Next week, a total of 10 projects will unlock, and ZETA will unlock nearly 10% of the tokens in circulation.

ZetaChain

プロジェクトTwitter: https://twitter.com/zetablockchain

プロジェクトのウェブサイト: https://www.zetachain.com/

Number of unlocked tokens this time: 54.91 million

Amount unlocked this time: Approximately 32.54 million US dollars

ZetaChain is a foundational public blockchain that enables full-chain, universal smart contracts and messaging between any blockchain. ZetaChain aims to build a fluid multi-chain 暗号 ecosystem. These “full-chain” smart contracts can send data and value between connected blockchains, including Bitcoin, Ethereum, Polygon, and more.

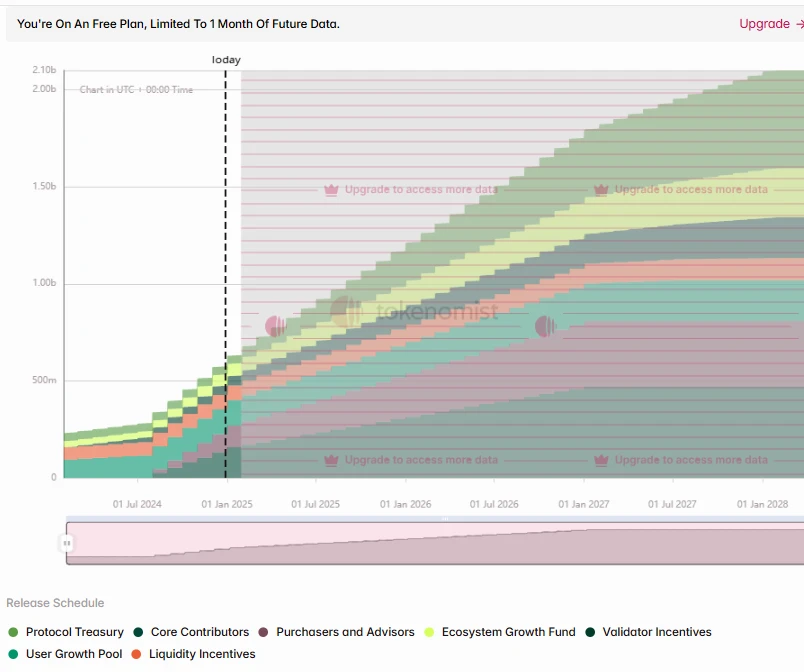

ZETA has only unlocked 27% so far and is currently in a period of rapid release. This round of unlocking is for five categories of people, the most important of which are core contributors (26.25 million) (US$15.52 million), consultants (18.67 million) (US$11.04 million), and ecological development funds (5.25 million) (US$3.1 million).

具体的な放出曲線は次のとおりです。

スイ

プロジェクトTwitter: https://twitter.com/SuiNetwork

プロジェクト公式サイト: https://sui.io/

Number of unlocked tokens this time: 68.33 million

Amount unlocked this time: Approximately US$278 million

Sui is one of the earliest projects in the Meta public chain, developed by the Mysten Labs team. Sui aims to create an environmentally friendly, low-cost, high-throughput, low-latency permissionless blockchain. Compared with traditional blockchains, Suis most critical innovation lies in Suis data model and transaction processing channel.

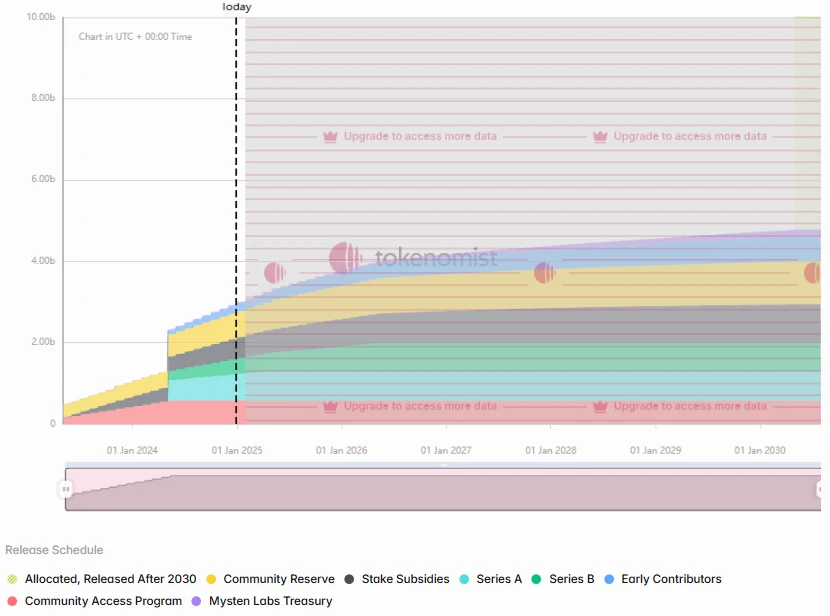

The current circulation ratio of SUI is 29%. The unlocking objects in this round include 19.84 million pieces (80.94 million US dollars) from Series A financing, 19.32 million pieces (78.83 million US dollars) from Series B financing, 12.63 million pieces (51.52 million US dollars) from community reserves, 10.34 million pieces (42.18 million US dollars) from early contributors, and Mysten Labs treasury (8.44 million US dollars).

具体的な放出曲線は次のとおりです。

Optimism

プロジェクトTwitter: https://twitter.com/Optimism

プロジェクトのウェブサイト: https://app.optimism.io/governance

Number of unlocked tokens this time: 31.34 million

Amount unlocked this time: Approximately 58.61 million US dollars

Optimism is a Layer 2 scaling solution that achieves the goal of scaling the Ethereum network by adopting the Optimistic Rollup solution. It can process transactions on a large scale while maintaining the security of Ethereum. Ethereum developers can efficiently use all tools on Ethereum without making changes.

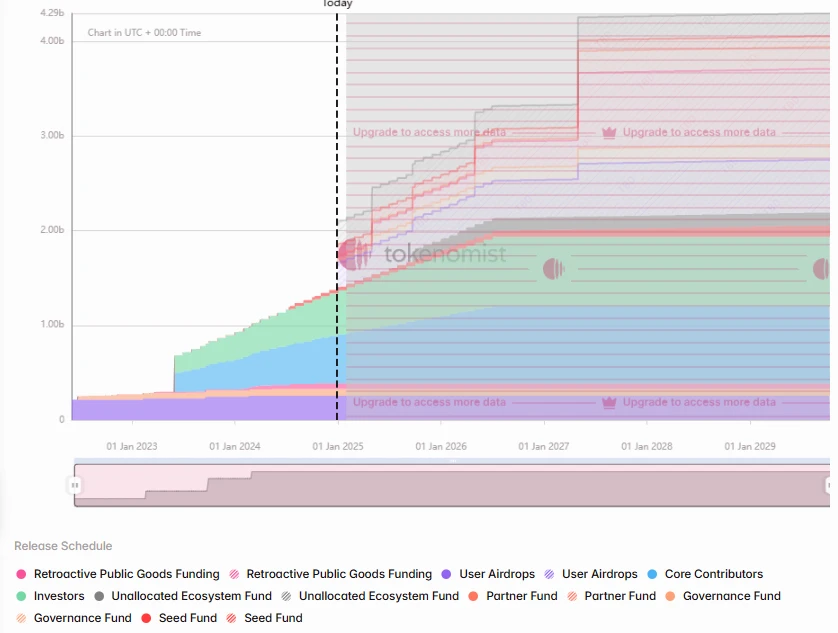

The current unlocking amount of OP is only 32%, and there are only two unlocking objects, namely core contributors 16.54 million (US$31.1 million) and investors 14.8 million (US$27.82 million).

具体的な放出曲線は次のとおりです。

This article is sourced from the internet: One-week token unlock: SUI unlocks nearly $280 million worth of tokens

Related: Shorts rebound, BTCs key support is around 88,000

Original source: BitpushNews The cryptocurrency market continued its correction trend on Tuesday. According to Bitpush data, Bitcoin continued to be under pressure after hitting a high of $95,000 in the morning. In the afternoon, bulls tried to rebound, but encountered bearish resistance at $94,800 and fell below $91,000. At the time of writing, Bitcoin was trading at $91,646, down 2% in 24 hours. The altcoin market performed even weaker, with more than 90% of the top 200 tokens by market value recording losses. The overall cryptocurrency market cap is currently $3.14 trillion, with Bitcoin’s dominance rate at 57.3%. In the U.S. stock market, the SP, Dow Jones and Nasdaq indices all closed higher, up 0.57%, 0.28% and 0.63% respectively. The decline may be due to overheating of the leveraged market…