Uncovering the legendary life of Michael Saylor: shouting at Musk and betting big on Bitcoin

As the price of Bitcoin once again broke through its all-time high, MicroStrategys stock price also soared, with an increase of more than 2,500% since mid-2020. This performance far exceeds Bitcoins increase of about 660% in the same period, and even outperforms AI leader Nvidia.

Last night, MicroStrategys stock price rose 15% during the trading session, reaching a high of $498.89, breaking the historical record again, and its market value also exceeded $100 billion for the first time. Currently, MicroStrategy has ranked among the top 100 US listed companies by market value, ranking 33rd on the Nasdaq, 89th on the SP 500, and 85th on the overall US stock market.

As of now, MicroStrategy and its subsidiaries hold approximately 331,200 ビットコインs, with a total cost of approximately $16.5 billion and an average purchase price of $49,874. According to statistics from Bitcoin Treasuries, MicroStrategy is the publicly listed company with the most bitcoins in the world, far exceeding bitcoin mining companies Marathon and Riot, as well as leading 暗号 trading platforms Coinbase and other companies that are more crypto-native in terms of business. Analysis shows that MicroStrategy still has $15.3 billion in funds to purchase further bitcoins, and its aggressive strategy of increasing holdings may continue until the end of the year.

MicroStrategys Bitcoin purchase date, price, stock price and market value statistics; data source: bitcointreasuries, mstr-tracker

In addition, the companys founder and CEO Michael Saylor also holds more than 17,000 bitcoins and owns 14% of the companys shares. If the price of bitcoin reaches $100,000, Saylors personal assets will reach $11.1 billion, enough to make him rise nearly 200 places in the worlds richest ranking, surpassing Peter Thiel.

This year is his zodiac year. Michael Saylor, who is 60 years old, not only went all in with the company to buy Bitcoin crazily, but also leveraged it, using a big gamble to completely change the fate of him and MicroStrategy.

Michael Saylor began to use Bitcoin as a strategic reserve in the name of the company in 2020. This company, which originally focused on business intelligence, data analysis and cloud computing, has transformed itself into the listed company with the most Bitcoin in the world due to its bold Bitcoin investment strategy.

But such a crazy Bitcoin fan once said ten years ago that Bitcoin will not last for a few days. It is a matter of time. Its end will be the same as online gambling. At that time, he thought that Bitcoin would either be declared illegal and banned completely, or it would be inferior to other cryptocurrencies and thus exit the stage of history.

So, what happened in the past decade that prompted Michael Saylor to transform from a Bitcoin skeptic to todays most staunch believer and promoter?

Playing Games with God: The First Half of the Life of Business Prodigy Michael Saylor

My belief is that if you want to play a game, its best to go all in, without any exceptions. I dont believe those who hold back will have the last laugh.

Like other Internet company founders, Saylor also has a nearly legendary life experience. His father is a sergeant in the US Air Force and his mother is the daughter of a country singer.

My father was the typical, disciplined sergeant, Saylor recalled. If you decide to do something, you have to do it to the best of your ability, you know? He was a man of absolute integrity. I never saw him lie, and he would never do anything half-heartedly to anyone or anything. It wasnt until I grew up that I realized how unique this quality was. A lot of people like to take shortcuts and bargain, but my father never did that. He never took shortcuts.

In a color photo, his mother, Phyllis, beams. My father taught me character, and my mother taught me charm.

His father told him that there were things he had to do, and his mother told him that he could do anything he wanted to do because he was smart. In seventh grade, when he was named Newsboy of the Year, his mother pulled him aside and whispered in his ear, Youre going to make a great contribution to society when you grow up, because you have talents and youre smart—so make sure you use them.

Saylor was a very good student. He learned to fly a glider in high school and graduated at the top of his class. Later, Saylor received a scholarship from the U.S. Reserve Officer Training Program (ROTC) and entered the Massachusetts Institute of Technology to study history of technology and aeronautics and astronautics. However, due to a heart murmur found during a physical examination, Saylor had to give up the idea of becoming a pilot or astronaut.

The ups and downs of the entrepreneurial journey

After a stint as a computer simulation planner at DuPont, Saylor co-founded MicroStrategy in 1989 at the age of 24 with his MIT roommate and fraternity brother Sanju Bansal.

At that time, Saylor realized that the Internet had powerful data analysis capabilities that could help companies analyze massive amounts of data about products and markets. Soon, customers began to pay MicroStrategy hundreds of thousands of dollars a year to create intuitive charts to show some intuitive consumer trends, such as which consumers like specific beverages or insurance products.

The turning point of the business really came when MicroStrategy signed a $10 million contract with McDonalds. The funds were used to develop applications to evaluate the effectiveness of promotional measures, which played an important role in the early development of MicroStrategy.

In 1992, 27-year-old Michael Saylor celebrated MicroStrategys first client, McDonalds, winning a $10 million contract; Image source: Instagram @michael_saylor.

By the time Saylor was on an 11-day road show for his IPO in 1998, he was already doing so well that he invited a Washington Post reporter to document the entire process. Saylors sales style relied on passion, stagecraft, and grand narratives rather than numbers, and his exaggerated presentations were much more attractive than PowerPoint.

Wall Street generally believed that Saylor was arrogant but very inspiring. According to news reports at the time, Saylor was very enthusiastic about data analysis technology and painted a convincing roadmap for the future of this technology. Investors almost all signed contracts based on their confidence in him.

There was a software investor on Wall Street who always looked down on CEOs in the software industry during every meeting, thinking they were all garbage. But Saylor used his eloquence to force him to sign. At Bear Stearns, Saylor only took 20 minutes to get the boss of the company to subscribe for 10% of the shares. Fidelity Group, the worlds largest fund company, is known as the industrys most difficult backcourt to break through, but in Saylors words, he broke through the company like a slam dunk.

MicroStrategy is also a pioneer in enterprise data analytics technology, which allows retail companies, pharmaceutical giants, banks, insurance companies and government agencies to discover important trends from large amounts of data through data analysis software. With this unique skill, MicroStrategy has won more than 300 long-term customers, including giants such as KFC, Pfizer, Disney, Allianz, Lowes and ABC.

After going public in June 1998, MicroStrategy quickly became a darling of Wall Street. By March 2000, its stock price had reached 16 times its IPO price, with a market value of nearly $18 billion.

But then MicroStrategy was caught up in an accounting scandal, and its stock price plummeted 62% in a single day. Saylor lost $6 billion in personal wealth, and even became the answer to a question in the puzzle game Guess the Big Game: Who lost the most money in a day?

In March 2000, MicroStrategys auditing firm PricewaterhouseCoopers asked it to restate its revenue and profits for the previous two years. After the re-audit, MicroStrategys performance in 1998 and 1999 changed from a profit of $28 million to a loss of $37 million. Saylor, another founder and the companys financial director chose to pay an $11 million fine to the Securities and 交換 Commission to settle the relevant charges. As CEO, Saylor himself paid $8.3 million, but Saylor and others involved in the scandal did not admit any wrongdoing.

Saylor on the front page of the Daily News on March 21, 2000

By mid-2002, MicroStrategys market value had plummeted to around $40 million, a 98% drop from its peak.

But then Saylor had an idea that would lead to MicroStrategys resurgence. He foresaw the explosive growth of mobile devices, so he thought he could develop programs to help customers analyze the massive amounts of data collected from users iPhones and laptops.

Around 2009, Saylor gave his software for free to Sheryl Sandberg, Facebooks new chief operating officer. MicroStrategys technology was important to Facebook, as it allowed sales staff to know how much revenue each product could bring in. Facebook eventually became a stable customer of MicroStrategy, bringing it millions of dollars in revenue each year, and Saylor also achieved sustained profitability with the help of mobile technology.

Become a giant of thought admired by all

Although his business is not particularly large, Saylors personal life is luxurious. He has a villa in Miami Beach with 13 bedrooms and 12 bathrooms. He also has a $47 million Bombardier aircraft and two yachts. One of the yachts is named Hal to commemorate the ship that brought his ancestors from Rotterdam, Netherlands to Philadelphia in 1736.

Saylor is also a party animal. In 2010, he held a wildlife-themed party for his birthday at the W Hotel in Washington, D.C., and took photos with a Burmese white python hanging around his neck. Every year before Thanksgiving, he holds a rock festival in SoHo, Manhattan, where guests dress up as rock stars.

In an interview with Fortune, Saylors former colleagues said that in addition to his glamorous social life, Saylor also longed to have a wide influence in the technology industry and wanted to become a famous thought leader. In the words of a former employee, he wanted to be a giant of thought admired by everyone.

However, according to former colleagues, Saylor was a moody, micromanaging person, and some said he was too strict. Saylor was an extremely confident person, so he felt that he could do everything himself, so he was reluctant to delegate too much power to his subordinates.

But it turns out that Saylor is very good at observing big trends. In 2012, he published a best-selling book, The Mobile Wave: How Mobile Intelligence Will Change Everything, which foresaw how mobile devices would revolutionize everything from retail to banking.

Saylor has built at least two notable new businesses within MicroStrategy. A former colleague of Saylor once said of him: He has the ability to see the future.

In the late 2000s, Saylor developed a monitoring platform that allowed homes and businesses to monitor their security systems through the website Alarm.com. He sold the business for $28 million in 2008. In the early 2010s, Saylor developed one of the first cloud-based automated voice response systems for call centers, naming it Angel. In 2013, Genesys acquired Angel for $110 million.

His former colleague said: Saylor does not allow people to do things their own way, but without this freedom, people cannot grow. Of course, I think the advantages outweigh the disadvantages. Imagine if you followed his investment every step, first the Internet, then mobile technology and cloud computing!

However, Saylor’s moody and volatile style also put a lot of pressure on management, which hindered the company’s development to a certain extent. Since 2018, he has changed three marketing directors, and a financial director left after working for a year. Saylor’s inability to retain outstanding talents also explains why he did not expand and strengthen excellent ideas such as Angel and Alarm.com, but sold them to other companies.

Michael Saylor’s favorite game is Dungeons Dragons, and he has always insisted on becoming a Dungeon Master because he “likes to create and control the situation.” Just as his choices that have been proven to be correct time and time again in his business journey are inseparable from Saylor’s judgment of the situation.

The entrepreneurial experience in the first half of his life has given Saylor enough adventure experience. Saylor believes in Christianity and has been baptized, but in his opinion, life in the real world is like playing a game with God. Look at my ring – there is a dam, right? And a beaver. This beaver is playing a game with God in the waves. Edison is also playing a game with God. Rockefeller, Carnegie… these people are just like me. This life is just playing a game.

The game of Michael Saylors second half of life has begun.

Call Musk on board, why does Saylor want to buy Bitcoin?

In 2015, MicroStrategys revenue was $134 million, but since then the companys operating income has been declining year by year. By 2018, revenue had dropped sharply to $3.981 million. In 2019, it lost $1 million. In the first three quarters of 2020, MicroStrategys revenue loss was about $14.02 million.

At that time, the world was in the midst of the black swan of the epidemic, and Saylor had an epiphany. At that time, MicroStrategy had a large amount of cash on hand, and Saylor was worried that the Federal Reserves loose monetary policy would exacerbate inflation, causing the cash in his hands to depreciate severely.

At its July 2020 quarterly meeting, Saylor announced that MicroStrategy planned to purchase Bitcoin, gold, and other assets to replace the cash still held on its balance sheet.

A month later, MicroStrategy used $250 million in cash on hand to buy 21,454 bitcoins. In September and December 2020, MicroStrategy spent $175 million and $50 million, respectively, to buy bitcoins.

In December 2020, in order to further expand its Bitcoin holdings, MicroStrategy issued $650 million in convertible bonds, which usually have longer maturities, most of which mature in 2027-2028, and some are even zero-interest bonds. This enables the company to maintain low financing costs in the next few years and quickly use the bond financing obtained to purchase Bitcoin and add it directly to the companys balance sheet.

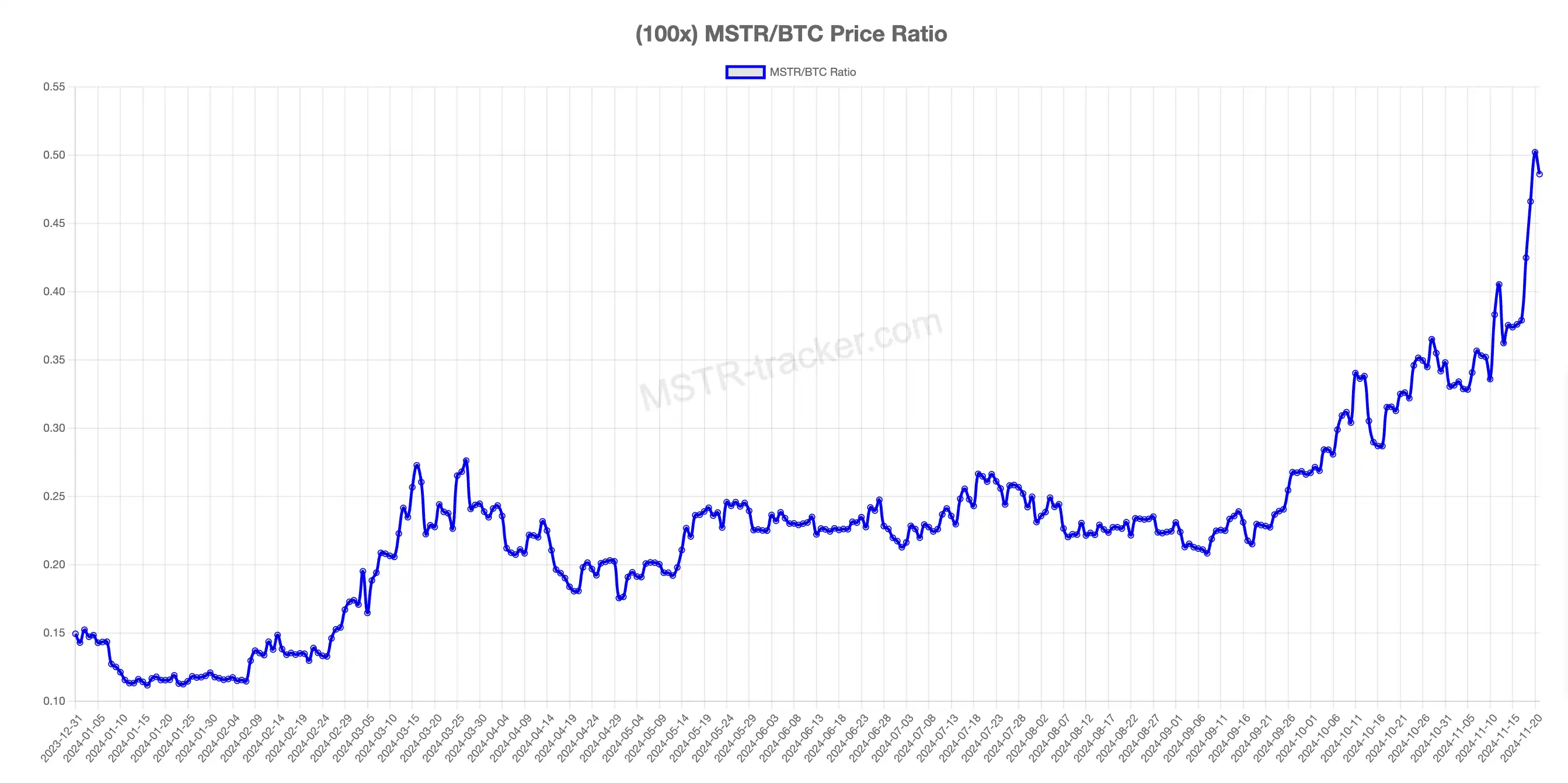

Through bond financing, MSTR has continued to increase its holdings of Bitcoin, which not only increased the number of Bitcoins in its balance sheet, but also significantly boosted the market price of Bitcoin. As the proportion of Bitcoin in MSTRs asset portfolio continues to increase, the positive correlation between the companys stock market value and Bitcoin prices has further strengthened. According to MSTR Tracker, the correlation coefficient between MSTR stock prices and Bitcoin prices has recently surged to 0.55, setting a record high.

Since the middle and late part of last year, MicroStrategy has adopted a new way to buy coins, that is, to buy more Bitcoin by issuing additional shares and selling its own MSTR shares. This strategy of selling shares to buy coins seems very stupid at first glance, which may not only hurt the stock price, but may even threaten the market positioning of MSTRs leveraged Bitcoin. However, after a careful analysis of its logical chain, it is found that the additional issuance will not only not have a negative impact on the price of MSTR, but will make MSTR more valuable.

関連記事: The strategy of issuing bonds to buy coins has not changed, why did the MSTR premium suddenly soar?

When MicroStrategy issues additional shares to buy Bitcoin, the newly issued shares typically trade at a premium to their net asset value. With this premium, MicroStrategy will be able to buy more Bitcoin than the actual Bitcoin behind the individual shares when it sells each share of MSTR.

For example, we use the correlation coefficient between MSTR and Bitcoin to calculate that 36% of the value of each MSTR share represents the Bitcoin backed by the company. Without a premium, when MicroStrategy sells MSTR, it can only get 36% of Bitcoin from the market. However, at present, the premium of MSTR to Bitcoin is about 2.74, which means that every time MicroStrategy sells a share of MSTR, it will be able to get about 98% of Bitcoin.

This means that the company can use funds higher than the net assets of Bitcoin to increase its holdings of Bitcoin, thereby expanding its Bitcoin holdings on the balance sheet. The core of this strategy is that MSTR has increased the speed and scale of its Bitcoin holdings through high premium financing, which far exceeds the previous speed of issuing bonds to buy coins.

According to the latest Form 8-K filing, MicroStrategy has successfully achieved a 41.8% Bitcoin yield in 2024. From another perspective, this is equivalent to a net return of 79,130 bitcoins for shareholders, an average of about 246 bitcoins per day – all without incurring the high costs associated with mining. If all miners in the world were to achieve the same result, it would take about 176 days.

As a result, Saylor created two firsts: one is that MicroStrategy became the first listed company in history to purchase Bitcoin and incorporate it into its capital allocation strategy; the other is the first company that dared to borrow other peoples money to buy Bitcoin.

Repairing the worlds balance sheets

Not only did Saylor buy it himself, he also recommended that his business tycoon friends buy it as well.

Musk, who is now on good terms with Trump as Comrade Ma Baoguo, was not so deeply involved in cryptocurrency four years ago. In December 2020, Musk posted a slightly teasing picture of a monk with his hands clasped together and his eyes gazing upward devoutly, but unable to resist the temptation of Bitcoin. Saylor responded to Musk by suggesting that he do something worth $100 billion for Tesla shareholders, converting Teslas balance sheet from US dollars to Bitcoin.

Musk asked, “Is such a large transaction possible?” Saylor responded, “Of course, I have purchased more than $1.3 billion in BTC in the past few months, and I am happy to share my operation strategy with you privately.”

In February 2021, Musks Tesla disclosed that it had purchased $1.5 billion in Bitcoin using cash on its balance sheet and announced that it would begin accepting Bitcoin as a payment method for its products.

In October of this year, Saylor called on Microsoft CEO Satya Nadella again, saying, If you want to make another trillion dollars for Microsoft shareholders, please contact me. According to a SEC document, Microsoft is preparing to discuss possible Bitcoin investments at its shareholders meeting in December.

Time magazine once interviewed Saylor, and the reporter started by asking him whether Bitcoin is an irrational boom, Even if people dont believe that something has value, they will blindly join the gamble because they envy the success of others.

Facing this pointed question, Saylor answered confidently, No, on the contrary, Bitcoin is a textbook example of a rational response to inflation. The so-called rational behavior is to find a means of storing value that can maintain and increase its value. Speculation, on the other hand, is to suppress opponents through short selling, short squeezes, etc. This is called speculation. Investing in Bitcoin is not speculation at all! Bitcoin is a brand-new technology, comparable to Facebook and Google in the financial world, and has huge room for future appreciation.

The reporter then raised a more challenging question: So why is Bitcoin so badly regarded?

“A new paradigm means a radical change in the way we view the world, and vested interests often won’t accept this new thing. Our only hope lies in the next generation. Because unless there is a war or a very serious incident, these vested interests will change their minds, and young people are different.”

The reporter asked, What are your ambitions?

Saylor said only one thing: I want to fix the worlds balance sheets.

Michael Saylors enthusiasm for Bitcoin is not just a business adventure, but also a belief. From a data analysis pioneer to a firm promoter of Bitcoin, he has driven the transformation of MicroStrategy with his strong personal will and business insight, and also shown the market how to reshape a company through extreme risk-taking.

However, this gamble strategy has also raised questions in the market. Some analysts worry that MicroStrategys high leverage exposure to Bitcoin may amplify the impact of market volatility on the company, especially when Bitcoin prices fluctuate sharply. In addition, although Saylor claims to repair the worlds balance sheets, it remains to be seen whether such a vision can really stand the test of time.

Saylor once said: Life is a game, and he obviously has no intention of stopping this game about Bitcoin.

参考記事:

https://fortune.com/2022/08/03/michael-saylor-microstrategy-stock-bitcoin-bet-debt-outlook/

https://time.com/5947722/microstrategy-ceo-bitcoin/

This article is sourced from the internet: Uncovering the legendary life of Michael Saylor: shouting at Musk and betting big on Bitcoin

Original author: Arthur Hayes Original translation: TechFlow (The opinions expressed in this article are the author’s personal opinions only and should not be used as the basis for investment decisions, nor should they be considered as investment advice.) I spent the first two weeks of October skiing in New Zealands South Island. My guide, who had spent the previous season with me in Hokkaido, assured me that New Zealand was one of the best places in the world for backcountry skiing. I believed him and set off with him in Wanaka for two weeks chasing powder and spectacular ski lines. The weather cooperated and I skied down several stunning peaks and crossed huge glaciers. In addition, I improved my knowledge of alpine climbing. Storms in the South Island are extremely…