Original author: JW

Original editor: Liu Jing

The world of Web3 is a carnival every day.

Late last night, people were sighing over the depression of Double Eleven and exclaiming at the soaring of Bitcoin. As of last night, Bitcoin rose above 89,000 USDT, a height never seen in history.

This is the seventh year that Web3 has emerged on a large scale in China.

People like to use the term seven-year itch to describe the changes in a relationship. For the Web3 world, the past seven years have been a period in which it has gone from being a niche topic in China to being relatively popular, and then widely discussed and debated.

Most people have gone from knowing nothing about Web3 to knowing a little, and even being involved in it. People in the industry have also gradually moved from the margins to the mainstream. This once gloomy industry, like other industries, has not only the initial fascinating wealth effect, but also presented a cycle of change and the intricate entanglements of human nature.

Today, there are more than 500 million 暗号 users worldwide, and the on-chain stablecoin assets have exceeded 173 billion US dollars. But many people still do not understand what has happened and is happening in the Web3 world.

Seven years ago, 24-year-old JW joined Web3 after graduating from Tsinghua University’s Schwarzman College. This was her first job. At that time, most of her classmates entered investment banking consulting, government departments, and academic research.

As she said, fate has made her see a surreal world that she had never imagined: there are idealists who are obsessed with decentralization, and there are also scammers who are just here to make money; there are people who get excess returns, but there are also people who lose everything. And she herself, from someone who knew nothing about the world of cryptocurrency, has become the founder of a fund.

Where there are people, there is a world of martial arts. It’s just that in Web3, which is closer to money, the world of martial arts is more cruel.

In this article, JW will take a first-person look back at the past seven years in the world of cryptocurrencies. “Reflecting on where we are today and why we are still in this space.”

One day in the cryptocurrency world is like one year in the real world

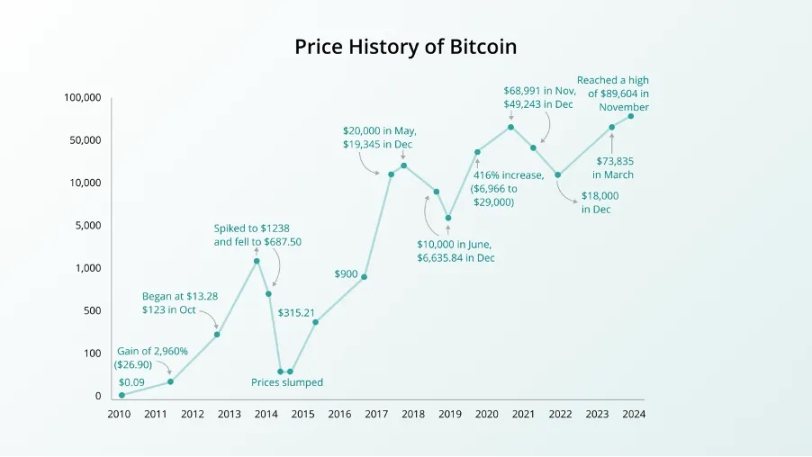

Price History of Bitcoin

It is generally believed that the concept of Bitcoin was born on November 11, 2008, and the proposer was Satoshi Nakamoto, whose whereabouts are unknown now. In China, on June 9, 2011, Yang Linke and Huang Xiaoyu founded Bitcoin China, the first Bitcoin trading platform in China; in 2013, OKCoin and Huobi were established successively.

But this is a game played by a small number of people – so few that you can count them on two hands.

It was not until 2017 that Bitcoin became a “popular term.” In that year, the price of Bitcoin soared from less than $1,000 at the beginning of the year to $19,000 at the end of the year. The 20-fold increase and the myth of wealth creation through mass ICOs instantly shook the entire Internet and VC circles.

Whether you participate or not, everyone is talking about blockchain, and white papers are everywhere. Li Xiaolai, Xue Manzi, Chen Weixing and other big Vs are preaching the concept of decentralization and shouting to their fans about the projects they invested in. In early January 2018, the screenshot of the WeChat message from the famous investor Xu Xiaoping, which said the blockchain revolution has arrived, is still memorable.

At 3 a.m. on February 11, 2018, Yuhong and a group of friends who did not sleep created a WeChat group called 3 Oclock Sleepless Blockchain. In less than three days, the group exploded… The total net worth of the friends in this group is probably trillions.

There is a popular saying in the currency circle:

If you haven’t heard of the 3 o’clock blockchain group, it means you are not a blockchain person yet;

If you haven’t joined the 3 o’clock blockchain group, it means you are not a big player in the blockchain circle yet;

If you haven’t been flooded with messages from the 3 o’clock blockchain group, it means you haven’t experienced what “one day in the cryptocurrency world is like one year in the real world” means.

But this was just the beginning of the madness.

“This is the godfather of e-commerce in Korea”

In the summer of 2018, I went to Seoul with my former boss (one of the founders of the top fund in Asia at that time) to attend the Korea Blockchain Week. South Korea is one of the most important markets for the crypto industry, and the Korean won is the second most traded fiat currency, second only to the US dollar. Crypto entrepreneurs and investors from all over the world want to get a piece of the pie here.

The company we were going to meet was called Terra, a top project in South Korea. The meeting was arranged in a Chinese restaurant at the Shilla Hotel, a traditional Korean hotel that is almost conservative. As the guesthouse of the local government, the lobby was filled with young people from all over the world who were enthusiastic about the crypto world.

Terra was founded by two Korean founders, Dan Shin and Do Kwon. Dans company Tmon was once one of the largest e-commerce platforms in South Korea, with a GMV of more than 3.5 billion US dollars per year; Do is about the same age as me and tried to start a business several times after graduating from Stanford.

“This is the godfather of e-commerce in Korea,” my boss told me on the way to lunch.

Similar to the investment ideas in traditional fields, the consideration of people is also the only way to invest in Web3. People like Dan who have achieved success in the Web2 world instantly attracted the participation of all top cryptocurrency exchanges and funds.

Later, we invested $2 million in Terra.

Maybe Do and I were the same age, and we kept in touch since then. Do was similar to my other classmates in computer science: a boy with standard American accent, wearing a T-shirt and shorts.

Do told me that they plan to build the stablecoin issued by Terra into a widely adopted digital currency, such as how they are negotiating with the largest convenience store chain in South Korea, the Mongolian government, and retail groups in Southeast Asia. They are also developing a payment application called Chai, which will become Alipay for the whole world.

In the office that looks like a warehouse, when Do talked to me about their grand plan while drinking coffee, I felt dreamy for a while: at that time, I didnt actually understand how they would achieve these plans. I just felt that it sounded so novel and ambitious.

At that time, cryptocurrency was far from a consensus (of course, it still is not today). Most of my classmates, who were either in investment banks, consulting firms, or Internet giants, either knew nothing about cryptocurrency or were full of doubts, but here I was chatting with someone who was planning to launch a global payment network.

This is an age of chasing narratives, big funds, and professor coins.

Help me track this link and tell me how much money has been deposited, the deadline is this week. My boss sent me a link to a Dutch auction project, a Layer 2 project that ran a public sale. In fact, we never actually met the team, and they only provided a website and a white paper for the project, but raised more than $26 million in 2018. Although the token has now fallen to 0.

People would rather trust a stranger across the continent on the Internet than a person in the same room.

I was just over 24 at this point, and although I guess most of the investment committee, at most times, had no idea what they were doing—just like me—they encouraged me to invest another $500,000 in the project “just to make friends.”

They tried to replicate the madness of 2017: as long as there was support from a well-known fund, any code could soar 100 times.

But the music soon stopped.

“When will Bitcoin return to $10,000?”

I once thought this was the best job in the world: traveling around the world at a young age; buying expensive business class tickets and hotels; walking through magnificent conference venues; learning new things and making friends with different people.

But the bear market came unexpectedly.

In December 2018, the price of Bitcoin plummeted from a high of over $14,000 to $3,400. As a young person who had just started working, I didn’t have much savings, but when I saw the price of Ethereum drop from $800 to $400 and then to $200, I decided to bet a month’s salary.

In hindsight, this was not a wise decision. Less than a month after I bought it at $200, the price of ETH dropped below $100.

“What a scam.” This thought occurred to me for the first time.

The world was hit hard by the pandemic in the first half of 2020, and the cryptocurrency industry was also hit hard by the market crash on March 12. I was trapped in Singapore at the time. I still remember that afternoon, every time I opened the price query website, the price of Bitcoin dropped by another $1,000. A month ago, the price of Bitcoin was around $10,000, and in just a few hours, it plummeted from $6,000 to $3,000 – much lower than the price when I first entered the industry.

To me, this is more like a farce. I am observing everyones reactions: some are waiting and watching; some are buying at the bottom; some are liquidated.

Even more experienced investors are pessimistic. “Bitcoin will never go back to $10,000,” they say. There is even discussion about whether the cryptocurrency industry will continue to exist, with some suggesting it may just be a detour in tech history.

But some people chose to stay. At that time, my institution had no new investment, but I was still accepting projects.

Soon, decentralized finance (DeFi) started to become a topic of conversation. I’m not a trader myself, but all my fellow traders thought DeFi was a bad idea: everything was slow, order book based exchanges were impossible, there was no liquidity, and even fewer users.

What I didn’t fully understand at the time was that security and permissionlessness were the biggest selling points of DeFi, but can permissionlessness really impress people? After all, the KYC (know your customer) of centralized exchanges is not too bad.

Attending DevCon IV and DevCon V during the bear market was also an eye-opening experience.

Although I studied computer science in college and was no stranger to hackathons, I had never seen so many weird developers anywhere else. Even with the price of ETH down 90%, people were still passionately discussing decentralization, privacy, and on-chain governance on Ethereum. I have no faith in decentralization and no passion for anarchism – these concepts only appeared to me in class.

But developers seemed to really embrace these philosophies. You joined at a bad time, a colleague consoled me. The year before, at DevCon III in Cancun, Mexico, our fund had made tens of millions of dollars simply by investing in projects presented at the conference.

During the bear market, we also missed the opportunity to invest in Solana when its valuation was less than $100 million (now its market value is over $84 billion). Although we interviewed the founder Anatoly and Kyle of Multicoin. Kyle believes in this project very much and believes it will become the killer of Ethereum.

Solana’s TPS is 1,000 times higher than Ethereum’s because they use a consensus mechanism called Proof-of-History. But my colleague and Anatoly had a technical due diligence call and thought, “Solana is too centralized. Centralized TPS doesn’t make sense, why not just use AWS?” Apparently, my colleague didn’t like it very much, “and the founder didn’t understand the value of a truly decentralized network like Ethereum, probably because he worked at Qualcomm before.”

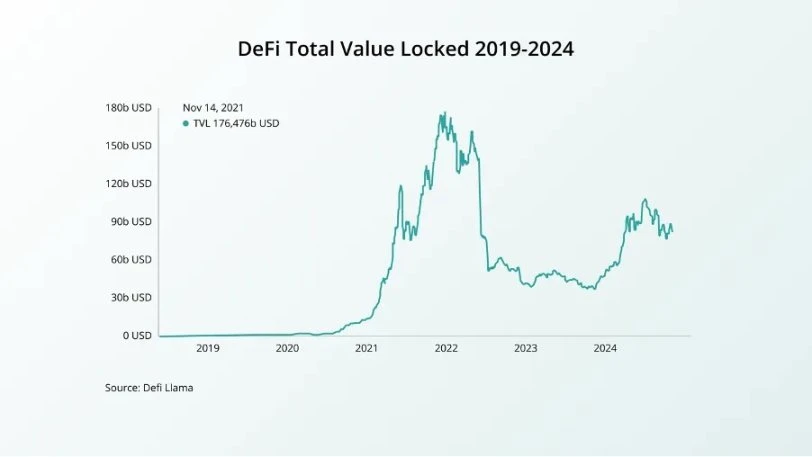

(DeFi TVL growth chart — the chart every VC will go crazy for) (Source: DeFi Llama)

My skepticism about decentralized finance (DeFi) was quickly shattered with the introduction of the concept of yield farming. By depositing tokens into DeFi smart contracts, users can become liquidity providers for the platform and can be rewarded with protocol fees and governance tokens. Whether you call it a growth flywheel or a death spiral, DeFi protocols have achieved tremendous growth in terms of the number of users and total locked value (TVL).

Specifically, the TVL of DeFi protocols has soared from less than $100 million at the beginning of 2020 to more than $100 billion in mid-2021. Thanks to open source technology, it only takes a few hours to copy or modify a DeFi protocol. Because the process of providing liquidity is called yield farming, DeFi protocols are often named after food.

For a while, new “food coins” were being created almost every day—from Sushi to Yam. People in the crypto community loved the pun, and even a protocol with millions of transactions could be named after food and use an emoji as its logo.

But hacks and exploits in DeFi projects make me nervous. I’m not a risk-taker. My friends are doing crazy farm operations: they’ll set alarms at 3 a.m. just to be the first ones to enter the new liquidity pool.

In the summer of 2020, annualized yield (APY) was the hottest topic – people were chasing those pools with the highest APY. Noticing the markets demand for allocating funds for yield farming, industry veteran Andre Cronje launched a yield aggregator product: Yearn. This product caused a huge response.

As more and more funds pour into DeFi, we have also witnessed the birth of some “great gods” on Twitter: such as SBF from FTX, Do Kwon from Terra, and Su and Kyle from 3AC.

Terra has launched several DeFi products, including Alice, a payment app for the US market, and Anchor, a lending protocol. Anchor is probably designed for chain novices like me – just deposit your stablecoins into the contract and you can get an annualized rate of return of nearly 20%, which is a no-brainer.

At its peak, Anchor’s total locked value (TVL) exceeded $17 billion. “Congratulations to Anchor, it’s a great product, and I’ve invested some money in it.” I sent Do a message on WeChat, not sure if he would reply.

But I know that he no longer seems to be the young man I know – he has 1 million followers on Twitter and has announced plans to buy $10 billion worth of Bitcoin.

“Thanks — you’re doing great with your portfolio too,” he actually replied. He was referring to some gaming projects I’d invested in earlier. DeFi has also changed the gaming landscape in crypto — now it’s all about “earning.”

As the craziness continued, I also invested in a lending project by Three Arrows Capital.

A few months later, questions about Anchors profitability began to emerge. It turned out that the lending products offered by Terra did not generate enough returns to cover the interest paid to liquidity providers like me; current payments were largely subsidized by the Terra Foundation. Upon seeing this news, I immediately withdrew my money; around the same time, I also redeemed my investment from Three Arrows Capital.

Crypto Twitter was starting to get weird. Especially when Do tweeted happy poor and Su went shopping in Singapore, it felt like a signal of a market top. I was lucky enough to escape the Terra and Three Arrows crashes; months after the crash, I learned that the payment app didnt actually process payments on the blockchain, and the borrowed funds were used to leverage so much that they could never be repaid if the market changed direction.

But when FTX crashed, I wasn’t so lucky.

For weeks, there have been rumors that FTX has suffered huge losses from the Three Arrows and Terra debacles and may be insolvent. Billions of dollars are being withdrawn from the exchange every day. Out of an abundance of caution, my firm has also withdrawn some, but not all, of its assets from FTX.

It was a turbulent period. Almost every day there were panic rumors about stablecoins USDT and USDC depegging, and rumors that Binance might go bankrupt. But we did not lose hope, and I had faith in SBF – what bad things could a billionaire who believed in effective altruism and slept on the trading floor do?

However, one day on my way to the gym, my partner called me and told me: FTX declared bankruptcy, $8 billion was missing, and because they misused user assets, we might not be able to get our money back.

But I was surprisingly calm about this result. Maybe this is our industry: magic Internet money. All assets are ultimately just a string of characters and numbers on the screen.

Money is a test of character, and cryptocurrencies have only accelerated everything. Fast forward to today, and I have no doubt that Do and SBF had good intentions in the beginning. Maybe they got carried away by the inflation of unrealistic growth; or maybe they thought they could “fake it until they make it.”

DeFi is like a Promethean fire for the cryptocurrency industry: it brings hope, but also comes at a heavy cost.

The Misunderstood World of Cryptocurrency

As an old Chinese saying goes: “Illness comes like a mountain falling, and goes away like pulling a thread.” It took the cryptocurrency industry several years to recover from the crash.

To the outside world, it looked like just another Ponzi scheme. People associate cryptocurrency founders with lavish clothing, a love of internet memes, parties around the world, and how to do anything to get rich quickly.

At an alumni gathering, I was catching up with old classmates. When I mentioned that I invested in cryptocurrencies, they jokingly said, So youre a crypto bro now. I didnt take this as an offense, but it was a strange statement: it seemed to distinguish cryptocurrencies from technology and VC. Traditional Internet and technology investments are seen as the right way to go, and a young person with a decent education joining the crypto industry is more or less on the wrong track.

For a long time, the terms Web 3 and Web 2 have often been used in opposing contexts. But such a divide does not seem to be seen in other industries. No one is trying to deliberately distinguish between founders in the field of AI and founders in other fields such as SaaS.

What is so unique about Web 3 in the context of venture capital?

My personal view is that cryptocurrencies have fundamentally changed the way venture capital and early-stage investing work, making the requirements for crypto startups to succeed slightly different from equity-based startups. In short, the token economic design in cryptocurrencies creates unparalleled opportunities for startups and venture capitalists. At the end of the day, everything comes down to product-market fit (PMF), user growth, and value creation – which is not fundamentally different from the Web2 world.

And, as the cryptocurrency industry matures, there is more and more convergence between Web 2 and Web 3 companies.

Its time to rethink this industry.

In the early days of crypto (and we are still in the early days), what people wanted might be a grand vision (e.g. a digital currency independent of central banks), a new computing paradigm (a general-purpose smart contract platform), a wish story (like a decentralized storage network to replace AWS), or even a Ponzi scheme that everyone wants to be one step ahead of. Today, crypto users know what they want, and they support those demands by paying for them or moving capital.

For those outside the industry, it may be difficult to intuitively understand that magic internet money can actually generate income; some crypto assets even offer more attractive price-to-earnings ratios than stocks. I tried to illustrate this with data –

$2.216 billion — Ethereum protocol revenue over the past year;

1.3 billion US dollars, 97.5 billion US dollars — the net operating profit of stablecoin issuer Tether in the second quarter of 2024, the total amount of US Treasury bonds held by Tether;

78.99 million US dollars — the revenue of meme distribution platform Pump from March 2024 to now (August 1). Even in the crypto industry, the value of memes is controversial: some people think it is a new cultural trend and a consensus that can be traded, such as Elon Musk using Dogecoin on his Mars colony; others think it is a cancer in the industry, after all, memes themselves do not have products and bring value to users.

But I think that, judging from the number of participants and the scale of funding alone, meme is already a social experiment that cannot be ignored – tens of millions of users around the world and tens of billions of dollars in real money may not have any tangible meaning, but by the same token, isn’t postmodern art the same?

Many people’s first impression of the crypto market may still be: storytelling, hype, and trading. This was partly true during the ICO bull market in 2017, but after several cycles, the way the crypto industry plays has changed significantly.

Five years later, the revenue-generating ability of DeFi protocols has proven PM. Judging from the comparables traded, the value of these projects is getting closer and closer to the traditional stock market.

In addition to the difference in asset liquidity, the connection with the real world is also generally considered to be the main difference between Web2 and Web3.

After all, compared to AI, social networking, SaaS and other Internet products, Web3 products still seem a bit far away from the real world. But in some countries, such as Southeast Asia, the largest comprehensive application platform Grab (taxi, food delivery, financial products) already supports cryptocurrency payments; in Indonesia, the worlds fourth most populous country, the number of users trading crypto assets has exceeded the number of users trading stocks; in Argentina and Turkey, where local currencies have depreciated severely, cryptocurrencies have become a new choice for people to reserve assets. In 2023, Argentinas cryptocurrency trading volume exceeded US$85.4 billion.

Although we haven’t yet fully realized an “Internet of Ownership,” we’ve already seen the vibrant innovation that cryptocurrencies bring to the current Internet.

For example, stablecoins represented by Tether (USDT) and Circle (UDSC) are quietly changing the landscape of global payment networks. According to a Coinbase research report, stablecoins have become the fastest growing payment method. Stripe recently completed the acquisition of the stablecoin infrastructure project Bridge for $1.1 billion, which is also the largest acquisition in the crypto world.

Blackbird was founded by the co-founder of Resy and is focused on changing the dining experience by allowing customers to pay for their meals with cryptocurrencies, specifically its own token $FLY. The platform aims to connect restaurants and consumers through a cryptocurrency-powered app that also serves as a loyalty program.

Co-founded by Sam Altman, Worldcoin is a pioneering movement to promote universal basic income, relying on zero-knowledge proof technology. Users scan their irises through a device called Orb, which generates a unique identifier called IrisHash to ensure that each participant is a unique human, thereby combating the growth of fake identities and robot accounts in the digital space. Worldcoin has more than 10 million participants worldwide.

If we go back to the summer of 2017, we probably wouldn’t have imagined what the next seven years would mean for the crypto industry—we wouldn’t have imagined that so many applications would grow on the blockchain, or that hundreds of billions of assets would be stored in smart contracts.

How AI uses cryptocurrencies as a mirror

Next, I want to talk about the similarities and differences between cryptocurrency and AI. After all, too many people often compare the two.

Comparing cryptocurrency to AI may be like comparing apples to oranges. But if you look at today’s AI investments from the perspective of a cryptocurrency investor, you may find some similarities: both are full-stack technologies, each with its own infrastructure layer and application layer. But the confusion is also similar: it is not clear which layer will accumulate the most value, the infrastructure layer or the application layer?

“What if Toutiao does what you want to do?” This may be the nightmare of all entrepreneurs. The past development of the Internet has proved that this nightmare is not groundless. From Facebook and Zynga breaking off cooperation and making their own mobile games to Twitter Live and Meerkat, the resource advantages of large companies make it difficult for startups to compete.

In the crypto industry, because the economic models of the protocol layer and the application layer are different, the focus of each project is not to build every layer in the ecosystem. Taking the public chain (ETH, Sol etc.) as an example, the economic model determines that the more people use the network, the higher the gas income, and the higher the value of the token. Therefore, the top projects in the crypto world spend most of their energy on ecosystem construction and attracting developers. Only the emergence of popular applications will increase the use of the underlying public chain, thereby increasing the market value of the project. Early infrastructure projects will even directly provide subsidies ranging from tens of thousands to millions of US dollars to qualified application developers.

Our observation is that it is difficult to distinguish the value capture of the infrastructure and application layers, but for capital, the infrastructure and application layers will alternately be hot, but both are winners. For example, a large amount of capital has poured into the public chain, the performance of the top public chain projects has improved, giving rise to new application models and eliminating the middle and tail public chains; capital has poured into new business models, the user scale has grown, and the top applications have occupied capital and users, giving rise to higher requirements for the underlying infrastructure, forcing infrastructure upgrades.

So what is the reference for investment? The simple truth is that there is nothing wrong with investing in infrastructure and application layers, and the key is to find the leading player.

Let’s go back to 2024 and see what kind of public chain survived. Here are three rough conclusions:

Disruptive technology does not account for much of the success of a project. Of the Ethereum killer projects that were previously favored by Chinese and American VCs and featured professors and academic concepts (such as Thunder Core, Oasis Labs, Algorand, etc.), only Avalanche finally survived, and that was on the premise that the professor resigned and was fully compatible with the Ethereum ecosystem. On the contrary, Polygon, which was not favored by investors because of its poor technology and lack of novelty (fork ETH), has now become one of the top 5 ecosystems in terms of on-chain assets and users.

It is a pity that Near Protocol, which focuses on sharding technology and has a TPS that can beat Ethereum, has a founder who is one of the original authors of the Transformer model paper and has raised nearly 400 million US dollars, but now has only ~60 million US dollars in assets on the chain. Of course, the numbers will fluctuate with the market every day, but the trend is indeed very obvious.

The stickiness between developers and users comes from the ecosystem. For public chains, users include developers in addition to end users (ignoring the completely different model of miners). For end users, the ecosystem with rich applications and more trading opportunities will be more sticky. For developers, the ecosystem with more users and better infrastructure, such as wallets, block browsers, and decentralized exchanges, will be given priority for development. The overall situation presents a flywheel in which developers and users drive each other.

The head effect is greater than imagined. The number of Ethereum users and the amount of funds in on-chain applications are greater than all the “Ethereum killers” combined. Everyone (especially those outside the industry) thinks of Ethereum when they think of smart contract chains (just like today when people think of AGI, they think of Open AI) – it has almost become the industry standard for everyone who wants to develop blockchain applications.

In addition, the existing leading public chains already have a lot of cash, and can provide developers with investments or donations that new startups cannot. Finally, because most blockchain projects are open source projects, the mature leading ecosystem allows decentralized application building blocks to have more possibilities.

So, what are the significant differences between the development of public chains and large models?

Infrastructure requirements. According to a16z, 80-90% of early-stage funding for most AI startups is spent on cloud services. The average fine-tuning cost for AI application companies for each customer is 20-40% of revenue.

Simply put, all the money went to Nvidia and AWS/Azure/Google Cloud. Although public chains also have mining rewards, the cost of hardware/cloud is borne by decentralized miners, and the current data scale processed by blockchain is insignificant compared to the billions of data labels that AI requires, so the cost of infrastructure is still much smaller than that of large models.

Liquidity, liquidity, liquidity. Public chains without a mainnet can issue tokens, but AI large-scale model companies without users and revenue will have a hard time going public. So although the final performance of various professor chains may not be as successful as expected (after all, Ethereum is still the well-deserved No. 1), from the perspective of investors, they will not lose money, and it is even less likely to go to zero. Large-scale model companies are different. If they cannot raise the next round of financing and have no takers, they will easily go bankrupt. From this perspective, venture capital should be more cautious.

The actual improvement of productivity. Through ChatGPT, LLM found its own PMF and began to be used on a large scale by B-end and C-end, which improved production efficiency. Although the public chain has experienced two rounds of bull and bear markets, it still lacks a killer app, and the application scenarios are still in the exploration stage.

End-user perception. Public chains and end users are strongly related. If you want to use some decentralized applications, you must know which public chain it is on, and then work hard to move your assets to this public chain to form a certain stickiness. AI is even more silent, just like cloud services and processors in computers. No one cares whether the taxi app is powered by AWS or Alibaba Cloud. Because ChatGPTs memory is very short, no one cares whether you are chatting with it on ChatGPTs homepage or on an aggregator today. Therefore, it is more difficult to stick to C-end users.

As for the application scenarios of encryption in AI, many teams have given their own insights. It is generally believed that decentralized financial networks will become the default financial transaction network for AI Agents. I think the following figure accurately summarizes the current stage.

Find the needle in the haystack more quickly

When I joined the cryptocurrency industry, I had little faith in the idea of decentralization. I think most industry participants did the same in the early stages. People joined the industry for a variety of reasons – for money, technology, curiosity, or just chance.

But if you ask me if I have confidence in cryptocurrencies today, I would give a positive answer. You cant deny the entire industry because of the scams in the cryptocurrency industry, just like you cant deny the entire financial industry because of the Madoff scandal.

A recent example from my own life is my friend R (not his real name), who successfully turned an idea into a company with 200 employees, positive cash flow, and a market cap of over $200 million.

Rs entrepreneurship revolves around his understanding of the value of decentralization. My girlfriend is a small influencer on TikTok, but influencers can only get a small part of the audiences tips, he once told me that the worlds largest creator network is not fair, I want to build a decentralized version. I thought he was joking at the time, but almost three years later, he really launched the project. The platform now has hundreds of thousands of users.

As someone who joined this industry right after graduation at the age of 24, the past 7 years have allowed me to see enough aspects of the world: there are idealists and gold-digging scammers; there are people who get excess returns and there are those who lose all their money.

Remember my former boss who I mentioned at the beginning of the article – an OG who made a lot of money in the crypto industry once said: You still have to work hard, otherwise you will become an ordinary rich man.

I think a respected investor once described the job of VCs as “finding needles in a haystack.” To me, VC investing in the crypto world is also a similar process.

The only difference is that the crypto haystack may be moving faster, so we need to stay agile.

The author of this article is JW (@bestmosquito), founder of Impa Ventures. Impa Ventures is a fund focusing on early-stage investments in the Web3 industry.

Impa Ventures’ other two partners Shiran and James, and Undercurrent analyst Guo Yunxiao also contributed to this article.

Image source: IC Photo

This article is sourced from the internet: The ups and downs of the crypto industry: From a pile of air to $3 trillion

Related: Overview of the current status of Layer 2 technology development on Filecoin

Original author: Filecoin Network Layer 2 (L2) is an important innovation in blockchain technology that enhances the scalability, efficiency, and functionality of their respective networks. For Filecoin , L1 focuses on decentralized storage, and L2 solutions play a vital role in bringing new features to network infrastructure. As Filecoin continues to grow, L2 solutions are driving Filecoin to market and tailoring products for creators focused on specific verticals. This article explores the current state of L2 solutions on Filecoin, highlighting groundbreaking advances and future directions. Underlying Architecture Before diving into L2, it is recommended to first understand the shared framework on which Filecoin L2 is based: InterPlanetary Consensus (IPC). Video link: https://youtu.be/aRyj9kOvW7I Interstellar Consensus (IPC) is a framework designed to solve the scalability problem of decentralized applications (dApps). IPC does…