AI Meme: The biggest trend in 2024, a repeat of history from DeFi Summer to AI Winter

原作者: Taiki Maeda , Founder of HFAresearch

原文翻訳: TechFlow

At the market high in Q1 2024, the top 10 “AI Tech Coins” had a combined market capitalization of $30.9 billion. On the other hand, despite attracting more attention, the top 10 AI ミームコインs had a combined market capitalization of just $2.54 billion.

I think the emergence of $GOAT そして 真実のターミナル has opened up a whole new field of AI that could grow 100x in the future. This is a great opportunity to get ahead in PvE (Player vs. Environment) mode, just like the early days of DeFi summer in 2020.

市場 機会

Meme Coin Super Cycle + AI Super Cycle = AI Meme Coin Ultimate Cycle

In Q1 2024, as NVIDIA (NVDA) stock price surged wildly, many AI tokens also saw parabolic growth despite their fundamentals and token economics. We saw the total valuation of the top 10 AI technology coins exceed $30 billion, not including fully diluted valuation (FDV) and smaller market cap tokens. I believe this is just a market trial to push prices higher in the 暗号 and AI space, and in 2025, we will see a larger parabolic growth.

However, I believe that most of the excess returns will appear in the AI Meme Coin category. Currently, the total market value of AI Meme Coin is only equivalent to Ethereum Classic. AI Meme Coin will gradually attract capital from AI technology coins, static memes, and venture capital tokens through blood sucking attacks.

“DeFi Summer” Moment

Many people have likened the phenomenon of $GOAT rising from $0 to $1 billion to the YFI moment of this new space. An important catalyst for the DeFi summer of 2020 was the emergence of $YFI. It was fairly launched in July and reached a market cap of $1 billion within 2 months. This phenomenon activated a large amount of on-chain capital to flow into the DeFi space because it verified the possibility that a fair-launched DeFi token could start from 0 and reach a market cap of $1 billion.

DeFi became a hot area in the last cycle because it was novel, attractive, and made people imagine the future. In the context of 0% interest rates, the narrative of DeFi was to attract capital from traditional finance (TradFi) through blood-sucking attacks and become the financial system of the future. This triggered a speculative boom on the chain, helped DeFi applications gain total value locked (TVL) and users, and battle-tested the ecosystem. When $YFI was launched, the total market value of DeFi was about $5 billion, and at the market peak, this figure reached about $170 billion, an increase of 34 times. If $GOAT is compared to $YFI , then we are indeed in a very early stage now, because the total market value of AI Meme Coin is less than $5 billion.

The rise of the DeFi cycle depends on both internal catalysts in the crypto space (such as liquidity mining, high-return mining mechanisms, and speculative behavior) and external factors (such as interest rates falling to zero and capital pouring into the crypto space in search of returns). This process eventually formed a bubble.

The ultimate cycle of AI Meme Coin is similar. In the crypto space, the current mainstream narrative is the super cycle of Meme Coins, while in the stock market, AI technology brings continuous growth momentum. These two combined constitute the ideal conditions for a bull market.

In the crypto space, areas that capture people’s imaginations often see parabolic growth opportunities.

Reflexivity in the new paradigm

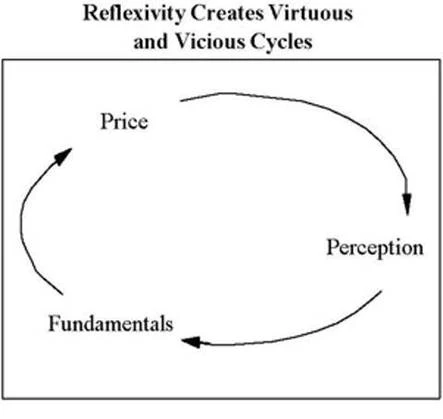

Reflexivity theory states that investors make decisions not based on reality but on their perception of reality. This perception-driven behavior in turn changes reality (or fundamentals), which further affects investor perception and market prices.

In this context:

-

The price refers to the overall market capitalization of the AI Meme Coin space.

-

Perception is the market’s view of what these tokens represent.

-

Fundamentals are based on attention and how big a dream these tokens can inspire.

I think these tokens are not pure meme coins but closer to トークンized AGI. They are all fairly launched on the pumpfun platform. If these tokens were launched by venture capital (VC), they might be sold at a fully diluted valuation (FDV) of $1 billion and 10% of the circulation, and then sold to retail investors by VC. But these AI meme coins start from 0, providing everyone with the opportunity to participate early. This phenomenon is similar to the ICO (Initial Coin Offering) that we are replaying in real time.

Here’s how I think reflexivity works:

-

The “AI Meme Coin” category attracts speculators. Most people ignore it because “it’s just another PvP Meme Coin narrative.” (We are at this stage now)

-

As time went on and the capabilities of the AI agents gradually improved (e.g. Zerebro launching a record label, Truth Terminal releasing Infinite Backrooms v2, etc.), investors’ perception of these tokens changed from “just meme coins” to “a whole new field.”

-

This shift will attract more capital and attention from both inside and outside the crypto space, spurring more speculative activity. Some failed AI startups may transform into issuing tokens as a last-ditch effort, and wealthy tech billionaires may also start investing in a handful of tokens.

-

Unlike static memes, these AI agents will perform activities on the chain, launch NFT and DeFi projects, and even have real-world impacts. They are not static, but constantly evolving to attract more attention.

-

All of the above factors combine to drive potential valuations upward inデフィnitely, eventually forming a bubble and ending in a boom-bust cycle.

It is particularly important that these tokens are all launched on the pumpfun platform. This launch method fits the current trend, including the formation of cult culture, the superposition of meme coins and AI supercycles, and anti-VC sentiment. If you believe in the four-year cycle theory, then the arrival of AGI in 2025-26 predicted by Elon Musk may coincide with the high point of the crypto market in the fourth quarter of 2025.

My investment strategy

Frankly, I’m not sure how to allocate funds correctly. If this is just a “meme” category, then the current winners may continue to lead, so it’s worth betting on them. On the other hand, if $GOAT behaves similarly to YFI, it may experience a round of big gains – but it may eventually be replaced by “better technology”. Personally, I know that I can’t accurately predict which tokens will ultimately win, so I choose to build a portfolio of AI Meme coins to profit in the “rising tide lifts all boats” scenario where the market as a whole rises.

Here is a rough framework for how I would allocate funds to this emerging field:

-

For tokenized AGI, you are actually betting on which AI agent can continue to attract and grow attention. The attention here is similar to the income in the traditional market and is the core indicator of value.

-

Large Language Models (LLMs) will continue to improve over time, so you want to bet on founders or developers who are motivated to create the best possible agent by fine-tuning the model.

-

This space is in a secular bull run. Keep an eye on AI agents that have the potential to attract attention outside of crypto Twitter/X, as they can break through the small bubble in the crypto space and gain wider attention.

-

As the market develops, token economics (Tokenomics) will become more and more important. You need to think about what is the purpose of the token? What does it represent? If the token price increases, will this help the AI agent further achieve its goals? The interplay of price, perception, and fundamentals (i.e. reflexivity) is critical for every token.

In the last cycle, the total market value of DeFi reached $170 billion. If the field can reach a similar valuation, it will mean an increase of about 40 times from current levels. But since the overall market value of the current crypto market is higher, it is entirely possible that we will exceed these levels. The key is to have firm conviction, remain patient, and flexibly adjust investment strategies according to market fluctuations and rotations to maximize your sleep-friendly returns – that is, get the best returns without affecting your sleep.

Please take my words seriously, I really have no idea what I am doing. In fact, I don’t think anyone really knows what they are doing. This may change at any time, but my current AI Meme Coin portfolio consists of:

-

$GOAT : The current leader and strongest performer in the market.

-

#ZEREBRO : Led by crypto-native founders, with a deep understanding of cultural trends and developing at an extremely fast pace.

-

#Fartcoin : Taking into account the needs of left, center, and right curves, it aims to satisfy investors at different levels. After all, everyone farts.

-

#Ai16z : Despite the controversy, it has maintained a cult-like developer community. If they can survive this period, they will become more antifragile.

-

$FOREST : An AI monkey project trying to save the rainforest, with real-world impact.

This article is sourced from the internet: AI Meme: The biggest trend in 2024, a repeat of history from DeFi Summer to AI Winter

Related: Jupiter founder talks about ultimate vision: Why do we need Jupuary?

Original author: Meow, founder of Jupiter Original translation: Luffy, Foresight News One thing that being open and diverse has taught me is that figuring out what I want is the hardest thing to do, and also possibly the most important thing to do. Without that clarity, it’s easy for me to get sucked into endless pain and uncertainty with the people I care about most. Likewise, I think the lack of clarity around Jupuary and Jupiter’s broader goals could cause a lot of friction between the stakeholders I care about most (i.e. the community, users, and of course the team). Jupuary is an unprecedented event that requires voters to work together to make the pie bigger. If this is not communicated well, we will have big problems. This article aims…