原作者: BitMEX

長すぎて読めない:

-

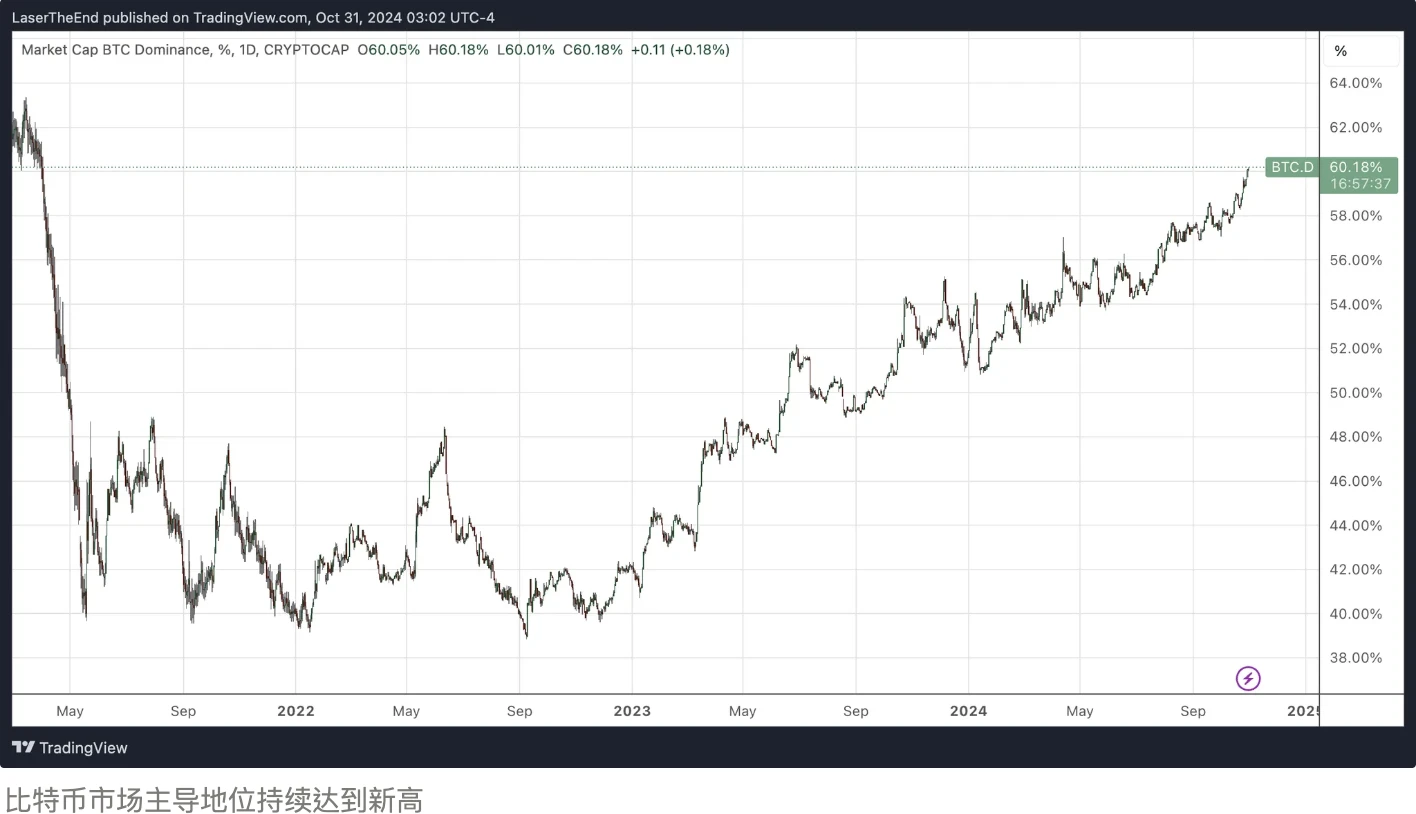

ビットコインは史上最高値に達したが、$70,000前後まで下落し、その市場占有率は60%まで上昇し続けた。

-

今週はドージコインにとって特にエキサイティングな週で、イーロン・マスクやドナルド・トランプなどの著名人による政府効率化セクターへの公的な支持が主な理由で、価格が15%以上急騰しました。選挙日まで残りわずか1週間となった今、ポリマーケットでトランプが次期選挙に勝つ確率が67%に上昇したことで、ドージコインの価格上昇はさらに拡大しました。

-

ビットコインが市場支配力で新たな高みに到達し続ける中、ビットコインの最新動向を探ります。 暗号通貨市場。

データの概要

良いコイン

-

$DOGE (+14.4%): ドージコインは政治動向に追随し、マスク氏の「政府効率化省」計画を反映して最高のパフォーマンスを見せた。

-

$SUI (+3.2%): 隋は引き続き強く、多くの人を驚かせている

-

$POPCAT (+2.7%): Popcatは今サイクルでも好調を維持しており、新たなトップミームコインとなった。

悪いコイン:

-

$MEW (-14%): 上がったものはすぐに下がる、そうでしょう? MEWは先週最もパフォーマンスの良かったコインでした

-

$TIA (-19.8%): Tiaは大規模なロック解除に直面しており、プロトコルが手数料を生成できないため、その基礎が疑問視されている。

-

$NEAR(-14.1%):NEARの下落は、AI株も圧力を受けているという事実から来ている可能性がある

ニュース速報

マクロ:

-

ETH ETFの週次純流出額: +$2390万( ソース )

-

BTC ETFの週次純流出額: +$22.7億( ソース )

-

米国の10月26日までの週の新規失業保険申請件数は21万6000件だった( ソース )

-

米国の世論調査:ハリス氏がトランプ氏を1%の僅差でリード( ソース )

-

Mt. Goxのアドレスは2か月ぶりに500BTCを送金し、その価値はおよそ3504万ドル( ソース )

-

マイクロストラテジーは株式市場の魔法を駆使し、ビットコインをさらに購入する大規模な計画を開始した( ソース )

プロジェクト

-

VanEckがWeb3ゲームスタートアップのGunzilla Gamesに投資( ソース )

-

カナダの上場企業であるソル・ストラテジーズは、保有するSOL株12,389株を増やした( ソース )

-

VitalikはPolygonのZK証明システムPlonky 3のパフォーマンスの飛躍的進歩を称賛している( ソース )

-

9230万枚のTIAトークンが流通し、$4億6000万枚の売り圧力がかかる可能性がある( ソース )

-

ブロックチェーン太陽光発電企業GlowがFrameworkとUnion Square Venturesから1億1,000万3,000万ドルを調達( ソース )

トレーディングインサイト

注意: 以下は金融アドバイスではありません。これは市場ニュースの編集であり、取引を実行する前に必ず独自の調査 (DYOR) を行うことをお勧めします。以下は収益を保証するものではなく、取引が期待どおりに実行されなかった場合、BitMEX は責任を負いません。

かけがえのない:ビットコインの根本的な利点

Bitcoin remains the best trade in this cycle, especially for institutional-scale trading. In this article, we will analyze Bitcoins current market position and explore the factors that influence whether to go long or short. We will look at fundamental demand drivers, current market dynamics, and potential risks in an attempt to provide a comprehensive overview of Bitcoins appeal in the cryptocurrency market.

従来の金融流入は ETH よりもはるかに強力です。

ビットコインは機関投資家の間で人気を集めており、この傾向は最近のETF流入データからも明らかだ。過去2日間のBTC ETFへの記録的な流入は、ビットコインが史上最高値を突破しようとしていた時期と一致しており、伝統的な金融投資家がビットコインが歴史的な価格上限を突破する可能性に自信を持っていることを示している。特に、BTC先物の資金調達率は大幅な上昇が見られず、ヘッジファンドがまだ大規模なベーシス裁定取引を行っていないことを示唆している。これは、流入を牽引しているのは裁定取引業者ではなく、主に一般投資家であることを示唆しており、市場センチメントがビットコインの成長可能性に傾いていることを示す強い兆候である。

ビットコインETFには大量の資金流入が見られる一方で、イーサリアム(ETH)の時価総額はBTCの約21%であるにもかかわらず、ETHへの流入はビットコインの約1%に過ぎません。この差は、ビットコインが伝統的な金融に持つ独自の魅力を浮き彫りにしており、他の代替コインに対する長期的な優位性を推進する可能性があります。

上場企業の保有資産と市場支援

マイクロストラテジーとそのCEOマイケル・セイラー率いる上場企業は、ビットコインへの強い支持を示し続けている。マイクロストラテジーの株価は先週金曜日に166%の最高値に急騰し、投資家の強い信頼を反映している。同社が最近ビットコイン購入に$42億ドルの資金を割り当てたことは、同社の長期的な取り組みを浮き彫りにしている。同社のビジョンは明確で、ビットコイン銀行に発展し、機関投資家にビットコイン担保の商品を提供することだ。一方、マイクロソフトの次回の株主総会ではビットコインへの投資が検討される予定で、これは市場に別の大手プレーヤーが参入することを意味するかもしれない。これは、数週間で40%の価格急騰を引き起こした2021年初頭のテスラのビットコイン購入を彷彿とさせる。マイクロソフトの参加はまだ確認されていないが、同様の市場の興奮と期待を引き起こしている。

今こそビットコインを買うべき時でしょうか?

10月革命の歴史的ダイナミクス

これまでのビットコインの強気相場では、10月は典型的には大きな上昇の始まりを示してきました。歴史的な傾向が続くと、さらなる爆発的な上昇が見られるかもしれません。 市場 勢いはすでにビットコインを押し上げており、この勢いが11月まで続くと、BTCはさらに上昇する可能性があります。

米国の選挙の不安定さの潜在的影響

今後の米国選挙は、さらに複雑な状況に拍車をかけます。仮想通貨に友好的な政府は好ましいように聞こえるかもしれませんが、新政権による主要な政策転換や経済再編計画は、より高いボラティリティをもたらす可能性があります。どの候補者がより仮想通貨に友好的と見なされるかに関係なく、関連する金融不確実性が仮想通貨市場に影響を与える可能性があり、投資家は急激なボラティリティに備えることが不可欠です。イーロン・マスクが政府の効率化委員会に参加する可能性は、劇的な経済政策の変更を引き起こす可能性があります。投資家は、これらの変更が金融市場にもたらすリスクを考慮する必要があります。これにより、ビットコインのボラティリティが増加する可能性があります。

ブータンのビットコイン

ブータンが最近、約1,000 BTC($65百万)をBinanceに預けたことで、売却の可能性についての憶測が飛び交っている。ブータン政府がビットコイン保有量を清算するつもりがあるかどうかは不明だが、大規模な売却は価格に下押し圧力をかける可能性がある。投資家は、ビットコイン価格の安定性に対する潜在的なリスク要因としてこれを監視する必要がある。

結論は

ビットコインの長期的な見通しは依然として明るいものの、今後の選挙やマクロ経済要因により、慎重なアプローチが必要になる可能性があります。強気の姿勢を維持したい人は、スイングトレードでビットコインの上昇の可能性を活用しながら利益を上げることができます。予想されるボラティリティの増加により、戦略的なポジショニングにより、投資家は下落リスクを管理しながら利益を最大化できます。

この記事はインターネットから引用したものです: BitMEX Alpha: ウィークリートレーダーレポート (10.25-11.1)

関連:DeSci リーダーも行動を起こし、Pump.science は生物科学ミームをうまく活用できるでしょうか?

原著者:Zhouzhou 原訳:Joyce ソラナブレイクポイントカンファレンスにて トークン 2049年、SolanaエコシステムのDesciプラットフォームであるMolecule DAOは、新しいミームトークン発行プラットフォームPump.Scienceを立ち上げました。他のミームトークン発行プラットフォームと比較して、Pump.scienceの特徴はトークン発行メカニズムではありません。医療研究者はPump.scienceで薬物研究提案を提出し、その後、ワームに薬物を使用してテストし、テスト結果をプラットフォームのフロントエンドに送信できます。このプロセスでは、ユーザーは薬物を表すミームコインを取引することでテストプロセスに参加できます。薬物研究を奨励するためにミームコインを導入するPump.scienceは、トークンベースの延命実験予測ゲームとして理解できます。Pump.scienceはPump.funで薬物を表すミームトークンを発行し、プレーヤーは直接取引できます。市場が…