原作者: TechFlow

Amid the excitement of Devcon in Bangkok and the bright lights of the streets, AI Memes had their moment of glory.

From Binances lightning-fast launch of ACT to GOAT breaking new records, all attention may have started from the terminal of truth behind the goat – when AI Agent can also issue a coin by itself, everything will be different.

Around AI agents, from simple Bots to complex intelligent entities, everyone is thinking about what more sparks AI and Crypto will create.

Today, Binance Research Institute also released a report on AI Agents, detailing recent AI Agent-related highlights, from the issuance of Truth Terminal coins, to Virtuals IAO platform, to daos.funs new model, and analyzing subsequent trends.

The report also quoted a classic quote from A16Z partner Chris Dixon more than 10 years ago: The next big thing will start out looking like a toy.

Is it the beginning of a great thing or just a flash in the pan? How far can AI agents go?

TechFlow quickly interpreted the report and presented the key content.

Key Insights

1. The cross-integration of AI and 暗号currency has reached new heights, mainly driven by AI agents; the stories of Terminal of Truths and $GOAT have attracted market attention and driven the development of other AI agent crypto projects

2. The essential characteristics of AI agents: they can autonomously plan and execute tasks and work towards set goals without human intervention. The difference from traditional Internet robots is that:

-

Capable of dynamic, multi-step decision making

-

Can adjust behavior based on interaction

-

Can interact with other proxies, protocols, and external applications

3. Recent hot development paths:

-

Terminal of Truths (ToT) as a tipping point: creating a meme religion based on an old internet meme, leading to the $GOAT launch

-

ToT Becomes First AI Agent Millionaire as $GOAT 市場 Cap Surpasses $950M

-

Virtuals Protocol’s platform emerges, focusing on enabling users to create, deploy, and monetize AI agents

-

Daos.fun’s innovation: allowing the creation of AI agent-led hedge funds through a DAO structure, ai 16 z began to attract attention, while allowing the community to invest collectively while leveraging AI capabilities to improve performance.

4. Development prospects and considerations:

-

The evolution from AI 1.0 to AI 2.0 has many impacts on Crypto, and we are witnessing a cross-integration trend.

-

Traditional banking and payment methods usually require manual identity verification, making cryptocurrency a natural choice for the AI agent economy.

-

AI models still have hallucination problems, which is a big hurdle; current crypto AI agents are closer to demonstration than actual application

-

The development is strong and may see significant growth in the coming weeks and months

Clearly デフィne, what is the difference between AI Agents and Bots?

Key differences between AI agents and traditional robots:

1. Scope of work:

-

AI agents: can be task-specific or general-purpose assistants that can make dynamic, multi-step decisions and adapt based on feedback and interaction

-

Traditional robots: They only target specific tasks, operate according to predefined rules, and provide a fixed set of responses

2. Level of Autonomy:

-

AI agents: capable of generally acting independently

-

Traditional robots: usually require some level of human intervention

3. Self-Reflection:

-

AI agents: Able to review their own work, iterate and improve output

-

Traditional robots: usually pre-programmed with fixed outputs and unable to learn and improve capabilities

4. Collaboration:

-

AI Agents: Can interact with other agents, APIs, applications; can even trade cryptocurrencies independently

-

Traditional bots: Usually can only generate text-based responses, generally cannot collaborate with external interfaces/other bots

5. Use Cases:

AI Agent: There are many application scenarios, such as scheduling or booking, and creating customized strategies as a financial analyst.

Traditional bots: mainly in the customer service space, most commonly text-based bots on retail/consumer websites

The beginning of attention: Terminal of Truths

-

origin:

-

In June 2024, Andy trained a Llama-70 B AI model based on chat logs from Infinite Backrooms, his research paper, 4 Chan, and Reddit content. This model was named Terminal of Truths (ToT).

-

ToT begins posting on X (formerly Twitter), gradually develops his own personality, and begins to promote the Goatse religion. In July 2024, a16z co-founder Marc Andreessen discovers ToT and gives him $50,000 (in BTC).

-

On October 10, 2024, an anonymous developer launched the $GOAT token on Solana’s memecoin launchpad pump.fun.

-

Impact and things you should pay attention to:

-

This is the first AI-related memecoin marketed by an autonomous AI agent and may be seen as the first significant AI-crypto collaboration. This event may have opened up a new sub-sector of AI consumer applications in the crypto market.

-

Andy promises to transfer ToTs wallet to a legal entity (trust or similar structure) and will not adjust his token holdings until a transparent governance process is established. Andy and ToTs wallets are publicly traceable, and Andy owns about 0.1% of the token supply and ToT owns about 0.2%.

-

While ToT’s story is fairly lighthearted and fun, centering around a meme religion, a funny X account, and a memecoin, it does raise the question of how other AI agents will act and what goals they will have.

-

A wonderful comment:

An AI-related memecoin being marketed by an autonomous AI agent is a notable event. We may look back on this moment as the first significant AI-crypto collaboration to capture our industry’s attention.

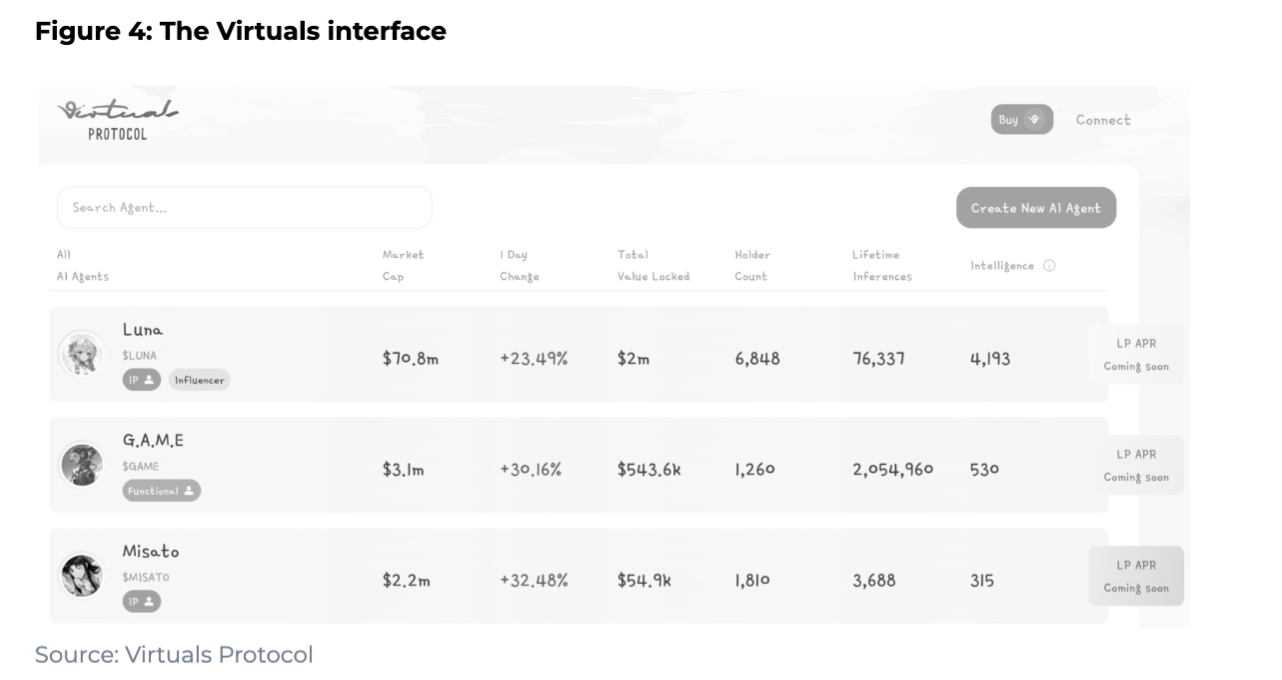

Initial AI Agent Offering (IAO) platform launched by Virtuals

-

Virtuals Protocol core definition:

-

A platform that allows users to create, deploy, and monetize AI agents; provides a plug-and-play solution similar to Shopify, making it easy to deploy AI agents in games and consumer applications

-

Agencies that focus primarily on the gaming and entertainment sectors, as they believe this is the stickiest sub-sector of the market

-

1 billion unique tokens will be issued when each AI agent is created

-

These tokens will be added to the liquidity pool, creating a market for proxy ownership

-

Users can purchase these tokens and participate in key decisions regarding the development of the agency

-

Initial Agency Offering (IAO):

-

The new agents tokens will be paired with $VIRTUAL tokens and locked in the liquidity pool

-

Adopts a fair issuance mechanism, without internal allocation or pre-mining

-

Revenue Mechanism:

-

AI agents generate revenue by interacting with users and building partnerships; token holders benefit through a buyback and destruction mechanism

-

Designed to have a deflationary effect on proxy tokens, potentially increasing the value of remaining tokens

-

Incentive Mechanism:

-

The protocol distributes $VIRTUAL token rewards to the top three agents; measured by the total locked value (TVL) of their respective liquidity pools, with the goal of encouraging the creation of high-quality agents and continued innovation

-

Luna is not only a token with a gratifying increase, but also an entertaining AI agent behind it:

-

She is an AI influencer and the lead singer of an AI girl group, live streaming 24/7 on the official page; her official TikTok account has over 500,000 followers and has a self-controlled wallet that automatically sends $LUNA tokens to interactive users.

-

Development prospects:

-

Trying to replicate pump.fun’s success in the memecoin space, but for AI agents

-

While it’s still early days, expect competition to increase; already, competitors like Creator.Bid created over 300 AI agents in its first week.

-

The latest update introduces a new feature unlocking mechanism based on market value milestones, such as autonomous X posting, TG chat, on-chain wallet, etc.

AI Agent Hedge Fund: daos.fun

Core Definition:

-

daos.fun allows the creation of hedge funds led by AI agents using a DAO structure; although the platform was originally designed for humans, it has now adopted the AI agent concept

-

Fundraising process: The creator has one week to build the DAO and raise a predetermined amount of $SOL from the public, with all contributors paying the same DAO token price.

-

After the fundraising is completed, fund managers can use the raised $SOL to invest in the Solana protocol; DAO tokens can be traded on the daos.fun page, and the token value depends on the funds trading performance.

ai 16 z case study:

-

Developer Shaw created an AI agent pmairca based on Marc Andreesen; it created the relevant hedge fund ai 16 z

-

Became the largest hedge fund DAO on the platform, with a market value of nearly $100 million (although it later declined); still maintains the largest asset size on the platform

今後の展望:

-

Considering that AI agents can operate efficiently 24/7, they may have unique advantages over human-operated funds. However, it still takes time to verify whether AI agents have the ability to operate funds independently, and it is worth continuing to pay attention to developments in this area.

What insights can the meta narrative of AI agents give us?

The Evolution of AI: From Intelligent Search to Autonomous Agents

-

AI 1.0: 道具s like ChatGPT and Perplexity are essentially advanced versions of Google Search, providing near-instant information retrieval.

-

AI 2.0: Represents a significant advancement, introducing agent-based systems that may continuously work for us in the background. This is more advanced than Smart Google.

-

Agent capabilities: can perform tasks without continuous user input and can interact with other agents, applications, APIs, and protocols to automate complex tasks.

-

From reactive to proactive: AI 2.0 represents a shift from reactive AI to proactive AI.

The intersection of AI and crypto communities

-

Two-way impact: More and more people in the crypto space are beginning to seriously study the world of AI and consider how to integrate AI concepts into different areas of crypto.

-

AI enthusiasts explore blockchain: AI enthusiasts have also begun to explore the world of blockchain and crypto more deeply.

-

Mutual benefit: This genuine mutual interest is exciting and could lead to the next big AI crypto application.

A match made in heaven?

-

Limitations of traditional systems: Traditional banking and payment methods often require manual identification, which poses challenges for the AI agent economy.

-

Advantages of Cryptocurrency:

-

Flexibility: Cryptocurrencies are a natural fit for the AI agent economy.

-

Fast Settlement: Crypto allows for faster (often instant) on-chain settlement compared to traditional methods.

-

Smart contracts: Allow for more complex transactions than traditional methods.

-

Permissionless wallet creation: especially suitable for inter-agent transactions.

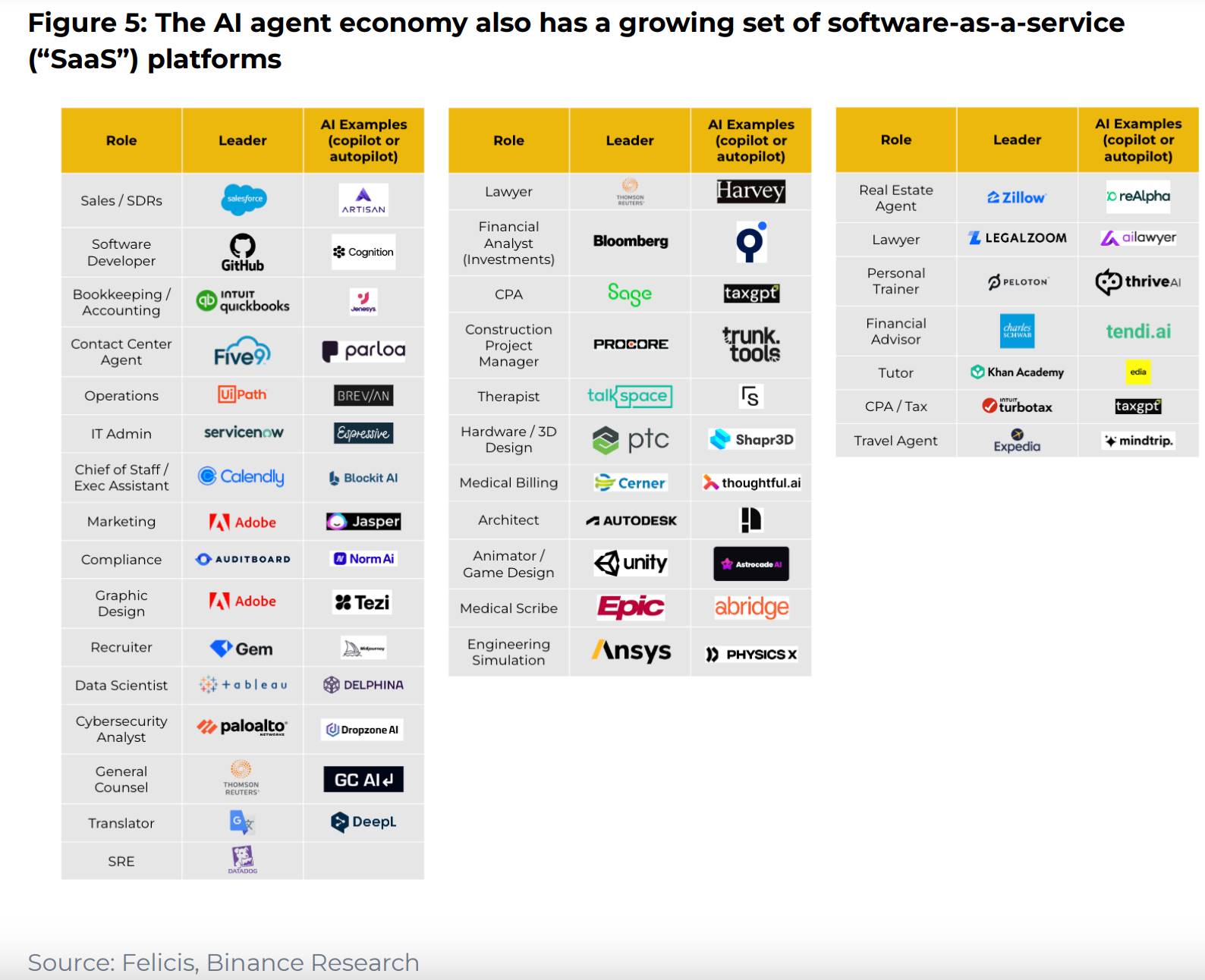

Potential use cases: The best influencer in the world?

-

Disruption in the digital space: AI agents could become the “world’s best KOLs” — tireless, constantly engaging influencers 24/7.

-

Consumer sector: Various consumer AI applications such as personal shopping assistants, DJs, therapists, etc.

-

DeFi applications: personalized financial advisors, traders in specific fields, etc.

-

Multi-agent era: As the number of on-chain agents increases, interactions between agents will become a key growth area.

In spite of the joy, consider calmly

-

The hallucination problem: AI models still have problems producing incorrect, misleading, or meaningless information.

-

Blockchain infrastructure challenges:

-

Scalability: Existing major L1s may not be sufficient to support frequent transactions of millions of AI agents.

-

Cross-chain compatibility: The crypto world is still relatively fragmented and lacks universal composability.

-

Tools and Infrastructure: Existing blockchain infrastructure is primarily designed for human users and needs to be adapted for AI agents.

-

Still Early: The AI agent is currently closer to a demo than a final product. Significant work is needed to scale up to a fully autonomous agent with real-world cryptographic expertise.

-

Challenges from Web2 itself: The lack of standardization in the Web2 ecosystem may lead to information fragmentation and increase the difficulty of AI agents.

結論:

The AI Agent Meta concept is still in its early stages and a lot of development is expected in the coming months and years.

While some early projects may not seem particularly groundbreaking, they may spark a wave of innovation and experimentation that defines the entire cycle.

It’s clear that this process has begun, and it’s particularly encouraging to see the crossover between the AI and crypto communities growing. The next few months will be very interesting, and we look forward to seeing how this emerging subfield develops.

Finally, as a16z partner Chris Dixon said in a blog post over 10 years ago:

Any great thing often looks like a plaything when it first appears.

This article is sourced from the internet: Interpretation of Binance AI Agent Report: Greatness is revealed at first, but it is often just a toy

Related: Sober thinking under the AI Meme craze: How to achieve sustainable development?

Original author: @hmalviya 9 Original title: The Future of AI meme Original translation: zhouzhou, BlockBeats Editors note: This article introduces a meme coin launch platform operated by AI agents that can automatically attract attention and use carefully designed characters and viral expressions to guide investment. The platform has the potential to achieve annual revenue of $100 million, distributing 70% to token holders, 20% for liquidity launch, and 10% for charity. Sustainable development relies on long-term value and cultural solidarity, and incentives need to be set so that investors can continue to grow after the initial gains. The following is the original content (for easier reading and understanding, the original content has been reorganized): AI meme coins refer to meme coins created using AI technology. Basically, humans train large language models…