Recently, Hyperliquids upcoming TGE has drawn many peoples attention to the Perp DEX track again. In the last cycle, Perp DEXs performance was unsatisfactory and failed to become the on-chain liquidity star that people expected. However, since the end of last year and the beginning of this year, Perp DEX protocols such as Hyperliquid, Drift, Surf, and Orderly have emerged one after another, and the old leader dYdX has become active again. With the rapid rise of the meme track, the power of on-chain liquidity has further opened up a new situation for the Perp DEX market.

Memecoin leads a new cycle, with on-chain liquidity gathering

In this cycle, the performance of meme coins is extremely eye-catching, and golden dogs appear frequently on the chain. MOODENG, SPX, and GOAT have not only become potential meme coins in various tracks during this meme boom, but have also attracted more and more players to the chain. Even though the players on the chain self-deprecatingly say that they are doing real POW every day and moving to various battlefields for PVP, it is undeniable that liquidity has gradually gathered on the chain, and there is even a trend of acceleration. Among them, MOODENG and GOAT have also attracted the attention of CEX Listings such as Binance.

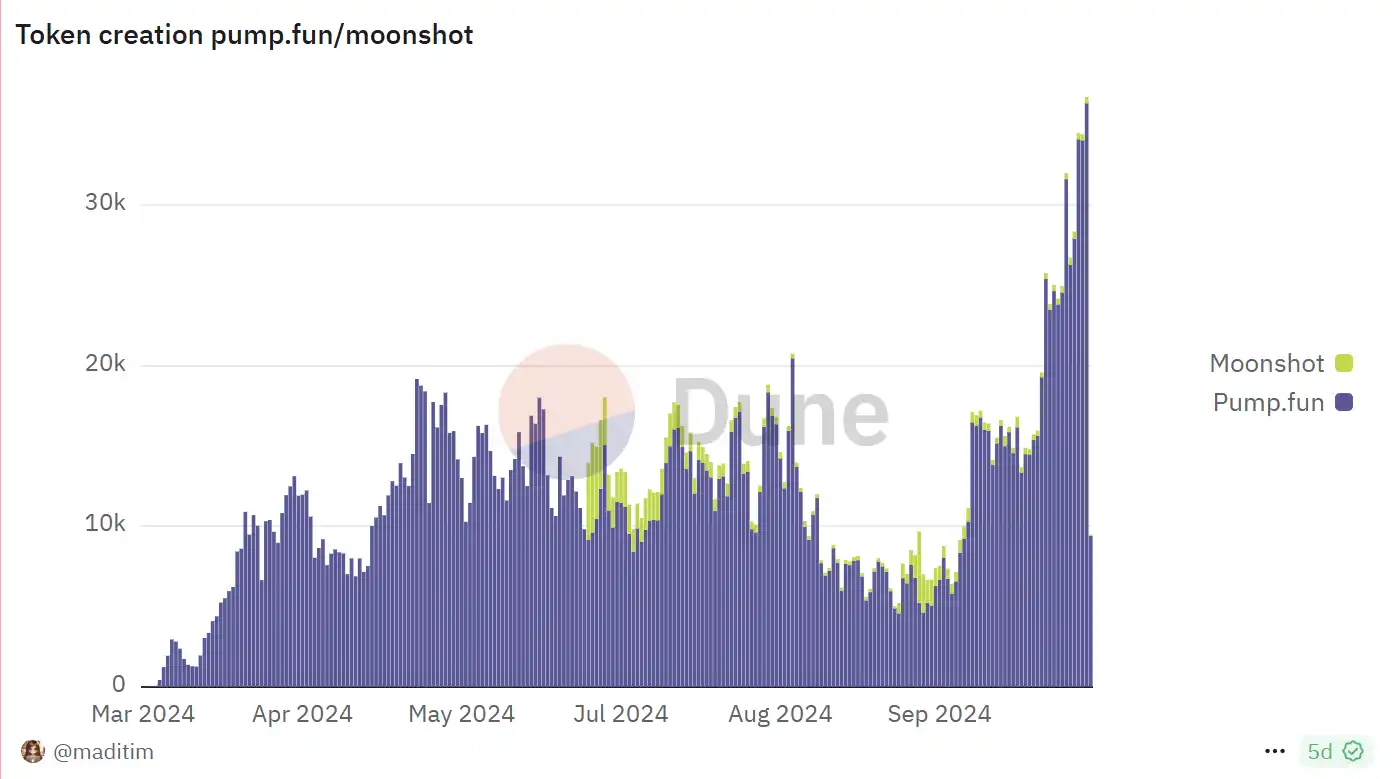

In addition to the emergence of the Golden Dogs, the data of meme-type infrastructure can more directly reflect the exaggerated increase in on-chain liquidity. For example, the well-known Pump.fun, the number of its listed coins began its main uptrend at the end of August, and the number of listed coins continued to set new highs. This shows that the current Crypto native users have great enthusiasm for on-chain memes, and also reflects the concentration of market liquidity in on-chain memes.

In addition to Pump.fun, there is also Moonshot, which is also popular as a floodgate of liquidity. With Murads speech on memecoin supercycle at the トークン2049 conference, Moonshot also began to go viral along with MOODENG. Moonshot not only has a strong listing effect, becoming the Binance on the chain, but its fiat currency deposits have also opened up a new Mass Adoption outlet, creating growth in Web2 traffic for encryption. At the end of September, Moonshots daily fees quickly rose from around US$3,681 to US$24,000, and the number of daily trading users increased from 396 to 3,458. Its accumulation is also steadily rising, and even its slope has an accelerating trend. The success of Moonshot has further gathered liquidity on the chain.

Perp DEX on-chain liquidity beneficiary

Behind the explosion of meme infra and memecoin on the chain, Perp DEX has naturally become a beneficiary of the on-chain liquidity gathering. Perp DEX was not popular in the last cycle, but in the recent bull market recovery, it gradually became popular from the English circle to the Chinese circle. On the one hand, due to the sufficient DeFi narrative in the last round, Perp DEX did not have enough stage performance; on the other hand, the meme market on the chain in this round is better than the secondary performance of the CEX bid, and retail investors are more willing to embrace DEX with higher odds and more diverse gameplay.

Dydx: An excellent negative example

Among the decentralized perpetual trading projects, DYdX is the earliest big brother. Since the establishment of the project in 2017, DYdX has stood out in terms of 24-hour trading volume and daily active users by adopting an order book model, providing users with comprehensive functions, including lending, leveraged trading, and perpetual contracts. At the beginning of this cycle, it undoubtedly became the focus of market attention. However, since this year, the development of Dydx has become increasingly inadequate. Both its protocol revenue and token prices have declined severely, and have gradually been caught up by the later Perp DEX. The specific details of Dydxs fundamental changes can be reviewed in our previous article: From the perspective of price-to-earnings ratio, is todays DeFi industry overvalued? | Rhythm of Finance.

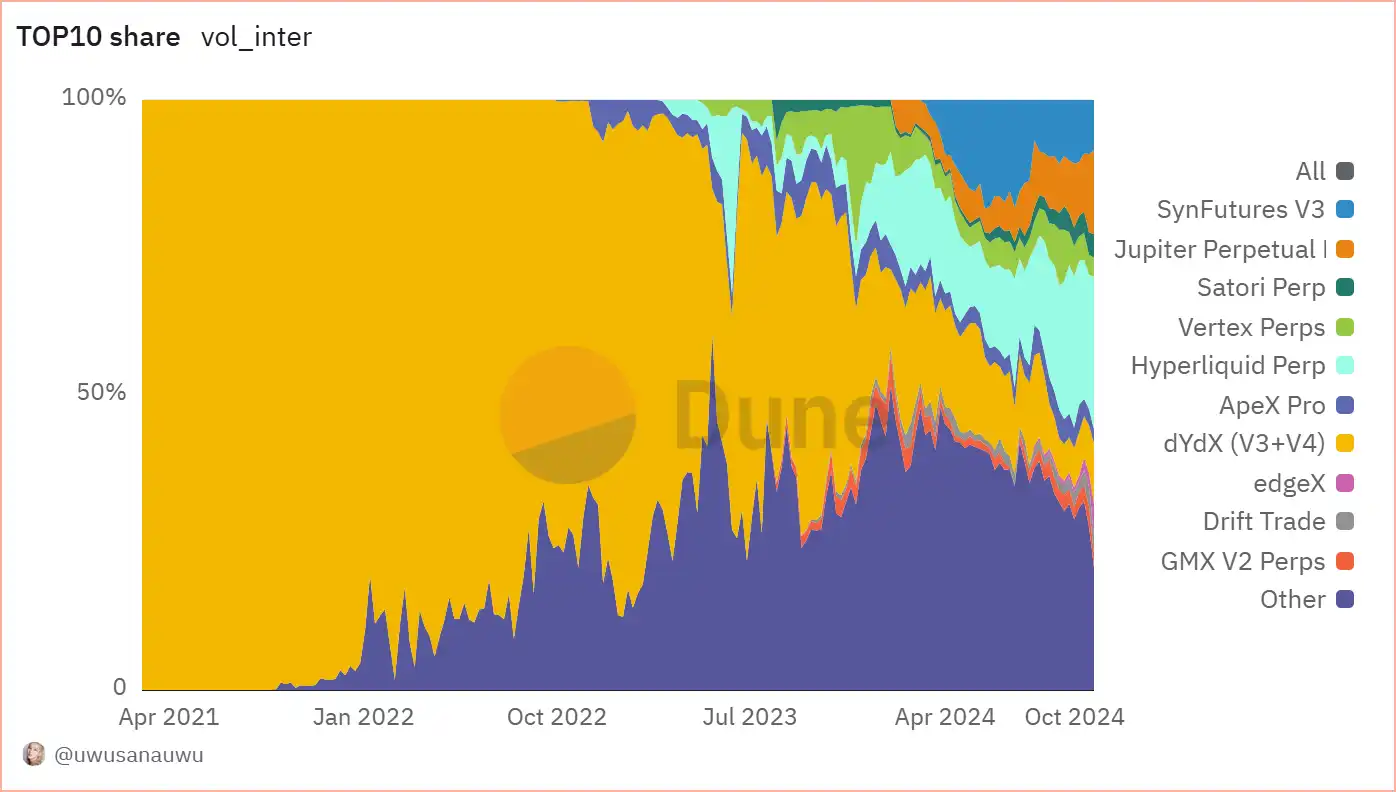

Although Dydx is the frontrunner of perp DEX, it has almost become a negative example of Perp DEX in recent months. Dydxs market share has been gradually eroded by several other Perp DEXs. After two years of changes, Dydx has not become stronger, but has regressed. From the initial 80% market share, it has weakened to only 6%. In this wave of meme craze, Dydx has not reaped much dividends except for announcing that it will be a pump, and there have been news of layoffs and personnel changes recently, which shows how deep its decline is.

The Crypto market is ever-changing, and Hyperliquid, which has not yet issued a coin, has quietly taken over Dydxs leading position.

Hyperliquid: A low-key top student

Hyperliquid, as the most popular Perp DEX in the English region, has always been relatively low-key. It was originally built based on Tendermint. Users can query orders, cancel, trade and build order books on the chain.

In terms of technological advancement, the HyperBFT optimization algorithm was introduced in May 24, which increased the previous 2W TPS based on Tendermint to 10-20w TPS, achieving an order of magnitude leap. The introduction of HperBFT allows users to trade more smoothly, but there is still a certain gap in transaction processing capabilities compared to CEX (such as Binance 140w TPS). At the same time, Hyperliquids ambition is still more than just being an ordinary perp DEX. Hyperliquid is still actively developing the L1 public chain, creating a low-latency, high-throughput public chain, and becoming a transaction public chain characterized by high-frequency trading and order books.

Hyperliquid is also actively embracing meme culture and has become the biggest beneficiary of this meme craze. Hyperliquid has more meme spot products for users to choose from than CEX. Compared with CEX Listing, which was late when the market value of memecoin was several hundred million, Hyperliquid has more first-mover advantages in meme.

According to Dune, in the past three months, Hyperliquid has become the largest perp DEX, accounting for 40% of the market share and becoming the undisputed leader. Its TVL has also begun to grow explosively this year and has now reached a level close to US$670 million.

On October 14, Hyperliquid announced the establishment of the Hyper Foundation to support the development of the Hyperliquid blockchain and ecosystem.

Hyperliquid is also preparing for the TGE of its native token. As the $HYPE TGE approaches, millions of users will join Hyperliquid, injecting more capital into its ecosystem, which is good for the spot products already listed on Hyperliquid.

However, the launch of Hyperliquid EVM will have some negative impact on its spot. If EVM is launched before or during the support of TGE, investors from Solana may transfer their funds to other EVM chains for trading. In this case, the current native spot tokens will experience a certain degree of dilution in the form of an influx of new tokens on EVM.

What are people playing on Perp DEX?

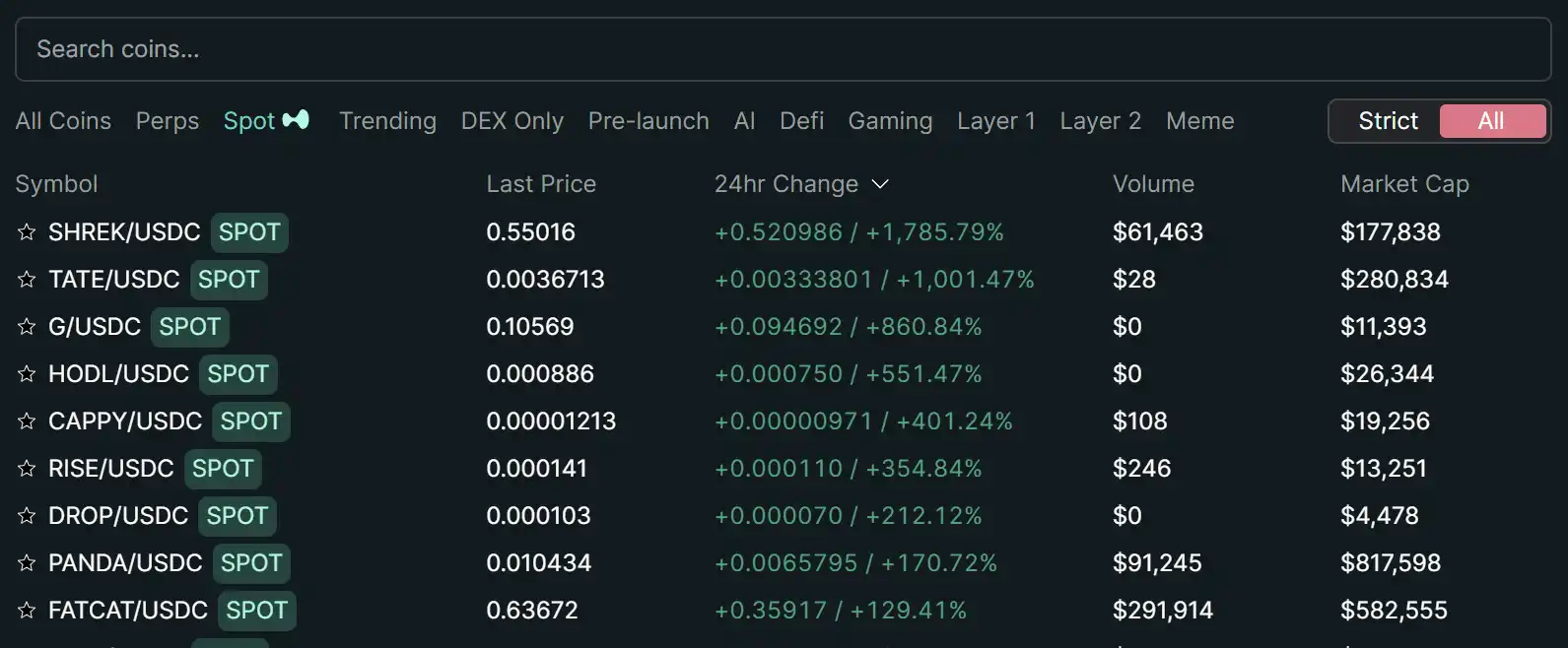

Hyperliquidはすでに強力な富の創出効果を持っていますが、議論の範囲は依然として英語圏に集中しています。Hyperliquidのスポット変動のランキングによると、CEXの取引体験に追いつくという前提の下、100%以上のトークン増加はすでにCEXに劣らない体験を提供していることがわかります。CEXで契約をプレイする代わりに、DEXでスポットをプレイする方が良いです。

The most discussed and less valuable coins in Hyperliqiud are:

$SCHIZO

SCHIZO is a representative of the popular memes on Solana. Its original meaning is schizophrenia. Its funny pictures are highly popular among many memes. SCHIZO returned to zero in August this year, but started to rise again in October this year. It has now reached a new high and reached a market value of 4.72 million US dollars.

$CATBAL

In the Hyperliquid ecosystem, the cat-related meme is the most popular one, with the mysterious cat as the meme. Currently, the number of followers is small, but the price trend is strong. It started to rise on October 15, and has now achieved a 30-fold increase, with a market value of 6.92 million US dollars.

$JEFF

JEFF is a character-type meme on Solana and the most undervalued meme spot token on Hyperliquid. JEFF is not as exaggerated as other memes with a hundredfold increase, but its market value is 4.76 million, and there is still room for growth. The current price is hovering around $4.8, with the potential to hit a new high.

$NOCEX

NOCEX is a spot product launched by Hyperliquid. Its ticker is “NO CEX”, which is quite ironic. It is this ironic ticker that has attracted more attention from the community. NOCEX has achieved a hundredfold increase since October 2, and its current market value is 687,000 US dollars. The price has retreated after reaching 2.3 US dollars.

$PURR

Hyperliquid airdropped MEME coin – PURR to early users of the platform when the spot function was launched. It is also the first spot token launched by Hyperliquid. The current price trend is strong, nearly doubling from the beginning of October to now.

This article is sourced from the internet: Behind the Meme craze, Perp DEX has become a beneficiary of on-chain liquidity aggregation

関連: Lista DAO の詳細な調査: LSDFi と CDP プロトコルの可能性を解き放つ

原文 | Odaily Planet Daily ( @OdailyChina ) 作者: Golem ( @web3_golem ) DeFiの旋律を奏でたUniswapの登場から、2020年のDeFi SummerにおけるCompoundの狂気的なマイニングの波、そしてPendleが伝統的な金融の割引メカニズムを借用し、将来の収入の早期実現をDeFiの世界に持ち込み、さらに資産の流動性を解放するまで、DeFiの世界には革新的なメカニズムが随時市場ステージと組み合わされ、多くの製品が追随(または模倣)します。Pendleの発展はLSDの爆発的な成長によるものです。資金利用効率の向上だけを根拠に、LSTを担保とする貸付プロトコルの市場需要は、特に…