2024 RWA Track Annual Summary: The prospects are promising, but it is still difficult for retail investors to benefit fr

オリジナル | Odaily Planet Daily ( @OdailyChina )

著者 | フー・ハウ( @ヴィンセント 31515173 )

The RWA track came to the fore in 2024 and outperformed the broader market.

In this year, RWA is no longer just a concept sale, but has seen actual progress in many projects. Globally, regulatory policies on blockchain technology and physical assets on the chain have gradually become clear, creating favorable conditions for the inflow of funds and the expansion of investment scale. As more and more traditional assets flow onto the chain, RWA has gradually become a key bridge connecting traditional finance and the 暗号 world, injecting new growth momentum into the capital market.

McKinsey has predicted that tokenized assets will reach a market value of $4 trillion by 2030 (excluding stablecoins), which is the most conservative estimate of the future RWA market value by most institutions. According to rwa.xyz data, the total market value of RWA excluding stablecoins is currently about $14.9 billion. If the growth expectations of these institutions are followed, the RWA market will need to grow by about $330 billion per year in the next few years, which means that this field has huge growth potential and investment opportunities.

Although the market is full of confidence in the future of RWA, the current RWA sector still mainly serves institutions and large investors, and many projects even only use asset tokenization as part of the distribution tool. For retail investors, how to choose the right investment project and successfully catch this trend is still a difficult problem that needs to be solved.

To this end, Odaily Planet Daily will review the progress of the RWA track in 2024 in the RWA annual summary, and look forward to the future development direction of the RWA industry in 2025.

Review of major events and analysis of RWA sub-sectors

In 2024, the RWA sector has seen several major positive events. The establishment of regulatory policies in various countries, the rush of traditional financial institutions to enter the market, new progress in crypto-native projects, and breakthroughs in iconic market capitalization have highlighted the development of the RWA sector this year. The following figure is a summary of major landmark events in the RWA sector in 2024.

ステーブルコイン

There has been controversy over whether stablecoins should be classified as RWA (real world assets) sector. Since the development of stablecoins predates the concept of RWA, they are usually not included in the RWA data in statistics. But in essence, stablecoins are a tokenized legal currency that achieves value anchoring through a 1:1 benchmark against legal currencies such as the US dollar. At the same time, the development of stablecoins has provided reference and guidance for other RWA products to a certain extent. Therefore, this article discusses stablecoins as part of the RWA sector.

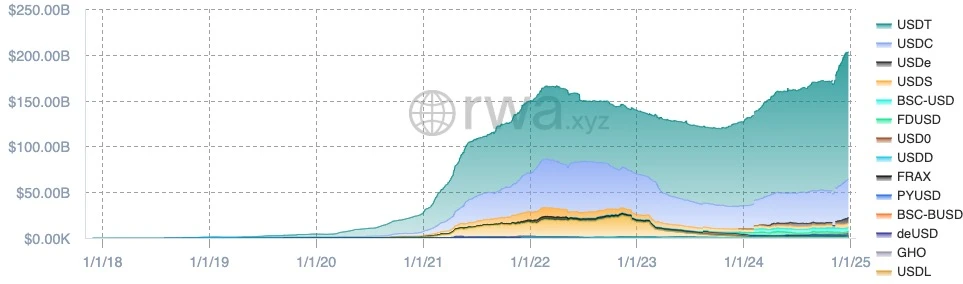

According to rwa.xyz, the total market value of stablecoins is currently about $203 billion, and the number of global holders has reached about 139 million. As one of the most mature asset classes in the blockchain field, the application scenarios of stablecoins continue to expand. From on-chain lending and trading to cross-border payments and real-world commodity payments, stablecoins have demonstrated their wide applicability in different fields. Especially in emerging markets, stablecoins have gradually become the preferred tool for foreign exchange transactions and payments. For example, mainstream stablecoins such as USDT and USDC have firmly occupied a dominant position in the market, among which USDTs trading volume is particularly prominent in Southeast Asia and Latin America. In addition, decentralized stablecoins such as DAI have further enhanced their trust and flexibility in DeFi protocols through multi-collateral mechanisms.

However, in 2024, the global regulation of stablecoins has been significantly strengthened. Europe has clarified the issuance requirements and compliance standards of stablecoins through the MiCA Act, the US Stablecoin Act further regulates reserve disclosure and transparency, and Hong Kong has also launched a stablecoin sandbox program. These policies and programs have brought greater transparency and stability to the stablecoin market, but at the same time have also brought greater compliance costs and technical pressures to small and medium-sized issuers. Despite this, the increasingly improved regulatory framework has provided confidence for traditional financial institutions to participate in the field of stablecoins. Large institutions, including banks and fund companies, have begun to more actively explore applications and innovations related to stablecoins.

U.S. Treasury Bonds

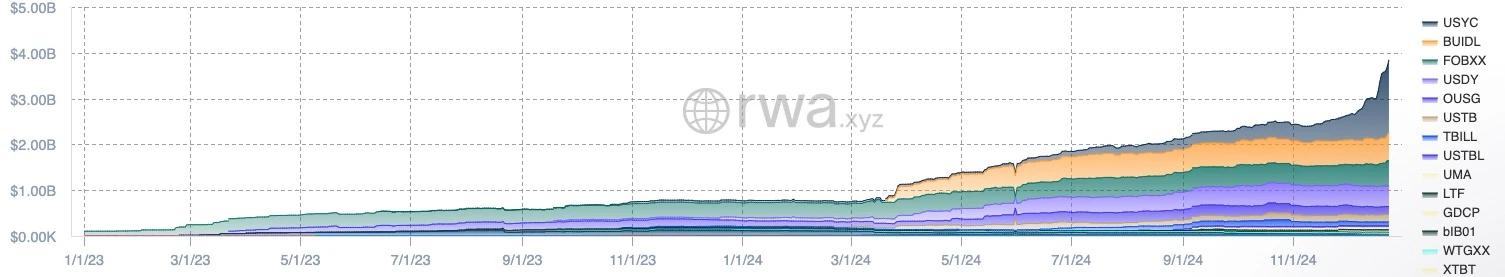

As one of the most liquid and credit-rated assets in the world, U.S. Treasury bonds play an important role in the tokenization process of the RWA (real world asset) sector. In 2024, the market value of the U.S. Treasury tokenization market has exceeded $1 billion at the beginning of the year and recently exceeded $3 billion, with an annual increase of more than 500%, ranking first in the RWA sector. As of now, the total market value has exceeded $3.8 billion, with more than 11,000 holders.

This growth is mainly due to the participation of traditional financial institutions. Institutions such as BlackRock and Securitize launched the tokenized fund BUILD on the public blockchain, attracting multiple projects to cooperate, and Ondo is one of the representative projects. Ondo occupies an important position in the field of US Treasury tokenization and is one of the few projects with a platform currency.

In addition, Hashnotes Hashnote Short Duration Yield Coin (USYC) has emerged as a dark horse, surpassing BUIDL in market value by the end of 2024 and taking over 40% of the market share. MakerDAO also announced plans to invest $1 billion in tokenized U.S. Treasury bonds. This move shows that decentralized finance (DeFi) is integrating more deeply with traditional financial assets, promoting the application of U.S. Treasury tokenization in decentralized finance.

Overall, the U.S. Treasury tokenization market showed a steady growth trend in 2024, driven by the participation of traditional financial institutions and the launch of innovative products. With the participation of more institutions and the continuous development of technology, tokenized U.S. Treasury bonds are expected to expand further and become an important asset in the RWA sector.

Private credit

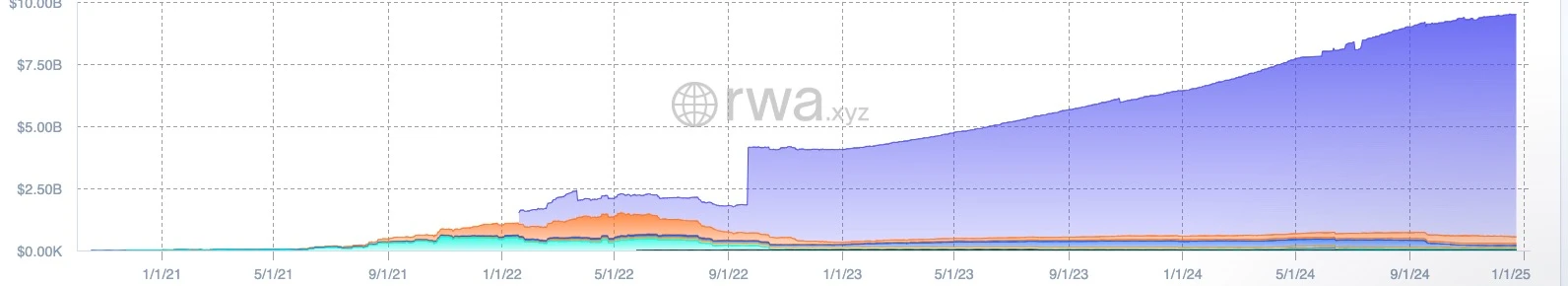

In the RWA field, excluding stablecoins, the private credit sector has an important market share. According to RWA.xyz data, the total value of active loans in the private credit market has reached US$9.53 billion, the total loan value is US$16.2 billion, and the number of loan agreements involved has exceeded 2,300. The average annualized interest rate (APR) is about 9.91%.

Among them, Figure Technologiesz, the largest non-bank home equity line of credit (HELOC) lender in the United States, has the highest market share in private credit and has issued more than $10.4 billion in loans, of which approximately $9.096 billion are active loans.

As a crypto-native project, Maple Finance has also made significant progress in this field. The current total loan value is US$2.44 billion, of which about US$270 million are active loans with an annualized interest rate of 9.72%. In addition, this year, a new product Syrup.fi focusing on DeFi lending was launched, and its own platform token MPL was branded. The new token SYRUP will introduce a staking function to improve the conversion of protocol revenue.

Additionally, protocols such as Centrifuge and Goldfinch are driving the growth of on-chain credit, supporting $560 million and $170 million in loans, respectively.

These blockchain-based private credit platforms are gradually changing the traditional credit market by providing a transparent, standardized and low-cost loan process. Most importantly, blockchain enables global liquidity to fund on-chain credit without permission, which provides borrowers with more financing channels. The tokenization of borrowers financial data and on-chain cash flows may further optimize the credit process in the future, making it more automated, fair and accurate.

At present, the private credit market is gradually expanding, and more non-standardized credit products have appeared in the market, showing strong growth potential. The CEO of Securitize also said that tokenized private credit has broad prospects and will become a key sector in the RWA field in the future. As the market demand for innovative financial products increases, private credit is expected to become an important growth point in the RWA sector.

Commodities

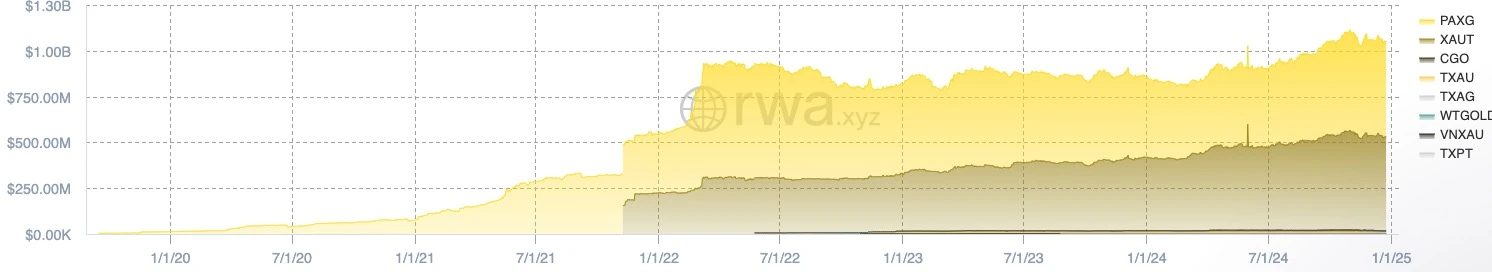

In 2024, the tokenization of commodities is gradually becoming an important trend in the financial market, especially in the field of gold. As one of the most stable assets in the world, the tokenization process of gold has attracted more and more attention. According to the latest data, the total market value of the gold token market has reached 1.05 billion US dollars, and the total number of gold token holders is 58,610, indicating that the market is gradually recognized and participated by investors.

In the gold token issuance market, Paxos and Tether Holdings dominate, driving the market through tokenized gold products such as PAXG and XAUT, respectively. Paxos and Tether Holdings have a market share of 49.59% and 48.71%, respectively. The gold tokens provided by these two companies are pegged 1:1 to physical gold, ensuring the value stability of gold tokens. In addition to these two major issuers, other companies such as Comtech Gold and Aurus are also involved, but their market share is smaller, at 1.1% and 0.45%, respectively.

The main advantage of gold tokenization is that it can use blockchain technology to improve transparency, liquidity and tradability. Through blockchain, gold token transactions can be settled in real time without the need for traditional financial intermediaries, thereby reducing transaction costs and time delays. In addition, the application of smart contracts allows gold tokens to be used not only as investment tools in traditional markets, but also as collateral assets in DeFi platforms to participate in financial activities such as lending. This decentralized feature allows investors to trade gold 24/7, breaking through the time limits and physical delivery issues of the traditional gold market.

With the participation of more traditional financial institutions and decentralized financial platforms, the gold tokenization market is showing a rapid development momentum. Although the market is still in its early stages, gold tokens, as a flexible investment tool, have provided diversified options for global investors, especially in asset allocation and risk management.

他の

The breadth and diversity of the RWA track make it one of the important areas for the application of blockchain technology. In addition to the four major sectors mentioned earlier in this article (such as bonds, real estate, private equity and commodities), the RWA track also covers a number of sub-sectors with great potential. Such as the real estate sector, stock and fund sector, art sector, carbon credit sector, etc., are all rapidly developing areas. Each sector has its own unique market characteristics and needs, and its potential is also different. The tokenization process of real estate is accelerating globally, especially in terms of improving the liquidity of high-value real estate projects. The tokenization of stocks and funds provides investors with a more flexible and low-threshold investment method, especially the innovation of circulating traditional stocks and funds on the chain, allowing investors to directly participate in the global market. In addition, artworks, as unique physical assets, are also being tokenized through blockchain technology, allowing more investors to participate in the investment of high-value artworks. The tokenization of the carbon credit market has also attracted attention in the environmental protection field. Blockchain technology can help improve the transparency and liquidity of carbon credit transactions and promote the sustainable development of green investment.

However, despite the potential of these segments, this article does not discuss them in detail as many of them are still in their early stages and have low market capitalizations or cannot be measured using market capitalization as a metric.

In addition to the diversity of RWA products, the public chains that issue these RWA products have also become the focus of market attention. According to Bitwise, Ethereum is still the most important issuing chain in the RWA market, accounting for 81% of the market share. Ethereum has become the preferred platform for many RWA projects with its strong technical foundation and ecosystem. At the same time, Ethereums continuous updates and upgrades have also provided continuous momentum for its leading position in the RWA track.

In addition to Ethereum, other emerging public chains are also beginning to gain a share. For example, Solana, with its high throughput and low transaction fees, has gradually attracted more and more RWA projects to be issued on its platform. In addition, other public chain platforms such as Avalanche, Polygon and Sui have also joined the RWA track, providing more options for the market.

Based on these major public chain platforms, some emerging public chain projects have also emerged, focusing on providing solutions for asset tokenization. Among them, Mantra, as one of the most eye-catching representatives, has attracted widespread attention from the market. Mantras token OM has increased by as much as 160 times in the past year. This remarkable achievement is due to its cooperation with MAG (one of the largest real estate developers in Dubai). Through this cooperation, Mantra tokenized the financing of $500 million in real estate plots and development projects, allowing on-chain investors to participate in the funding of the project, and after the project is completed, investors can also participate in equity returns. Through this innovative model, Mantra not only introduced more funds to the real estate industry, but also provided investors with the opportunity to directly participate in asset appreciation.

In addition, startups focusing on the RWA sector are also emerging. Among them, the fully modularized integrated Layer-1 blockchain Plume recently received $20 million in financing. More than 180 protocols are being built in its ecosystem, with an asset size of more than $4 billion. It is believed that in the near future, another batch of public chains with potential exclusive to the RWA sector will enter the publics field of vision.

The investment dilemma behind the RWA boom: How do retail investors choose targets?

Since 2023, RWA has become a hot topic in the Web3 field. Whether it is the hot discussion on social media or the focus of offline conferences, RWA is regarded as the next important outlet for Web3. However, although people are full of expectations for the future of RWA, there is still a lack of clear interpretation of how to invest in this field.

The RWA concept has attracted widespread attention due to its potential to combine traditional financial assets with blockchain technology. This field is different from many experimental projects in the early days of the crypto industry because it has a mature revenue model and is closer to the operation of traditional asset management companies. Most RWA projects do not rely on token financing and mainly adopt a centralized model to ensure compliance and management efficiency, rather than emphasizing decentralized community governance.

Data shows that the total market value of RWA products is about 14.9 billion US dollars, but most projects have not launched platform coins, and there is a high probability that they will not be issued in the future. This is because the business models of these projects do not require token economic support, and are also constrained by the regulatory environment. This feature makes the participation path of ordinary investors vague, and the market is more about optimistic about future potential rather than actual action.

Currently, the RWA sector is still in its early stages, with the core driving force coming from traditional financial institutions. They are introducing real assets into the blockchain in a compliant manner and building a basic product layer. For ordinary investors, the opportunities to participate at this stage are limited, and they need to wait for the infrastructure to be gradually improved before they can participate through the innovation and profit mechanism of blockchain native projects.

Two main investment ideas

At this stage, there are two main ways to invest in RWA: one is to directly purchase RWA products, and the other is to invest in the platform coins of RWA-related projects.

There are a few things to consider when investing directly in RWA products:

-

Compliance and SPV : Investors should pay attention to the compliance of products and ensure that the investment complies with local regulations. At the same time, products that manage assets through special purpose vehicles (SPVs) need to pay special attention to the establishment background, operating model and compliance of the SPV. The operating model of the SPV directly affects the security and liquidity of assets, so investors should carefully review relevant audit reports and compliance certificates.

-

Choose asset issuers with high reputation : Give priority to products issued by well-known financial institutions or platforms, such as US Treasury bonds or high-quality stocks. These platforms usually have perfect asset custody and risk management mechanisms, which can effectively reduce investment risks. In contrast, smaller platforms need to pay extra attention to the security of their asset custody and the background of their management team.

-

Security of asset custody : Investors need to ensure that their assets are managed by a mature third-party custody platform to reduce the risk of losses due to mismanagement or security vulnerabilities. Choosing a reputable custodian, such as a bank or a professional asset management company, and understanding its insurance mechanism and risk mitigation measures is an important step in ensuring the security of your assets.

At this stage, direct investment in RWA products is not the focus of most readers of this article. Investing in platform coins is a more attractive option. However, how to choose the right target among the many RWA projects that issue platform coins has become a big problem. Here are some suggestions from the author to help investors make more informed decisions:

-

There is no need to pay too much attention to the actual role of platform coins : the platform coins of most RWA projects do not have actual value, and usually only provide governance rights, but do not have the right to distribute platform revenue. This is because the current RWA track is still in the early stages of large-scale real-world asset on-chain, and most projects are still dominated by traditional companies, which rely more on asset management fees and other methods to achieve returns, rather than obtaining investment returns through issuing coins.

-

Pay attention to the market share of the project in the segmented track : Many RWA projects may only sell concepts and their actual share in the segmented market is almost zero. Such projects often rely on issuing coins to maintain operations rather than benefiting from actual asset management or market share expansion. For projects whose product market value is much higher than the token market value, investors should pay special attention. This shows that the project is developing healthily in the actual market and is likely to achieve a higher market share in the future, thereby driving the value growth of the token.

-

Pay attention to the potential of diversified tracks of RWA projects : the market value of a single RWA project may be inflated, and there may be a huge gap between the market value of the product and the market value of the token. However, if a project involves other tracks (such as DeFi, NFT, blockchain infrastructure, etc.) in addition to the RWA field, the token performance of this project tends to be better. Diversified tracks and application scenarios can provide a more robust growth momentum for the project. Therefore, investors should pay attention to projects that are not limited to the RWA field. The expansion of these projects in different tracks will help increase the actual demand and value of tokens.

-

Emphasis on real-world partnerships : The RWA sector currently relies more on real-world cooperation and support, especially with the participation of traditional financial institutions and well-known companies. Which RWA projects can attract the cooperation of these institutions often means that they have stronger compliance, market trust and risk control capabilities. Therefore, investors should focus on RWA projects that have partnerships with well-known institutions, banks or other traditional financial platforms. These collaborations can not only bring more resources to the projects, but also provide more security for investors, while also giving these projects higher narrative value and development potential in the market.

Future Outlook of the RWA Sector in 2025

Looking ahead to 2025, RWA is gradually becoming one of the core driving forces for the development of Web3. Alex Saunders, an analyst at Citibank, emphasized that with the acceleration of the process of asset digitization, the widespread adoption of RWA will inject long-term vitality into the crypto market. Combined with the improvement in the efficiency of on-chain capital flows brought about by the popularization of stablecoins, the position of blockchain in traditional finance will be further consolidated.

In addition, Coinbase pointed out in its 2025 market forecast that RWA will become the next wave of growth in the blockchain industry. With the improvement of the regulatory environment and the maturity of the technical infrastructure, traditional financial institutions will participate in the field of on-chain assets on a larger scale. The tokenization of high-value assets such as bonds and real estate is expected to introduce more liquidity and stability to the crypto market, and gradually become a new pillar of the on-chain economy.

Judging from the current market performance, the data in 2024 has verified the growth potential of RWA. According to the rwa.xyz report, the market size of tokenized RWA increased by 60% year-on-year to US$14.9 billion this year. In the next few years, the tokenization of asset classes such as private credit, real estate and commodities will further expand the scope of application of this market and provide investors with more transparent and efficient financial tools.

Although it will take time for tokenized assets on the chain to be fully popularized, its potential is unquestionable. Against the backdrop of gradual relaxation of regulations and continuous technological advancement, the outbreak of RWA may become an important turning point for the transformation of the crypto industry. For investors seeking long-term value, 2025 will be a critical moment for the layout of the RWA sector – this year may not only become a turning point for technological innovation, but also a milestone in the deep integration of traditional finance and the crypto industry.

This article is sourced from the internet: 2024 RWA Track Annual Summary: The prospects are promising, but it is still difficult for retail investors to benefit from it

Original author: BitMEX BitMEX is pleased to announce the launch of a new address book whitelisting feature to improve the security and convenience of asset withdrawals for users on the platform. Functional Overview Add a new whitelist address at the network level to cover all assets under the network Prevent unauthorized withdrawals and ensure fund security Detailed Introduction What is the address book whitelist feature? The address book feature allows BitMEX users to store and name specific addresses for easier access when initiating withdrawal requests. Users can now convert their address book to a whitelist, allowing only addresses in the whitelist to make withdrawals. This means that addresses not listed in the whitelist will not be able to make withdrawals. Using the address book function, users can enjoy the following…