Can Ethereal, the first airdrop project in the Ethena ecosystem, replicate the miracle of Hyperliquid?

オリジナル | Odaily Planet Daily ( @OdailyChina )

著者:東( ゆーすけ )

Ethena (ENA) is probably one of the most outstanding performing tokens in the past period of time.

Bitget market data shows that since hitting the bottom at 0.194 USDT in early September, ENA has achieved a nearly 600% increase in the past two months until it rebounded to 1.33 USDT yesterday.

There are many reasons for this. For example, the contract funding rate rose in the bull market, driving Ethenas protocol revenue to rise sharply, and the supply of USDe also increased significantly; for example, the Trump family project World Libertys purchase support for ENA; and the expectation of opening the ENA fee switch promoted by Wintermute; plus the direct cooperation with BlackRock BUIDL, the new stablecoin product USDtb was launched… In addition, the expectation of an open airdrop for holding and staking ENA is also seen as a key reason for the continued rise of the token.

Previously, two projects with a high degree of business relevance to USDe, Ethereal and Derive (formerly Lyra), have announced that they will airdrop to sENA holders (i.e. ENA staking users), of which Ethereal plans to airdrop 15% of the token supply and Derive plans to airdrop 5% of the token supply. Currently, users who hold sENA on the chain can directly view the mining status of these two projects on the Ethena homepage.

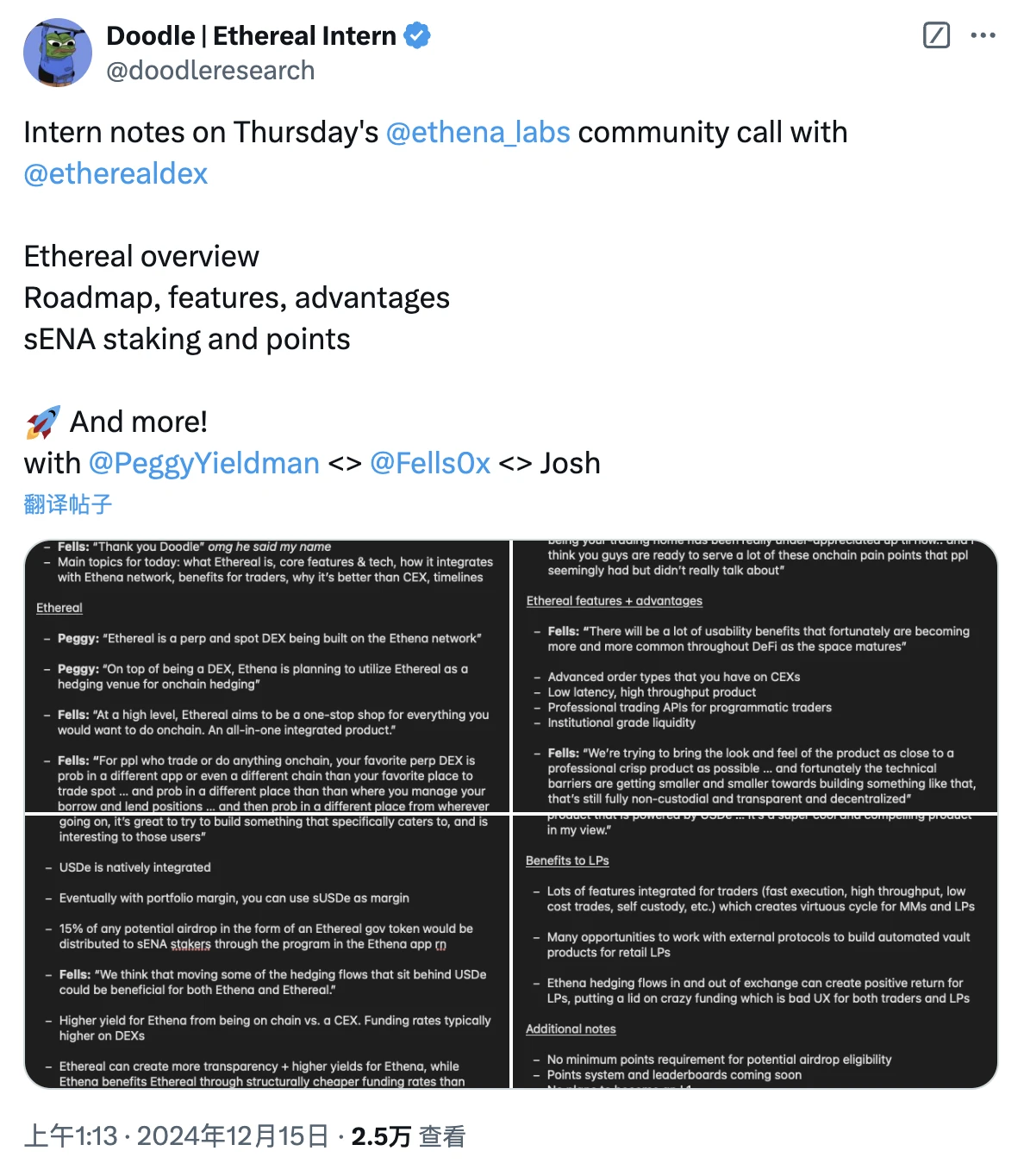

Last week, Ethereal officially held a community conference call to outline Ethereal’s roadmap, features, advantages, and airdrops. It is worth mentioning that Ethereal’s developers have clearly noticed the amazing performance of another strong project, Hyperliquid, and mentioned that Ethereal hopes to build a “one-stop trading service” similar to Hyperliquid.

Ethereal: Ethena Ecosystem’s First エアドロップ Project

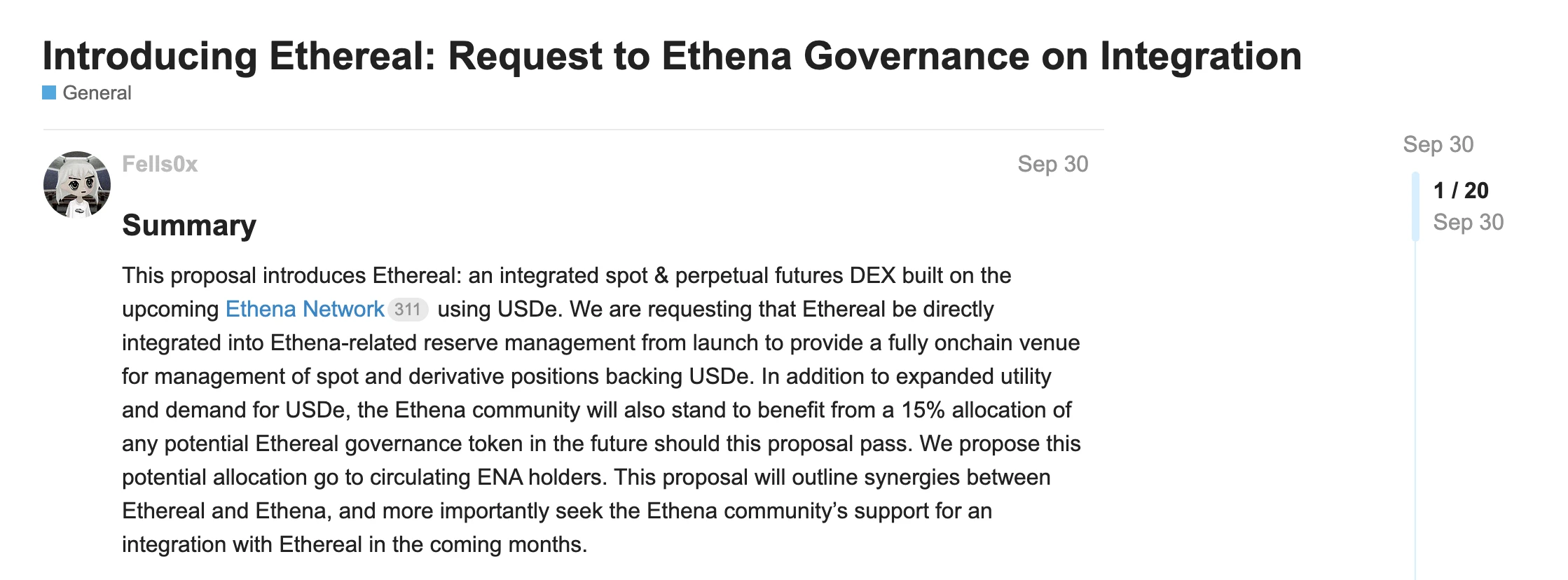

Ethereal made its debut on September 30th of this year.

At that time, Ethereal founder Fells initiated a related proposal on Ethena, proposing to build an on-chain trading venue around USDe to support spot and derivative transactions. On the one hand, Ethena can profit from the expansion of USDes utility, and on the other hand, Ethereal can seize the ecological hub position in advance in the early stage of USDes growth.

From an architectural perspective, Ethereal will serve as Layer 3 based on the Ethena network; from a business perspective, in addition to being equipped with a complete trading system, Ethereal also supports the deployment of other USDe-related applications (such as lending).

In order to gain the support of the Ethena community and deepen the binding relationship, Ethereal stated in the initial version of the proposal that it would give 15% of the tokens as airdrops to ENAs pledge users.

Latest News: Learning from Hyperliquid

In the latest community conference call, Ethereal team members emphasized Hyperliquid and believed that the key factor for the project’s success is “providing a complete set of transaction services”, which solves the hidden pain point that users need to switch between different applications when performing different operations, thus better helping to retain users and funds.

In this regard, Ethereal founder Fells also re-described Ethereals positioning as a one-stop product that supports all DeFi operations. Users can conduct spot or contract transactions, rate arbitrage, lending, options and even forecasting operations here, and at the same time use sUSDe (staking USDe) to obtain stable interest-bearing income.

Fells added that he hopes to make Ethereal a platform similar to CEX in terms of user experience, but at the same time Ethereal will remain completely non-custodial and decentralized. For example, Ethereal will abstract the payment of gas through a specific design, and users do not have to sign or pay gas fees for each transaction.

Time plan: Q1 mainnet launch

According to the timeline mentioned in the conference call, Ethereal expects the following development rhythm:

-

Testnet release: expected next month;

-

Test gateway stop;

-

Mainnet launch: expected in the first quarter of 2025;

Falls also mentioned that Ethereals concrete functions will be launched in stages, starting with USDe perpetual contract trading, followed by combined margin models, lending and spot trading. The relevant businesses are likely to be launched in the first half of 2025. In addition, Ethereal will only support the trading of a few blue-chip tokens at the beginning of its launch. After users and liquidity accumulate, a batch of new trading pairs will be launched every week.

Ethena’s Ecosystem Expansion

Ethenas ecosystem is expanding rapidly. In addition to Ethereal mentioned in this article, Derive, a derivatives project formerly known as the options protocol Lyra, will also issue tokens in the first quarter of next year, and will also airdrop 5% of tokens to sENA holders.

Benefiting from the positive sentiment of the bull market, the funding rate of the contract market has remained high, driving up the yield of the Ethena protocol itself and sUSDe. As of the time of writing, the supply of USDe has approached the $6 billion mark, with a real-time yield of 27%.

At the same time, the new stablecoin product USDtb launched by Ethena and BlackRock BUIDL also made up for Ethenas biggest shortcoming – the protocol itself and sUSDe will temporarily show negative returns during the negative rate cycle. The structure of USDtb is similar to that of traditional RWA stablecoins. Its stability is supported by reserve assets, and its income comes from treasury bond interest rates. In the future, when the supply of this stablecoin increases, Ethena will obtain a reliable safe-haven window during the negative rate cycle or when the rate income is lower than the treasury bond income, thereby solving the hidden danger of the protocol being susceptible to negative rates.

Arthur Hayes, the famous Bitcoiner and founder of BitMEX, predicted earlier this year that “USDe will surpass USDT to become the largest dollar stablecoin.” Although the supply scale of the two parties is still dozens of times different, considering Ethena’s current sustained high yield and ecological expansion speed, this is not impossible. If this expectation can be realized, ecological sub-projects such as Ethereal, which have seized the ecological hub position in the early stage, will inevitably benefit, and then once again form value feedback to ENA.

This article is sourced from the internet: Can Ethereal, the first airdrop project in the Ethena ecosystem, replicate the miracle of Hyperliquid?

Related: IOSG Ventures: Let’s talk about Unichain’s design architecture again. Why is it necessary?

Original source: IOSG Ventures Preface Over the years, Uniswap has been continuously pushing for functional and innovative reforms to make exchanges more user-friendly and fair. For example, we have seen Uniswap Mobile, Fillers Network in UniswapX, ERC-7682 for unified cross-chain intent standards, and hooks for custom AMM pools in Uniswap V4. On October 10, Uniswap announced their master optimistic Rollup, Unichain. The chain aims to become a one-stop liquidity center in the superchain ecosystem, providing traders with a near-instant exchange experience and lower spreads, while maximizing the privacy and integrity of MEV participants in the process, and using TEE in the process. While these visions are impressive, users question the need for another L2, with some, including Vitalik, commenting that Unichain = “a copy of Uniswap on every Rollup.” In…