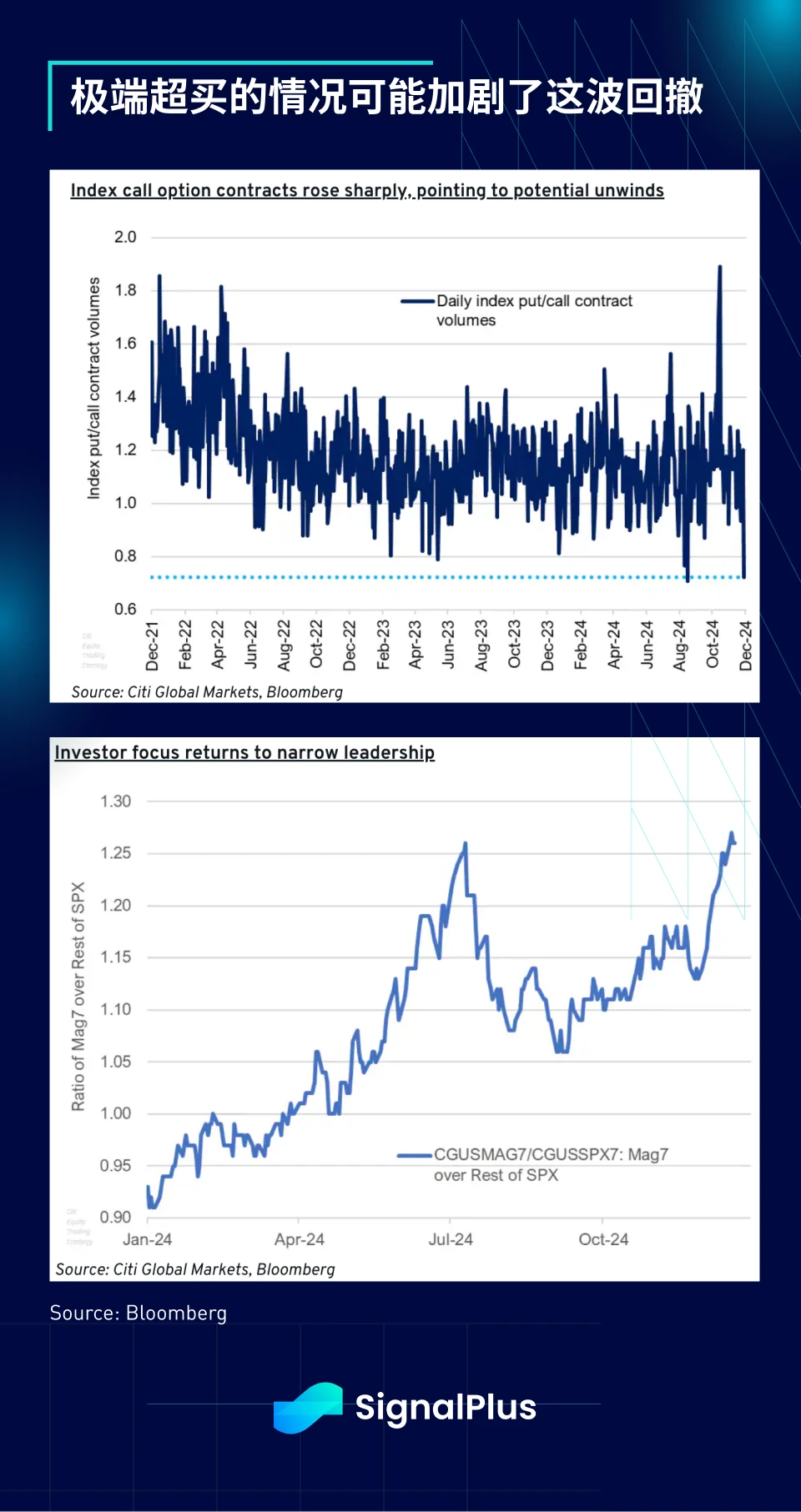

The SPX experienced a minor crash after the FOMC meeting, the VIX spiked significantly, the index options were significantly overbought for calls before the sell-off, and the stock markets lead narrowed to levels beyond July, both of which may have played an important role in the VIX spike. The stock market has rebounded quickly to nearly 6,000 points in the past few days amid extreme oversold conditions, but it remains to be seen whether the market is out of the woods.

The so-called Christmas rally may be indicative of how risk markets will end and welcome the new year. Past data shows that negative performance in the last week is often followed by a sell-off in January. Will the year-end rally come? We will know the answer in a few days…

では 暗号currency space, 2024 will undoubtedly go down in history, with the cryptocurrency market value rising by more than 90% during the year, from $1.65 trillion to $3.2 trillion. Incredibly, cryptocurrencies are the only asset class to surpass US stocks based on market value growth in 2024, thanks to the launch of spot ETFs in January and regulatory optimism following Trumps election.

Cryptocurrency gains this year were initially led by BTC, whose dominance rose from a low of 40% to over 60%. Overall, this years market activity consists of three important phases: the first quarter, the approval of spot ETFs led to significant gains; the second and third quarters were flat and lacked continued momentum, leading to sideways trends; finally, Trumps re-election made altcoins the dominant force in the market again, driving the recent gains, XRP and Dogecoin have risen by more than 200% throughout the year, and other major altcoins have also risen by around 150%, which makes ETHs 40% year-to-date gains pale in comparison.

The impact of mainstream markets on cryptocurrencies is best reflected in the high correlation between BTC and the SPX index, which will remain the asset class with the highest correlation with BTC by the end of 2024. In addition, Citis research shows that ETF inflows can explain nearly half of BTCs weekly return fluctuations, and this trend is likely to continue into the new year.

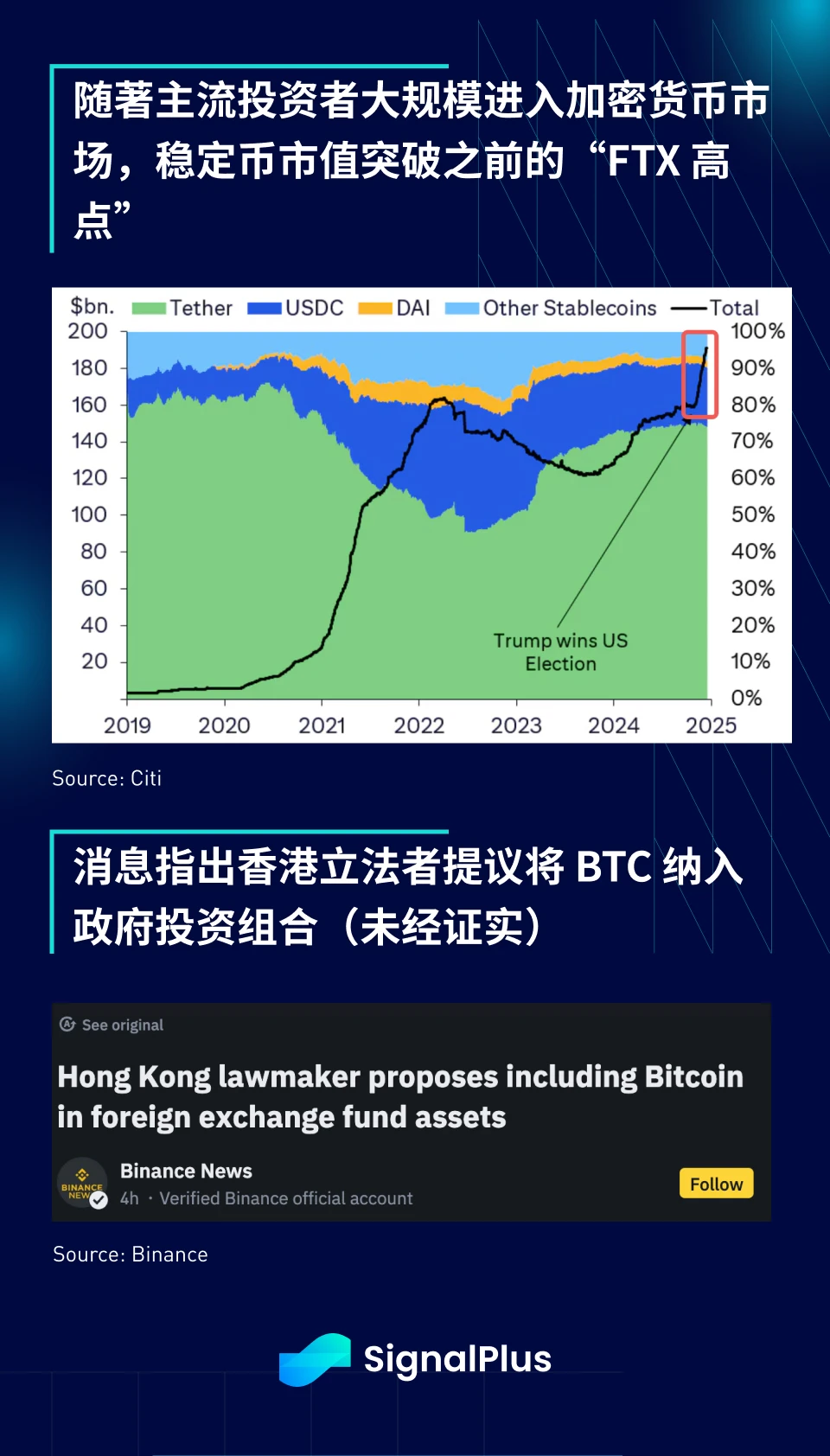

In addition, taking the market value of stablecoins as an indicator, mainstream funds have re-entered the cryptocurrency market on a large scale since Trump was elected. The current market value of stablecoins is close to US$190 billion, far exceeding the high point of the FTX period in 2022. At the same time, discussions on BTC reserves by governments are becoming increasingly popular. Unconfirmed media reports indicate that Hong Kong lawmakers recently proposed that the government should consider including BTC in its foreign exchange reserve portfolio.

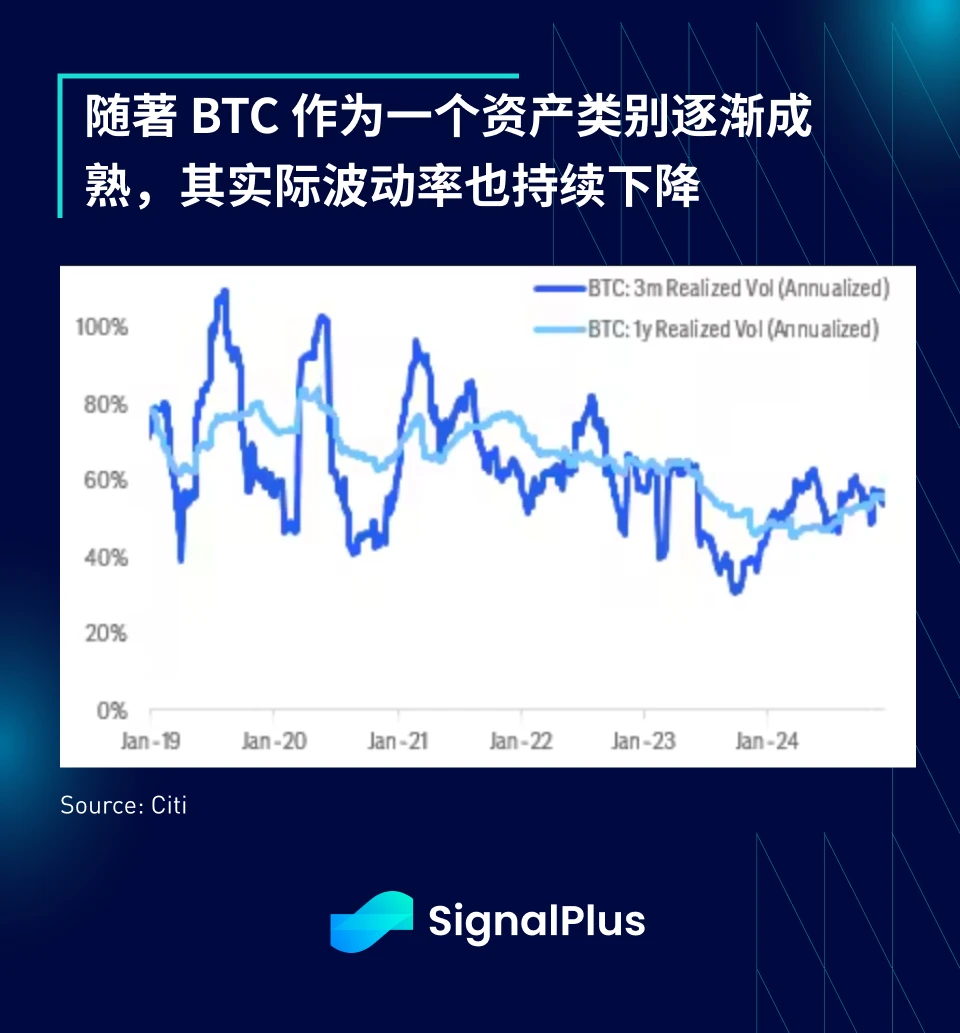

Another sign that BTC is becoming a mainstream asset class is the continued decline in realized volatility, which will eventually provide more diversification benefits and excess returns to the traditional 60/40 portfolio. As the asset class matures, volatility should continue to decline, and the development path of cryptocurrencies is no different from that of other asset classes.

Finally, I end with an unsolved BTC and M2 chart. As global liquidity continues to decline, should we be cautious about BTCs rise? Will the continued inflow of new TradFi funds and crypto-friendly regulations in the United States lead to a breakthrough change in this correlation? Or will macro factors prevail, allowing skeptics to prove that BTC is just a part of the liquidity performance?

Thank you for your company in 2024. We look forward to sharing more insights on cryptocurrencies and macro markets with you in the new year! Happy holidays!

SignalPlusのトレーディングベーン機能は、 t.signalplus.com よりリアルタイムの暗号通貨情報を入手してください。最新情報をすぐに受け取りたい場合は、Twitter アカウント @SignalPlusCN をフォローするか、WeChat グループ (アシスタント WeChat を追加: SignalPlus 123)、Telegram グループ、Discord コミュニティに参加して、より多くの友人とコミュニケーションや交流を行ってください。

SignalPlus公式サイト: https://www.signalplus.com

This article is sourced from the internet: SignalPlus Macro Analysis Special Edition: The Xmas Grinch

Related: A quick look at the AI MEME coin ACT that will be listed on Binance soon

Original author: Nancy, PANews AI MEME coin Act I: The AI Prophecy (ACT) once fell into a trough after experiencing multiple backstabs from Dev (deployers), but now it has ushered in a dramatic plot reversal. On November 11, Binance announced the launch of ACT and added a seed tag to it. After this news ignited market sentiment, ACT soared more than ten times in a short period of time. This is also a dark horse among the few low-market-cap MEME coins launched by Binance this year. DEX Screener data shows that as of the time of writing, ACTs highest intraday increase was 1445.4%, and its market value once soared from more than 20 million US dollars to a maximum of 300 million US dollars. The trading volume in the past…