Original author: Lianyanshe (X: @lianyanshe )

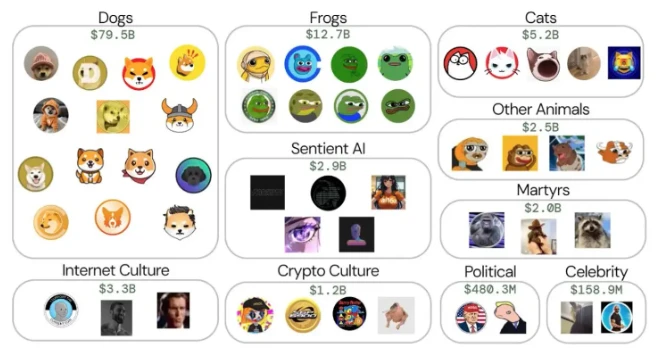

When the big cake ATH, meme craze, and value coins pretended to be dead, Binance successively listed PNUTS and ACT spot. The market value was low enough and the selling pressure was small enough, which provided enough space for secondary profit and further ignited the craze of the meme track. Binances choice of listing coins has always been the vane of the market. After half a year of questioning of VC listing coins, Binance finally learned its lesson and avoided coins that could not bring positive transaction value, and paid more attention to community effects and secondary space. Judging from the overall market heat, the market value of the entire memecoin has exceeded 120 billion, and it has dominated the market in every quarter. Where the market is trading, it is there. So what is wrong with other coins?

People used to distinguish the business fields of the 暗号 industry by track, such as L2, LSD, Depin, AI, etc. After experiencing a bear market that lasted for half a year, they realized that the entire crypto industry actually has only two categories: meme coins or VC coins. VC coins are known for their value, but the price has been falling to zero, while meme coins have been advertised as useless, but the price has repeatedly ath. What is the problem?

This was pointed out in Binance鈥檚 May report: The trend of low circulating supply and high fully diluted valuation (FDV) tokens in the crypto market has attracted widespread attention. This phenomenon is mainly due to the influx of private market capital, aggressive valuations, and optimistic market sentiment. It is expected that about $155 billion in tokens will be unlocked between 2024 and 2030, which may cause selling pressure on the market. Investors should focus on fundamentals when selecting projects, while project teams need to consider long-term impacts and ensure reasonable token economic design. In general, market participants need to be cautious to avoid potential risks caused by token unlocking.

Obviously, the essence of the so-called VC coin is low circulation supply and high dilution valuation. In this contradiction, investors need to consider many factors, such as whether to evaluate the coin price based on the current supply market value or FDV valuation? How will future dilution affect current investment? Is unlocking and releasing a release of value or chronic suicide? Can the growth of the market value of the entire crypto industry in the next five years accommodate the huge amount of release? In the face of so many uncertainties, the requirements for investors have gradually deviated from the value fundamentals of the token and turned to its complex token economics design. The multi-party interest distribution and game of the token itself have actually been reflected in the coin price. Therefore, instead of studying the track, technology, and token economics, it is better to directly hype the meme without thinking.

What is the essence of meme? What is the difference between meme and VC coin? The answer is fair launch. Although this fairness is relative, the conspiracy is still far superior to the conspiracy of team/VC/CEX joint harvesting. For any token supported by VC, fair launch is impossible because VC has already bought at a lower price before the token generation event (TGE).

So is there a better solution? After communicating with @Dr . Daoist (@Dr_Daoist) / X , our general consensus is that the timed unlocking of VC coins is actually the culprit for the surface problem of low circulation, high fully diluted market value (FDV). The economically reasonable way is to abandon the timed issuance of tokens and instead release them according to market demand.

They have very deep thoughts on tokens. You can take a look at their three versions of ideas for fair release of tokens : https://x.com/Dr_Daoist/status/1847937835653099726

There are three versions of fair release. 1.0 is actually a flawed version of fair release, because each round of release effectively dilutes the communitys share of the circulating supply. 2.0 fixes the problem in the Ponzi version, because token unlocking only occurs in the inflationary part of each round of release, but the impact on the token price is still neutral. And version 3.0 introduces a positive feedback loop to drive the continued growth of token prices: in each round of fair release, part of the income is injected into the liquidity pool to increase the token price, thereby further incentivizing community holding and participation.

-

1.0 Ponzi version (no income): Whenever the tokens in circulation are consumed and destroyed, an equal amount of new tokens will be released in proportion (allocated to the team/VC/community/fund pool, etc.) to keep the circulating supply constant;

-

2.0 HODL version (with income): Similar to the Ponzi version, but will release a certain amount of inflation tokens, and use the income to buy back and destroy to offset the inflation amount and keep the circulating supply stable;

-

3.0 Moonshot version (with income): Similar to the HODL version, but part of the income will be used to increase the token price instead of just buyback inflation release, creating a only up and no down potential.

This version seems to respond to Litecoins wishes, and it is not difficult to touch memecoin, provided that the design is based on fair release: including setting the best inflation rate and the ideal distribution of income – ensuring that part of the income is used to cover inflation repurchases, and the rest is effectively used to increase the token price. Apart from these calculations, the rest is careful execution.

While this may be the fairest and most sustainable token economic model for any venture-backed token, it is already too late for many old coins that are in a state of disrepair. The new project Gabby World has quietly implemented Fair Release 3.0 (Moonshot version) in a token generation event (TGE) on a decentralized exchange (DEX). Everyone can look forward to whether the new token model can create a memecoin price flywheel. If feasible, this will also be a good opportunity for economic correction for other tokens waiting for TGE!

This article is sourced from the internet: VC coin fraud meme, a third way to fair release?

関連:トランプの売り込み:トランプ一家はスポンサーやブランド化で数千万ドルを稼いでいる

原著者:グレープフルーツ、ChainCatcher 原編集者:Nian Qing、ChainCatcher 現地時間11月5日、第60回米国大統領選挙の投票が終了しました。ドナルド・トランプとカマラ・ハリスのどちらが最終的にホワイトハウスに入るかは、世界の注目を集めるだけでなく、暗号通貨の世界の新たな変化でもあります。トランプは選挙運動の開始以来、暗号通貨の発展に対する支持を何度も公に表明してきました。彼がホワイトハウスに無事に復帰すれば、暗号通貨市場に対する米国の厳格な規制政策に変化がもたらされ、業界の発展に新たな活力が注入される可能性があります。ビットコイン2024カンファレンスで、トランプはスピーチで次のように述べました。再選された場合、政府が100%を保持することを保証します…