Is the interest rate cut stable next week? Nasdaq breaks 20,000 points for the first time, Bitcoin stands at $101,000

原作者: BitpushNews

U.S. stocks and 暗号 markets rose after the release of the U.S. Consumer Price Index (CPI) data for November.

The US CPI data for November rose 2.7% year-on-year, higher than 2.6% in October, in line with market expectations. The monthly CPI rose 0.3% in November, slightly higher than 0.2% in the previous month. Among them, the core CPI rose 3.3%, the same as in October.

Data from the FedWatch 道具 showed that the probability of the Federal Reserve cutting interest rates by 25 basis points next week has risen to more than 96%.

As of the close of US stocks on Wednesday, the Dow Jones Industrial Average initially closed down 0.2%, the SP 500 rose 0.8%, and the Nasdaq rose 1.77%, breaking the 20,000 mark for the first time. Tesla (TSLA.O) and Google (GOOG.O) both rose more than 5.5% and set new highs.

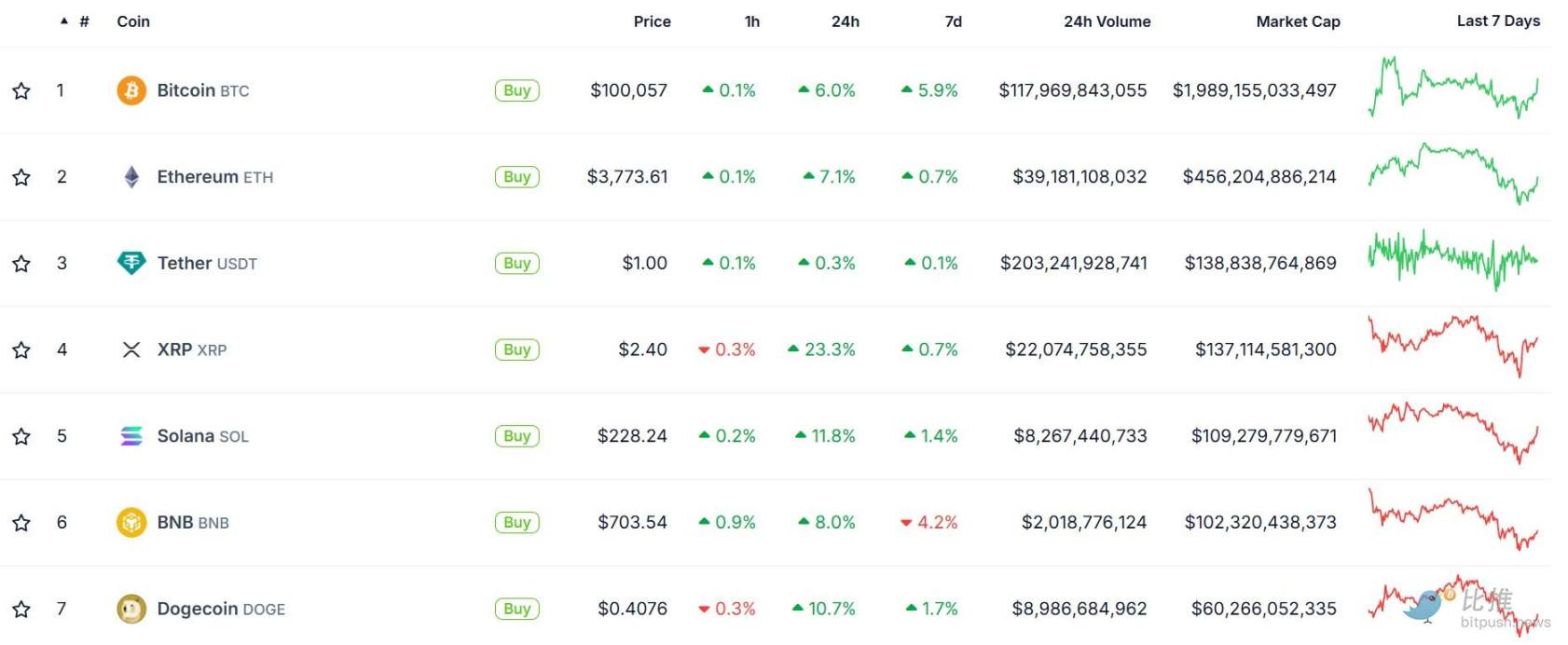

In the crypto market, Bitcoin rebounded above $101,000, up more than 6% in the past 24 hours. During the same period, XRP, Solana (SOL) and Cardano (ADA) rose by 23%, 11% and 16%, respectively.

Meme coins such as Dogecoin (DOGE), 柴犬 (SHIB), dogwifhat (WIF), BONK and FLOKI all achieved double-digit gains. AI concept tokens also rose by more than 7%, with NEAR, ICP and Render rising by more than 10%.

Institutions buy on dips

Data from Sosovalue shows that institutional investors are seizing the opportunity to buy on dips, with $439.5 million flowing into U.S. spot Bitcoin ETFs on December 10. The U.S. spot Ethereum ETF recorded the third-largest daily inflow ever, at $305.7 million. Arkham monitoring data shows that BlackRock and Fidelity ETFs have purchased more than $500 million worth of ETH in the past 48 hours.

Trader: BTCs next target is around $112,000

Well-known trader Skew pointed out that the market is currently in a state of supply and demand balance, and emphasized that there are passive buyers supporting prices. In addition, he also mentioned that on Binance, the worlds largest cryptocurrency exchange, there are strong buying and selling orders around $97,000.

Another trader, Roman, analyzed from the perspective of the daily chart and believed that the relative strength index (RSI) has been completely reset, which indicates that Bitcoin may usher in a strong rise with a target price of around US$112,000.

Well-known trader Johnny also said that Bitcoin has rebounded several times around $95,000, showing strong support and is expected to continue to rise in the future.

Chart analyst Upadhyay believes that the strong rebound of Bitcoin price from the 20-day moving average (about $96,133) shows that the bulls are still strong. If it can effectively break through the resistance range of $101,351 to $104,088, it will further confirm the upward trend. By then, Bitcoin is expected to hit $113,331 and even challenge the $125,000 mark.

However, if the price falls below the 20-day moving average, it may trigger profit-taking and cause the price to fall back to around $90,000. Therefore, $90,000 is the focus of competition between bulls and bears and is also an important support level.

On the whole, many analysts are optimistic about the future trend of Bitcoin. Although the market may fluctuate in the short term, the overall trend is still bullish.

This article is sourced from the internet: Is the interest rate cut stable next week? Nasdaq breaks 20,000 points for the first time, Bitcoin stands at $101,000

Related: Trump Bubble: What’s Next for Bitcoin?

Original author: @packyM, Not boring Original translation: Vernacular Blockchain In the new US presidential election in 2024, Trump was re-elected. The capital market also ushered in a wave of enthusiasm, the US dollar index hit a new high, and the crypto market was unstoppable. The total market value of the global crypto market exceeded 3 trillion US dollars for the first time. After Bitcoin broke through the 90,000 US dollar mark, it seemed that 100,000 US dollars was within reach. Trumps election has undoubtedly injected a dose of stimulant into the capital market, especially the crypto market. Can the various favorable expectations released during the campaign be realized? How will the future crypto market develop? @packyM has made an outlook on the Trump bubble, and Vernacular Blockchain has compiled excerpts…