Original title: No production, only hoarding coins: MSTRs latest financial report released, revealing MicroStrategys capital growth and high premium valuation model

Original author: Alvis, MarsBit

Historically, whenever a traditional industry reaches its peak, there are often some groundbreaking companies that find unique production methods in the cracks of the market and rely on unique strategies to attract capital. These companies rarely produce actual things, but concentrate their resources on a core asset – like Shell Oil Company in the past maintained its valuation through oil reserves, and gold mining companies relied on gold mining and reserves to dominate prices. In the early hours of this morning, MicroStrategys financial report was released, and people once again saw such a company: it is not known for production, but with its huge investment in Bitcoin, it broke the traditional valuation rules and became one of the worlds largest and most unique Bitcoin holders.

From software company to Bitcoin whale: MicroStrategys transformation journey

MicroStrategy (MicroStrategy), stock code MSTR, was originally a company that relied on business intelligence software to build its kingdom. However, its founder Michael Saylor stepped on the accelerator in 2020 and drove directly onto the fast lane of Bitcoin. From this year on, Saylor no longer let the company stay in traditional production, but saw the potential of Bitcoin as a core asset, and began to exchange the companys reserves for Bitcoin little by little, and even bet on his own wealth, step by step to build MicroStrategy into a coin hoarding bank for Bitcoin. In Saylors eyes, Bitcoin is the gold of the digital world and the anchor of the future of global finance. Some people think he is crazy, and some call him a fanatic missionary of Bitcoin, but he firmly believes that he is winning the new gold standard for the company.

Saylor does not intend to follow the old path. He positions MicroStrategy more like air express delivery: compared with the ground logistics of traditional ETFs, MicroStrategy directly purchases Bitcoin through financing through bond issuance, lending, equity issuance, etc. , which is flexible, efficient, and can also chase the rise of the Bitcoin market. This makes MicroStrategy not only a stock code, but also a express target in the Bitcoin market, and the companys market value is directly linked to the rise and fall of Bitcoin. Saylors operation has caused considerable controversy. Well-known investor Peter Schiff even joked on the social platform X that the company does not produce any products, but has achieved a super high market value by hoarding Bitcoin. He pointed out that MicroStrategys market value has exceeded most gold mining companies, second only to Newmont.

In response, Saylors response was simple: Bitcoin is our future reserve asset. Driven by this firm belief, MicroStrategy has accumulated more than 250,000 ビットコインs and plans to raise $42 billion in the next three years to continue to increase its holdings. MicroStrategys production method is not traditional material manufacturing, but building a new financial system around Bitcoins infrastructure.

Some people say Saylor is gambling, but perhaps, this is not only a bet, but a belief. He took an adventure to take an alternative path, making MicroStrategy an alternative target in the financial market. As he said: We dont produce, we just hoard coins.

MSTRの最新財務報告の解釈:資本増強とビットコイン準備金のさらなる増加

1. Overall overview of financial report and financing plan

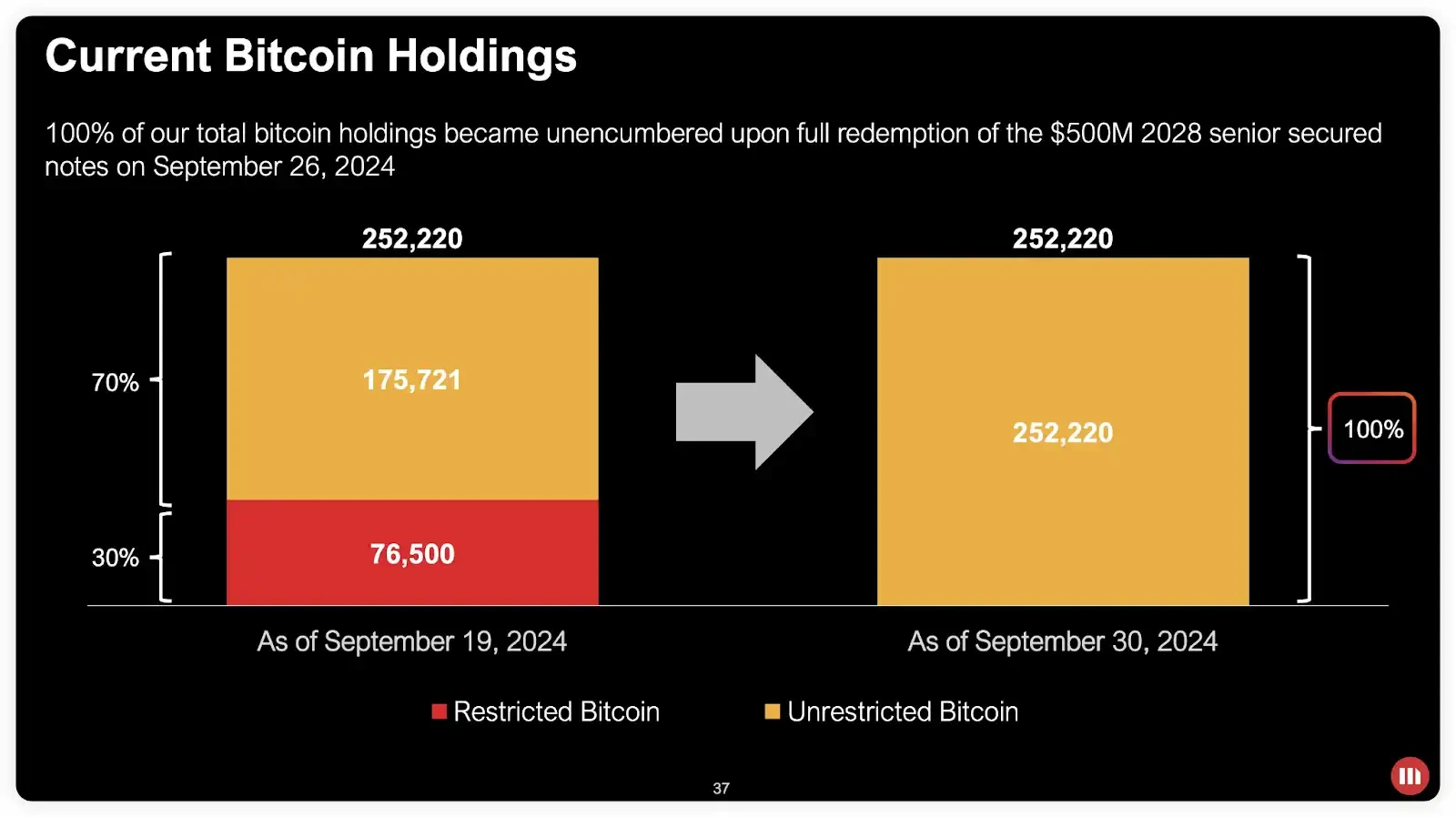

MicroStrategys financial report released this time showed a positive outlook overall. The company plans to raise $42 billion in the next three years to continue to increase its holdings of Bitcoin, and has completed the repurchase of previously pledged Bitcoin. As of the date of the financial report, MicroStrategy holds a total of 252,220 Bitcoins.

Since the end of the second quarter of 2024, the company has purchased an additional 25,889 bitcoins at a total cost of approximately $1.6 billion and an average price of $60,839 per bitcoin. The companys total market value is currently approximately $18 billion, and the cumulative cost of purchasing bitcoins is $9.9 billion, with an average price of approximately $39,266 per bitcoin. The company also raised $1.1 billion through the sale of Class A common stock and another $1.01 billion through the issuance of convertible bonds due in 2028, while repaying $500 million in senior secured notes and releasing all bitcoin assets from collateral. This release of collateral significantly enhances the companys financial flexibility and reduces its risk in extreme market conditions.

2. Cash reserves and future financing targets

MicroStrategy currently holds $836 million in cash, which provides stable financial support for further purchases of Bitcoin in the future. The company also released phased financing goals: $10 billion in 2025, $14 billion in 2026, and $18 billion in 2027, totaling $42 billion. CEO Michael Saylors plan aims to strengthen the companys core asset reserves by gradually increasing its holdings of Bitcoin, which is undoubtedly seen by the market as positive rather than negative news.

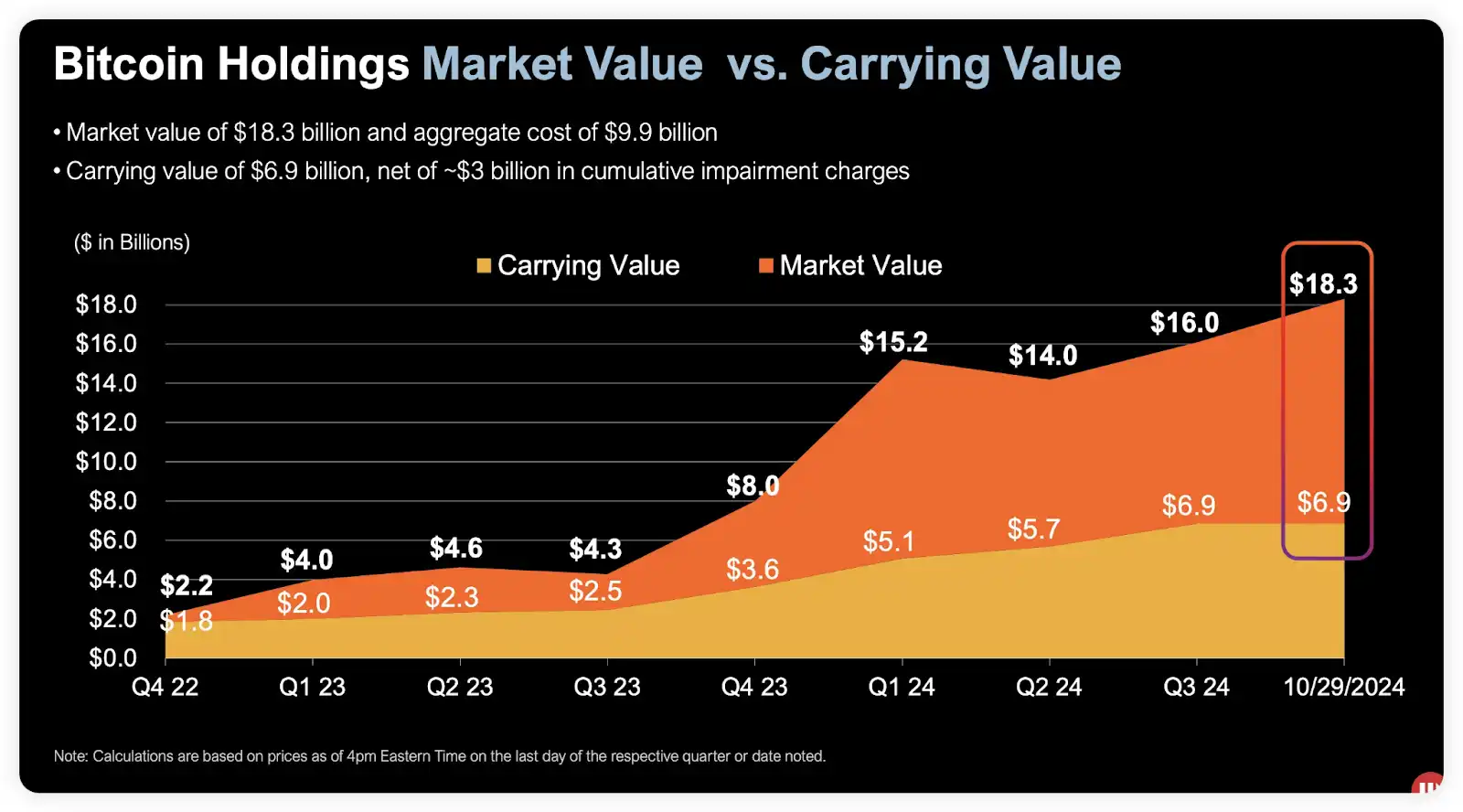

3. 市場 value and book value

As of October 29, 2024, MicroStrategys market value is approximately $18 billion and its book value is $6.9 billion, which has deducted $3 billion in accumulated impairment losses. The reason for the impairment is not that MicroStrategy sold Bitcoin, but based on book adjustments under current accounting standards. According to accounting regulations, if the market price of Bitcoin falls in a certain quarter, the company must lower the book value of these assets and record an impairment loss. However, even if the price rebounds subsequently, the book value will not automatically recover, and the appreciation will only be reflected when it is sold. If future changes to accounting standards (such as the approval of FASBs fair value measurement) are implemented, this problem is expected to be improved.

4. BTC鈥檚 flexibility as a core asset

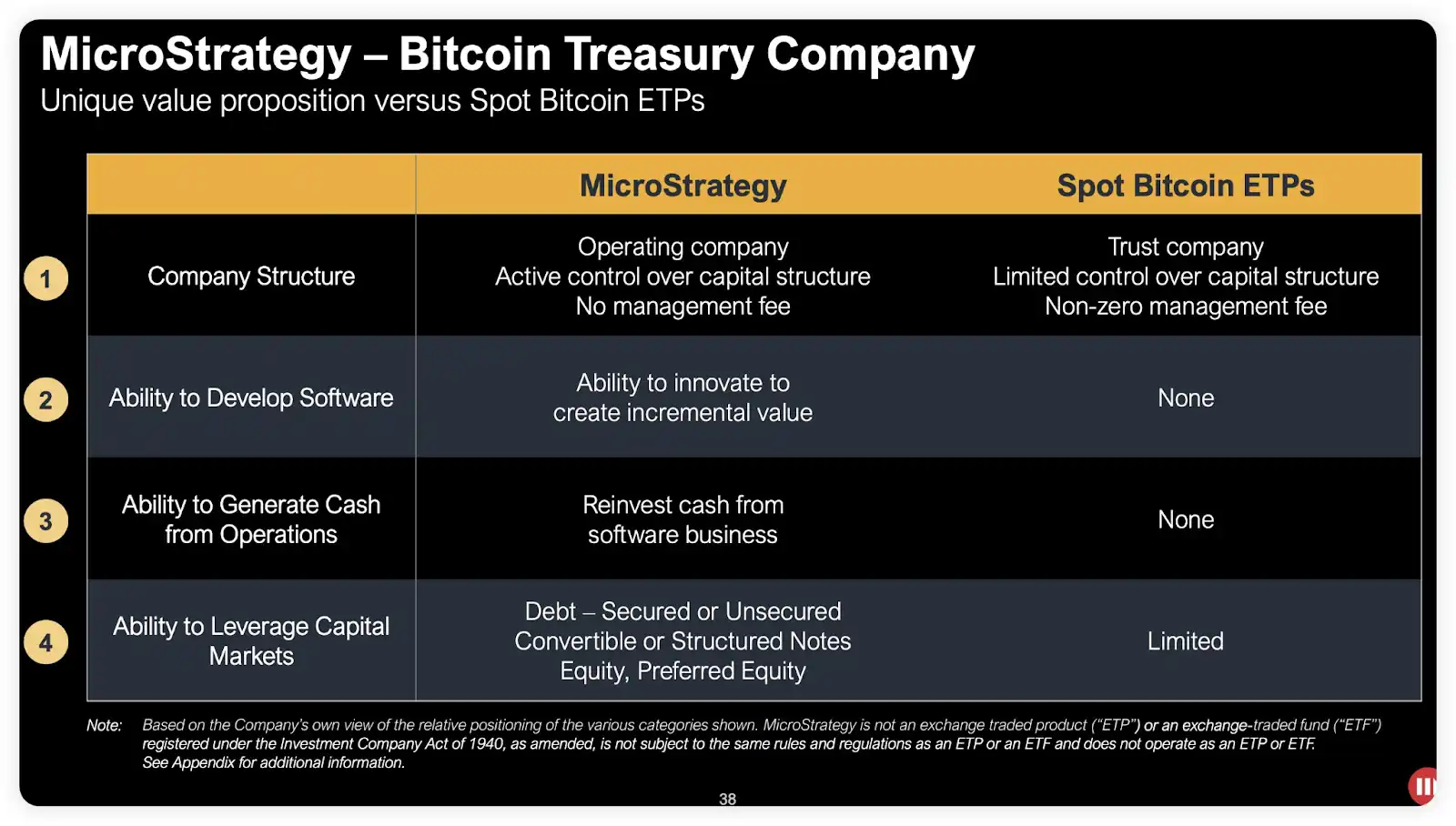

As a core asset, Bitcoin gives MicroStrategy greater capital operation flexibility than spot ETFs. The company compares its Bitcoin reserve operations to oil companies oil reserves. Just as oil companies handle unrefined and refined products (such as gasoline, diesel, and jet fuel), MicroStrategy also views Bitcoin reserves as a capital preservation tool. Through this core asset, the company can improve productivity and implement innovative financial strategies.

5. MicroStrategy鈥檚 Bitcoin holding principles

MicroStrategy has established eight core principles for its Bitcoin holdings, reflecting its long-term investment strategy and market orientation:

Continue to buy and hold Bitcoin, focusing on long-term gains;

Prioritize the long-term value of MicroStrategy common stock;

Maintain transparency and consistency with investors;

路 Using smart leverage to ensure the company outperforms the Bitcoin market;

路 Adapt quickly and responsibly to market dynamics and continue to grow;

Issuing innovative Bitcoin-backed fixed-income securities;

路 Maintain a healthy and strong balance sheet;

Promote Bitcoin to become a global reserve asset.

6. The difference between MicroStrategy and Bitcoin spot ETF

Compared with the Bitcoin spot ETF, MicroStrategy is unique in its financing method. ETF investors need to actively purchase ETF shares, while MicroStrategy raises funds through multiple channels such as equity, unsecured or secured debt, convertible bonds and structured notes to directly increase its holdings of Bitcoin. This stock financing model allows the company to actively raise funds to achieve long-term strategic holdings of Bitcoin.

The cycle of capital and high premium rates: MicroStrategys valuation code

The higher the premium rate, the more suitable it is for large-scale financing

MicroStrategys valuation model relies on the market value premium rate, which increases the holdings of Bitcoin (BTC) through equity dilution financing, increases the BTC holdings per share, and thus pushes up the companys market value. The following is a detailed analysis of this model:

Simplified analysis of premium rate and thickening effect

Assuming the price of Bitcoin is $72,000, MicroStrategy holds 252,220 BTC, with a total holding value of approximately $18.16 billion. With the current company market value of $48 billion, MicroStrategys market value is 2.64 times the total value of its Bitcoin holdings, which translates to a current premium rate of 164%.

Assuming that the companys current total share capital is 10,000 shares, the corresponding BTC holdings per share are approximately 25.22.

If MicroStrategy plans to raise $10 billion through additional issuance, the total share capital after the additional issuance will become 12,083 shares (calculation method: divide the financing amount of $10 billion by the current market value of $48 billion, the result is 0.2083 times, that is, the share capital will increase by 20.83%, and the total share capital will become 10,000 shares multiplied by 1.2083, which is approximately equal to 12,083 shares). In this case, the company can use $10 billion to purchase approximately 138,889 bitcoins at a price of $72,000, increasing the total bitcoin holdings to 391,109. In this way, the BTC holdings per share will also increase to 32.37 (dividing 391,109 bitcoins by 12,083 shares), an increase of about 28%.

Similarly, if the planned financing of $42 billion is followed

Further assuming that MicroStrategy issues 87.5% of its shares, that is, it raises $42 billion by issuing 8,750 shares, the total share capital after the issuance will increase to 18,750 shares (calculation method: multiply 10,000 shares by 1.875 times). If the company purchases Bitcoin at a price of $72,000, it can purchase approximately 583,333 BTC, bringing the total holding to 835,553 Bitcoins. At this time, the BTC holding per share will increase to 44.23 (i.e. 835,553 Bitcoins divided by 18,750 shares), an increase of approximately 75% compared to the previous 25.22.

If this thickening effect is achieved within three years, the average annual thickening will be 25%.

Of course, when the final reinvestment is made, the price of Bitcoin will change, possibly higher or lower, but this will not change the conclusion of thickening. Under the extremely high premium rate of MicroStrategy (currently fluctuating around 180% -200%), the company should maximize financing by taking advantage of the premium rate as much as possible. Therefore, although CEO Michael Saylors $42 billion financing plan initially caused market panic, market sentiment soon recovered, indicating that the company has a clear understanding of the current model. This is a rational decision that maximizes shareholder equity.

MicroStrategys advantages and the logic behind its high premium rate

Many investors may wonder why the market is willing to buy MicroStrategys ATM or convertible bonds at a high premium instead of directly buying Bitcoin ETFs? This involves several unique advantages of MicroStrategy:

Continue to increase profits

By continuously raising funds to increase BTC reserves, MicroStrategy has achieved an annualized return of 6%-10%, and has achieved an annualized return of 17% so far in 2024. Under the current high premium financing model, the annualized return is expected to reach more than 15%. Based on a valuation of 10 to 15 times, MicroStrategys premium rate corresponds to a valuation of 150%-225%.

Volatility and Market Bridges

Michael Saylor believes that MicroStrategy serves as a bridge between the traditional capital market and the Bitcoin market. The current market value of Bitcoin is about $1.4 trillion, and the penetration rate is relatively low. If the penetration rate increases, even if only 1% of the funds in the global $300 trillion bond market are allocated to Bitcoin, it will bring MicroStrategy about $3 trillion in potential incremental funds. In addition, the convertible bonds issued by the company not only provide certain downside protection, but also provide potential options for Bitcoin price increases.

Conclusion: The self-reinforcing effect of high premium rates in a bull market

In a bull market environment, MicroStrategys valuation model and high premium financing model form a self-reinforcing positive cycle. The higher the premium rate, the more the company raises, which increases the BTC reserves per share and further increases the companys market value. This market effect is like a snowball, especially when the price of Bitcoin is expected to rise to the $90,000-100,000 range, MicroStrategy may be able to continue to accelerate under the escort of the high premium rate.

Michael Saylors bet and the markets response seem to foreshadow a subtle game between traditional finance and digital assets. In this dual contest between capital and technology, will MicroStrategy achieve a financial revolution or just be a flash in the pan? What we are witnessing may be a harbinger of future financial change.

This article is sourced from the internet: Interpretation of MSTR鈥檚 latest financial report: capital increase and further increase in Bitcoin reserves

Original | Odaily Planet Daily ( @OdailyChina ) Author | Asher ( @Asher_0210 ) On October 17, Seraph announced on the X platform that the latest round of PTR testing has officially started, and players can get the PC or Android download link through the Seraph official website to experience it. The next day, CMC Labs, a subsidiary of CoinMarketCap (CMC), announced that Seraph has entered its accelerator program. Seraph is backed by the Korean game giant Actoz Soft. This cooperation with CMC Labs will provide it with more strategic resources, help accelerate the development of games, and expand its influence in the Web3 game ecosystem. The latest round of PTR testing is a pre-season before the official season S1 . In essence, it is the final testing phase before…